On top of continuous COVID-19 impacts, small business owners are now dealing with the effects of a nationwide labor shortage. Many are responding by paying higher wages, changing their compensation packages.

With information from more than 100,000 small businesses and 1 million active hourly employees who use Homebase, we’re able to provide a unique look into hourly wage trends.

Let’s dive into what that wage growth looks like since just before the pandemic to the end of 2021, as well as what can be expected in the coming months.

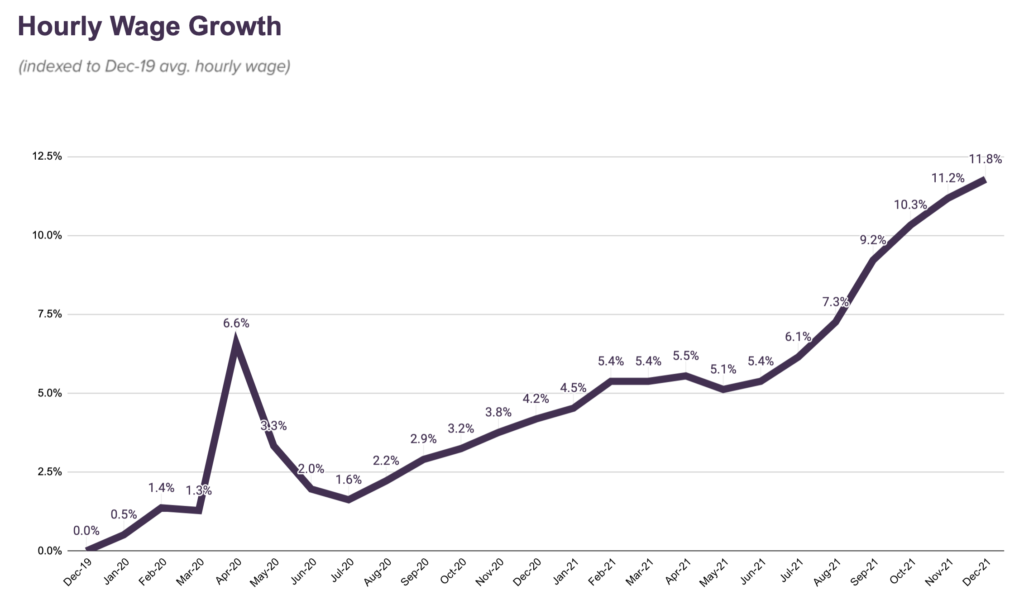

Reported hourly wages have grown 12% nationally since the end of 2019

Average wages have increased almost every month, with the national average growing from $11.72 in December 2019 to $13.10 by December 2021 — representing an 11.8% increase.

The immediate impact of COVID-19 likely caused the upward spike in April 2020, as shown in the graph above. Many businesses that stayed open during this time had a reduced staff consisting of managers or high-level employees, leading to a higher average wage.

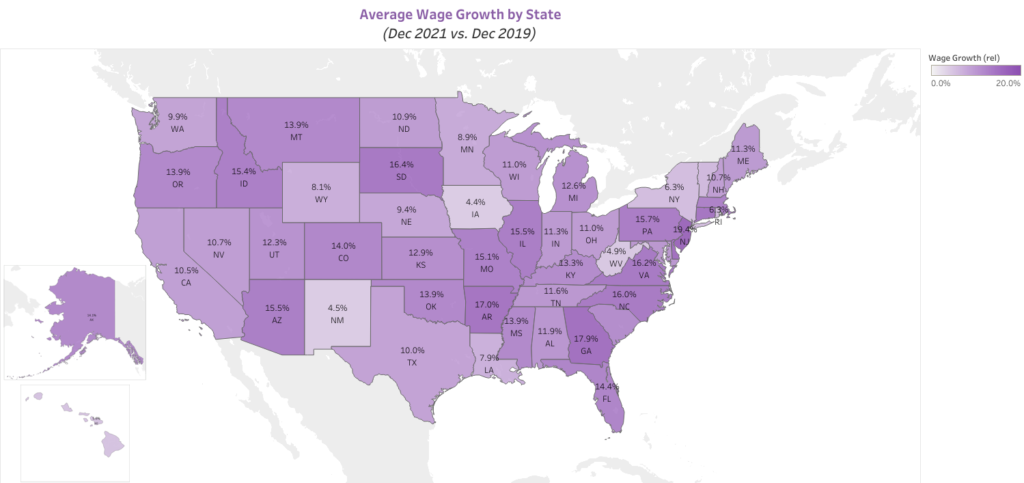

Fastest wage increases occurred in New Jersey, Georgia, Delaware, Connecticut, and Arkansas

Wages in these five states all increased by over 17% from 2019 to 2021. New Jersey saw the highest increase at 19.4%. Inversely, New York saw the lowest wage growth out of the top 10 largest workforces, with just 6.3%.

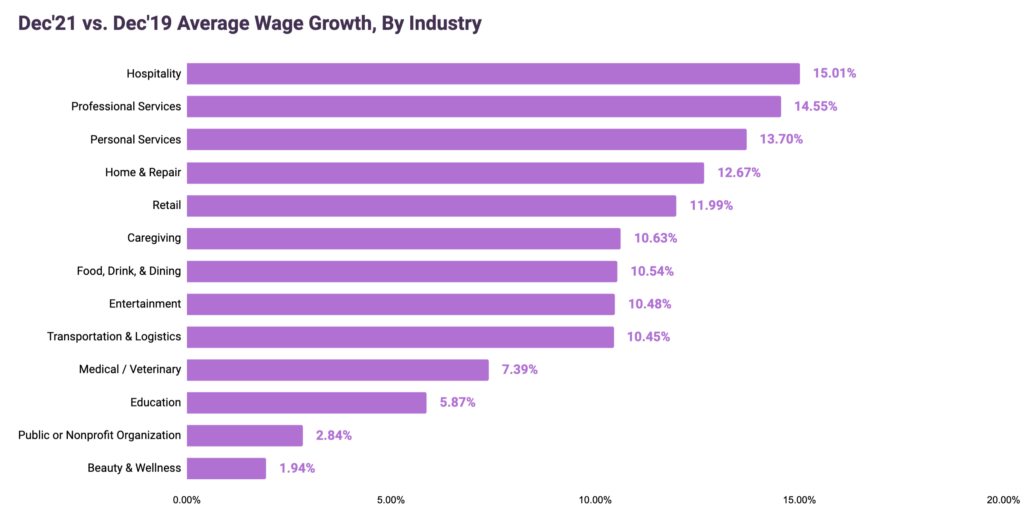

Hospitality, Professional Services, and Personal Services have seen the highest growth during that time

Hospitality, which includes hotels, resorts, and other lodging, saw over 15% growth in average wages.

Professional Services, including IT/tech, legal, financial, and insurance services, and Personal Services, including automotive service, laundry and dry cleaning, repair shops, and more, both exceeded the national average growth.

Meanwhile, larger sectors like Retail and Food & Dining were below the national average increase.

Introducing Main Street Metrics

Homebase is excited to bring you data insights from the thousands of small businesses across the United States using our platform to help manage their teams.

Our data offers insight into how the US small business economy is faring and what we might expect in the coming months ahead. Keep an eye out for more useful insights like these on our blog.

How has Homebase data been validated?

We’ve partnered with a number of academics, researchers, and policymakers to validate and improve our data. Here are a few examples:

- The St. Louis Federal Reserve suggested that Homebase data could be predictive of the jobs reports

- Researchers at Drexel used Homebase data to estimate the “true” employment level

- A team at UChicago and Berkeley used Homebase data to show disparate impacts across different groups