Running payroll isn’t exactly fun. But every business owner needs to do it if they want to keep employees happy (and paid).

The payroll process covers everything that goes into paying employees while staying compliant with labor and tax laws — like registering for tax IDs, accurately tracking hours, calculating and withholding taxes, and sharing pay stubs.

It’s easy for errors to sneak in that could lead to unhappy employees or even regulatory fines.

Payroll is a crucial yet complex task that often leaves managers scratching their heads. In this article, we’ll help you understand what payroll truly involves, how to do it right, and the perfect software to streamline the process.

No jargon, no complications — just actionable insights.

What is payroll processing?

Payroll processing is managing the payment of wages to employees. It’s not just about cutting checks — the process includes tracking employee hours, calculating gross wages, deducting taxes and other withholdings, and finally, delivering payment and pay stubs to employees. It also involves record-keeping for audit purposes.

Payroll processing guarantees accurate and timely wages while keeping your business compliant with tax and labor laws.

Manual Processing vs. Using a Service

Manual processing gives business owners full control over every step. They track hours, calculate wages, handle tax deductions, and distribute paychecks on their own. But, the potential for human error makes it a less viable option for many businesses.

For example, incorrect tracking of employee hours can lead to overpayment or underpayment. And a single miscalculation or overlooked tax update can result in fines or penalties.

This is why most businesses opt for a payroll service provider. Payroll services handle all the math for you — accurately tracking employee hours, calculating gross wages, and deducting the right amount for taxes. This eliminates the risk of human error in calculations, reducing costly mistakes.

They ensure you’re always compliant. And digital record-keeping reduces the clutter of paperwork, making it easier to audit your payroll records.

The different elements of payroll

There are a lot of processes and tasks that go into running payroll — you need to collect employee information, set up a payroll schedule, calculate and deduct tax withholdings, and a whole bunch of other stuff that can quickly feel overwhelming.

Payroll schedules

A payroll schedule is essentially the calendar your business follows to pay its employees. It defines how often paychecks are distributed — weekly, bi-weekly, semi-monthly, or monthly.

For example, a bi-weekly schedule means employees are paid every two weeks, typically on a specific day like Friday. The payroll schedule you choose depends on factors like your business’s cash flow and employee preferences and should be in compliance with state and federal laws.

Payroll taxes

Payroll taxes are deductions from an employee’s paycheck that go towards federal, state, and local tax obligations. This can include income tax, Social Security, and Medicare.

For example, if an employee earns $1,000 in a pay period and their total tax rate is 25%, $250 will be deducted from their paycheck for taxes. It’s crucial for businesses to calculate and withhold these taxes to avoid penalties.

Here’s an overview of employment taxes in the USA:

| Tax Type | Description | Responsibility |

| Federal Income Tax | Withheld from employees’ wages based on their W-4 form. | Employer |

| Social Security and Medicare Taxes (FICA) | Withheld from wages. Employers match the employee’s contribution. | Employer & Employee |

| Additional Medicare Tax | Extra 0.9% tax on wages that exceed $200,000 in a calendar year. | Employer (Withholding only) |

| Federal Unemployment (FUTA) Tax | Paid separately by employers and doesn’t involve employee funds. | Employer |

| Depositing Employment Taxes | Employers must deposit withheld federal income tax, FICA, and FUTA taxes. | Employer |

Note: For the most accurate and current tax rates as applicable to exempt and non-exempt employees, refer to the relevant publications or visit the official IRS website.

Payroll costs

There can be quite a few costs associated with running payroll smoothly. But depending on the type of payroll system you use and whether you outsource these activities or not, your payroll costs can vary a great deal.

If you’re using a payroll service solution, you’ll have expenses like:

- A base monthly fee and fees for each employee you have on payroll

- 401k distribution

- Tracking employee time

- Workers’ compensation

- Direct deposit, state, and federal tax filings

- Paid leave and overtime pay

- Bonuses

Payroll summary reports

A payroll summary report shows you an overview of all your payroll activities. This includes employee details like net and gross pay and employer taxes. Maintaining and properly storing these documents is crucial as you’re required by the federal government to submit several payroll report forms, including Form 940, Form 941, W-2s, and W-3s.

You may also be responsible for a local payroll report, so check your local employment laws to cover your bases.

How to set up and process your payroll

If you’re the kind of manager or business owner who enjoys getting hands-on with the numbers, there are a few things to consider while setting up your payroll system. Before you get into the nitty-gritty of it, decide what your payroll policies will be and how you’ll handle the process.

1. Payroll process creation

Step one in the manual payroll process is all about establishing a reliable system for gathering and documenting your employees’ work hours — timesheets. It’s a data table that you can use to track when a particular employee has worked during a certain period.

Some businesses use paper timesheets, while others use digital or punch clock systems. Your timesheet process should record start and end times, breaks, and overtime.

Here’s an example of a weekly timesheet for a manufacturing plant:

| Employee | Role | Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 | Total Hours |

| Employee 1 (Assembly Line Worker) | Regular Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Overtime Hours | 0 | 0 | 0 | 0 | 2 | 4 | 6 | |

| Employee 2 (Quality Inspector) | Regular Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Overtime Hours | 0 | 0 | 2 | 2 | 0 | 0 | 4 | |

| Employee 3 (Forklift Operator) | Regular Hours | 8 | 8 | 8 | 8 | 8 | 0 | 40 |

| Overtime Hours | 0 | 2 | 0 | 0 | 2 | 4 | 8 |

In the above example, each employee records their regular and overtime hours separately, as these are often paid at different rates. This ensures that each employee is paid correctly for their work and that overtime is accounted for.

2. Timesheet review and approval

After your employees log their work hours into the timesheet, it’s time for the second step: review and approval. You need to verify that the hours logged align with your records and expectations, ensuring no discrepancies, like over-reporting or under-reporting of hours.

You’ll also need to cross-check that all overtime hours, if any, are correctly documented. Any discrepancies should be addressed and corrected before approval.

Depending on the size of your business, the timecard approval process can be single-tiered (requiring one person’s approval) or multi-tiered (requiring multiple approvals). For example, in a multi-tiered system, a direct supervisor might review and approve timesheets. Then, the HR department would conduct a final review and approval before processing payroll.

3. Pay calculations

When it comes to pay calculations, the method you use depends on if you’ve got part-time or full-time employees. Hourly employees are paid based on the number of hours they’ve worked during a pay period, while salaried employees receive a predetermined amount each pay period, regardless of the hours worked.

Here’s a quick comparison:

| Hourly Employee | Salaried Employee | |

| Payment Structure | Paid per hour | Paid a set amount annually |

| Example Rate/Salary | $15 per hour | $60,000 per year |

| Hours Worked in a Week | 45 hours (40 regular + 5 overtime) | N/A |

| Regular Pay Calculation | 40 hours x $15/hour = $600 | $60,000 ÷ 24 pay periods = $2,500 |

| Overtime Pay Calculation | 5 hours x $15/hour x 1.5 = $112.50 | N/A |

| Gross Pay | $600 (regular) + $112.50 (overtime) = $712.50 | $2,500 |

4. Tax and deductions calculations

After the gross pay of an employee is calculated, the next step in payroll processing is determining the proper amount to deduct for taxes and other deductions. This can be a complex process due to the various tax laws and regulations that must be adhered to.

Let’s continue the above example. We already calculated Gross pay, so now we can easily calculate the net pay after deductions:

| Hourly Employee | Salaried Employee | |

| Payment structure | Paid per hour | Paid a set amount annually |

| Gross pay | $600 (regular) + $112.50 (overtime) = $712.50 | $2,500 |

| Example deductions | Federal, state, local taxes, Social Security, Medicare, Health Insurance | Federal, state, local taxes, Social Security, Medicare, Health Insurance |

| Example deductions calculation | Let’s say total deductions come up to $162.50 | Let’s say total deductions come up to $600 |

| Net pay | $712.50 (gross pay) – $162.50 (deductions) = $550 | $2,500 (gross pay) – $600 (deductions) = $1,900 |

5. Make payments

Making payments promptly and correctly is a crucial part of maintaining trust and satisfaction among your employees. Ensuring everyone understands how their pay is calculated and what deductions are made can also help prevent any issues or misunderstandings.

Here’s how it works:

- Choose a payment method: This could be through direct deposit (where funds are transferred electronically to the employee’s bank account), paper check, or pay card (a reloadable debit card onto which an employer loads an employee’s pay). Direct deposit is usually the most convenient for both parties and ensures employees receive their pay promptly.

- Schedule the payments: Then, as per the established payroll schedule (weekly, biweekly, semi-monthly, or monthly), process the payment. If using direct deposit, be sure to initiate the transfer a few days in advance to allow time for the banks to process the transaction. If you’re issuing checks, ensure they’re printed, signed, and ready to distribute on payday.

- Deliver pay stubs: Along with their pay, provide employees with a pay stub — a detailed breakdown of their pay for the period. The pay stub should include gross pay, net pay, and details of any deductions, such as taxes and benefit contributions.

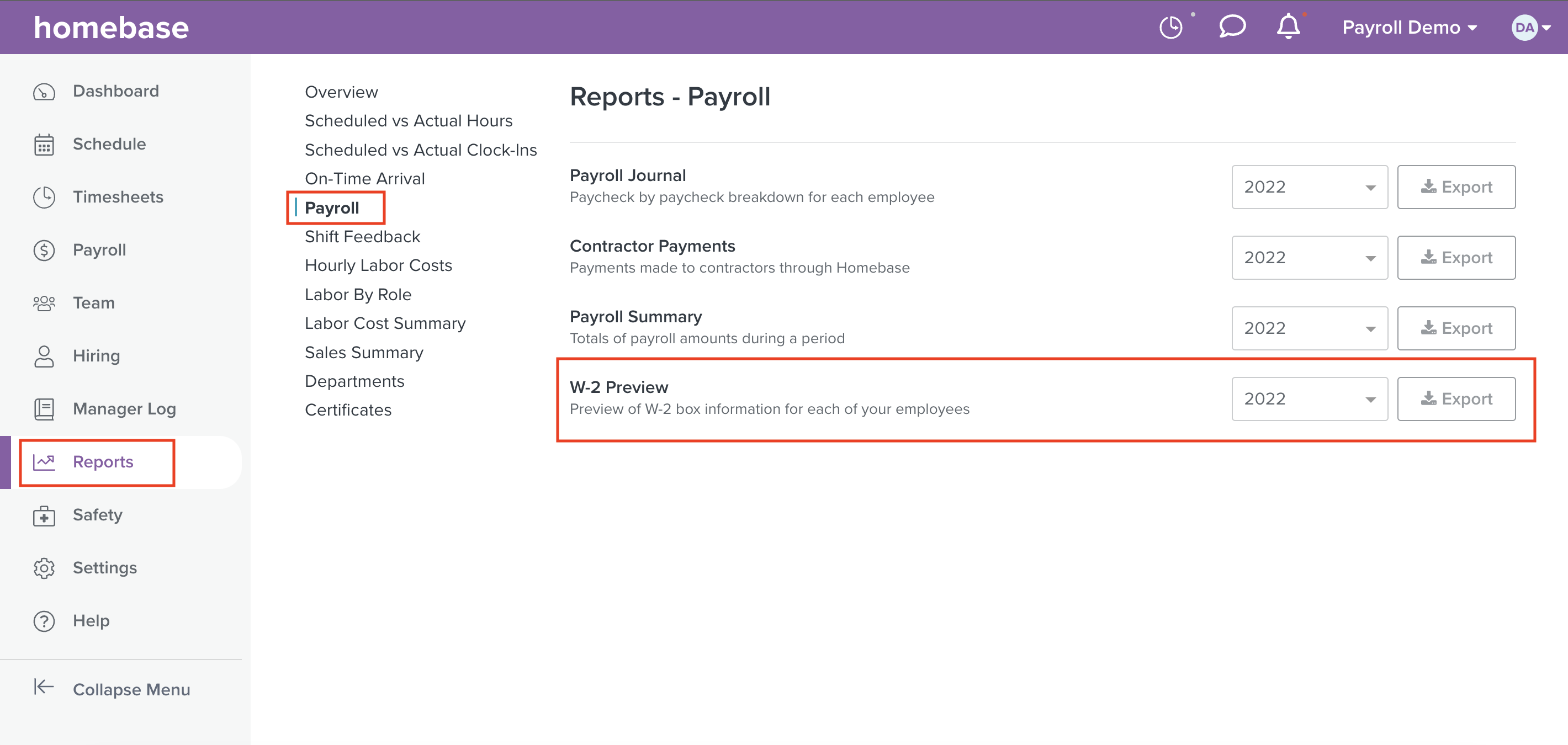

6. End-of-year reporting and data storage for compliance

At the end of each tax year, employers have the responsibility of preparing and distributing certain tax forms. The most common is the W-2 form, which details an employee’s earnings and tax withholdings for the year.

Apart from employee tax forms, you also need to prepare and file your business’s own tax returns. This includes paying any employer federal unemployment taxes (FUTA), and reconciling and paying any remaining Social Security, Medicare, and income tax withholdings.

Additionally, maintaining thorough payroll records is a must for legal compliance and internal tracking. Records should include employees’ personal information, timecards, wage information, and payroll dates. These records should be kept safe and secure yet accessible for at least three years, according to the Fair Labor Standards Act (FLSA).

Note: In case of audits from the Internal Revenue Service (IRS) or Department of Labor, having accurate and complete payroll records can make the process smoother. Remember, non-compliance can result in penalties, so keeping good records is essential.

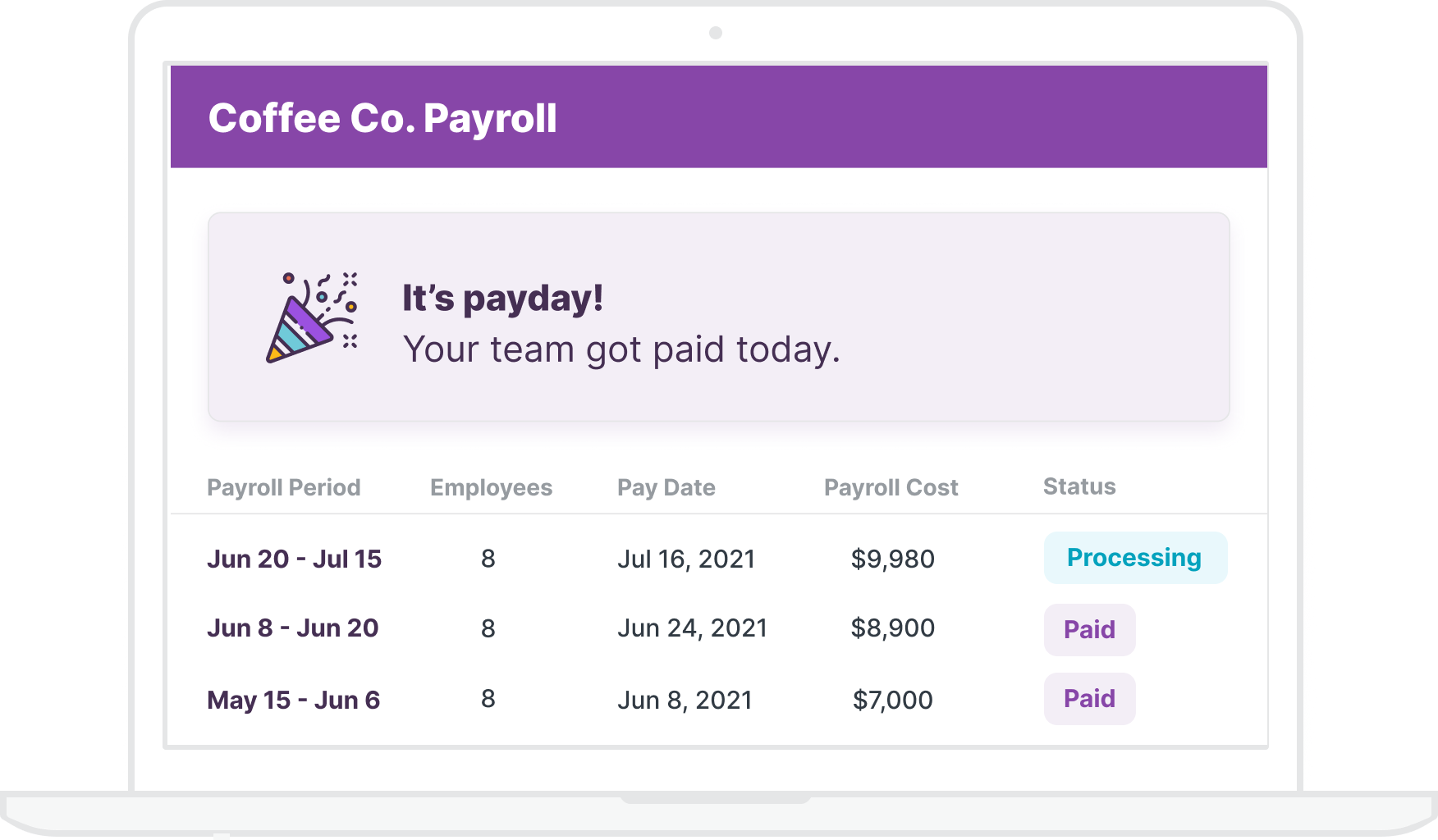

How to streamline payroll with Homebase

There are many steps involved in carrying out the payroll process on your own, and they can be difficult and exhausting to accomplish, especially if you don’t use any HR services to assist you.

Payroll software specifically designed for small businesses like Homebase can save you the headache of having to remember every single payroll step yourself and running the risk of falling out of compliance, even accidentally. Here’s how Homebase can simplify your payroll and help you stay compliant with ease:

1. Implement a digital payroll process

When you shift your payroll online with a tool like Homebase, you boost accuracy and efficiency. Let’s say you’re running a medium-sized restaurant with a team of 20 full-time and part-time employees. Each week, your employees clock in and out at different times, maybe even in various roles, with different rates.

With the old way, you’d spend precious hours every week manually inputting timesheets, calculating wages, and figuring out taxes. One misplaced decimal or overlooked overtime can cause a payroll mess.But a tool like Homebase automatically tracks employee hours, meaning your timesheets are accurate to the minute. It even adjusts for overtime and paid time off. Now, your timesheets are accurate and ready for payroll without your manual input.

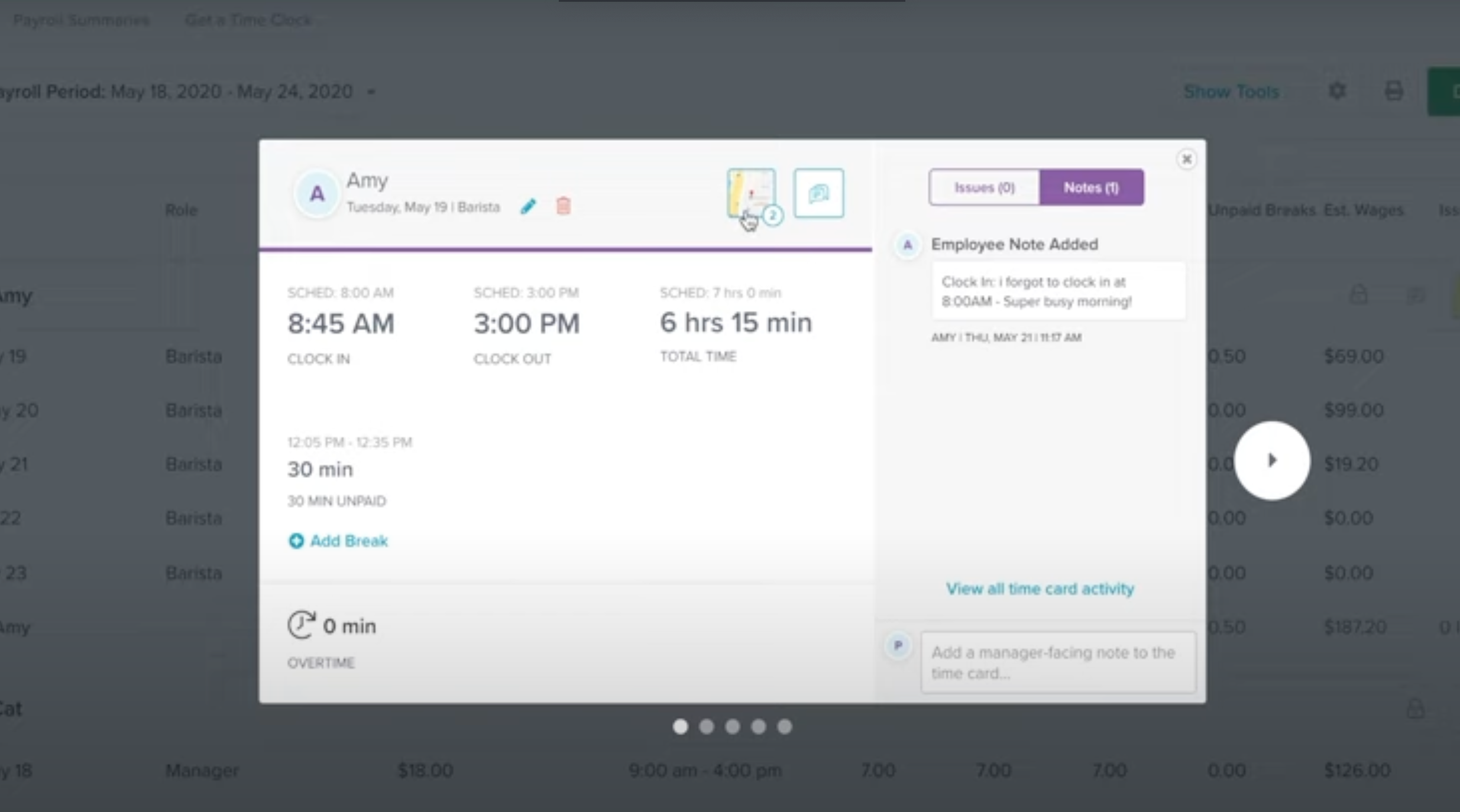

2. Approve timesheets

Let’s say it’s the end of the workweek, and your employees’ timesheets are populated with their clock-in and clock-out data. In a manual system, you’d be sorting through these, possibly matching them against schedules or cross-checking for errors. But with Homebase, these timesheets are already digitized and accurately populated.

You can select how often you want to run payrolls and the day when your payroll starts. Then you can confirm which payroll period you want to approve or select custom dates. You can sort, group, and customize the view. Each row magnifies to show the actual time your employees clocked in, breaks taken, previous edits made, and GPS snapshots of where your employees clocked in from.

Plus, once a time card is approved, it’s locked from future edits. Only managers and users with permission can edit approved time cards.

Want to learn more about approving timesheets with Homebase? See it in action:

3. Your automated solution runs pay and tax calculations

Managing pay and tax calculations can often be the most intimidating part of the payroll process. Why? Because the last thing any business wants is an unexpected letter from the IRS or a disgruntled employee because of a payroll tax miscalculation or incorrect payment.

Homebase automatically sends you notifications when an employee is close to overtime. YOu can also set up custom break and overtime rules that comply with federal, state, and local labor laws and FLSA rules.

Homebase calculates the correct tax withholdings for each employee, sends the correct payments, and forwards the withheld taxes to the right government agencies. Plus, the platform automatically processes tax filings, issuing 1099s and W-2s to your employees and contractors. So, instead of drowning in tax forms and calculations, you can focus on what matters most — running your business.

Seamless payroll in a matter of clicks

Payroll is the lifeblood of your business. Every employee, from your newest hire to your seasoned professionals, depends on it. It involves tracking accurate hours, precise tax calculations, and punctual payments. And the stakes are high.

Errors can lead to unhappy employees, hefty penalties, and a whole lot of unnecessary stress. But an all-in-one tool like Homebase can help your business set up a fully automated system for tracking time and paying staff.

Homebase can automatically calculate wages and taxes and send the correct payments to employees, the state, and the IRS. We also offer HR and compliance features and hiring and onboarding capabilities so you can communicate your policies easily to every new team member.And with our free plan, small businesses can access many of these high-impact features for up to 20 employees at a single location without any cost. Because with Homebase, you can control your and your team’s time on your own terms.