Last Friday, the Bureau of Labor Statistics (BLS) released their monthly jobs report and it took the policy and economics world by storm. A survey of 78 economists predicted that the economy would lose another 7.5 million jobs; the most optimistic guess in the group was a loss of 800K jobs.

In reality, the economy gained 2.5 million jobs. The biggest driver of this gain was a massive employment turnaround in the Leisure & Hospitality sector which lost 7.5M jobs in April but actually gained 1.2 million jobs in May.

While the number of workers out of a job is still at a historically low level—13.3%—beating expectations by this much was undoubtedly a positive sign for the economy and the recovery from this pandemic.

From our seat, though, we were surprised no one saw this coming. Since the pandemic began, we have made Homebase data public to help policymakers and our customers understand what is happening. Our dataset tracks 60,000 Main Street businesses that were active at the beginning of March and looks at how many are open—and at what operating levels—every day since.

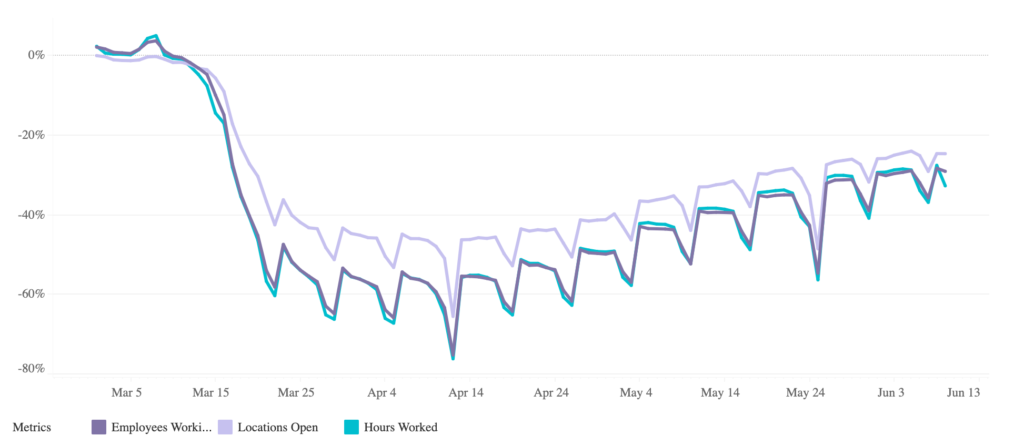

If you look at the data, it’s easy to see a steady, if slow, recovery from the depths of the shutdowns in mid-April:

Lest you accuse us of drinking our own Kool-Aid and getting lucky, on Tuesday the St. Louis branch of the Federal Reserve published findings validating that our data is, in fact, predictive of the jobs report since the coronavirus pandemic began.

Given this validation, we are publishing state- and city-level changes over the period May 1st to May 29th so you can see how Main Street in your region has been faring during what we all hope is the beginning of a permanent, and speedy, recovery.

First, some clarification about our data might be helpful:

- This dataset is based on Homebase data for over 60,000 main street businesses and 1 million hourly employees active in the US in January 2020. All the rates compare that day vs. the median for that day of the week for the period Jan 4, 2020 – Jan 31, 2020.

- “Employees working” is based on the distinct number of hourly workers with at least one clock-in. I focus on that metric in this post as it most closely aligns with the spirit of the jobs report

- We also make data on “Hours Worked” and “Businesses Open” available on our public data portal

- Finally, some of the improvement numbers below may look shockingly high. It’s important to remember that that’s a reflection of just how bad things got by the end of April. As an illustrative example: If hours worked dropped to 50% of January levels by the end of April, and then improved by 50%, you’d still be at only 75% of January levels. It’s going to take lots of months like May to get us anywhere near normal again.

Ok, now that all the fine print is out of the way, let’s dive in!

10 cities and states with biggest relative

improvement in Employees Working

| State | Percent growth during May | End of May, relative to Jan ‘20 level |

| NH | 102% | -27% |

| VT | 72% | -38% |

| IN | 61% | -21% |

| WV | 56% | -27% |

| MI | 56% | -39% |

| KY | 56% | -27% |

| OH | 53% | -21% |

| CT | 52% | -41% |

| NV | 51% | -38% |

| WI | 50% | -14% |

| City | Percent growth during May | End of May, relative to Jan ‘20 level |

| Louisville | 86% | -23% |

| Cincinnati | 57% | -25% |

| St. Louis | 55% | -23% |

| Columbus | 51% | -18% |

| Miami | 51% | -40% |

| Boston | 49% | -49% |

| Jacksonville | 49% | -13% |

| Indianapolis | 49% | -25% |

| Nashville | 48% | -25% |

| Pittsburgh | 48% | -43% |

10 cities and states with smallest relative

improvement in Employees Working

| State | Percent growth during May | End of May, relative to Jan ‘20 level |

| MN | 6% | -39% |

| ND | 14% | -17% |

| UT | 19% | -5% |

| VA | 23% | -37% |

| NM | 25% | -34% |

| OK | 26% | -14% |

| IL | 27% | -42% |

| TX | 28% | -23% |

| WA | 28% | -34% |

| GA | 29% | -26% |

| City | Percent growth during May | End of May, relative to Jan ‘20 level |

| Minneapolis | 0% | -41% |

| Kansas City | 2% | -19% |

| Virginia Beach | 20% | -33% |

| Richmond | 21% | -39% |

| Portland | 22% | -42% |

| Dallas | 25% | -26% |

| Los Angeles | 25% | -40% |

| Washington DC | 25% | -45% |

| Salt Lake City | 26% | -22% |

| Houston | 26% | -28% |

Full Employees Working results for all states

| State | Percent growth during May | End of May, relative to Jan ‘20 level |

| AK | 31% | -14% |

| AL | 36% | -20% |

| AR | 37% | -23% |

| AZ | 39% | -27% |

| CA | 30% | -38% |

| CO | 36% | -23% |

| CT | 52% | -41% |

| DE | 29% | -29% |

| FL | 46% | -31% |

| GA | 29% | -26% |

| HI | 40% | -51% |

| IA | 37% | -10% |

| ID | 30% | -6% |

| IL | 27% | -42% |

| IN | 61% | -21% |

| KS | 34% | -5% |

| KY | 56% | -27% |

| LA | 36% | -36% |

| MA | 47% | -51% |

| MD | 36% | -34% |

| ME | 38% | -30% |

| MI | 56% | -39% |

| MN | 6% | -39% |

| MO | 33% | -14% |

| MS | 35% | -19% |

| MT | 33% | -9% |

| NC | 42% | -30% |

| ND | 14% | -17% |

| NE | 29% | -7% |

| NH | 102% | -27% |

| NJ | 39% | -42% |

| NM | 25% | -34% |

| NV | 51% | -38% |

| NY | 37% | -55% |

| OH | 53% | -21% |

| OK | 26% | -14% |

| OR | 35% | -33% |

| PA | 38% | -41% |

| RI | 49% | -33% |

| SC | 41% | -14% |

| SD | 32% | 20% |

| TN | 38% | -17% |

| TX | 28% | -23% |

| UT | 19% | -5% |

| VA | 23% | -37% |

| VT | 72% | -38% |

| WA | 28% | -34% |

| WI | 50% | -14% |

| WV | 56% | -27% |

| WY | 42% | -14% |

Full Employees Working results for top cities represented in the data

| City | Percent growth during May | End of May, relative to Jan ‘20 level |

| Atlanta | 29% | -29% |

| Austin | 43% | -17% |

| Baltimore | 33% | -34% |

| Birmingham | 41% | -25% |

| Boston | 49% | -49% |

| Buffalo | 41% | -42% |

| Charlotte | 36% | -29% |

| Chicago | 29% | -45% |

| Cincinnati | 57% | -25% |

| Cleveland | 40% | -28% |

| Columbus | 51% | -18% |

| Dallas | 25% | -26% |

| Denver | 35% | -31% |

| Detroit | 34% | -59% |

| Hartford | 42% | -41% |

| Houston | 26% | -28% |

| Indianapolis | 49% | -25% |

| Jacksonville | 49% | -13% |

| Kansas City | 2% | -19% |

| Las Vegas | 45% | -43% |

| Los Angeles | 25% | -40% |

| Louisville | 86% | -23% |

| Memphis | 33% | -10% |

| Miami | 51% | -40% |

| Milwaukee | 37% | -12% |

| Minneapolis | 0% | -41% |

| Nashville | 48% | -25% |

| New Orleans | 39% | -48% |

| New York | 39% | -58% |

| Oklahoma City | 35% | -16% |

| Orlando | 47% | -31% |

| Philadelphia | 28% | -47% |

| Phoenix | 33% | -27% |

| Pittsburgh | 48% | -43% |

| Portland | 22% | -42% |

| Providence | 45% | -34% |

| Raleigh | 33% | -31% |

| Richmond | 21% | -39% |

| Riverside | 32% | -28% |

| Sacramento | 30% | -35% |

| Salt Lake City | 26% | -22% |

| San Antonio | 35% | -22% |

| San Diego | 35% | -35% |

| San Francisco | 29% | -52% |

| San Jose | 34% | -36% |

| Seattle | 27% | -40% |

| St. Louis | 55% | -23% |

| Tampa | 43% | -24% |

| Virginia Beach | 20% | -33% |

| Washington DC | 25% | -45% |