As we did in June, we turned to Homebase data to get a picture of what businesses looked like for Main Street establishments across the U.S. in July. With over 60,000 businesses and one million active hourly employees, we were able to gain insight into economic recovery, unemployment, and more.

Here’s what we found.

How did Main Street fare in July?

July was a month of stagnation for Main Street as cases surged in some areas, reigniting the discussion on shutdowns. It was also the first month since March without growth in SMB activity.

Further, Congress’s failure to reach a deal to extend unemployment insurance benefits puts hourly workers at risk as the economy loses momentum from the recovery in May and June.

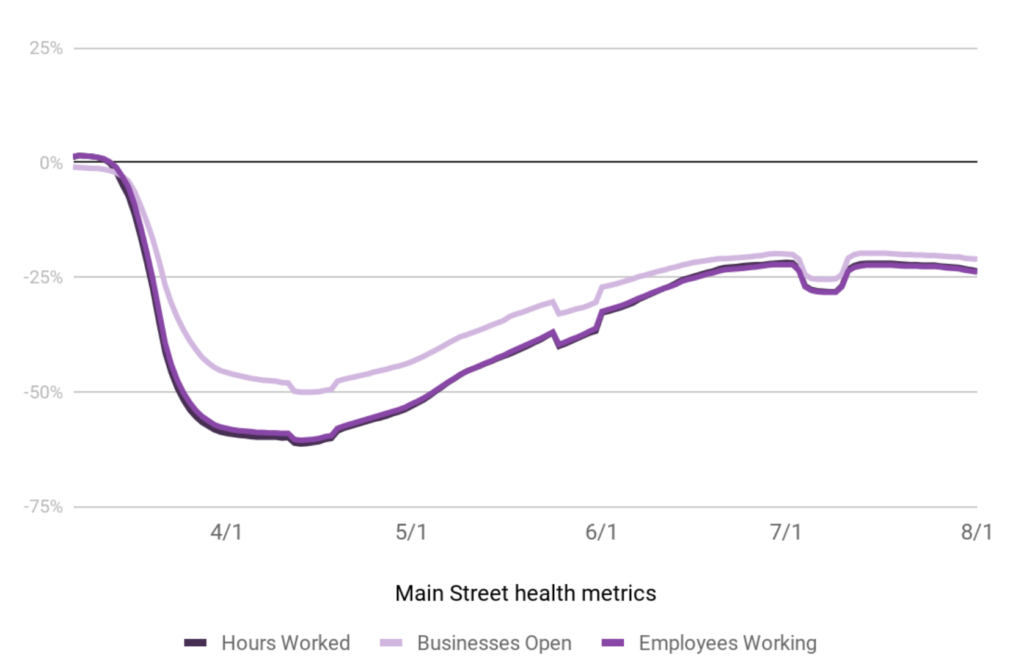

Small business economic recovery stagnated

Roughly the same number of businesses were open at the beginning of July as were open at the end of the month. This means July was the first month since March that saw declines in activity.

As for employment, a fewer number of employees were working, and the employees that were on the job worked slightly fewer hours.

While some areas of the country are still improving, declines in other regions led to an overall slight decrease in activity.

May and June improvements did not extend into July

Fewer employees were working at the end of the month, relative to the beginning of the month. This is in line with the recent uptick we’ve seen in unemployment claims.

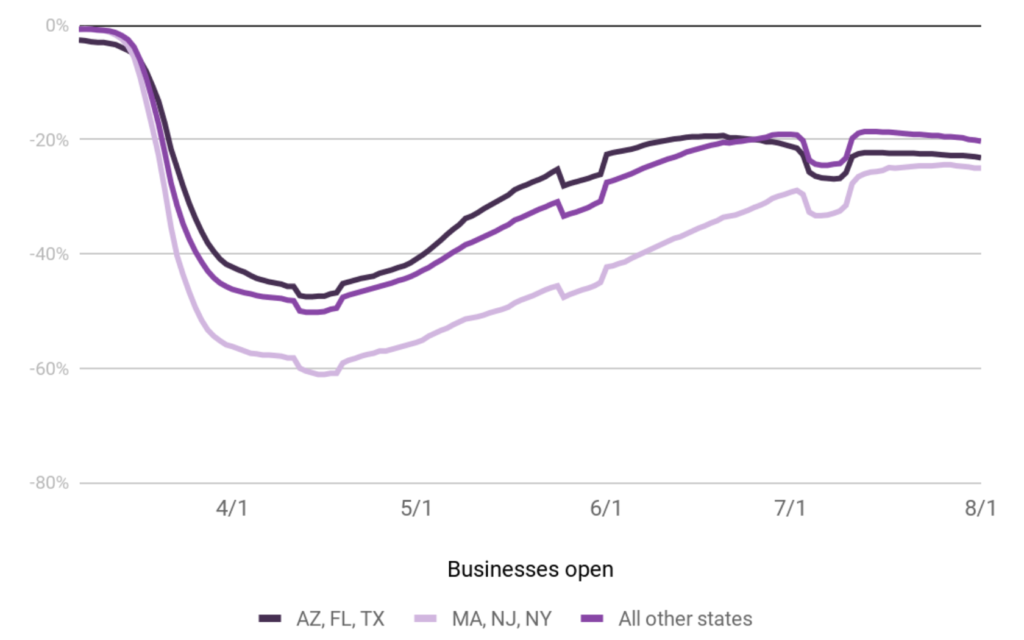

Furthermore, “late open” states like New York and New Jersey are now almost at the level of “early open” states like Texas and Florida, despite reaching much higher closure rates.

What does this mean for unemployment?

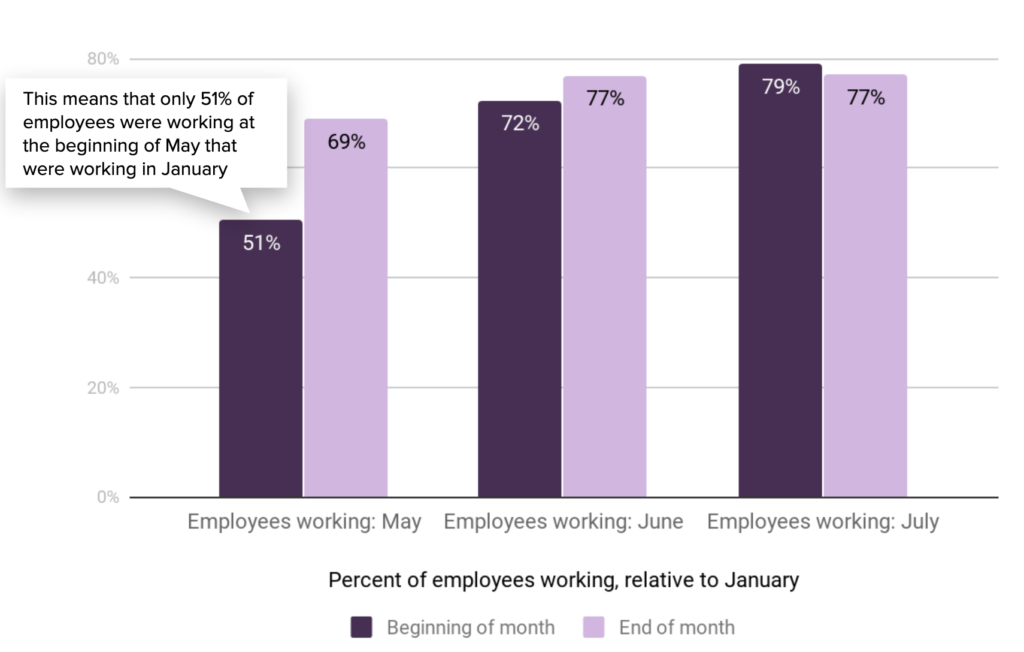

We could see improvements in unemployment numbers. The working metric among our employees improved from the June sample period to the July one.

However, almost all of this gain happened in the last weeks of June. The report might not reflect the current weakening in the labor market (a weakening the Census Household pulse survey also picked up).

Below is the percentage of employees working (during sample period), compared to January baseline:

- July: -23%

- June: -27%

- May: -42%

- April: -60%

Expiration of unemployment benefits

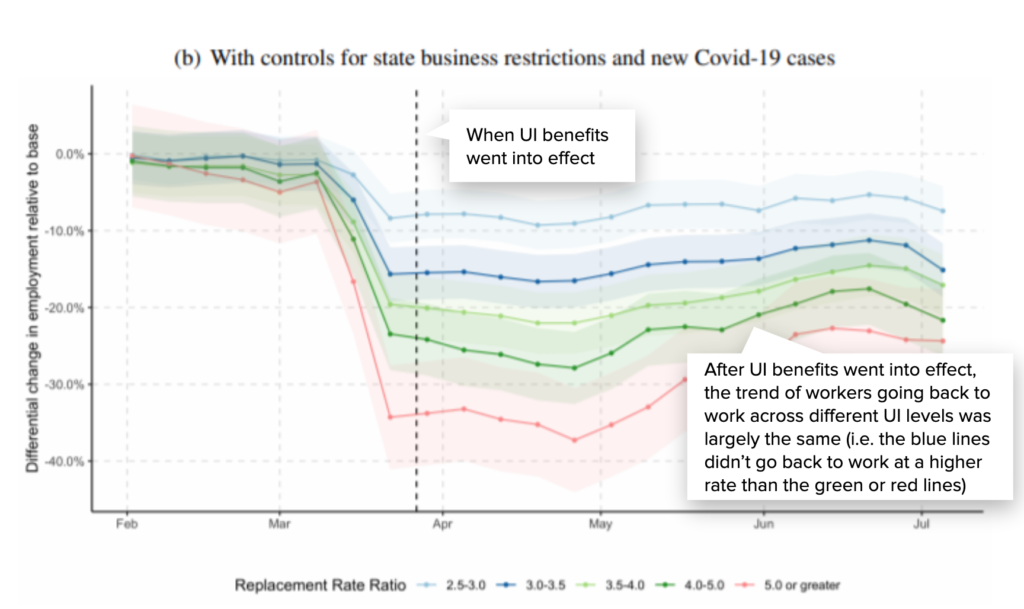

The expiration of UI benefits will likely harm hourly workers, without leading to more people returning to work. Economists from Yale, using Homebase data, found no evidence to support the claim that enhanced UI benefits leads to fewer people returning to work.

Instead, they found that the main driver was a lack of available jobs. For more information, read the Yale report here.

How has Homebase data been validated?

We’ve partnered with a number of academics and researchers to validate and improve the Homebase data. Here are a few examples:

- The St. Louis Federal Reserve suggested that Homebase data could be predictive of the jobs reports.

- Researchers at Drexel used Homebase data to estimate the “true” employment level.

- A team at UChicago and Berkeley used Homebase data to show disparate impacts across different groups.

Do you have any questions or comments about our findings? Contact Homebase VP of Data & Analytics Ray Sandza and Senior Analyst Andrew Vogeley to learn more.

Homebase makes work easier for 100,000+ small (but mighty) businesses with everything they need to manage an hourly team: employee scheduling, time clocks, team communication, hiring, onboarding, and compliance. We are not Human Capital Management. We are not HR Software. We’re tools built for the busiest businesses, so owners and employees can spend less time on paperwork and more time on what matters.