Having trouble figuring out whether your worker is an employee or an independent contractor? This issue has caused problems for both state and federal governments in recent years. The US Department of Labor is currently working to update federal laws, while some states have already made changes to their independent contractor laws in 2021.

Independent contractors are not considered employees and work on a contractual basis. They have more freedom to set their own schedules and work with multiple clients. In contrast, full-time and part-time employees have set schedules, are under the employer’s direct control, and receive benefits such as paid time off and healthcare.

It’s crucial to know how to properly classify your workers. However, up to 15% of employers are believed to wrongly classify at least one worker as an independent contractor, which can result in severe penalties.

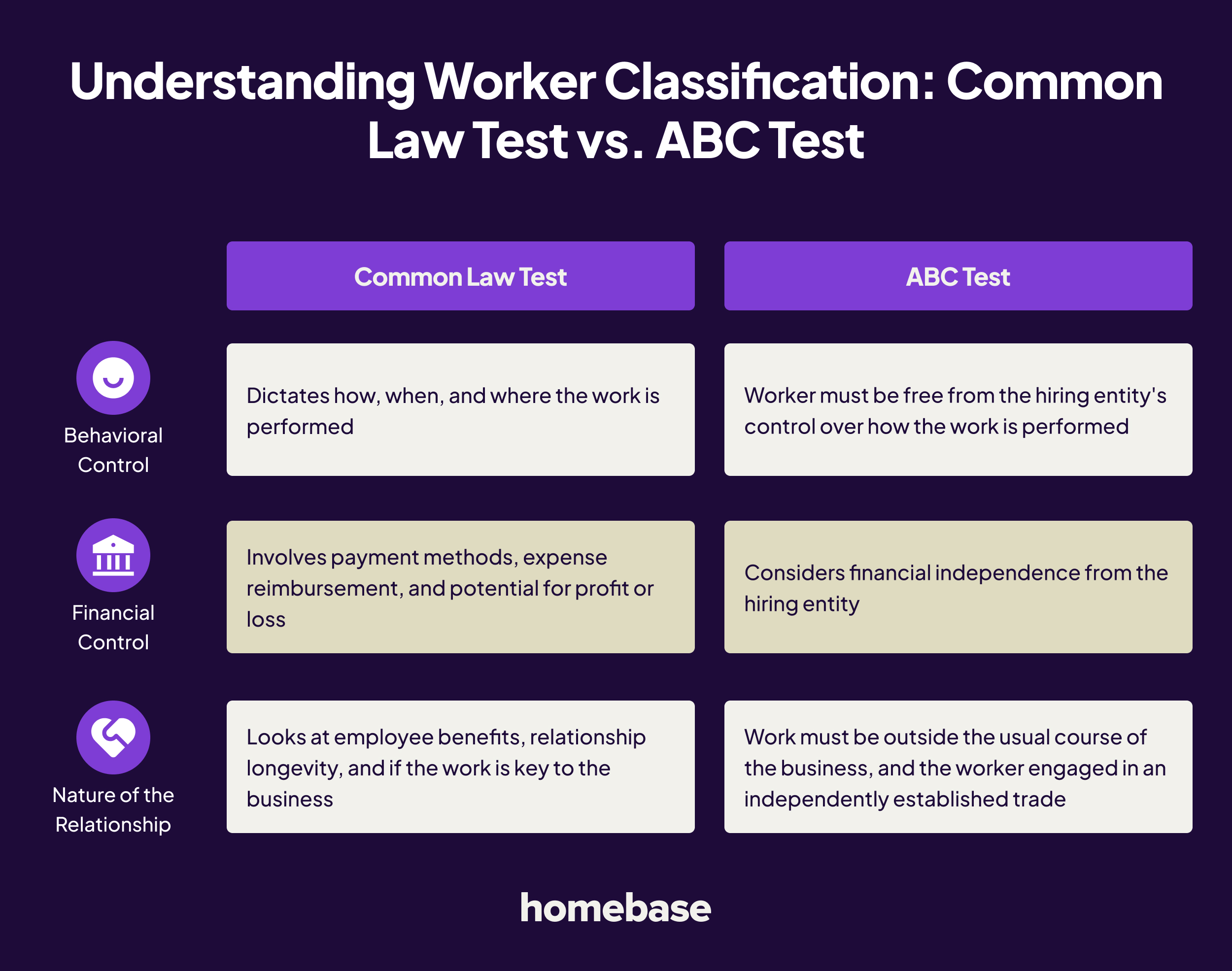

So how can you avoid this costly mistake? States use two tests to determine worker classification: the common law test and the ABC test. In this blog post, we’ll break down the differences between major independent contractor tests so you can figure out how to correctly classify your employees.

Independent Contractor Common Law Test

The common law test is used by the IRS for employment tax purposes. Additionally, 18 states and the District of Columbia use it as their law. (Check out the full list below.) This test looks at different types of control an employer could have to determine whether a worker is a W-2 employee or a 1099 contractor.

If any of the following controls are involved, the worker is considered an employee, and you are not engaged in an independent contractor relationship.

Behavioral Control

If you dictate how a worker performs work, behavioral control is in play. Controlling how an employee performs can include where they work, when they work, and how they get the job done.

The IRS poses this question to help determine behavioral control:

“Does the company control or have the right to control what the worker does and how the worker does his or her job?”

Financial Control

Financial control is evident if you rightfully control your worker’s finances in any way. According to the IRS, financial control includes the following aspects:

- Controlling how the worker is paid for work performed

- Deciding if expenses are reimbursed

- Your employee’s ability to experience profit and loss

- Providing your employee with tools and supplies

Employer-Employee Relationship

This factor looks at how your working relationship with the employee operates. There are several ways to determine if the relationship is in fact an employer-employee situati on:

- Are there written contracts or benefits that are usually offered to employees (like insurance, pension plan, paid leave)?

- Is the employment relationship going to continue on a long-term basis?

- Is the worker’s job a key aspect of business operations?

Here’s an example of the last question: If a restaurant hires someone to paint the exterior of their building, that worker is considered to be hired as an independent contractor because the restaurant isn’t in the business of painting.

The ABC Test for Independent Contractors

The US Department of Labor uses the ABC test to determine independent contractor status for labor law purposes, including minimum wages, overtime, and workers’ compensation. Also, 33 states use the test.

This test is similar to the common law test in that it looks at the degree of control and the nature of the work. It also examines whether or not the worker is customarily engaged in independent contractor work related to the job they are performing for a business.

A worker is presumed to be an employee unless they meet the following criteria.

Absence of Control

If the “hiring entity” does not have control and direction over the worker, both under the work contract and in fact, then an absence of control is present.

However, you may be able to set some hours if there are access restrictions that impact the worker’s ability to do their job. Still, you may not direct the worker in any way on how to perform the work.

Unusual Business

Independent contractors must perform work that is not part of the usual course of your business. Like the common law test, the painter who was hired by a restaurant to paint the walls would also be considered an independent contractor under this test.

Customary Engagement

Suppose the worker is customarily engaged in an independently established trade, occupation, or business that is of the same nature as the work they are performing for you. In that case, they are an independent contractor.

However, the Department of Labor also uses an “economic realities” rule that examines exactly how financially dependent the worker is on an employer. If the business provides a big chunk of their income, the DOL might lean more towards employment status.

Independent Contractor State Law Changes (2023)

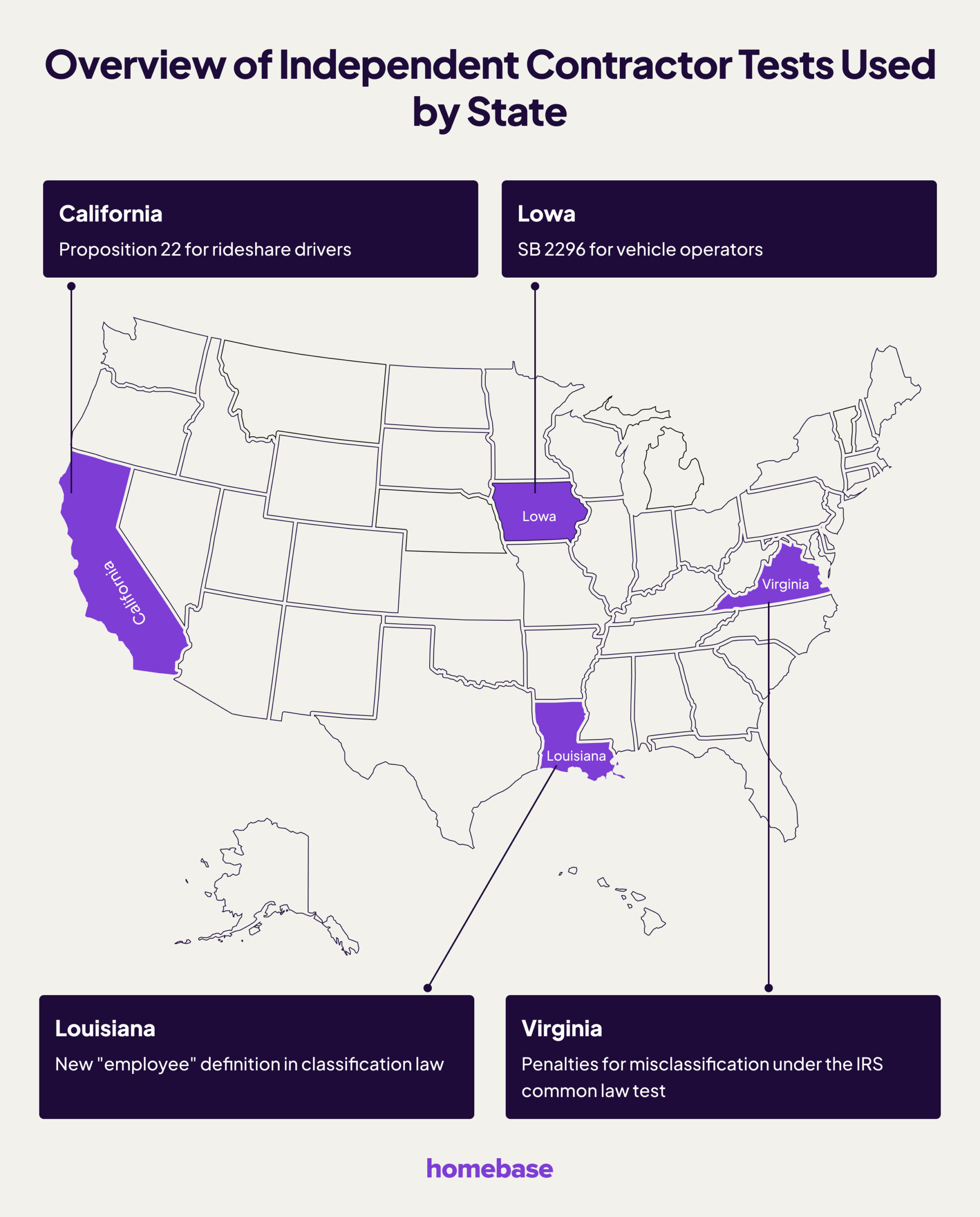

Many states—and one city—are expanding their independent contractor laws or changing definitions in the new year. Here is a look at what you should be aware of regarding state classification rules for 2023.

California

Proposition 22, which allows rideshare companies like Uber and Lyft to classify drivers as independent contractors, was approved by voters. Although they are not considered employees, the law requires that specific labor and wage policies be put in place for app-based drivers, which you can view here.

Meanwhile, the “Save Local Journalism Act” allows newspaper publishers to wait one more year until they are required to classify their newspaper carriers as independent contractors. The extension expired on January 1, 2022.

Iowa

SB 2296 established a new rule making workers who operate certain vehicles are classified as independent contractors instead of employees effective July 1, 2021.

Louisiana

Louisiana added a definition of “employee” to their existing classification law. The new definition reads:

“An ‘employee’ means an individual who performs services for an employer where there exists a right by the employer to control what work the employee does or how the employee performs his job or where the employer provides the tools and supplies to the employee for the performance of the job.”

Virginia

HB 1407 makes it illegal to misclassify an employee as an independent contractor under the IRS common law test. The Virginia Department of Taxation is allowed to investigate and impose civil penalties of up to $1,000 for each misclassified employee for the first offense, and up to $5,000 per employee for further offenses.

The new law has been in effect since January 1, 2021.

Independent Contractor Laws by State

As mentioned before, test usage varies among the states. Take a look at the list below to see if your state uses the common law test, the ABC test, or another type of variation.

| State | Independent contractor test |

| Alabama | Common Law |

| Alaska | ABC Test |

| Arizona | Common Law |

| Arkansas | ABC Test |

| California | ABC Test |

| Colorado | A&C of ABC Test |

| Connecticut | ABC Test |

| Delaware | ABC Test |

| District of Columbia | Common Law |

| Florida | Common Law |

| Georgia | ABC Test |

| Hawaii | ABC Test |

| Idaho | A&C of ABC Test |

| Illinois | ABC Test |

| Indiana | ABC Test |

| Iowa | Common Law |

| Kansas | ABC Test |

| Kentucky | Common Law |

| Louisiana | ABC Test |

| Maine | ABC Test |

| Maryland | ABC Test |

| Massachusetts | ABC Test |

| Michigan | Common Law |

| Minnesota | Common Law |

| Mississippi | Common Law |

| Missouri | Common Law |

| Montana | A&C of ABC Test |

| Nebraska | ABC Test |

| Nevada | ABC Test |

| New Hampshire | ABC Test |

| New Jersey | ABC Test |

| New Mexico | ABC Test |

| New York | Common Law |

| North Carolina | Common Law |

| North Dakota | Common Law |

| Ohio | ABC Test |

| Oklahoma | A&B or A&C of ABC Test |

| Oregon | ABC Test |

| Pennsylvania | A&C of ABC Test |

| Puerto Rico | ABC Test |

| Rhode Island | ABC Test |

| South Carolina | Common Law |

| South Dakota | Common Law |

| Tennessee | ABC Test |

| Texas | Common Law |

| Utah | ABC Test |

| Vermont | ABC Test |

| Virginia | A&B or A&C of ABC Test |

| Washington | ABC Test |

| West Virginia | ABC Test |

| Wisconsin | A&C of ABC Test |

| Wyoming | A&C of ABC Test |

Properly classifying your workers as employees or independent contractors can be complex and expensive. Keeping up with independent contractor law changes at state and federal levels can be challenging as well.

It’s crucial to know the differences between the common law test and the ABC test used by states to determine worker classification.

That’s where Homebase’s HR and compliance services can help. Our services help you navigate these laws and make sure your business complies with state and federal regulations. With Homebase, you can have peace of mind and focus on growing your business, knowing you’re covered when it comes to employment laws.