We know that managing payroll can be challenging for small business owners. It’s time-consuming, complex, and one wrong step can result in incorrect payment or penalties. And if you’re going about the process manually, you leave a lot of room for human error (no matter how meticulous you are).

But payroll doesn’t have to be a headache. While automated payroll software can be a game-changer in the digital realm, there are other strategies you can use to streamline the process more efficiently.

Whether you choose to invest in a dedicated payroll solution or not, take note of the following steps and best practices to ensure smooth sailing when it comes to managing payroll.

1. Establish a consistent schedule to run payroll

As the saying goes, consistency is key. And with payroll, it’s no different. If your pay periods and pay dates are inconsistent, it can cause a mess of problems with employee satisfaction, company culture, and even retention rates. Not to mention, you’ll feel scattered and disorganized too. Lose-lose.

But if you set a regular payroll frequency—weekly, biweekly, semi-monthly, or monthly—you’ll be able to keep your ducks in a row. Establishing a schedule will not only make sure your employees are satisfied, but your ability to track employee hours, calculate wages, deduct taxes, and deliver payment will be so much easier. Now we’re talking win-win!

If you stick to your schedule, you’ll avoid delays, errors, and unhappy employees.

2. Gather and verify data early when you run payroll

It’s super important that you have accurate employee info upfront to run payroll efficiently. This means double-checking details like hours worked, time off, and any pay rate changes. Without that info sorted early on, you won’t be able to process payroll correctly. Plus, leaving these items until the last minute will cause a payroll traffic jam—and it will back up fast.

To simplify things, get proactive about collecting and validating payroll information well ahead of time. Set up clear procedures for employees to send in their timesheets and attendance records on time. And don’t forget to stay on top of any pay or deduction updates. Being organized and on the ball with payroll from the start helps save you valuable time and avoid costly mistakes.

3. Automate processes to streamline efforts to run payroll

We’ve already touched on automation, but there’s a whole wide world of automation tactics and it’s important to understand the overarching benefits when it comes to payroll.

At the top of the list of payroll software benefits is doing away with that pesky manual data entry. You probably get a headache just thinking about it. Here’s the deal: manual data entry fills your plate to the brim. You have to track hours and match them against schedules, calculate wages and taxes, and distribute payments all on your own. That’s the opposite of ideal for a busy business owner.

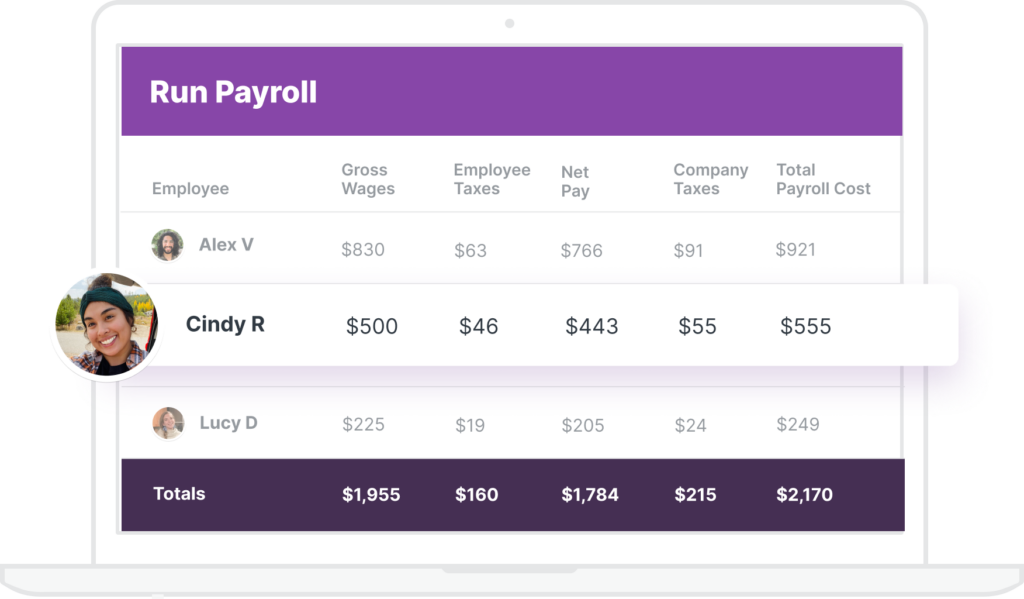

Instead, payroll software handles all the math for you. That not only saves you a bunch of time but it eliminates the potential for human errors that can be damaging in more ways than one. Plus, you can make sure data is 100% accurate before processing payroll.

Next up is the ability to integrate payroll with time tracking and accounting systems. It makes tax calculations, filing, and direct deposits a breeze. No more sorting through separate programs and leaving room for errors.

You can use automated tools, like Homebase, to create a designated timeline for collecting data, processing payroll, and distributing paychecks. You’ll be able to track hours worked, overtime, and PTO, which will automatically funnel into payroll processing and get paychecks into pockets. All in one place with a few easy steps.

4. Stay informed about payroll laws and regulations

We can’t forget about the legal side of things. You have to stay on top of federal, state, and local payroll laws as a small business. And let’s be honest, legal requirements can easily fall to the bottom of the priority list when you have so many things to juggle.

There are a lot of i’s to dot and t’s to cross when it comes to following payroll rules like minimum wage, overtime, hours worked, and recordkeeping requirements. It’s like juggling and riding a unicycle at the same time.

Staying current with payroll laws and regulations is crucial to avoid serious consequences. And this is another area where automated payroll software could be a good option. It simplifies processes, which lets you calculate hours and wages accurately, pay and file your taxes, distribute and file forms, and store time card records. Plus, you’ll get notified when laws change.

5. Communicate clearly with employees about payroll matters

The truth is, if you don’t tell your employees exactly what you need from them to make payroll seamless (and get them paid faster) you’re going to run into some major roadblocks. Late clock-ins or failure to clock in at all, not submitting timesheets, and missing or incorrect personal information … you get the picture. As the boss, it’s your job to provide clear guidelines on how and when to get these things done.

Have there been any changes to payroll policies or procedures? Your employees need to know this as well.

And don’t forget: communication is a two-way street. If your employees have concerns or questions about the payroll process, chat with them one-on-one and figure out where you can find a solution. Your employees are the oil on the wheels that make your business turn!

6. Maintain accurate records and documentation

Keeping precise and well-organized records is essential when you’re handling payroll. You need a reliable method for storing and accessing all your payroll docs—employee records, timesheets, tax papers, and payment history. Being all over the place with paper trails or random digital files can cause unnecessary hurdles.

Set up a central system for keeping records safe and easy to find. This not only keeps sensitive info secure but also gives you a clear record of everything whenever you need it. Keep your records neat and tidy, following guidelines to make sure you don’t lose anything important.

Here are some ways to securely store and access payroll info:

- Use an online database that’s accessible anytime, from anywhere, with automatic backups to protect your data.

- Set up a digital document management system with secure cloud storage, version control, and easy access with search capabilities.

- Leverage secure cloud storage solutions like Google Drive, Dropbox, or OneDrive.

- Keep physical, printed documents in binders or file cabinets and organize them by employee, pay period, or year for easy access.

- Track employee records, timesheets, and other data using secure spreadsheet templates, make sure to set up access controls and backup procedures.

Whichever method you choose, don’t forget to include clear rules for keeping documents so you’re always on the right side of the law. This makes everything easier, cuts down on mistakes, and keeps you compliant.

7. Prepare for payroll during holidays and special events

Ah yes, the magical moments of the holiday season—equal parts exciting and incredibly busy. If you don’t plan ahead, the holidays could impact your payroll schedule and interrupt pay dates. Rather than letting your pay period extend to after a holiday or office closure, get ahead of the game and adjust your payroll schedule to accommodate in advance. Your employees will thank you!

If you make changes to your payroll schedule, make sure your employees are in the loop ahead of time. People want and need to know when they’ll get paid. And not only will your employees appreciate it, but you won’t have to worry about it while you’re enjoying the holidays.

But sometimes the unexpected strikes (like natural disasters, a pandemic, or IT issues), so how can you be prepared for interruptions that may affect payroll? Enter stage left: a payroll contingency plan. Here’s how to build one:

- Backup all your payroll data in multiple places so you don’t lose critical information.

- Cross-train your employees on the basics of payroll and your software solutions.

- Keep reserves of cash for use in emergencies.

Implement a simpler payroll process

Mastering these savvy strategies can help make managing payroll smoother and less stressful. And while there are different methods to making this work, some companies lean towards an automated solution.

We know what you might be thinking—new software is costly and takes time and training. But you’ll be happy to hear that payroll software at Homebase is free and incredibly easy to set up. Just a few steps and you’re in.

The Homebase app is designed for small businesses like yours to make payroll and other management tasks simpler than ever. So now that you’re ready to minimize stress and ensure your employees are paid accurately and on time using these strategies, let’s get you started.

FAQs

What information do I need to collect from employees before running payroll?

Running payroll requires you to gather employee personal information such as bank details and addresses, timesheet data, and verified hours worked. You’ll also need the proper tax forms and documentation. With Homebase, all that data can be collected and stored in one place.

How often should I run payroll?

We highly recommend setting a regular payroll schedule that is consistent, whether that is weekly, biweekly, semi-monthly, or monthly. What is best for your business will depend on your cash flow and structure.

Can I run payroll myself, or should I hire a payroll service provider?

While you certainly can run payroll yourself, manual data entry can leave room for human error and also makes the process overly time-consuming. A payroll service provider can help streamline every aspect of running payroll and automate it to take on most of the legwork while eliminating errors.