To get a picture of what business looked like for main street establishments across the U.S. last month, we turned to our own data here at Homebase. With over 60,000 businesses and one million active hourly employees, we were able to compare data from recent days in June to that of the average weekday from the period of Jan 4, 2020 through Jan 31, 2020.

Here’s what we found.

How did Main Street fare during June?

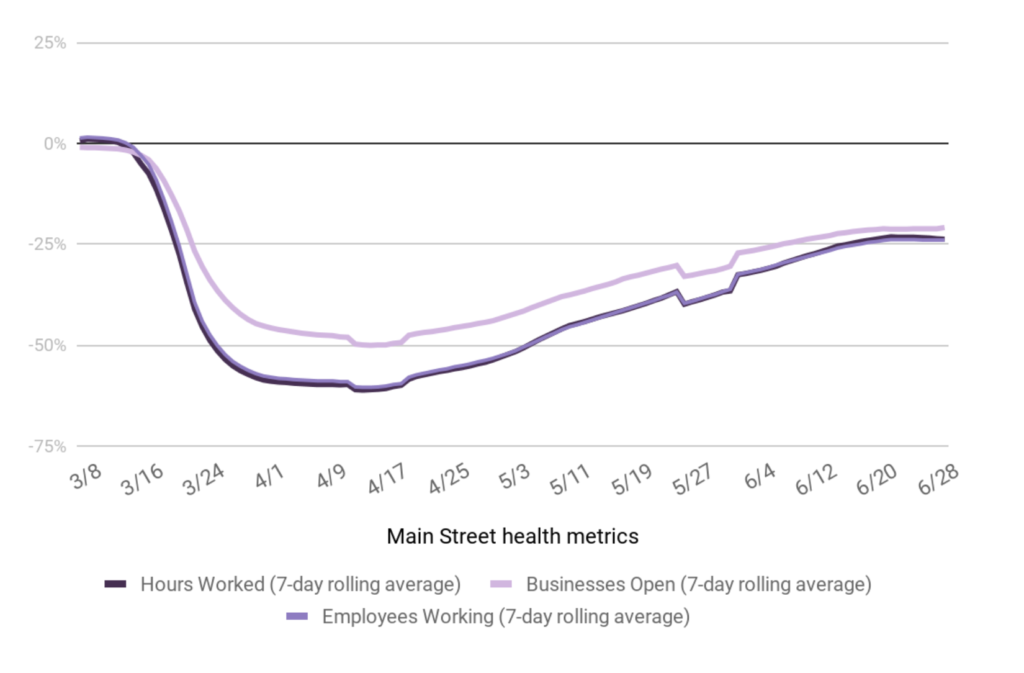

Based on our data, Main Street activity continued to improve throughout the month of June. However, the pace of improvement was slower in June than in May—particularly toward the end of the month.

The positive jobs report, while a good sign, likely overstates the economic health of Main Street businesses. In fact, we’ve already begun to see the negative impact of increases in COVID-19 cases in some states on small businesses.

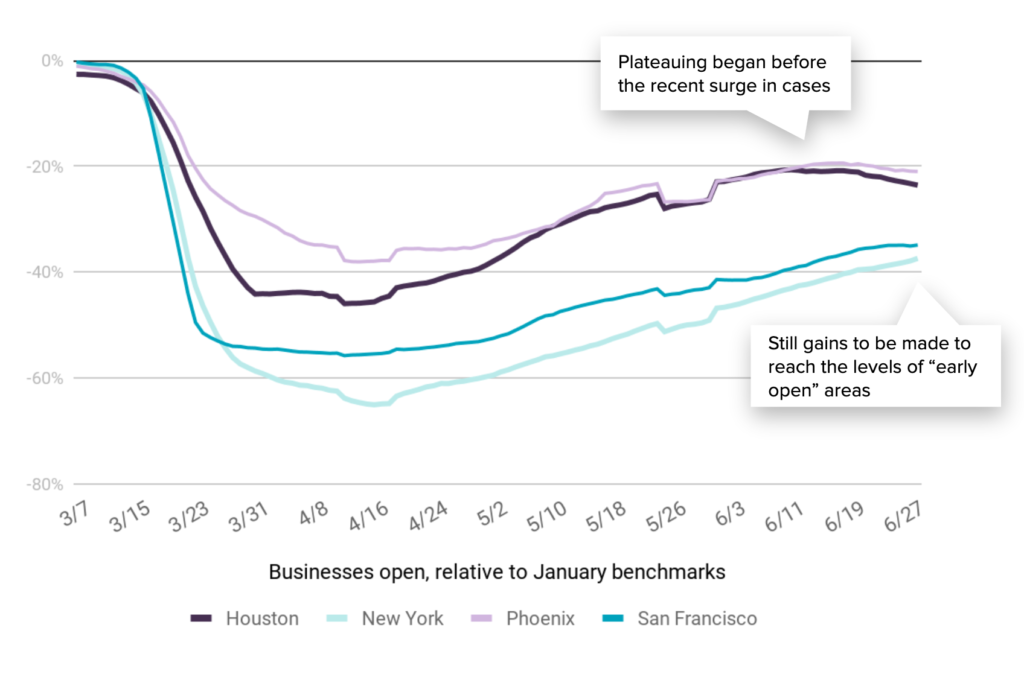

Even before cases increased, some states were hitting a reopening plateau, suggesting we might see around 20% of small businesses close permanently. Still, cities that remained locked down longer still lag in terms of total recovery, and the recovery has differed across industries, with retail bouncing back more quickly than food and drink.

Small business recovery continued

The good news: fewer businesses were closed at the end of June than they were at the beginning of the month, with more employees working more hours.

The not-so-good news: You can see a recent plateauing that will likely continue, or worsen, given new coronavirus case rates and associated impacts on lockdowns and customer demand.

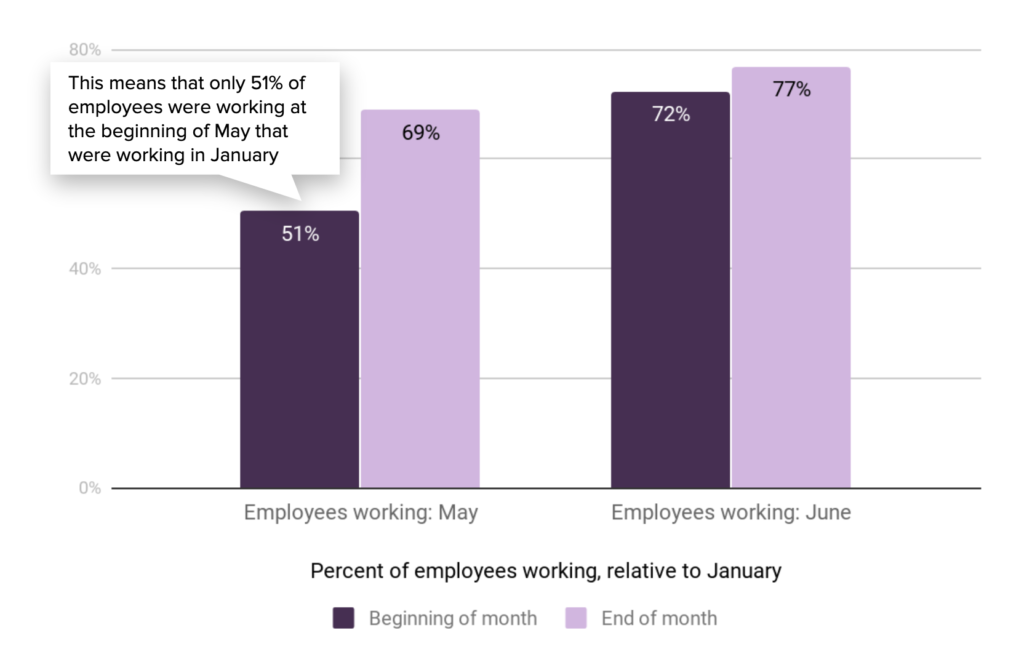

However, the pace of improvement was slower than May. We saw a 37% improvement over the course of May, compared to a 6% increase over the course of June. According to our data shown in the graph below, only 51% of employees were working at the beginning of May that were working in January.

What should we make of the jobs recovery report?

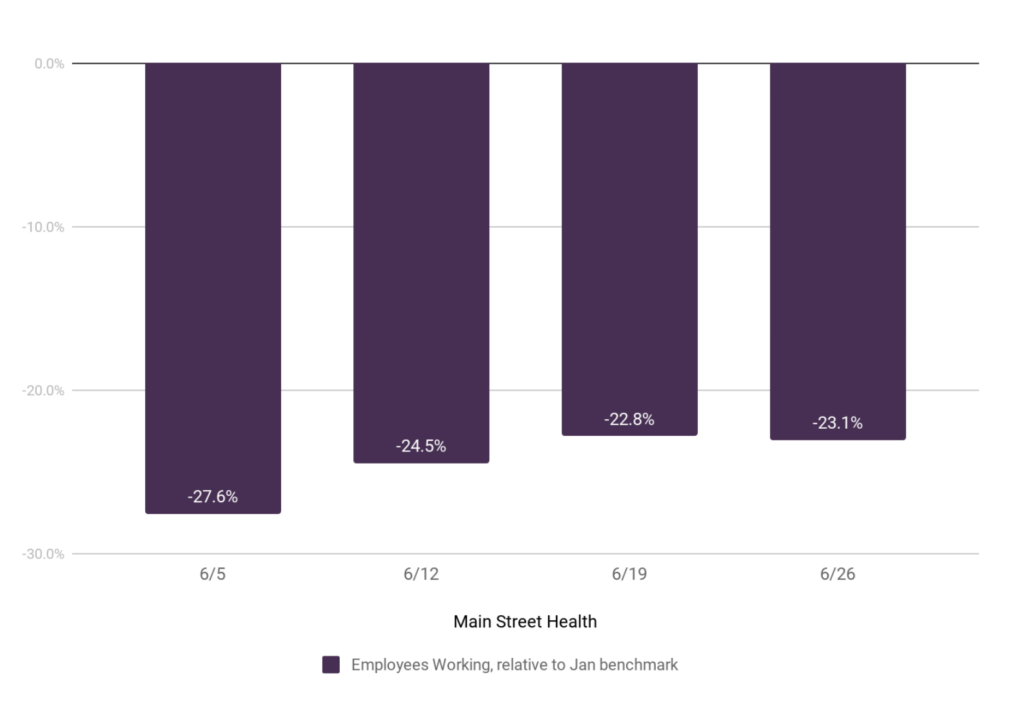

While we saw an overall increase in Main Street business activity in the month of June, our date leads us to believe this is likely a false signal for optimism. Over the last week, we’ve seen flattening and slight downward trends, a stark contrast to the upward curves we’ve seen since the lowest point in April.

Had we seen a continuation of the trends we saw in early June, we would have expected the 6/26 number on the graph above to be -20%—instead it’s up from the previous week. Because the jobs report only measures data for the week containing June 12, the data is already stale in this rapidly changing economic environment.

An increase in cases

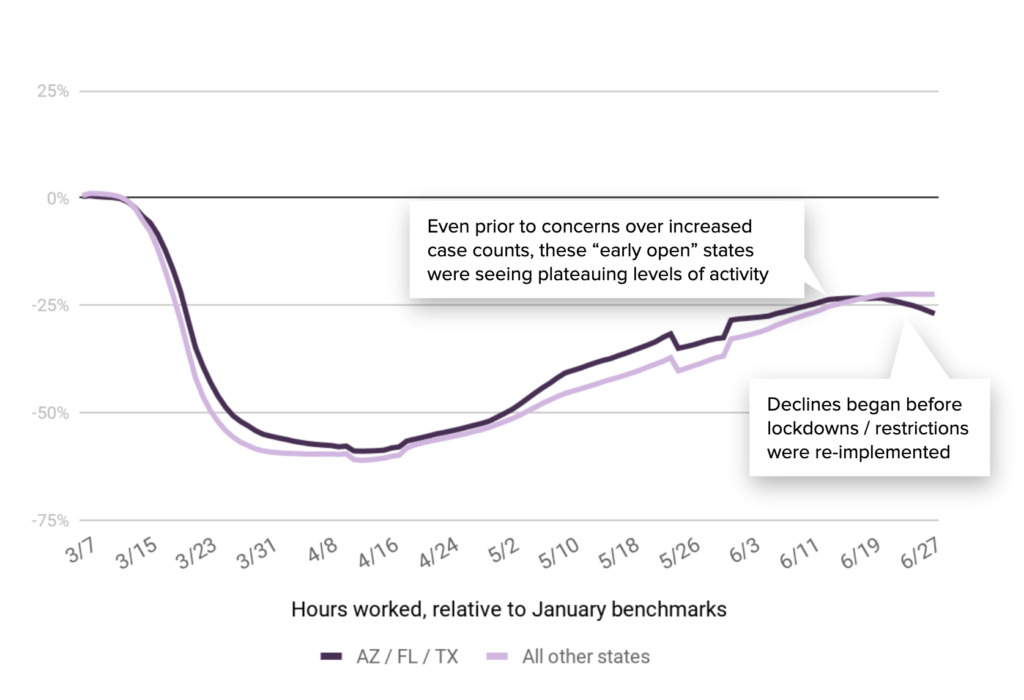

An increase in COVID-19 cases in states like Arizona, Florida, and Texas—which collectively make up a group we’re calling “Wave 2” states—have seen a decline in hours worked, as you can see in the graph below.

Even before concerns arose over the increase in cases, the “Wave 2” states were experiencing plateauing levels of activity. In fact, the declines preceded the re-implementation of lockdowns and restrictions.

Differential improvement

While cities like New York and San Francisco had lower troughs, they’ve steadily improved as cities like Houston and Phoenix have plateaued or given back some of their early gains. These plateaus suggest around 20% of Main Street businesses are closing permanently.

Differential impacts

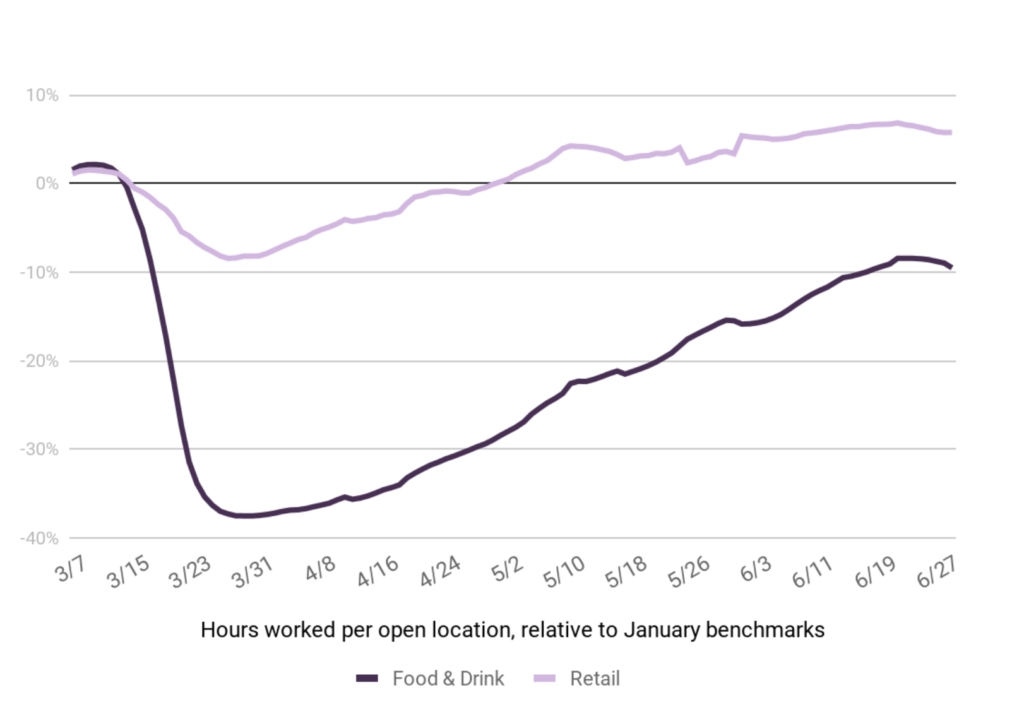

We can get a sense of how “surviving” businesses are doing by taking a look at the number of hours worked per open location. For example, retail operations that are open at levels slightly above pre-pandemic, suggesting survivors have thrived and perhaps taken market share from their still-closed competitors.

Businesses in the food and drink industry, however, are still below the benchmark. This is because restrictions on capacity levels have a larger negative impact on operations, given the nature of those businesses.

How has Homebase data been validated?

We’ve partnered with a number of academics and researchers to validate and improve the Homebase data. Here are a few examples:

- The St. Louis Federal Reserve suggested that Homebase data could be predictive of the jobs reports.

- Researchers at Drexel used Homebase data to estimate the “true” unemployment rate.

- A team at UChicago and Berkeley used Homebase data to show disparate impacts across different groups.

Do you have any questions or comments about our findings? Contact Homebase VP of Data & Analytics Ray Sandza and Senior Analyst Andrew Vogeley to learn more.

Homebase makes work easier for 100,000+ small (but mighty) businesses with everything they need to manage an hourly team: employee scheduling, time clocks, team communication, hiring, onboarding, and compliance. We are not Human Capital Management. We are not HR Software. We’re tools built for the busiest businesses, so owners and employees can spend less time on paperwork and more time on what matters.