There’s nothing quite like the stress of ensuring everyone’s wages are right, especially when relying on pen, paper, or basic spreadsheets.

Maybe you’ve had those moments, staring at numbers, wondering if you’ve factored in every deduction or bonus. We get it, and that’s why we’re here to help.

Here’s a list of the six top-notch free online calculators designed with businesses like yours in mind. Whether you need a quick calculation or a more detailed breakdown, there’s a tool on this list that’s got you covered.

And while these freebies can be game-changers, we’ll also touch on why investing in an affordable full-service system might be worth it. So, let’s ditch the payroll headache and explore solutions that won’t cost an arm and a leg.

The breakdown: 6 excellent payroll calculators

We’ve carefully curated a list of the top 6 solutions based on the best use case for each platform:

1. Homebase: Best affordable, full-service payroll system for small businesses

At its core, Homebase is an employee scheduling and time tracking powerhouse. Employees have the flexibility to clock in and out using various devices, be it their smartphone, tablet, or computer.

The platform also dives deep into the hiring process, streamlining everything from hiring to onboarding. With Homebase, businesses can broadcast their vacancies right from the platform and, upon finding the right fit, send them tailored employee kits – ensuring consistency where diverse roles and wage rates vary.

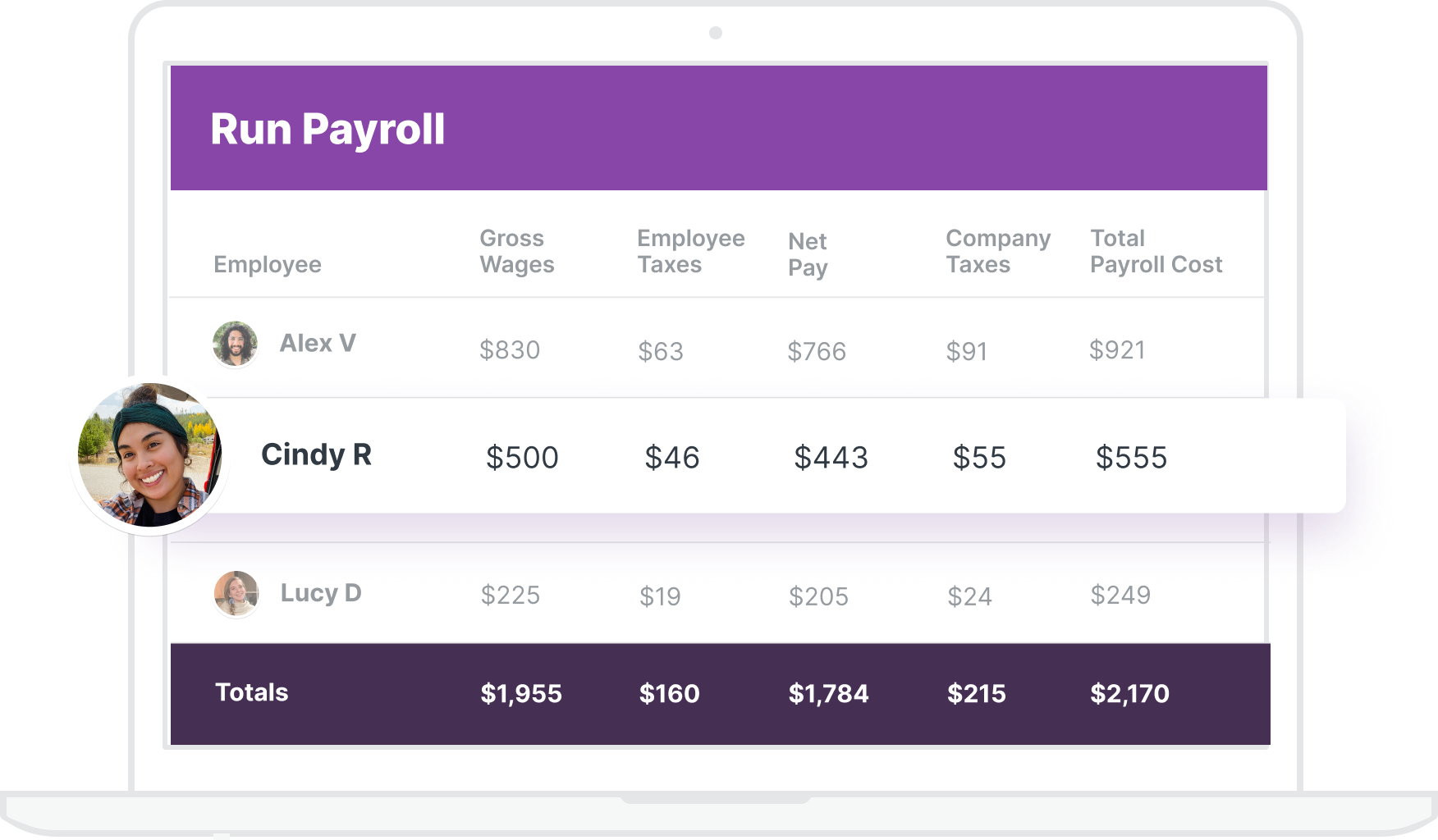

When it comes to payroll, Homebase truly shines. With its integrated time tracking, it automatically turns hours logged by employees into ready-to-process payroll reports.

Plus, if you’re working with other payroll providers, Homebase plays nice by offering smooth integrations. The real cherry on top? Its compliance alerts. These notifications keep you in the loop about potential payroll compliance issues, ensuring you’re always on the right side of the law.

Top features

- Simplified employee scheduling: A straightforward drag-and-drop feature that fills in schedules on the fly and keeps handy templates for swift planning in the future.

- Empowered self-scheduling: Tools that let your team pick up available shifts, swap slots, cover for peers, and pitch in their off-day requests without a hitch.

- Geofenced time tracking: A nifty tool that not only tracks time but uses GPS and geofencing to ensure team members clock in from the right spot, helping to keep time theft at bay.

- Team chat with smart alerts: A built-in chat app that shoots out instant notifications for things like tardy teammates, ghost shifts, and overlooked breaks.

- Labor law compliance: Compliance tools packing in essentials like break norms, overtime heads-ups, and secure record-keeping, making sure you’re always a step ahead and audit-ready.

- Insightful reports & forecasts: Get printable time card reports, labor expenses, team performance, and even peek into sales predictions.

Pricing

For small businesses managing up to 20 employees at one business location, Homebase offers a free plan that never expires. This means you can benefit from its basic features without worrying about the end of a free trial period or hidden costs.

And you can upgrade to any of the following paid plans:

- Essentials plan: $24.95 per month per location. Everything in Basic, plus payroll integrations, team communication, performance tracking, advanced time tracking and scheduling, and access to live support.

- Plus plan: $59.95 per month per location. Everything in Essentials, plus hiring tools, retention and performance tracking, time off controls, and departments and permissions.

- All-in-one plan: $99.95 per month per location. Everything in Plus, with HR and compliance, new hire onboarding, labor cost controls, and business insights.

2. Gusto: Best for international teams

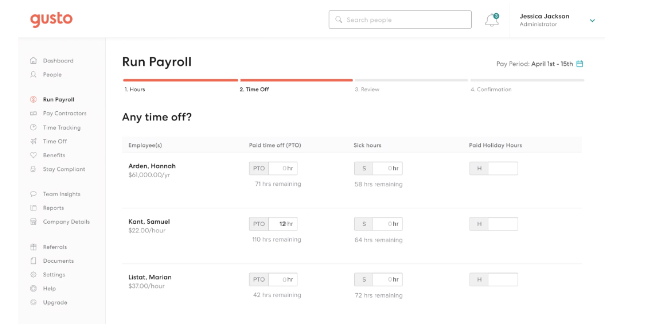

Initially launched to simplify payroll for small businesses, Gusto has grown to offer a suite of services, making employee management smoother. You can pay your employees, handle taxes automatically, offer health insurance, and even manage time-off requests, all in one platform.

Top features

- Automated payroll with tax handling

- International payments

- GPS time clock for easy employee hour logging

- Project tracking

- Employee self-service to check pay and manage documents

- Quick request and approval system for time-off management

Pricing

Gusto offers two main plans:

- Simple: $40/month + $6/person. This covers single-state payroll, employee self-serve, and app integrations.

- Plus: $80/month + $12/person. Adds multi-state payroll, time logging, and quicker payday deposits.

They also have a Premium option with tailored pricing, including compliance tools and priority support.

3. ADP: Best for large enterprises

Apart from payroll, ADP also handles tax filings, deductions, and compliance. It delves deep into HR services, benefits administration, talent management, and even HR outsourcing, making it a comprehensive HR management system. However, it comes with a steeper learning curve as compared to a platform like Homebase.

Top features

- Automated processing with tax compliance

- All-in-one tool for talent acquisition, training, and retention

- Simplifies health, retirement, and insurance offerings

- Efficient tracking of employee hours and leaves

- Deep insights into labor costs and performance metrics

- Manage payroll and HR tasks on the go with dedicated mobile app

Pricing

Specific pricing isn’t directly listed on ADP’s website. However, ADP four plans:

- Essential Payroll: Ideal for both startups and established firms looking for straightforward payroll solutions.

- Enhanced Payroll: Goes a step further by offering basic payroll alongside features like ZipRecruiter, State Unemployment Insurance, and background checks.

- Complete Payroll & HR Plus: Builds on the Enhanced package, adding in foundational HR support to the mix.

- HR Pro Payroll & HR: The top-tier choice, encompassing everything in the Complete package, but with amplified HR support and added perks for employees.

4. Intuit: Best for finance companies and accounting professionals

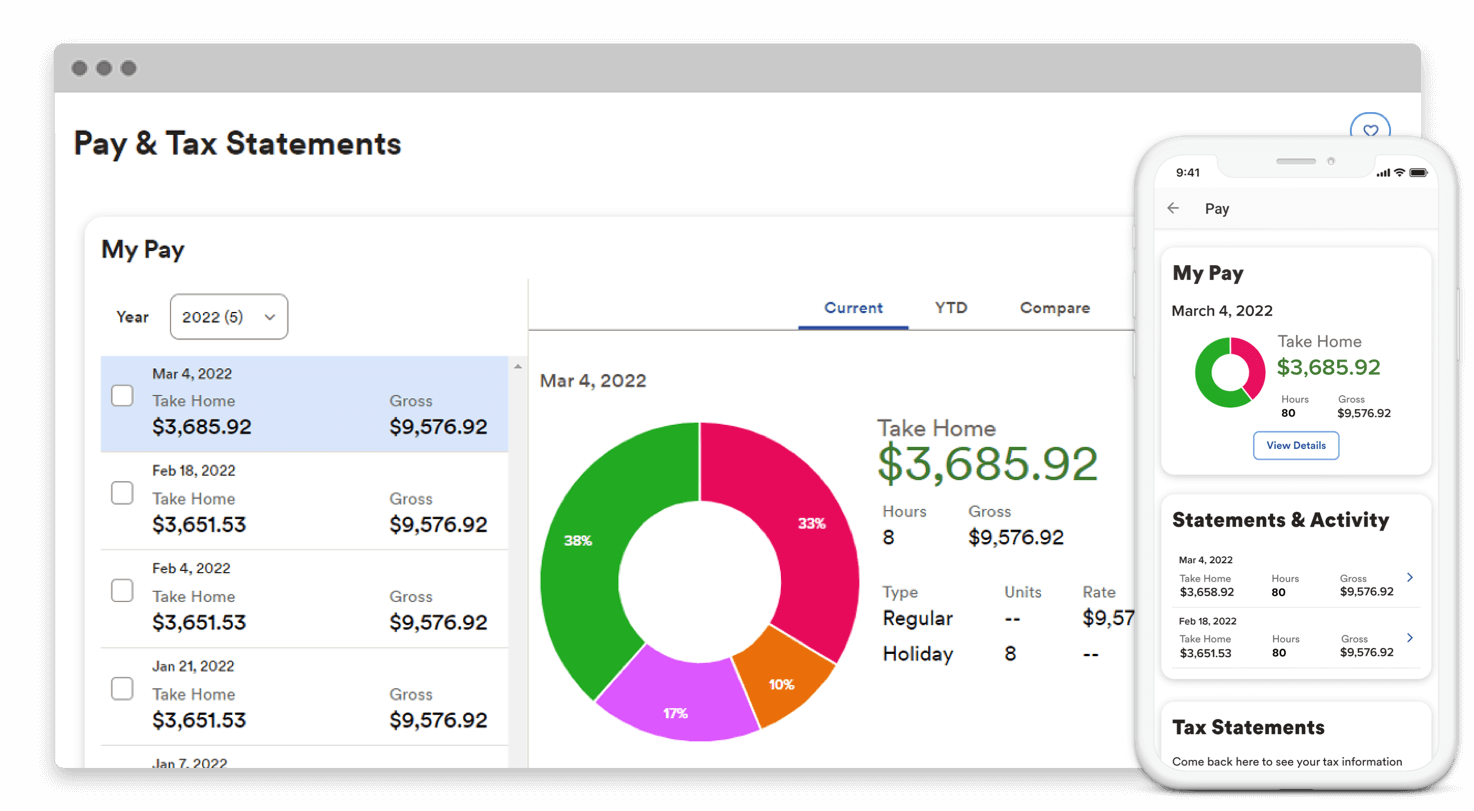

Intuit’s QuickBooks Payroll is an extension of their acclaimed accounting software, QuickBooks. With QuickBooks Payroll, businesses can automate wage calculations, handle tax filings, and ensure employees get paid accurately and on time, whether they’re salaried or hourly. A standout feature is its integration with the broader QuickBooks ecosystem, making it easy to sync financial data. This means less manual data entry and fewer errors.

Top features

- Automated payroll

- Automatic calculations and electronic tax filing submissions

- Syncs payroll data seamlessly into your Quickbooks accounting software.

- Pay your employees directly into their bank accounts.

- Allows employees to access pay stubs and W-2s online.

- Monitor hours, overtime, and set up geofencing for remote workers.

- Gain insights on payroll expenses and tax deductions

Pricing

Intuit offers a 30-day free trial across all paid plans:

- Simple Start ($30 per month): Basic features such as income, expenses, invoicing, tax deductions, mileage tracking, and a single sales channel connection.

- Essentials ($60 per month): All Simple Start features, enhanced reports, allows 3 users, bill management, enter time, and connects up to 3 sales channels.

- Plus ($90 month): Builds on Essentials with comprehensive reports, inventory tracking, project profitability, 5 user access, and unlimited sales channel connections.

- Advanced ($200per month): A comprehensive suite for businesses, including powerful reports, 25 user access, workflow automation, 24/7 support, data restoration, employee expenses, batch invoices, and custom access controls, among others.

5. Rippling: Best for businesses with international teams

Rippling is an all-in-one platform for managing a company’s HR, IT, and operations. At its core, it streamlines tasks like onboarding, benefits, payroll, and device management. What sets Rippling apart is its seamless approach to handling international teams, making it a go-to for businesses with a global workforce.

Top features

- Automated onboarding for new employees

- Simplify global payouts with built-in compliance for various countries

- Allocate and oversee company devices remotely

- Employee self-service portal

- Track work hours, PTO, and manage shift schedules

Pricing

Rippling doesn’t display specific pricing plans on their website, keeping things a bit under wraps. Instead, they’ve adopted a modular approach, where each HR, Finance, and IT product, such as Payroll, Expenses, Benefits, or Device Management, is available separately. This allows businesses to mix and match, creating a tailored plan that fits their specific needs.

6. Remote: Best for startups hiring internationally

Remote simplifies the complex process of global payroll, ensuring that employees around the world get paid accurately and on time. It also assists with tax compliance and local legal nuances, ensuring that businesses stay on the right side of regulations in each country they operate.

Top features

- Global payroll management

- Tax compliance automation

- Tailored benefit packages that adhere to local standards in each country

- Simplified processes to bring on talent from anywhere in the world

- Auto-generate contracts that comply with local employment laws

Pricing

- Instant international employee onboarding ($699 per employee per month): You can hire around the globe, even without having a local setup

- Contractor Management ($29 per contractor per month): Easily onboard, pay, and manage your international freelancers.

- Global Payroll: Need a quote for this. Includes multi-country payroll streamlined, all in one place.

- Remote Enterprise: It’s custom-priced for those looking for a tailored experience and dedicated support.

Simplify your small business payroll with Homebase

From the tailored services of Gusto to the international expertise of Remote and the established reliability of ADP, there’s no shortage of proficient tools out there. But for a small business, the search often zeroes down to a tool that’s both economical and comprehensive.

While other solutions may either overburden with features or strain the budget, Homebase strikes that ideal balance. Homebase offers a suite tailored for hourly employees across varied sectors, from hospitality to wellness and construction. Beyond payroll and time tracking, it integrates scheduling, communication, and hiring tools. It’s a comprehensive solution that’s budget-friendly for small businesses

Homebase serves as a pocket-friendly hub for all payroll needs, optimized for both desktop and mobile use.

FAQs about free payroll calculators

How do I calculate payroll?

You can calculate payroll by determining the gross pay. For an employee earning $20/hour and working 30 hours, that’s $600. Deduct taxes and other contributions (e.g., $100 for federal taxes, $50 for state taxes, and $30 for insurance) to get the net pay. This example results in $420 net pay. To simplify and automate, platforms like Homebase offer intuitive solutions tailored for diverse industries, ensuring accuracy and compliance, saving both time and potential headaches.

What is the best free paycheck calculator?

The best free paycheck calculator is offered by Homebase. Designed with user-friendliness, Homebase ensures accuracy in computing take-home pay, accounting for hours worked, deductions, and taxes. Ideal for various industries, it’s not only reliable but also efficient, turning a complex process into a breeze. Plus, it’s integrated with their broader suite of tools, making payroll and time management even simpler for businesses.

What is a payroll deduction online calendar?

A payroll deductions online calendar is a digital tool businesses use to track and schedule various payroll deductions throughout the year. This calendar ensures timely withholding of taxes, insurance premiums, and other employee-specific deductions. By setting reminders and automating calculations, it helps in accurate and punctual payroll processes, preventing costly errors or missed deadlines. Using one streamlines financial tasks and keeps employers compliant with regulations