Core employment activity indicators are more stable than prior years, signaling a prosperous new year for Main Street.

Meanwhile, worker wages continued to rise despite easing inflation and cooling consumer prices. Could we be nearing the end of the wage climb?

Noteworthy trends this month:

- Despite flattening inflation and cooling prices, worker wages continued to grow on Main Street in November.

- Winter typically brings a major small business slowdown, but this year sees increasing wages, low employee turnover, and steadier employment activity than years past.

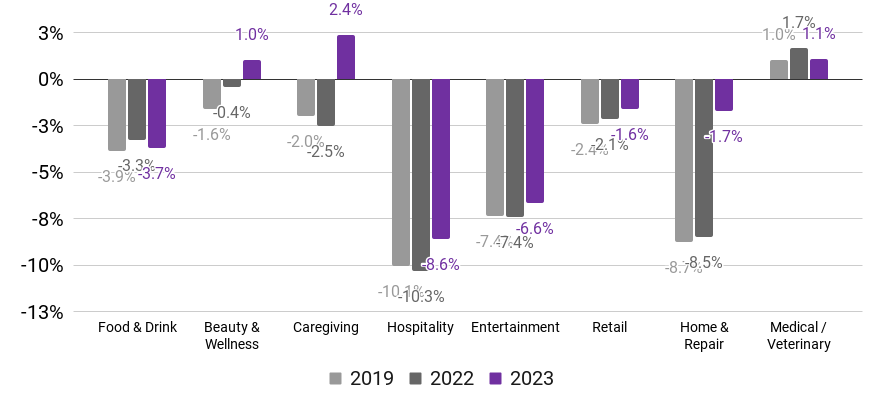

- Caregiving and Beauty & Wellness were standout sectors. Both saw gains in employees working in November (2.4% and 1%, respectively), when prior years showed declines for the same period.

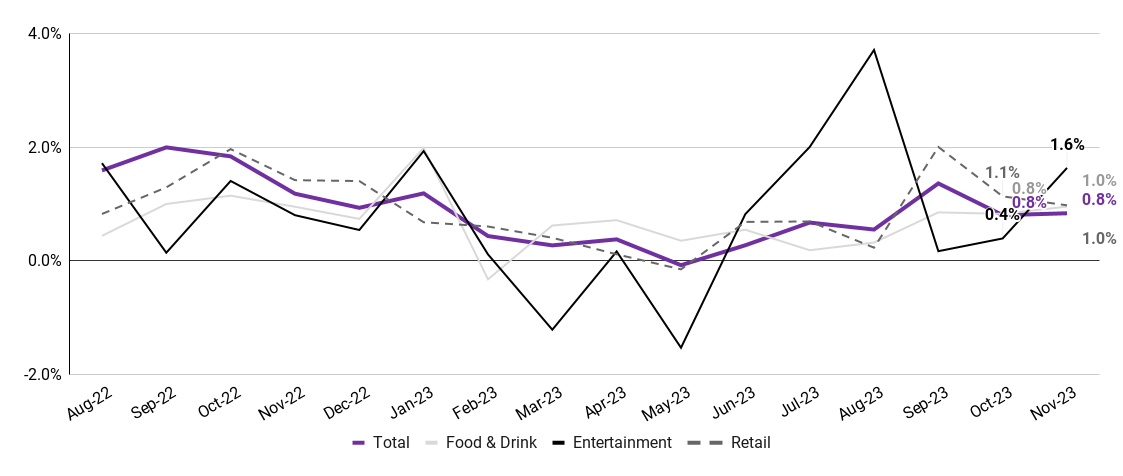

Entering winter, employment activity on Main Street has been stronger than in pre-pandemic years

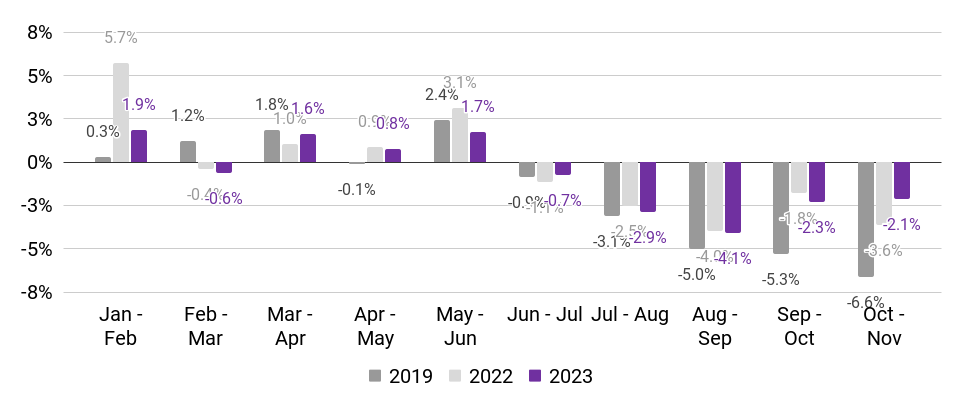

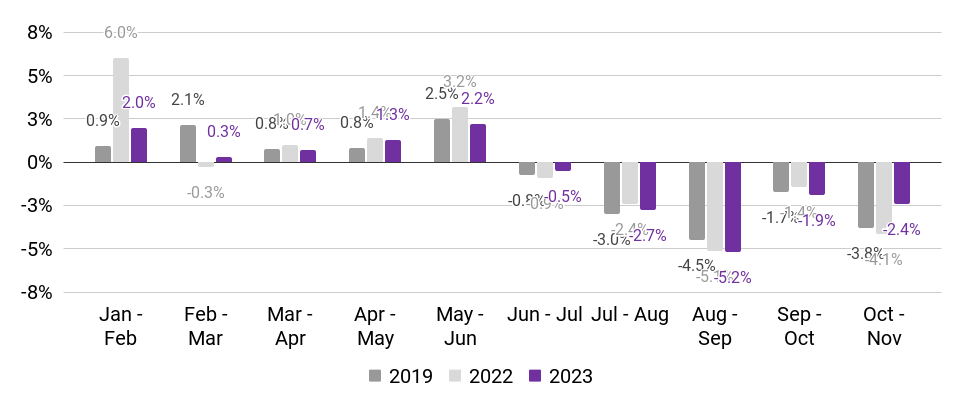

There was less of a decline in employees working and hours worked this year than in 2022 or 2019.

Employees working

(Monthly change in 7-day average, relative to January of reported year)

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Data generally compares rolling 7-day averages for weeks encompassing the 12th of each month; April 2023 data encompasses subsequent week to account for Easter holiday. Source: Homebase data.

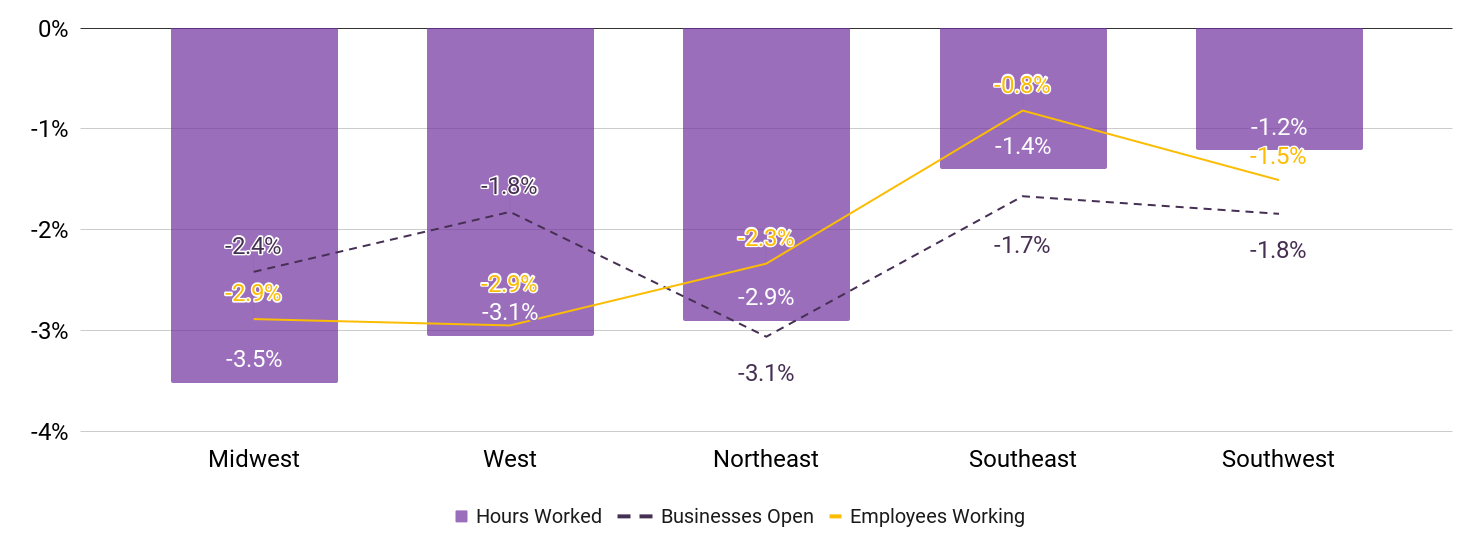

Southern states, as expected, are the least impacted by winter

All regions are showing lower winter-driven reductions in employment activity than previous years

Output by Region

Month-over-month change in core economic indicators, by Census region

Note: November 12-18 vs. October 8-14. Region classification – Midwest: ND, SD, NE, KS, MN, IA, MO, WI, IL, IN, OH, MI; West: NV, UT, AZ, NM, CO, WY, MT, ID, OR, WA, CA, HI, AK; Northeast: NY, PA, NJ, CT, RI, MA, NH, VT, ME; Southeast: MS, AL, TN, KY, NC, SC, GA, FL; Southwest: TX, OK, AR, LA. Source: Homebase data

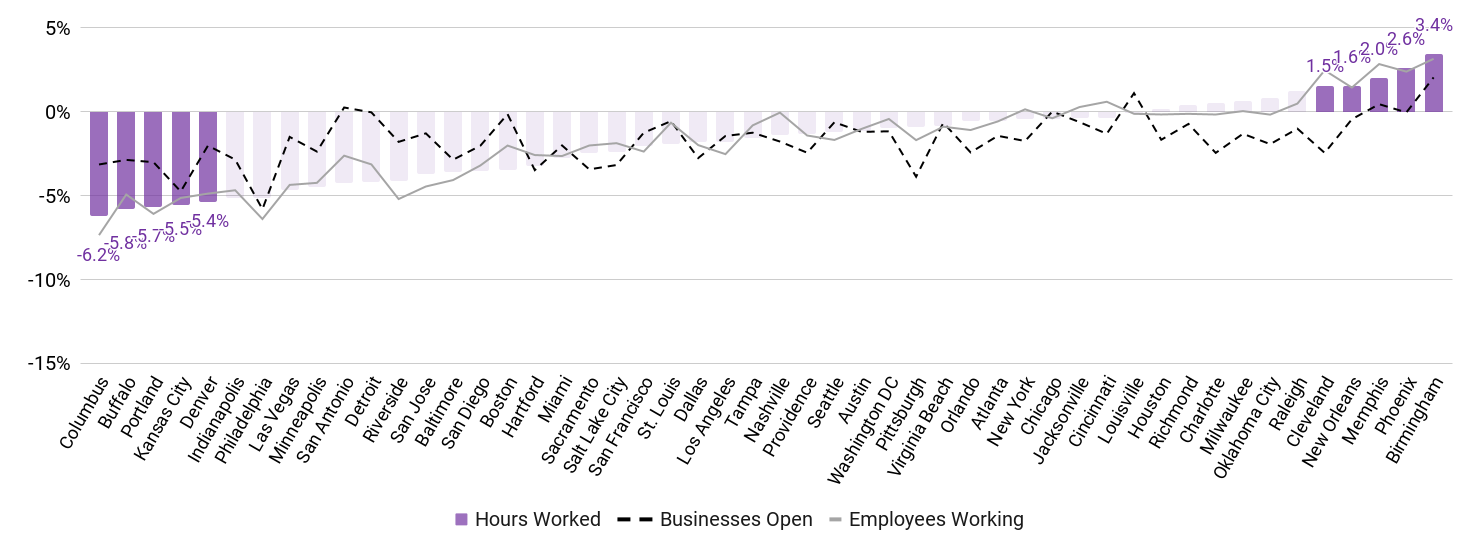

Changes in employment activity varied across major MSAs

MSA-specific patterns reflect the regional differences highlighted above (stronger activity in the South)

Output by MSA

Month-over-month change in core economic indicators, by metropolitan statistical area

Note: November 12-18 vs. October 8-14. Source: Homebase data

Winter employment activity strength consistent across all industries, with a couple very strong outliers

Caregiving and Beauty & Wellness both saw an increase in employees working in November, in spite of historical dips. Across most other industries, there were lower than expected declines.

Caregiving and Beauty & Wellness both saw strong gains in employees working, increasing in November for the first time since 2019 (2.4% and 1%, respectively).

Entertainment and Hospitality both saw less of a decline in employees working than in prior years (-6.6% and -8.6%, respectively). This is also true of Retail, Food & Drink, and Home & Repair.

Percent change in employees working

(Mid-November vs. mid-October, using Jan. ‘19, Jan. ‘22, and Jan. ‘23 baselines)1

1. November 10-16 vs. October 6-12 (2019); November 6-12 vs. October 9-15 (2022); November 12-18 vs. October 8-14 (2023). Source: Homebase data

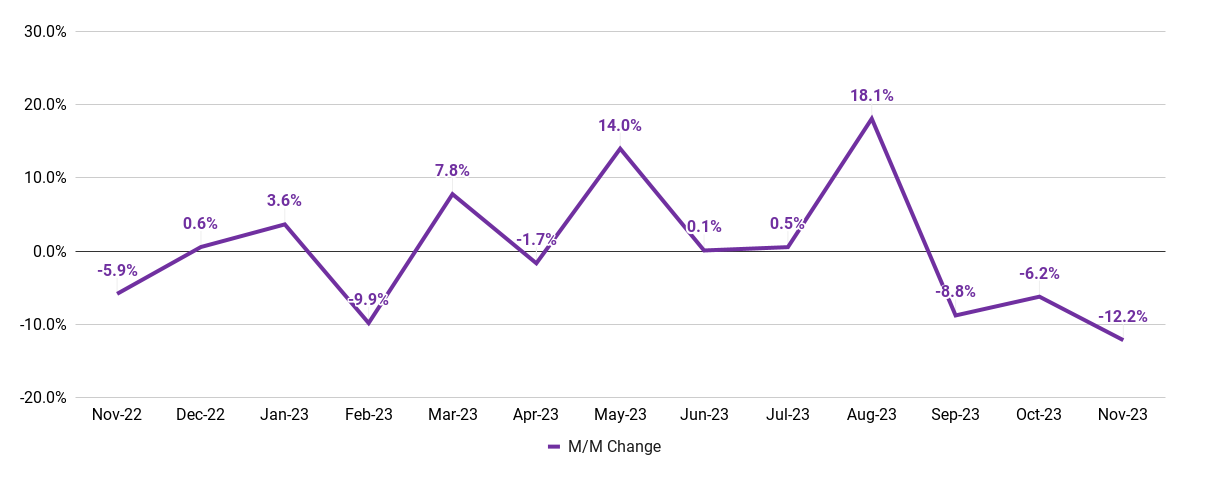

Worker wages continued to rise in November

Despite easing inflation and a steadying of consumer prices, Main Street workers wages rose in November.

Avg. wage changes, m/m

Monthly change in average hourly wages across all jobs

Note: Data measures average hourly wages for locations that utilized Homebase to pay employees in both November 2022 and November 2023. Total incl. industries not depicted here. Source: Homebase Payroll data.

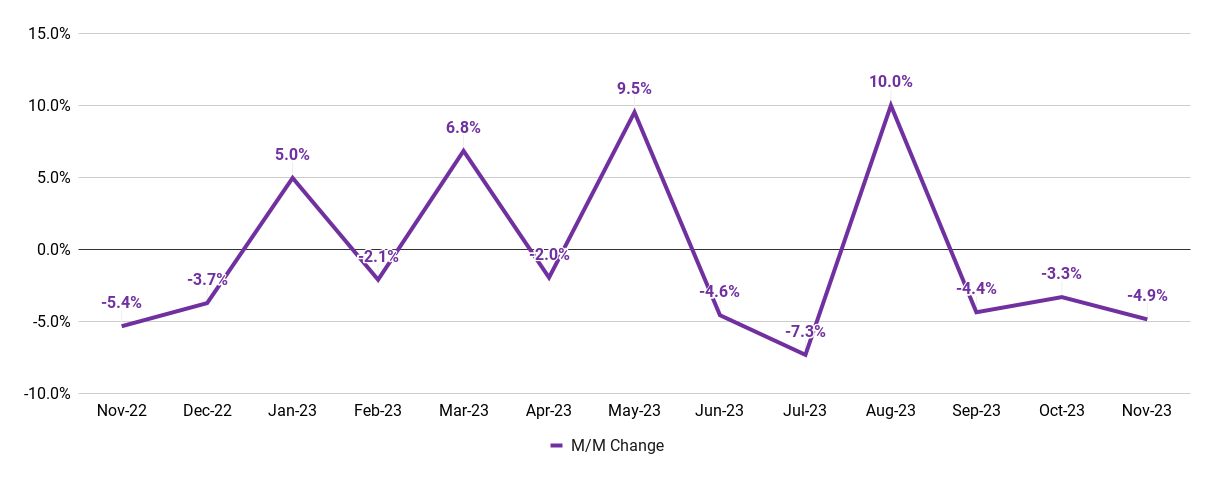

November showed the lowest employee turnover of 2023

This signals strength as businesses head into winter, and reflects the high employee satisfaction numbers we’ve recently reported

m/m changes in average number of jobs removed

Monthly change in average jobs archived across all jobs

Note: Data measures average monthly change in total number of jobs removed, whether by voluntary or involuntary exit, from official employee rosters for companies active in any given month. Source: Homebase data.

Given high employee retention, main street has been able to slow their pace of hiring

This is a positive development given the cost of hiring and benefits of longer-tenured team members

m/m changes in average jobs created

Monthly change in average number of jobs added across all jobs

Note: Data measures average monthly change in total number of jobs created in official employee rosters for companies active in any given month. Source: Homebase data.

For a PDF of our November 2023 report, please visit this link; if you choose to use this data for research or reporting purposes, please cite Homebase.