Context for October:

Main Street activity steadies to pre-pandemic levels, as workers feel increasingly secure at work and concerns over the economy decline.

This improvement signals Main Street is heading towards a strong holiday season, which will set them up for the New Year.

While the Fed deliberate rate hikes, Main Street is stabilizing in line with prior years, marking a turning point in economic stability. Meanwhile, small business teams are more confident about the health of their businesses. Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees during October by analyzing behavioral data from more than two million employees working at more than one hundred thousand SMBs.

Main Street at a glance:

While inflation remains top of mind, economic anxieties among hourly workers dipped in October. Data showed reduced concern around inflation, a possible recession and unemployment. Workers feel more confident and secure in their jobs.

The past three years have tested Main Street, but we’re seeing improvements and a return to normalcy. Core indicators, like employees working and hours worked, are finally returning to pre-pandemic levels.

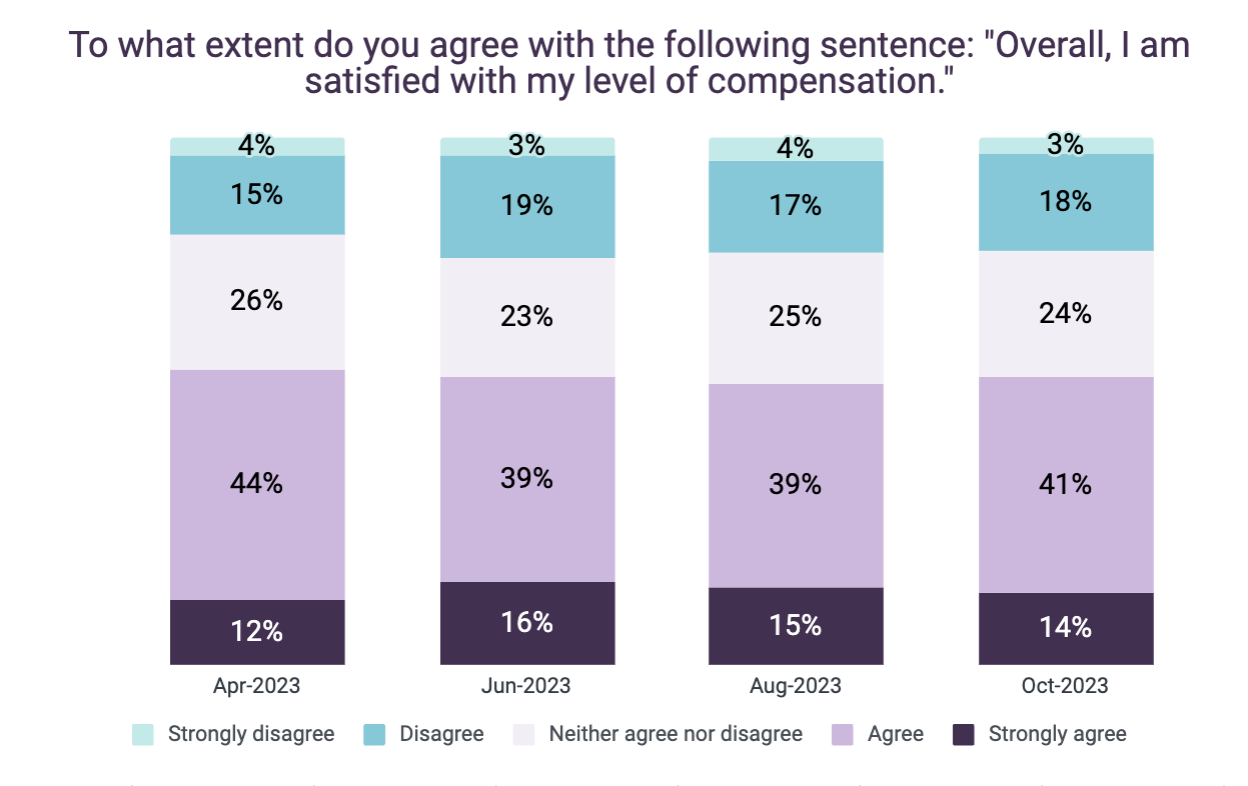

- Continued wage inflation has the majority of workers satisfied with their compensation. Non-wage factors, like schedule flexibility and team relationships, are top motivators for deciding where to work for most hourly employees.

- Core indicators show an expected October slowdown in employment activity across industries. Entertainment, specifically, has gained stability, steadying to pre-pandemic levels.

- Workers are less worried about the economy, signaling confidence in Main Street activity and job security. Most workers note the rising cost of goods, yet concerns over inflation dipped.

Core indicators revealed Main Street labor market steadied in October

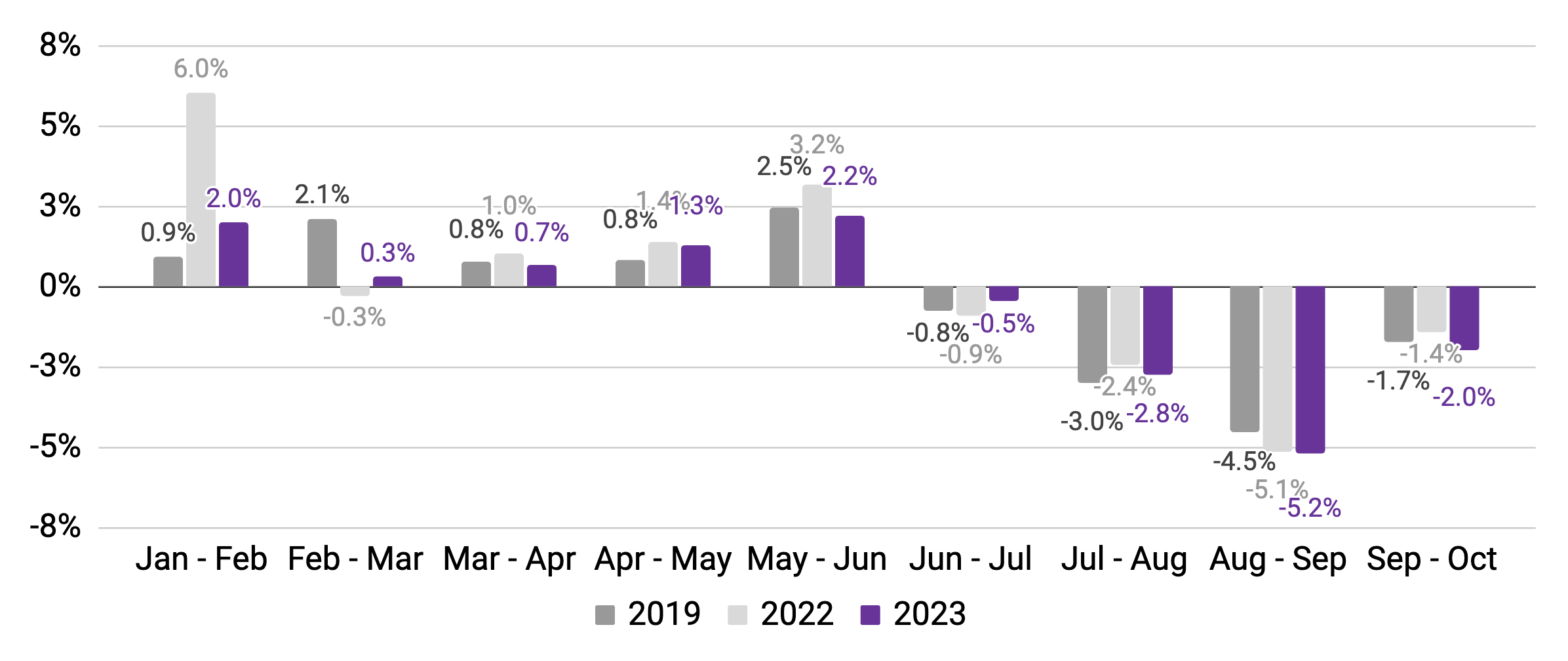

In October, employees working and hours worked saw expected seasonal dips in line with pre-pandemic levels.

Employees working

(Monthly change in 7-day average, relative to January of reported year)

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

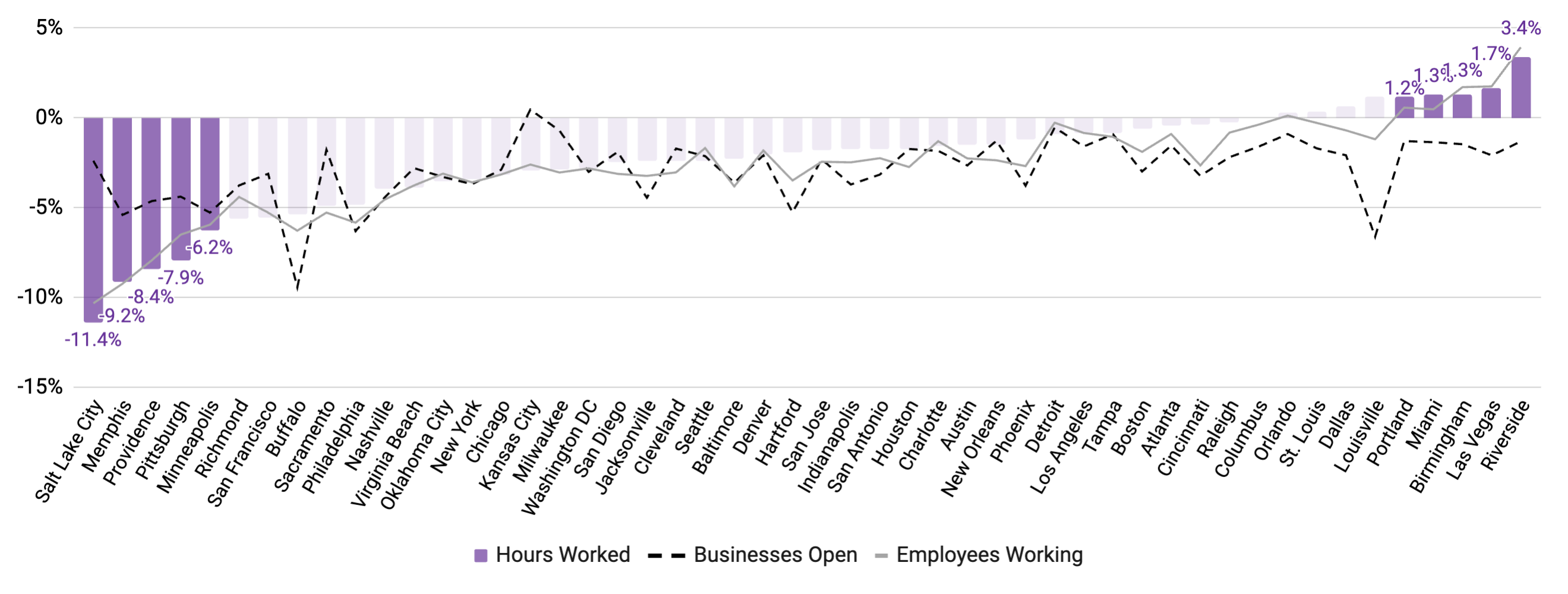

SMBs in key regions defied seasonal dip, driving growth in October

Riverside, Las Vegas, Birmingham, Miami and Portland saw an increase in hours worked and employees working, while the rest of the country declined.

Output by MSA – Month-over-month change in core economic indicators, by metropolitan statistical area

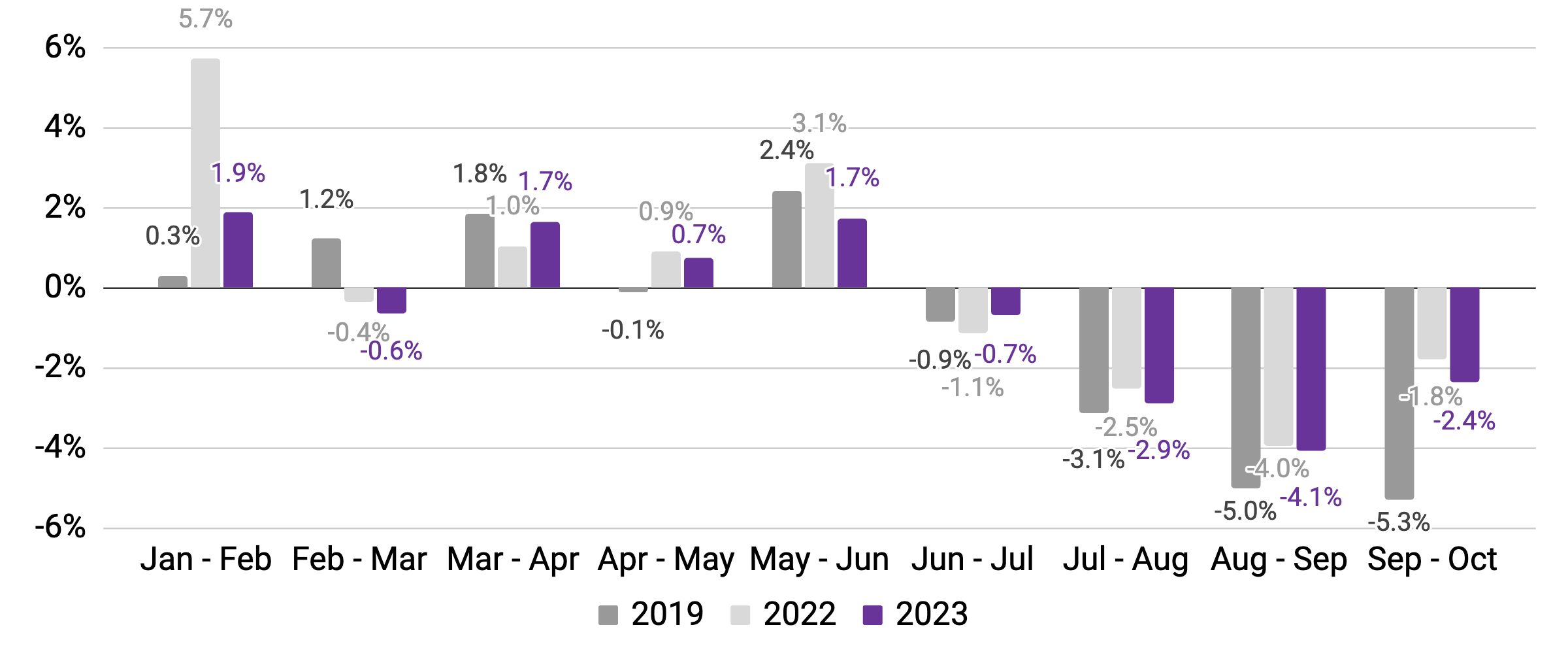

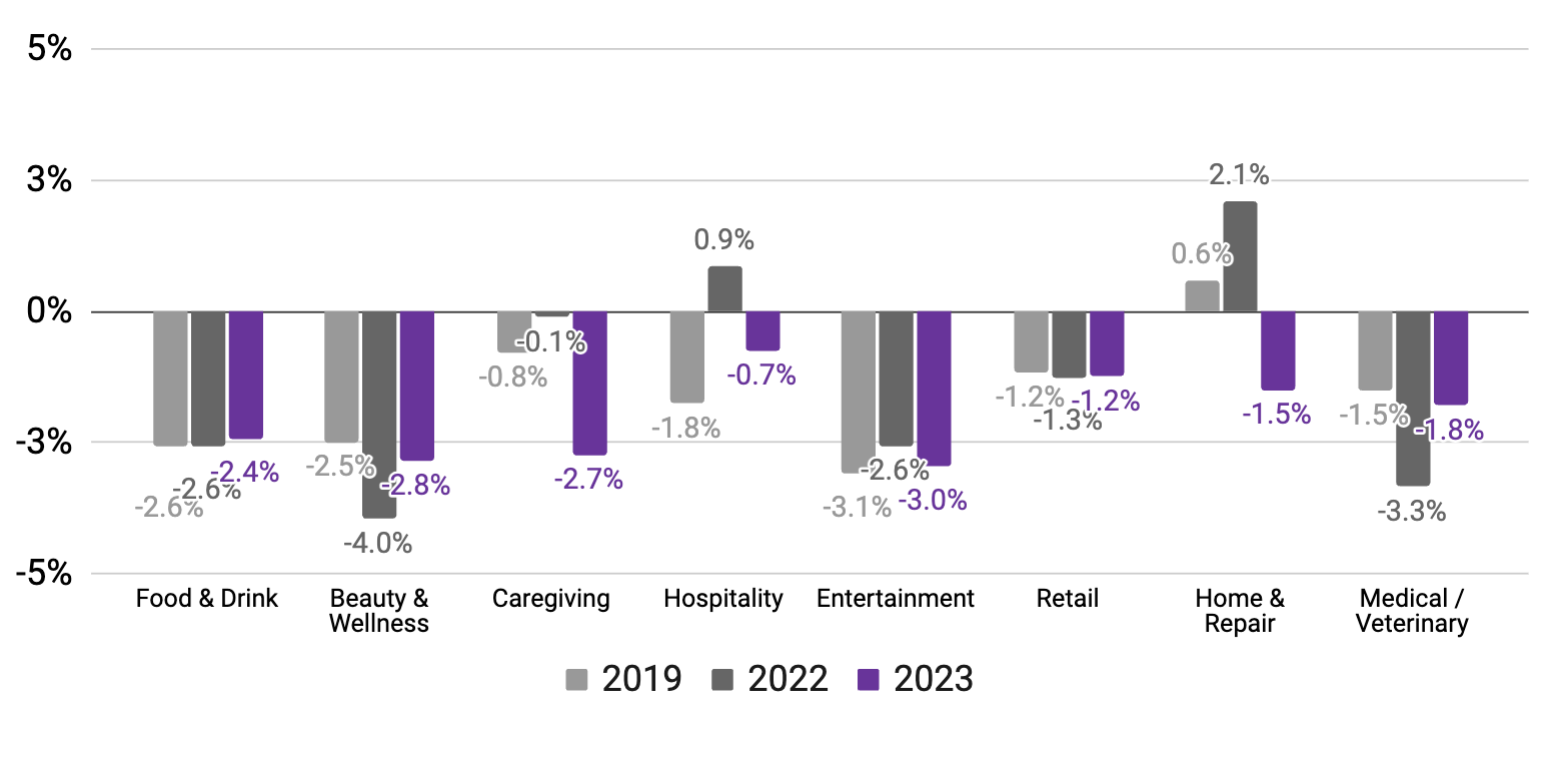

Most industries showed a return to pre-pandemic rates of employees working trends

After a strong September, Entertainment posted a comfortable decline for October relative to 2019, signalling the return to a steady rhythm.

Percent change in employees working

(Mid-October vs. mid-September, using Jan. ‘19, Jan. ‘22, and Jan. ‘23 baselines) 3

Entertainment continues to show signs of a return to pre-pandemic levels in the rate of employees working. September, saw a more muted end of summer decline than prior years, and now October data shows stability has returned to 2019 levels.

In fact, most industries across the board are showing a seasonal dip in employees working in line with pre-pandemic years. This could signal a turning point in economic stability on Main Street.

- Hospitality includes tourism and hotel/lodging businesses.

- Entertainment includes events/festivals, sports/recreation, parks, movie theaters, and other categories.

- October 6-12 vs. September 8-14 (2019); October 9-15 vs. September 11-17 (2022); October 8-14 vs. September 10-16 (2023). Source: Homebase data

Wages at small businesses continued to grow in October

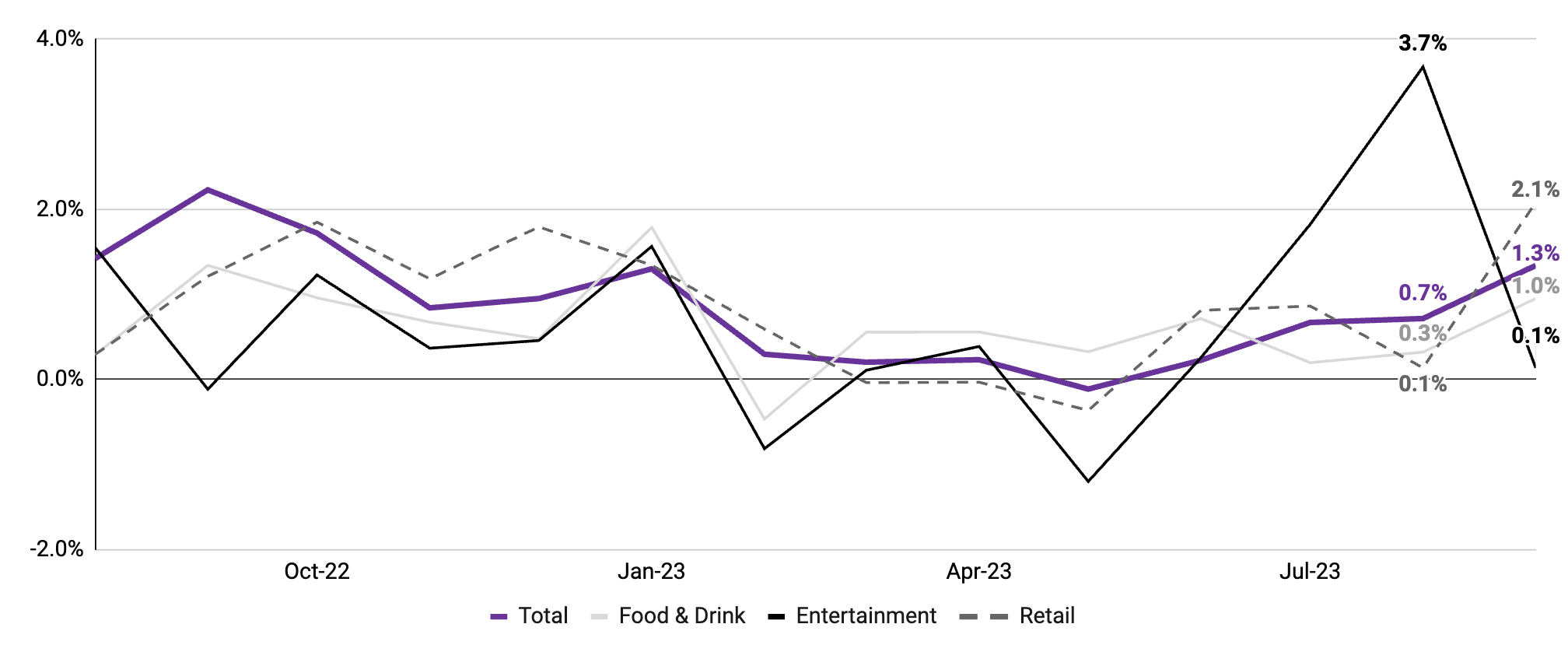

Entertainment saw a spike coming into October but then stabilized, while total wage changes continued on an upward trend.

Avg. wage changes, m/m

Monthly change in average hourly wages across all jobs

Note: Data measures average hourly wages for locations that utilized Homebase to pay employees in both October 2022 and October 2023. Total includes industries not depicted here. Source: Homebase Payroll data.

Hourly Worker Pulse Check

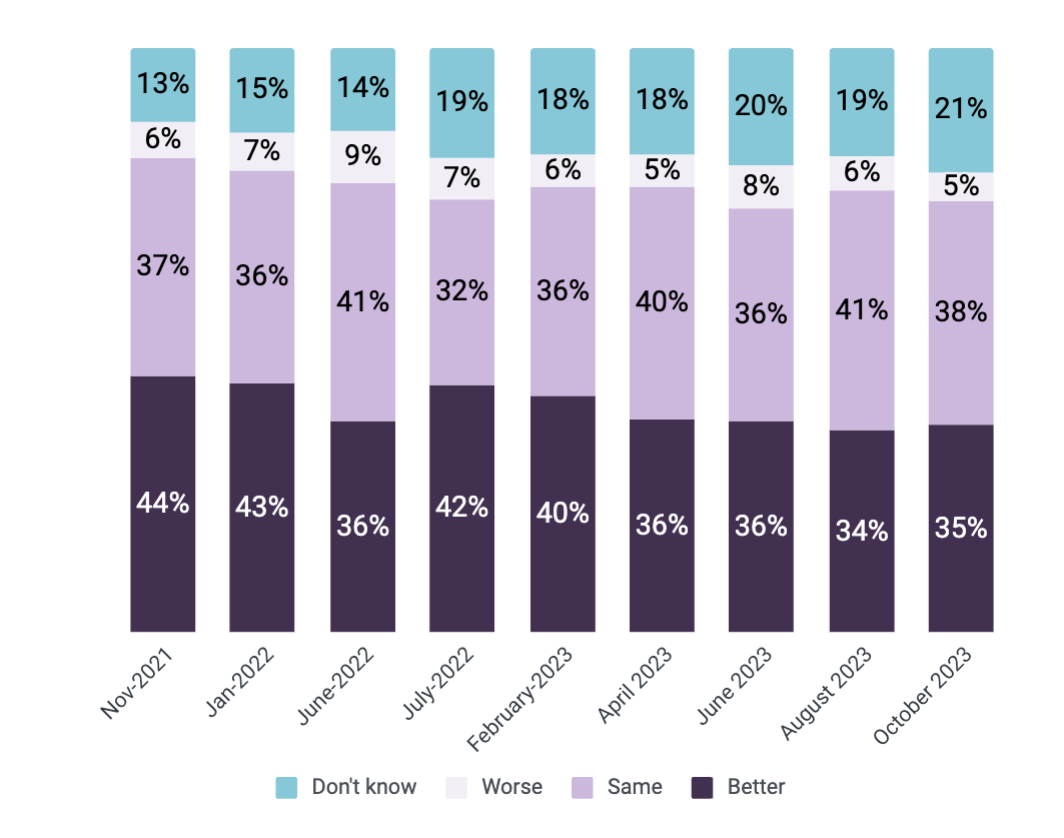

Workers are hopeful but uncertain about the future

Over a third of workers think job opportunities will improve one year down the line. As many as 21%, up from 19% in August, are uncertain about future prospects.

While uncertainty remains, a modest rebound in positivity shows workers are cautiously optimistic about activity and potential for work on Main Street.

Survey question: Do you think your job options will be better, about the same, or worse in 12 months compared to today?

Source: Homebase Employee Pulse Survey

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

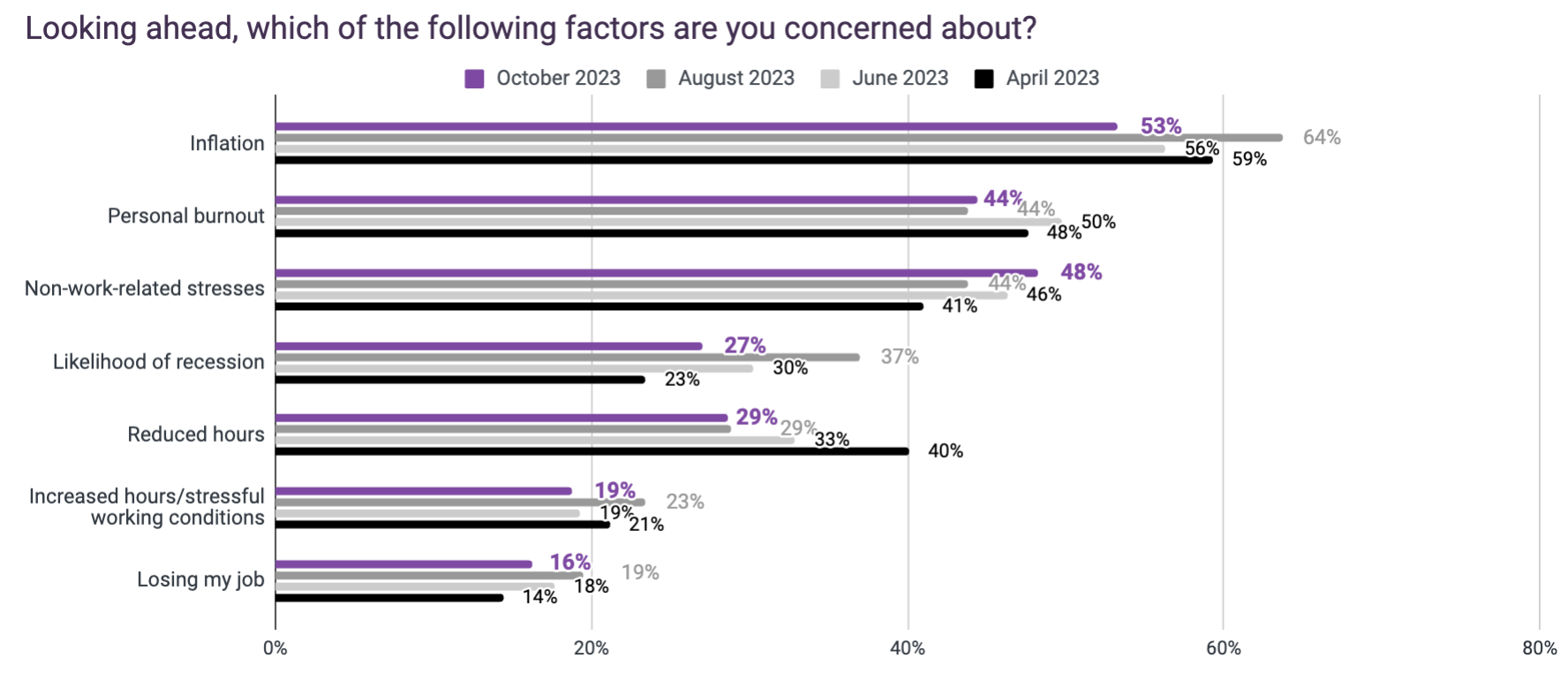

Economic concerns declined for workers

While workers are still worried about the likelihood of a recession and inflation, their fears are lessening. In October, 53% of hourly workers reported being concerned about inflation, a decrease of 11% from August. Fears around a recession also dropped 10% in October compared to August.

Economic fears are being replaced by more personal fears. In October, 48% of hourly workers reported concerns over non-work-related stresses, up from 44% in August.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

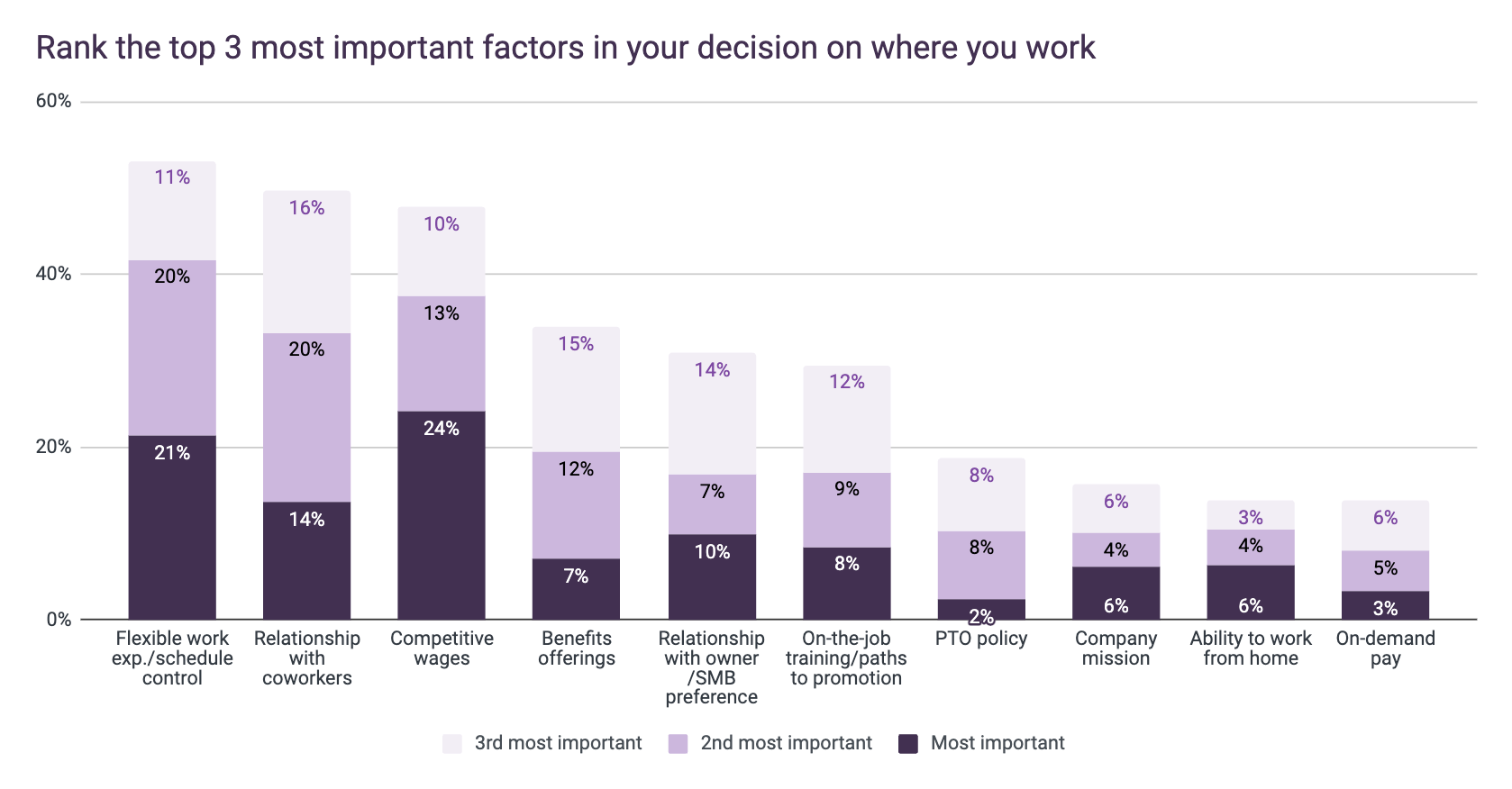

Non-wage factors like schedule flexibility and team relationships are top motivators for workers

Wages remain important but take third place, all while economic concerns soften for workers.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

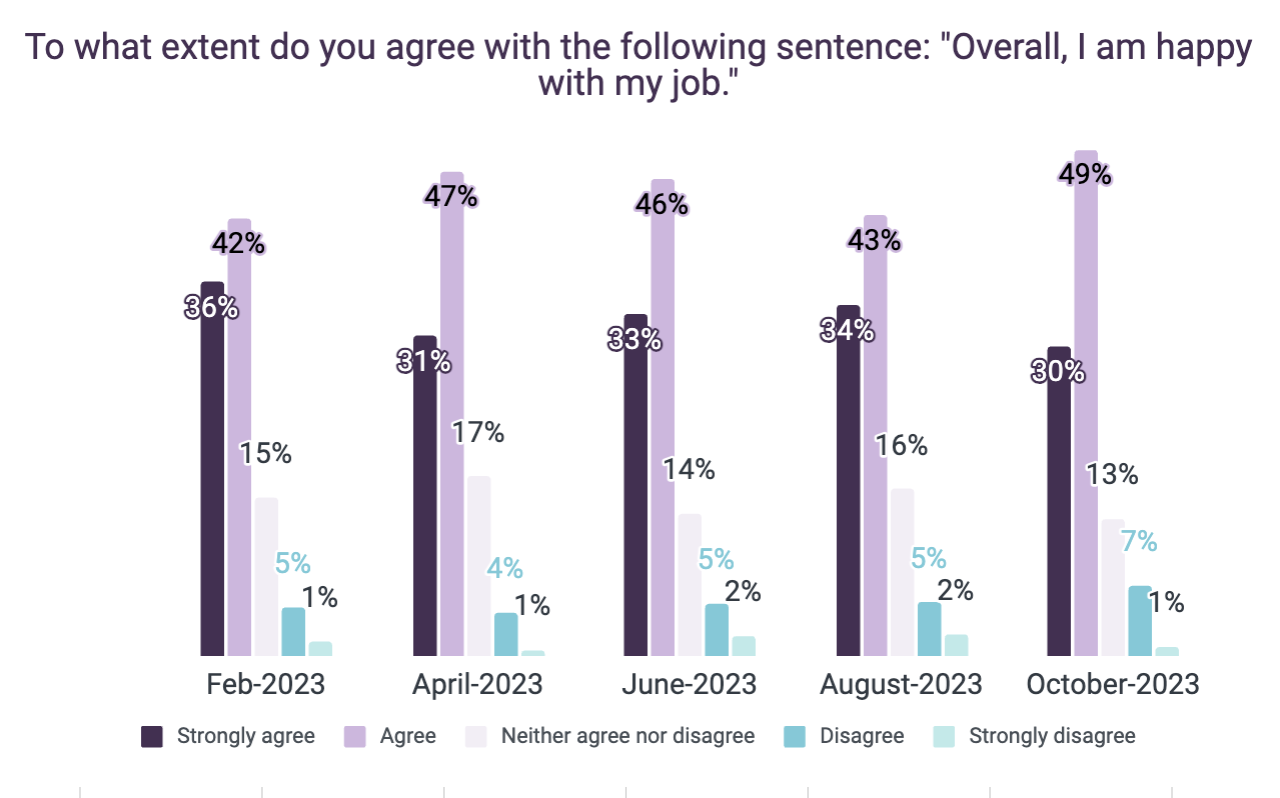

Job satisfaction on Main Street has increased since August

As many as 4 out of 5 hourly workers agree they’re happy with their jobs overall.

81% of workers surveyed saw an increase in the cost of household goods and services. Despite that, their outlook on wages has remained generally consistent. In October 2023, 55% of hourly workers at small businesses said they were satisfied with their compensation.

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23); N = 437 (Oct. ‘23)

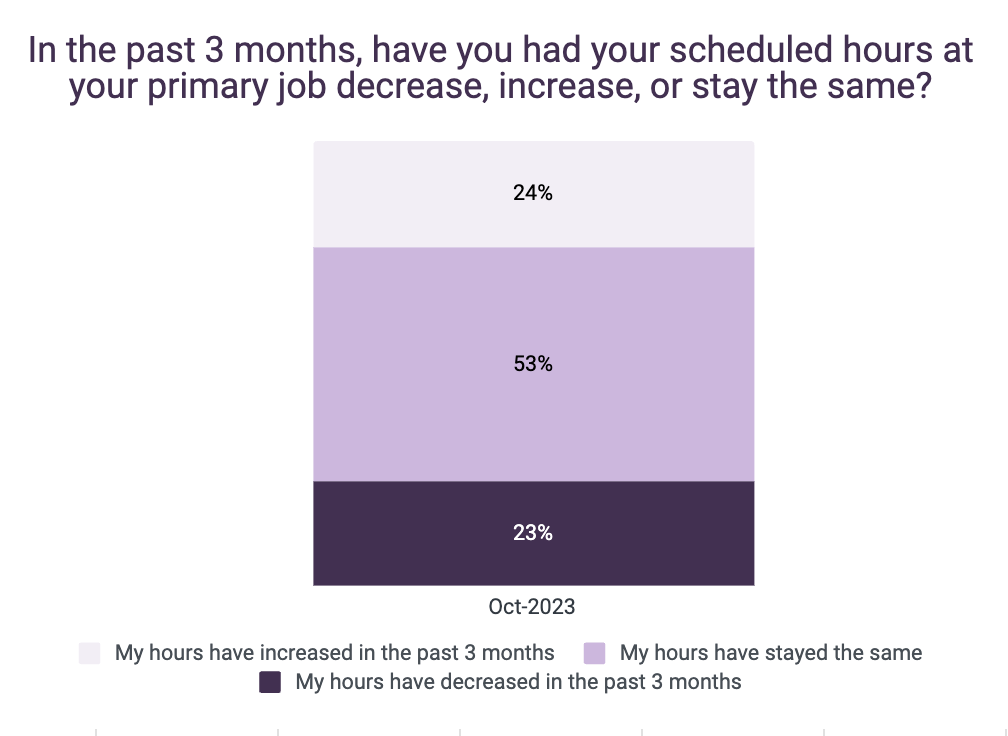

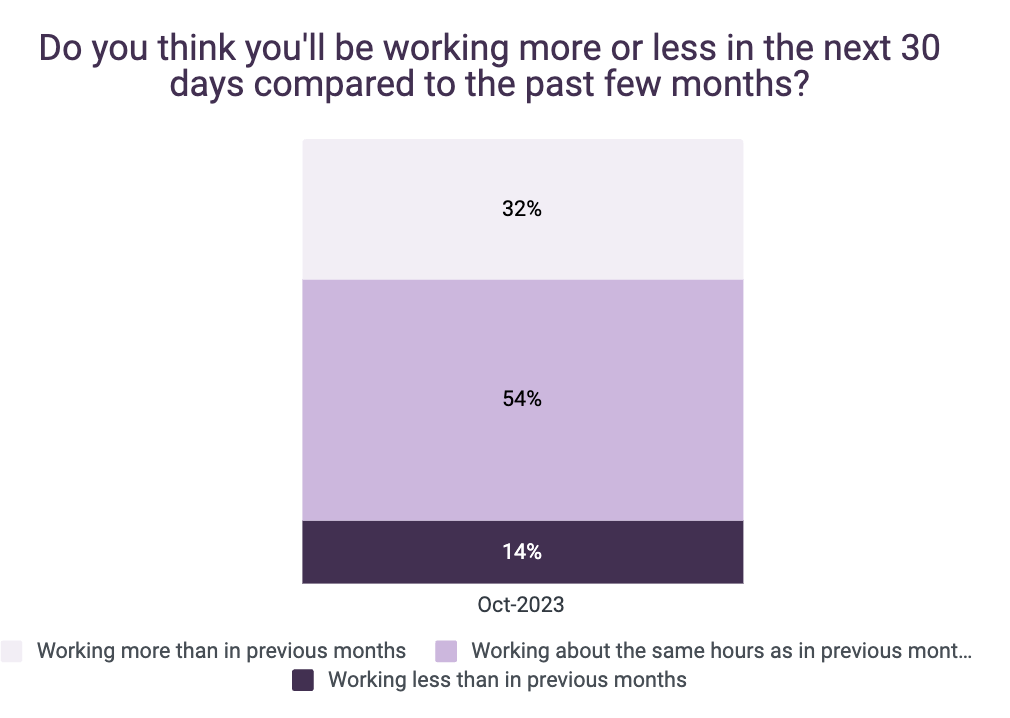

Despite consistent work over the past 3 months, employees expect work to pick up for the holidays

Workers are confident that the holidays will bring business, and with it, higher paychecks.

Source: Homebase Employee Pulse Survey. N = 437 (Oct. ‘23)

Link to PDF of: October 2023 Main Street Health Report. If you choose to use this data for research or reporting purposes, please cite Homebase.