Every month, we share our thoughts on the state of Main Street amid the global pandemic. With information from over 60,000 businesses and one million active hourly employees, our data offers insight into how the US small business economy is faring and what we might expect in the coming months ahead.

You can find the full report here, but here’s a snapshot of what we saw in August.

How did Main Street fare in August (30-second snapshot)?

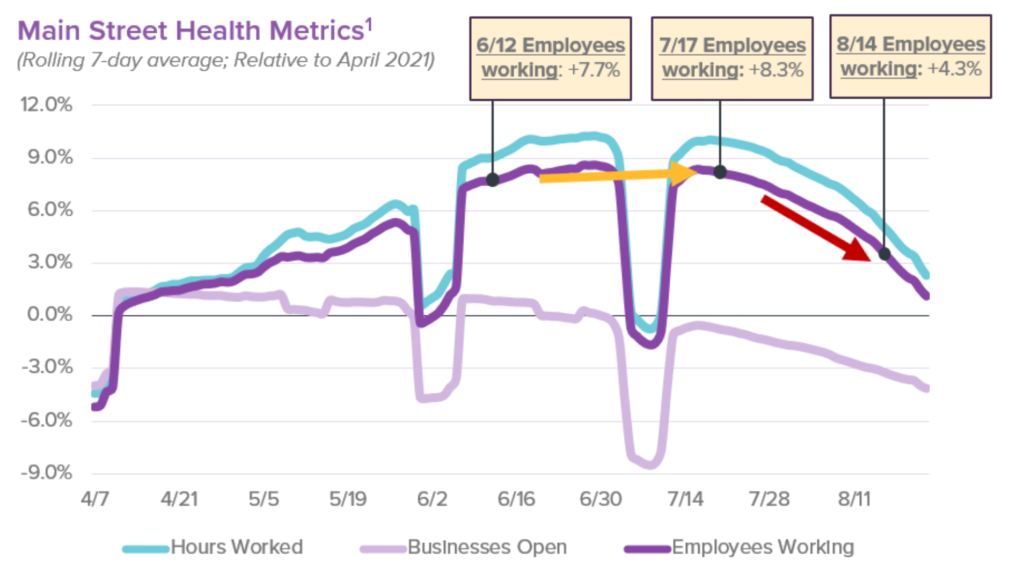

Following the first monthly decline in 2021 in July, August saw a significant worsening of that trend. The number of employees working declined by ~4%, alongside a ~2.5% decline in our small businesses open metric.

This is likely driven by a number of factors, including the COVID-19 Delta variant spikes, continued hiring challenges, and the approaching end of summer.

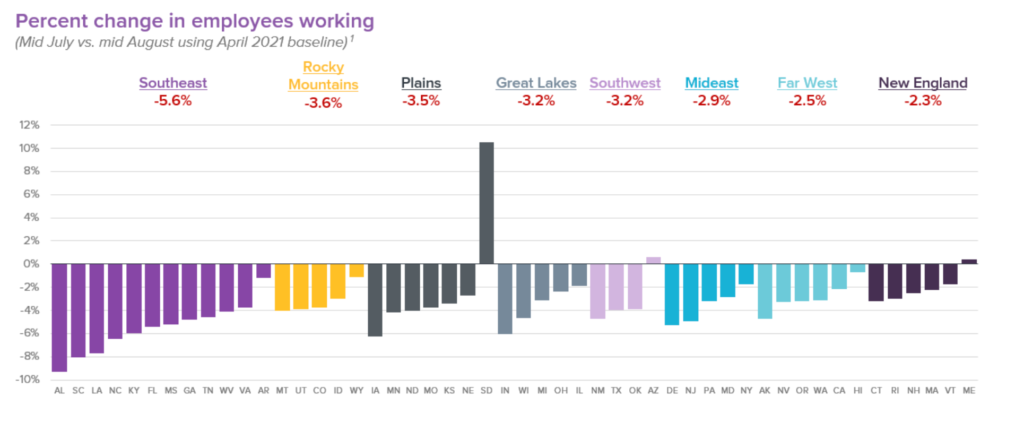

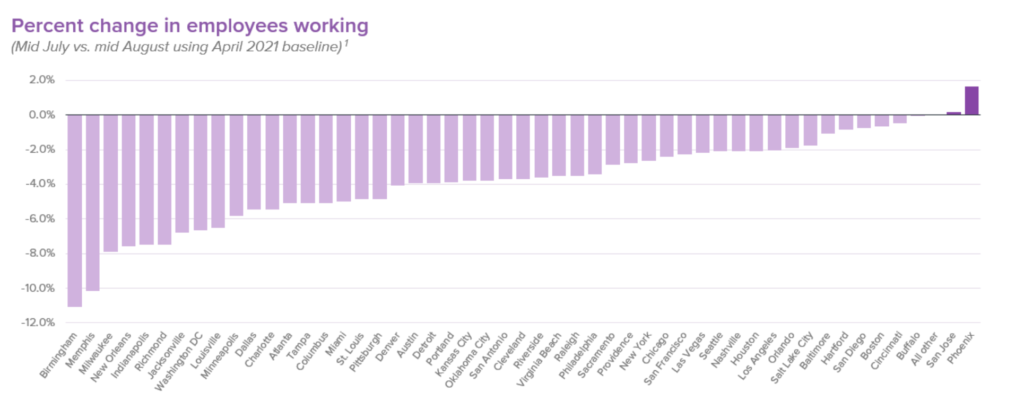

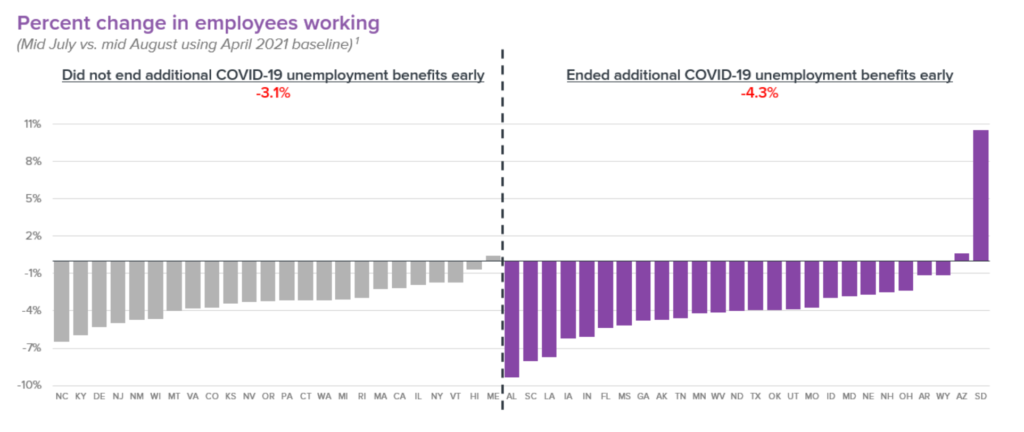

These declines were seen across nearly all states and top 50 MSAs, indicating that the challenges are being felt across the US. Of note, states that lifted additional federal unemployment benefits early continued to perform worse than those that maintained benefits.

Those lifting benefits decreased ~1.2% more than those that maintained benefits.

Large employment declines in August

While we saw growth through Q2, August continued the negative trend of July with ~4% decreases in our employees working metric.

Nationwide challenges

As we dive deeper into the data, it is clear that small businesses across the US are facing similar challenges. All but three states and every region in aggregate saw declining employment. The regions most negatively affected were, in order of negative impact, the Southeast, Rocky Mountains, and Plains. Additionally, all of the top 50 MSAs except Phoenix and San Jose saw declines.

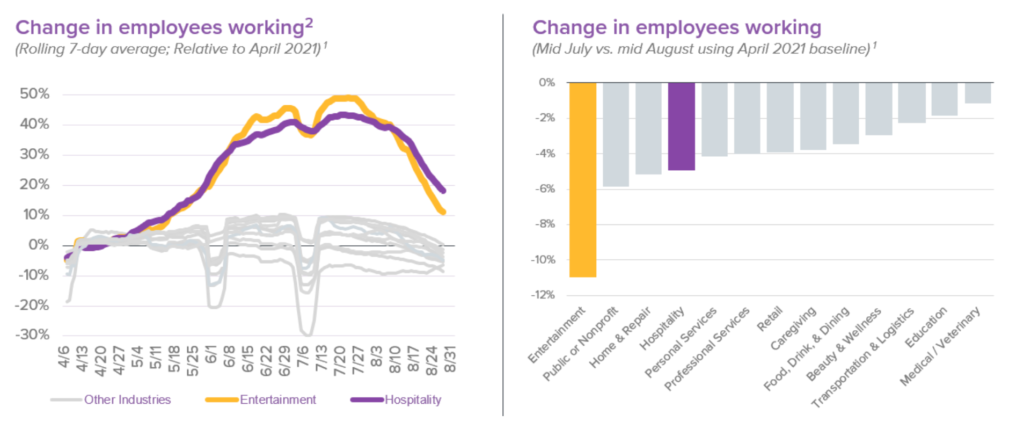

Significant declines in entertainment and hospitality

Unfortunately, the significant employment growth in the entertainment and hospitality industries reversed in late July and throughout August. In mid-July, the entertainment and hospitality industries had grown employment by ~50% and ~45% respectively, compared to April 2021 baseline.

However, since those peaks employment declined by ~35% in entertainment and ~20% in hospitality.

Impact of ending additional COVID-19 unemployment benefits

States that ended additional federal unemployment benefits for COVID-19 continued to perform worse than those that maintained these benefits. States that ended benefits saw employment decline by 4.3%, compared to a decline of 3.1% in states that maintained benefits.

While the impact of these policy decisions is interesting to explore, it is difficult to determine causation from this data.

How has Homebase data been validated?

We’ve partnered with a number of academics, researchers, and policymakers to validate and improve our data. Here are a few examples:

- The St. Louis Federal Reserve suggested that Homebase data could be predictive of the jobs reports

- Researchers at Yale used Homebase data to determine the impact of expanded UI benefits on employment

- A team at UChicago and Berkeley used Homebase data to show disparate impacts across different groups

Methodology and definitions

The January 2020 dataset is based on Homebase data gathered from over 60,000 businesses and 1 million hourly employees active in the US in January 2020. All the rates compare that day vs. the average for that day of the week for the period Jan 4, 2020 – Jan 31, 2020.

The April 2021 dataset does the same, except it looks at the period April 3, 2021 – April 30, 2021.

- “Hours worked” is calculated from hours recorded in Homebase timecards

- “Locations open” is based on whether a business had at least one employee clock-in

- “Employees working” is based on the distinct number of hourly workers with at least one clock-in

Questions or comments about our findings?

Contact Ray Sandza (VP, Data & Analytics) or Adam Beasley (Manager, Data Products) to learn more about our findings and our data.

Homebase makes work easier for 100,000+ small (but mighty) businesses with everything they need to manage an hourly team: employee scheduling, time clocks, team communication, hiring, onboarding, and compliance. We are not Human Capital Management. We are not HR Software. We’re tools built for the busiest businesses, so owners and employees can spend less time on paperwork and more time on what matters.