As we did in June, we took a look at Homebase data to get a better understanding of what small business activity looks like as some areas of the United States experience a spike in coronavirus cases.

With over 60,000 businesses and one million active hourly employees, we were able to see how the spikes are impacting currently Main Street.

Here are our most recent findings.

Declines after 2+ months of recovery

Areas that have seen a spike in coronavirus cases are seeing declines in business activities, although the declines are not as steep as during the first wave of cases.

Hiring for hourly workers, however, is now below the levels we saw before the coronavirus pandemic. After staying elevated in the immediate aftermath of the first wave, applicants and job post levels are also depressed.

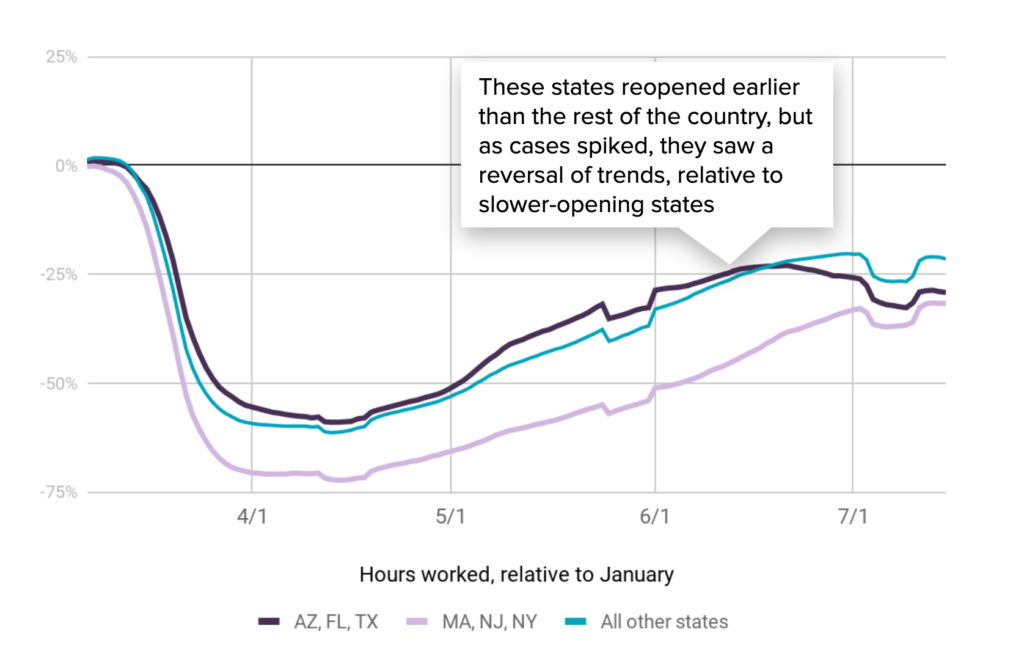

A divergence among states

After months of similar trends, we’re noticing a split among different locations. States like Arizona, Florida, and Texas have seen the number of hours worked decline since cases began to spike at the end of June. These states reopened earlier than the rest of the country, but as cases spiked, they saw a reversal of trends, relative to slower-opening states.

States hit hardest at the beginning of the pandemic, including Massachusetts, New Jersey, and New York, have steadily improved and, despite a deeper trough, are almost even with states that re-opened earlier and are now experiencing a second wave of cases.

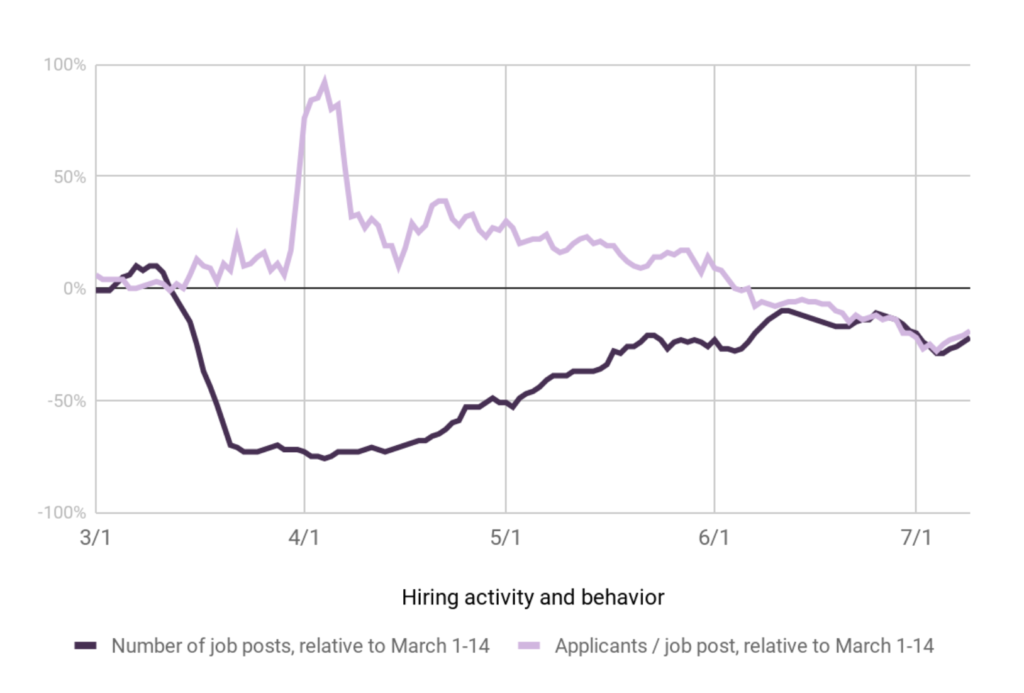

A slowdown in hiring

Hiring levels at small businesses remain below pre-COVID levels and the number of workers applying for those jobs has fallen to levels below what we saw before the coronavirus pandemic as well.

We saw a spike in the number of applicants and job posts at the beginning of the crisis. However, this large number of applicants were applying to a dramatically lower level of available jobs.

Application rates remained elevated in the months following the beginning of COVID-19, despite safety concerns among hourly workers. However, application rates have fallen over last month, perhaps as workers become discouraged by the lack of jobs and fear increases in coronavirus cases.

All data is taken from Homebase’s Hiring product. This tool allows owners to post jobs, track applicants, and ultimately hire employees for their teams.

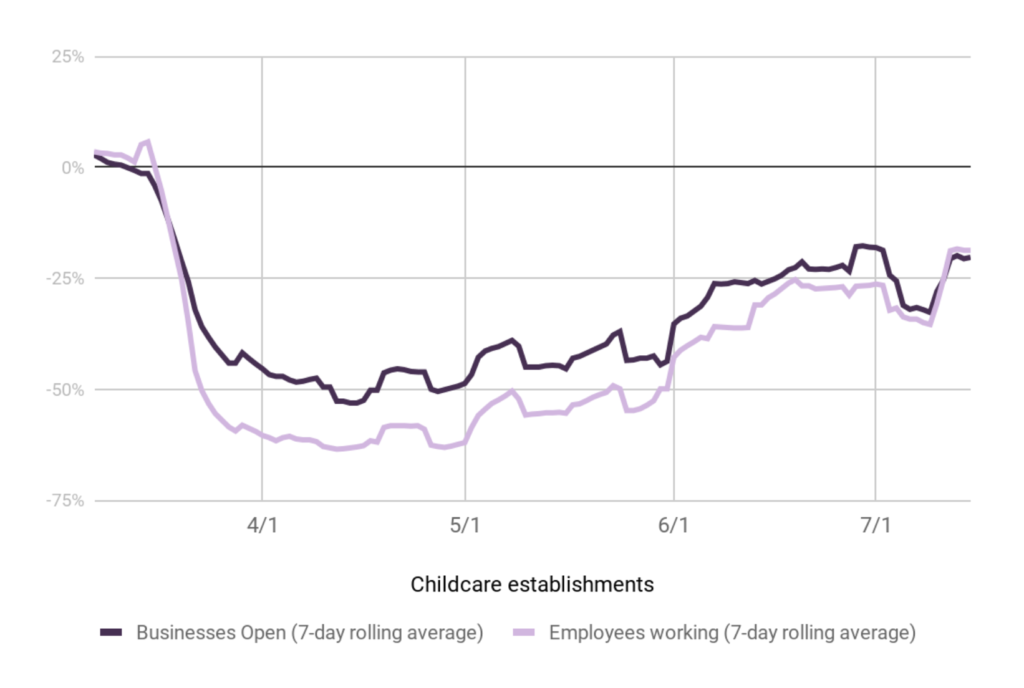

Constrained childcare

As the country debates whether or not to reopen office buildings and schools, we could be faced with a childcare availability issue—around 20% of these types of locations remain closed. A constrained childcare situation may complicate the ability of the economy to “get back on track.”

How has Homebase data been validated?

We’ve partnered with a number of academics and researchers to validate and improve the Homebase data. Here are a few examples:

- The St. Louis Federal Reserve suggested that Homebase data could be predictive of the jobs reports.

- Researchers at Drexel used Homebase data to estimate the “true” unemployment rate.

- A team at UChicago and Berkeley used Homebase data to show disparate impacts across different groups.

Do you have any questions or comments about our findings? Contact Homebase VP of Data & Analytics Ray Sandza and Senior Analyst Andrew Vogeley to learn more.

Homebase makes work easier for 100,000+ small (but mighty) businesses with everything they need to manage an hourly team: employee scheduling, time clocks, team communication, hiring, onboarding, and compliance. We are not Human Capital Management. We are not HR Software. We’re tools built for the busiest businesses, so owners and employees can spend less time on paperwork and more time on what matters.