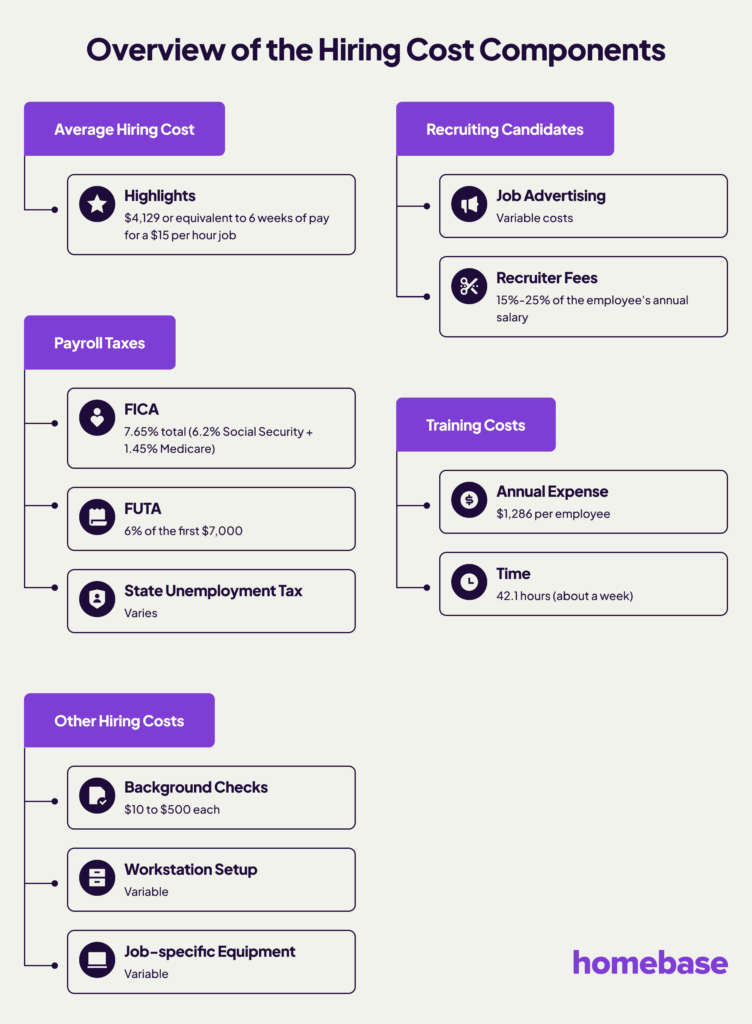

Hiring a new employee is an exciting next step for your growing business—but if you’re a business owner recruiting new team members for the first time, the actual cost can be surprising. Aside from the wages you plan to pay them, you’ll need to consider additional expenses like recruiting candidates, training costs, payroll taxes, other hiring costs, and more.

While it’s difficult to pinpoint an exact number, a Society for Human Resource Management study stated that the average cost to hire an employee is $4,129, or 6 weeks of pay for a $15 per hour job.

Hiring team members is perhaps the most important investment you’ll make to ensure you make the most of your business. As long as you budget accordingly, the benefits of having a solid team behind you will outweigh the additional costs.

Required Costs of Hiring A New Employee

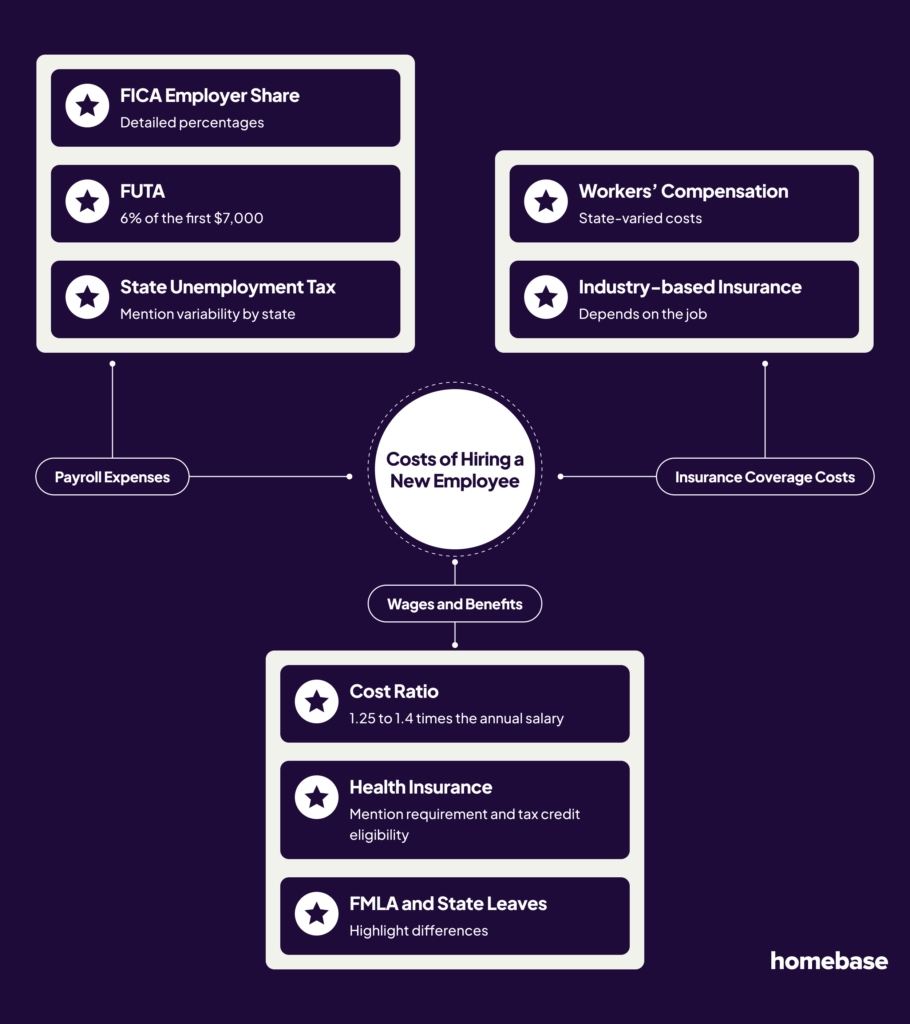

Regardless of what industry you’re in, bringing in a new hire will result in a considerable amount of payroll expenses:

- FICA employer share: 6.2% of the employee’s wages for Social Security taxes, and 1.45% for Medicare taxes.

- FUTA: 6% of the first $7,000 each employee earns.

- State unemployment tax: This varies from state to state, check with your state revenue department to learn more.

You’ll also need to budget for insurance coverage costs:

- Workers’ compensation: The cost varies from state to state.

- Industry-based insurance: Based on the work performed, different types of insurance could be required. For example, home cleaning businesses need insurance for their employees to cover any damage or theft. Speak with an insurance agent to determine what types of insurance coverage you need.

While tax and insurance costs can add up, the good news is that these expenses are fully tax-deductible.

Wages and Benefits

Your employee’s wages include a bundle of additional items that will increase the team member’s cost. Benefit packages can range from inexpensive perks like free coffee to large investments such as life insurance, medical plans, and disability coverage.

According to Boston Business Journal columnist and MIT senior lecturer Joe Hadzima, wages plus benefits for each employee typically totals “1.25 to 1.4 times” the employee’s annual salary.

Federal law only requires employers with 50 or more full-time team members to provide health insurance. However, if you choose to provide at least 50% of the cost of health coverage, you are eligible for a federal tax credit.

It’s important to note that you will have to provide health insurance under the law if your employee count increases to 50 with your new hire.

Businesses with 50 or more employees are also required to offer unpaid family and medical leave (FMLA), but other states have their own paid leave laws—some of which require employers to share the cost. Check your state labor laws to learn more about what’s required in your area.

Some employee benefit costs may be tax-deductible. Learn more about your options in this publication from the IRS.

Recruitment

Several expenses go into the hiring process. You’ll need to pay to advertise your job opening, and you may even be considering using an external recruiter. If you choose to do so, you’ll have to pay for the time spent reviewing resumes and conducting interviews.

When it comes time to perform background checks, you’ll typically pay anywhere from $10 to $500 per background check. The total cost depends on what you want the report to include. Simpler background checks that only include criminal searches will be cheaper than a report that includes additional inquiries into things like employment history, education verification, and drug testing.

If you need assistance advertising your job and finding applicants but don’t want to pay for a recruiter, Homebase can help. Our hiring tool provides customizable job templates, free online posting, and the option to boost your post so it gets in front of candidates faster.

Then you can track all your applicants in one place, identify the best candidates with screener questions, message applicants, and schedule interviews—all within Homebase.

Training

After finding the best candidate to hire, you’ll need to train them—which comes with its own costs. A recent study by Training Magazine found that businesses spend an average of $1,286 a year to train one employee, and training time for each employee is an average of 42.1 hours annually – just over a week!

Entrepreneurial consultant Scott Allen said the best way to better understand training expenses is to “calculate the cost of both structured training (including materials) and the time of managers and key coworkers to train the new employee to the point of 100% productivity.”

Miscellaneous Costs of Hiring an Employee

Depending on your industry, you’ll need to budget for the extra items you need for each newly hired employee. Additional expenses could include:

- Uniforms

- Protective gear

- Workstation materials like desks, chairs, etc.

- Job-specific equipment

The Productivity Timeline

Your goal when hiring new employees is to increase business productivity, but it can take time to see a return on your investment. According to business consultant Bill Bliss, there are three periods in the productivity timeline:

- The first month: Newly trained employees are operating at a 25% productivity level, meaning the lost productivity costs 75% of the employee’s wages.

- Weeks 5-8: The employee is now operating at a 50% productivity level, costing 50% of the employee’s wages.

- Weeks 9-12: During this time the employee’s productivity rate is usually up to 75%, with a 25% cost of wages.

- After week 12: The new hire is expected to be at full productivity.

Hiring employees requires thoughtful budgeting and financial planning. However, the investment will likely result in a great return—making the investment worthwhile.

If you need more help finding top talent for your team, get started with Homebase hiring. We’ll post your job description on the leading sites and help you find the perfect candidate. We’ll even streamline the onboarding process by sending your new hires a digital packet.

Cost of Hiring an Employee FAQs

What are The True Costs of Hiring an Employee?

Hiring and onboarding a new employee can be a strain on businesses. That is because there are extra costs during this process. Those extra costs include training, benefits, and even things like new uniforms. According to the Small Business Administration, hiring a new employee can cost 1.2 to 1.4 times their salary. This means if you hire a part-time employee, who will likely make $10,000 based on their hours worked and wages, you will actually end up paying $12,000- $14,000, all things considered.

How Do You Calculate the Cost of Hiring Someone?

There is a somewhat simple calculation method to see what the costs of hiring new employees are. If you add external (drug screening, recruitment, etc.,) costs and internal (salary, and training) labor, divide the answer by the number of people hired and you will have the costs of hiring new employees.

How Can Homebase Help with the Hiring Process?

Homebase can post your job on leading job board websites to help you find a candidate, and if they are hired, Homebase streamlines the onboarding process by sending the candidate a digital new hire packet.

Is it Cheaper to Hire A New Employee or Train an Existing Employee?

Taking into account the expenses associated with bringing in a new staff member, it can be more cost-effective to upskill an existing employee. This approach eliminates the need for spending on hiring and moving costs. Plus, since the individual is already familiar with your business, the decrease in output as they transition to their new duties is likely to be minimal. However, the true comparison of costs will vary based on the specific training required and the employee’s existing and expected wages. Specialized or advanced training may come at a high price, and a raise might be necessary to account for the added responsibilities.

What is a Hiring Budget?

Allocating funds for recruiting is the act of earmarking a certain amount to meet the expenses of adding new staff. To establish this budget, first, identify the number of positions you plan to fill in the upcoming year. Subsequently, make a financial projection that includes both internal resources and any outside services you may require for the recruitment process. Having this budget in place allows you to engage in hiring activities without concern for exceeding your financial limits.