Every month, we share our thoughts on the state of Main Street amid the global pandemic. With information from over 60,000 businesses and one million active hourly employees, our data offers insight into how the US small business economy is faring and what we might expect in the coming months ahead.

You can find the full report here, but here’s a snapshot of what we saw in November.

How did Main Street fare in November (30-second snapshot)

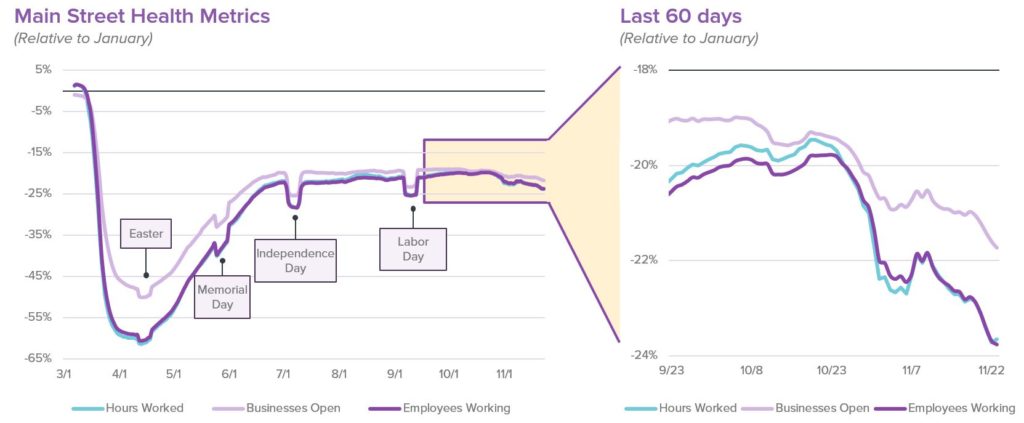

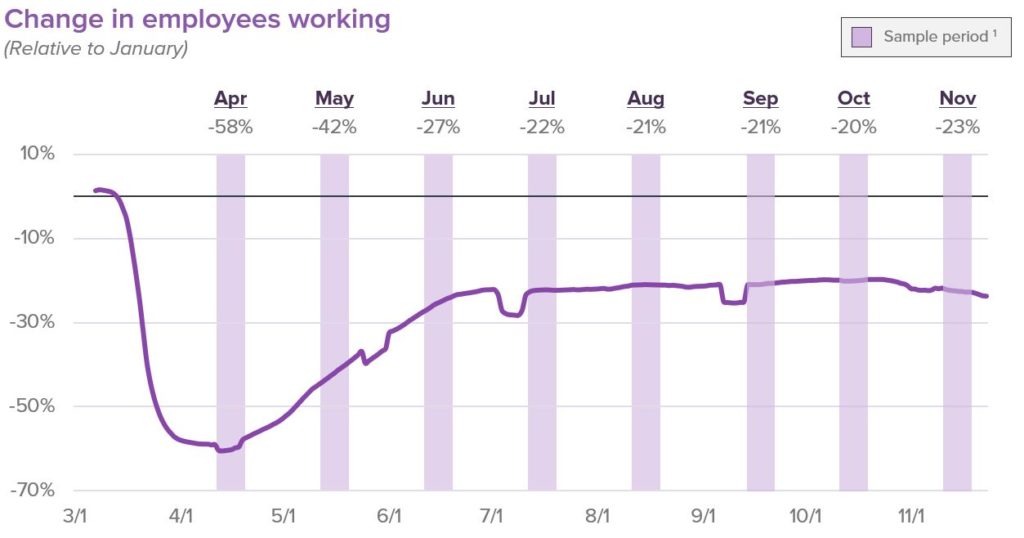

In November, our businesses open metric declined noticeably, along with our two other economic indicators of hours worked and number of employees working, ending a period of stagnation and initiating a clear decline across metrics.

While seasonality plays a role in this decline, COVID-19 continues to adversely impact small businesses, as seen in states and regions that concurrently saw both larger spikes in COVID cases in November and steeper declines in metrics.

As COVID cases continue to climb across the nation, we expect conditions to worsen, placing increased pressure on Main Street as small businesses continue to struggle to survive in the current environment.

Marked decline in November

While we’ve seen constant stagnation for the last 4 months with our data set baselined against January, we saw a noticeable decline across our three metrics in November.

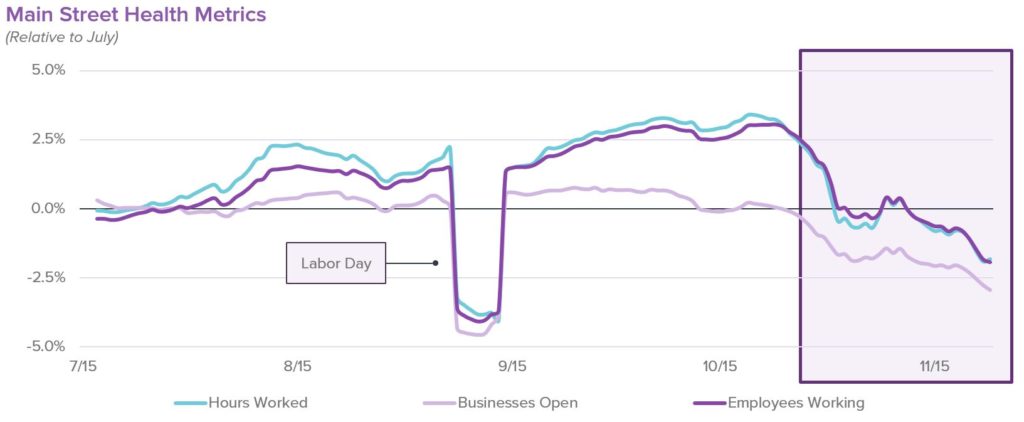

Similarly, when looking at our data set benchmarked against July, it’s clear that our metrics have fallen to pre-summer levels.

In particular, our “employees working” metric fell by 3 percentage points vs. October levels. This is the first time that our employment metric showed a clear decline vs. the prior month since the onset of the pandemic.

Is seasonality at play?

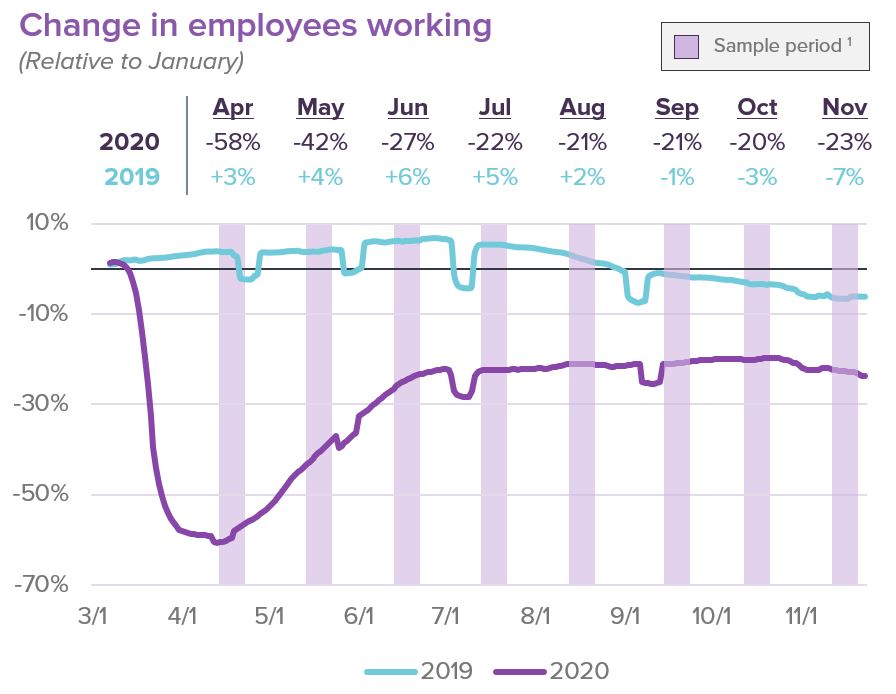

When looking at how our metrics trended in 2019, we saw a similar decline around this time of the year, suggesting that seasonality likely played a role in the November slowdown.

However, since we didn’t see the decline start earlier in the autumn season as we did last year, it could be that seasonal effects are less pronounced this year. Perhaps fewer seasonal businesses opened this summer due to the pandemic, resulting in a smaller end-of-summer retraction, or perhaps the remaining Main Street businesses open have grown to be resilient in the current environment.

Therefore, it’s likely that other factors, namely COVID-19, also contributed to this decline.

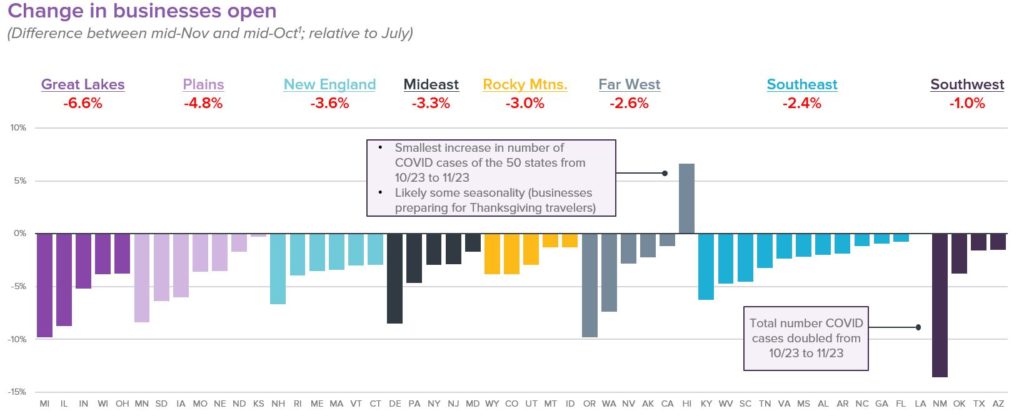

Regional perspectives: declines nationwide

Virtually every single state saw decreases in the number of businesses open in November. Once again, northern regions (e.g., Great Lakes, Plains, New England) saw steeper declines than their southern counterparts.

While climate is likely a contributing factor to this difference in impact between northern and southern regions, COVID-19 is another driver. It looks like regions that saw larger spikes in COVID cases last month concurrently saw steeper declines in our economic indicators.

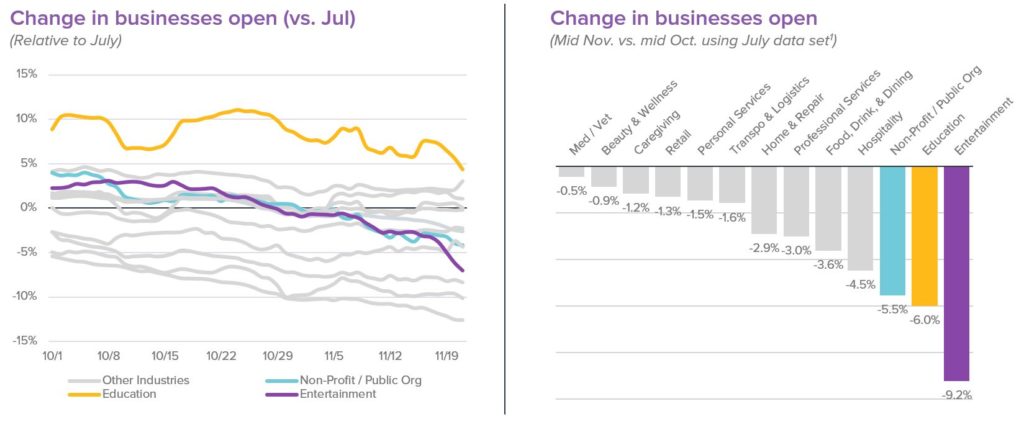

Industry perspectives: entertainment industry hit the hardest

Last month, we revamped our industry classifications, leveraging internal and external data sources to add specificity to our classification system. In doing so, we doubled the number of businesses that we can readily classify, and expanded our high-level business type classifications from 10 to 13.

With this updated view, it’s clear that industries across the board experienced declines last month, with the entertainment industry hit the hardest.

As we head into December and quickly approach the winter season, we expect conditions to worsen, adding increased pressure on Main Street as small businesses continue to fight to survive.

How has Homebase data been validated?

We’ve partnered with a number of academics, researchers, and policy makers to validate and improve our data. Here are a few examples:

- The St. Louis Federal Reserve suggested that Homebase data could be predictive of the jobs reports

- Researchers at Drexel used Homebase data to estimate the “true” employment level

- A team at UChicago and Berkeley used Homebase data to show disparate impacts across different groups

Methodology and definitions

The January dataset is based on Homebase data gathered from over 60,000 businesses and 1 million hourly employees active in the US in January 2020. All the rates compare that day vs. the average for that day of the week for the period Jan 4, 2020 – Jan 31, 2020. The July dataset does the same, except it looks at the period July 11, 2020 – August 7, 2020.

- “Hours worked” is calculated from hours recorded in Homebase timecards

- “Locations open” is based on whether a business had at least one employee clock-in

- “Employees working” is based on the distinct number of hourly workers with at least one clock-in

Questions or comments about our findings?

Contact Ray Sandza (VP, Data & Analytics) and Kevin Liang (Manager, Data Products) to learn more about our findings and our data.

Homebase makes work easier for 100,000+ small (but mighty) businesses with everything they need to manage an hourly team: employee scheduling, time clocks, team communication, hiring, onboarding, and compliance. We are not Human Capital Management. We are not HR Software. We’re tools built for the busiest businesses, so owners and employees can spend less time on paperwork and more time on what matters.