The end-of-summer slow down is underway, with businesses that staffed up in the spring now scaling down. However, worker wages continued to rise as Main Street fights to retain good talent amid a persistent labor shortage.

Most small business hourly workers are satisfied with their jobs and pay, as new priorities like schedule flexibility and team relationships top the list. Workers are less optimistic about future prospects, as inflation worries increase.

NEW AND NOTEWORTHY:

- Main Street wages continued to rise in August, despite salary cuts across big industries like technology and transportation, showing that small businesses are still battling the labor shortage.

- Hospitality saw only a slight dip in employees working as teams thinned towards end of summer while still supporting greater demand than prior years.

- Consistent summer wage growth has impacted worker priorities, with employees now valuing schedule flexibility & control and team relationships over wages.

- Inflation remains a top concern for hourly workers (more than 3x more than losing one’s job). Longer working hours have also been an increasing worry.

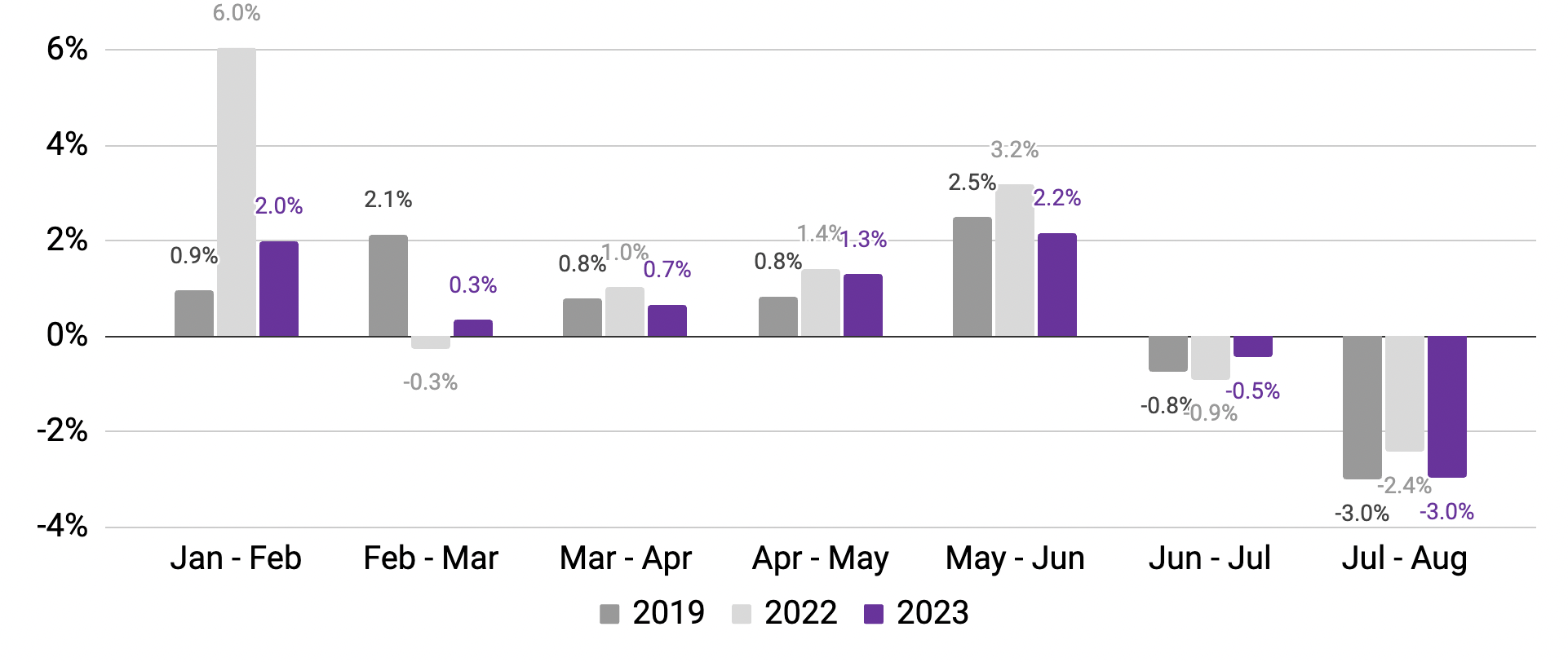

Summer slowdown has begun, in line historical seasonal trends.

The number of employees working and hours worked dropped from July at the same rate as prior years.

Employees working

(Monthly change in 7-day average, relative to January of reported year)

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Data compares rolling 7-day averages for weeks encompassing the 12th of each month; April data encompasses the subsequent week to account for Easter holiday. Source: Homebase data.

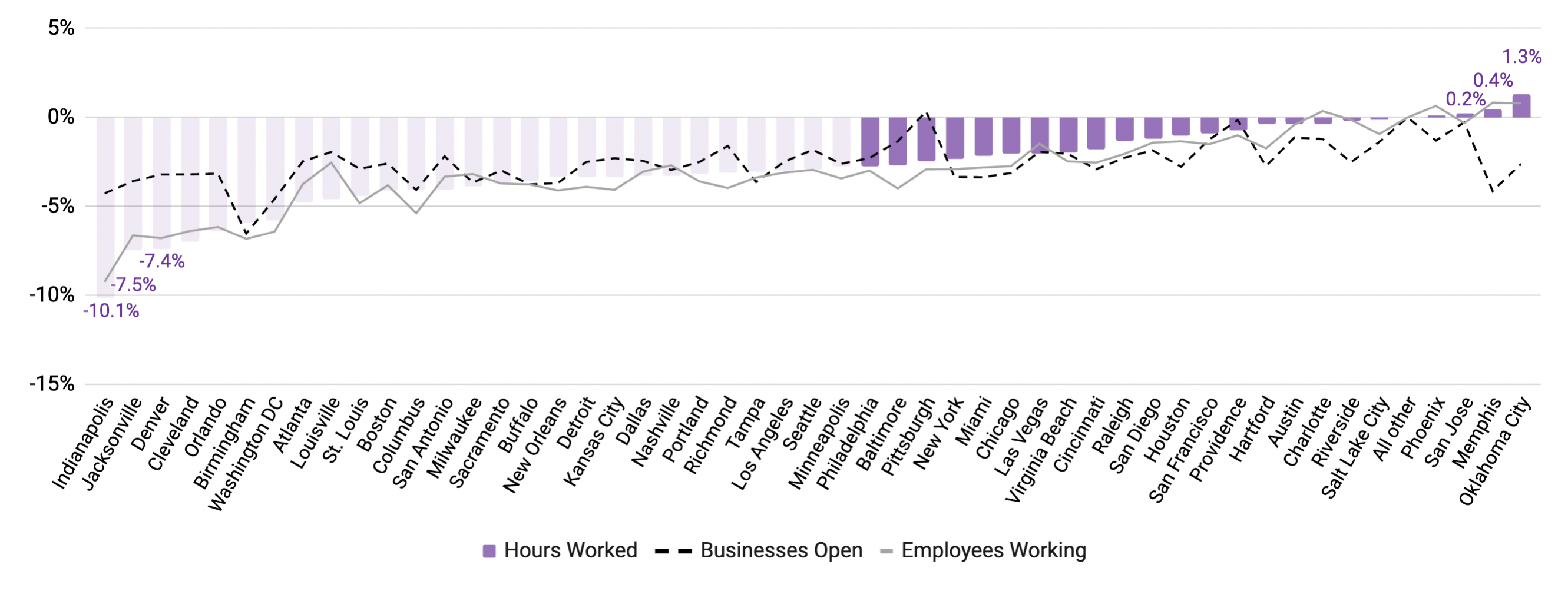

Impacts of the July heat dome have cooled.

Reductions in employees working are no longer concentrated in the South.

Output by MSA

Month-over-month change in core economic indicators, by metropolitan statistical area

Note: August 6-12 vs. July 9-15. Source: Homebase data

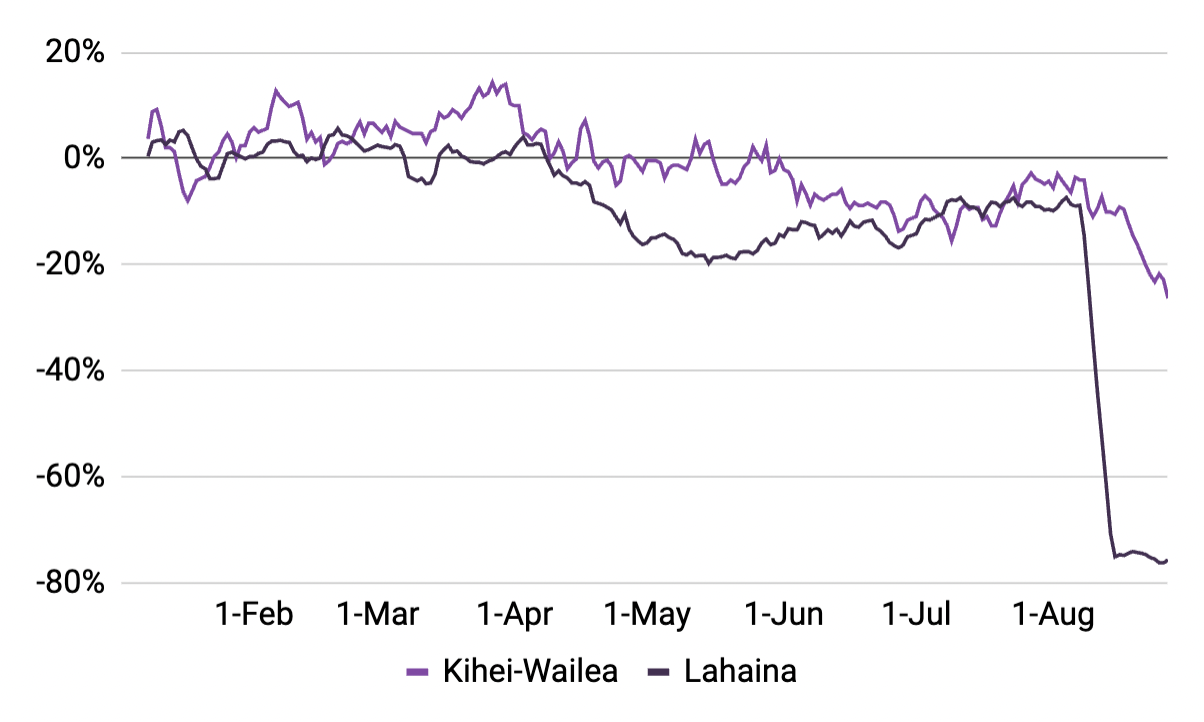

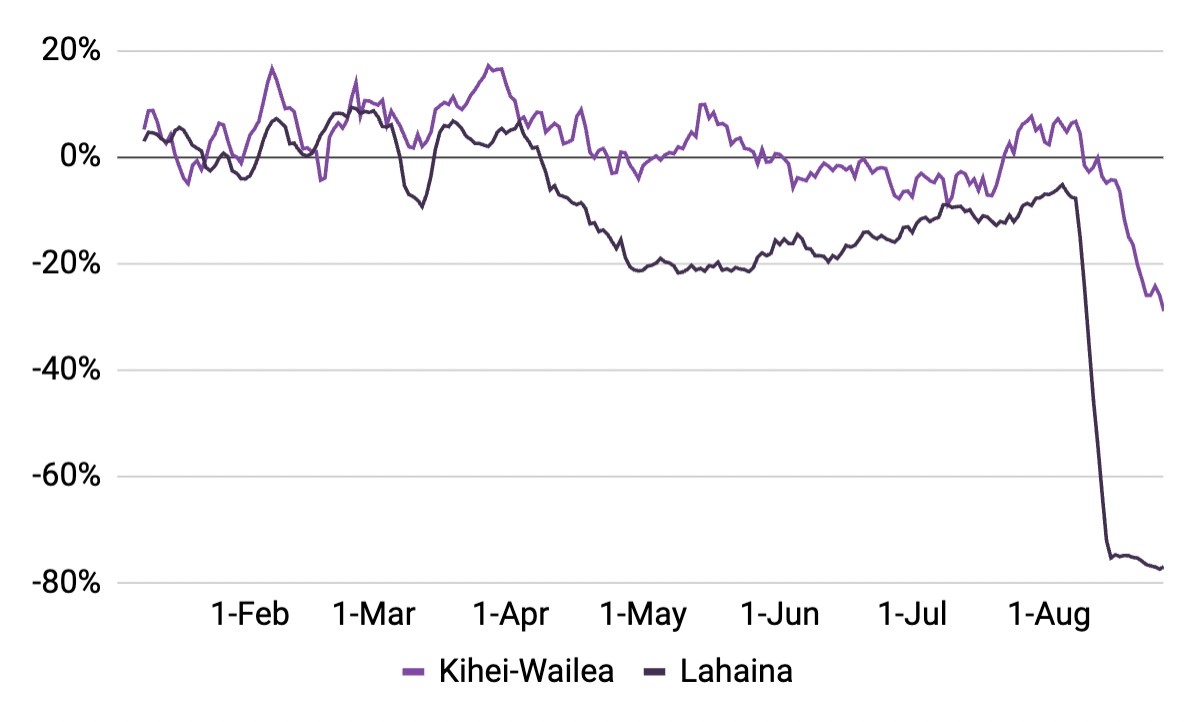

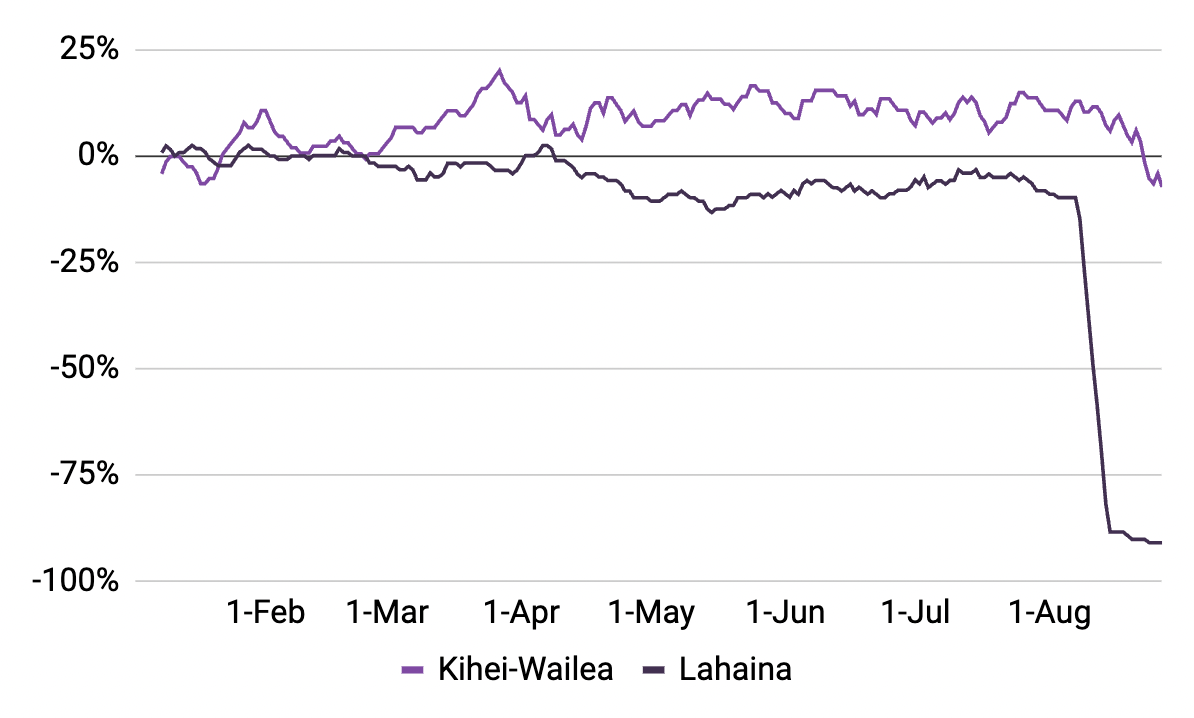

However, the Lahaina fire has affected much of Maui’s Main Street.

August’s devastating fires in Lahaina destroyed local businesses and forced many others to close their doors and focus on safety and recovery. Outside of Lahaina, calls for tourism to continue in outlying towns, like Kihei and Wailea, encourage visitor foot traffic for local businesses that are trying to keep their doors open and teams gainfully employed.

Employees working

(Monthly change in 7-day avg, relative to January 2023)

Hours worked

(Monthly change in 7-day avg, relative to January 2023)

Businesses open

(Monthly change in 7-day avg, relative to January 2023)

Note: Data encompasses businesses that operates in the census-designated places (CDPs) of Kihei, Wailea, and Lahaina. Source: Homebase data.

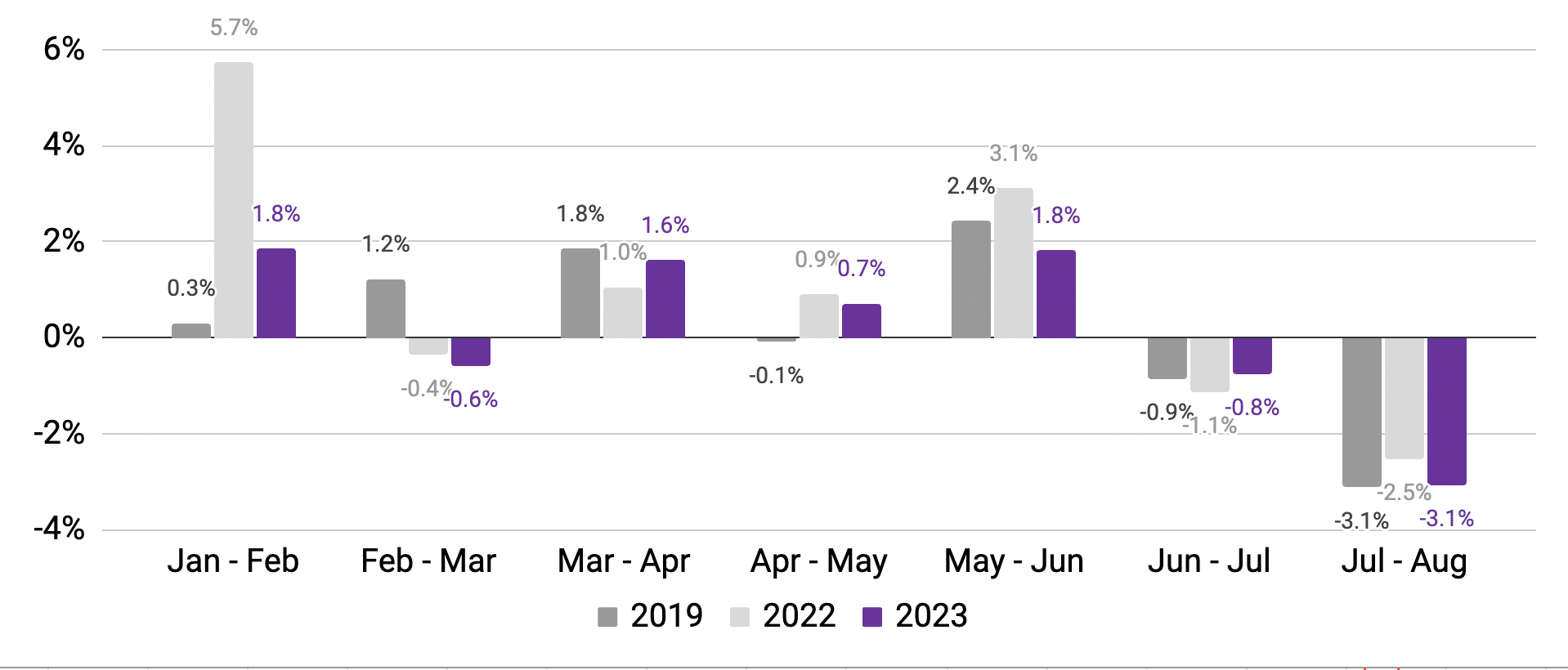

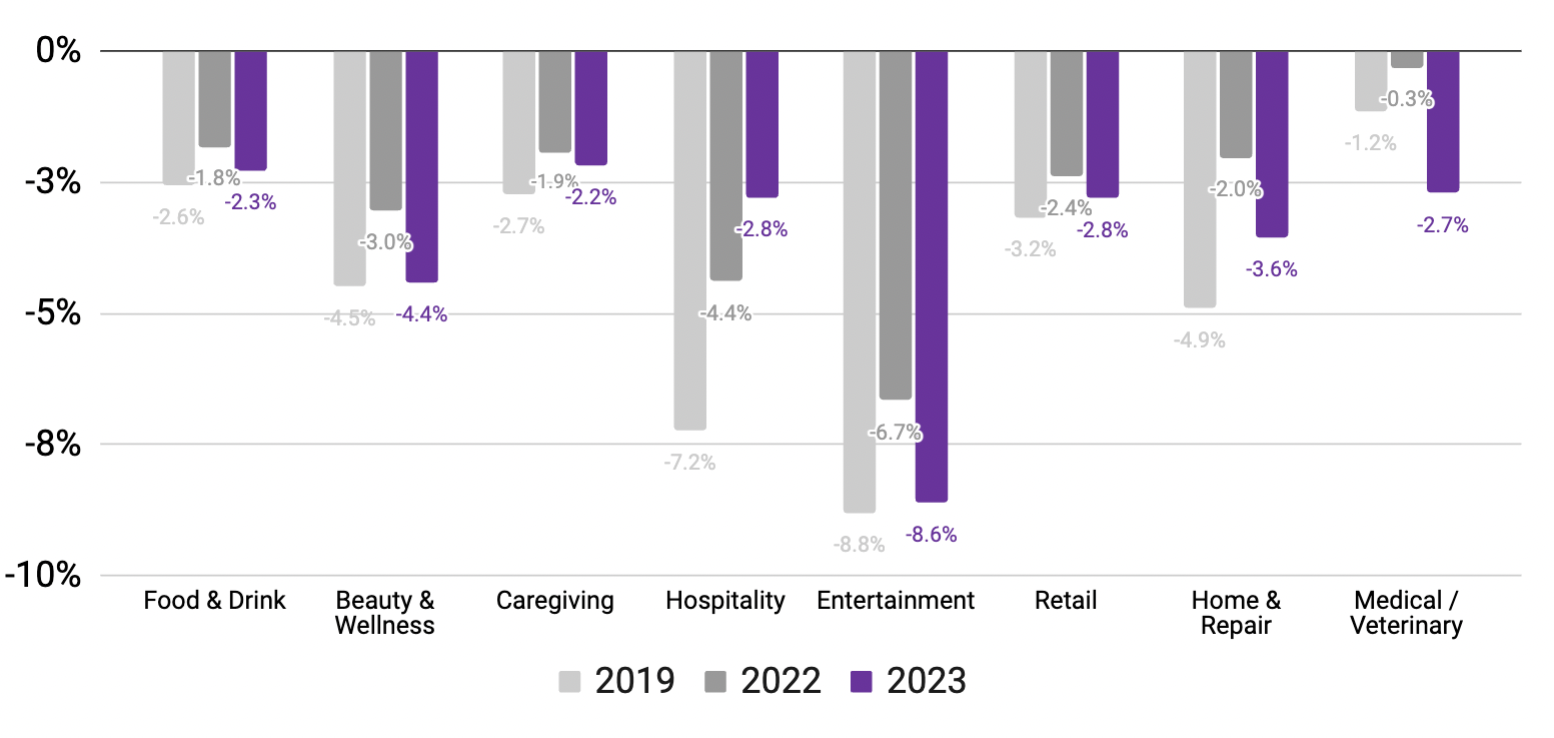

Fewer employees working is driven by the transition from summer vacations to back-to-school (and work).

Hospitality businesses saw leaner teams in August than midsummer, but needed more workers to support greater demand than prior years.

This year, Hospitality1 saw only a slight dip in employees working in August, which is much less than in prior years. This is likely due to early summer labor shortages, which meant lower hiring in June and July and thus smaller team reductions in August (compared to previous years).

Entertainment2 saw a stark but expected decline in employees, as the need for outdoor activities slowed in line with prior years.

Percent change in employees working

(Mid-August vs. mid-July, using Jan. ‘19, Jan. ‘22, and Jan. ‘23 baselines) 3

- Hospitality includes tourism and hotel/lodging businesses.

- Entertainment includes events/festivals, sports/recreation, parks, movie theaters, and other categories.

- August 11-17 vs. July 7-13 (2019); August 7-13 vs. July 10-16 (2022); August 6-12 vs. July 9-15 (2023). Source: Homebase data

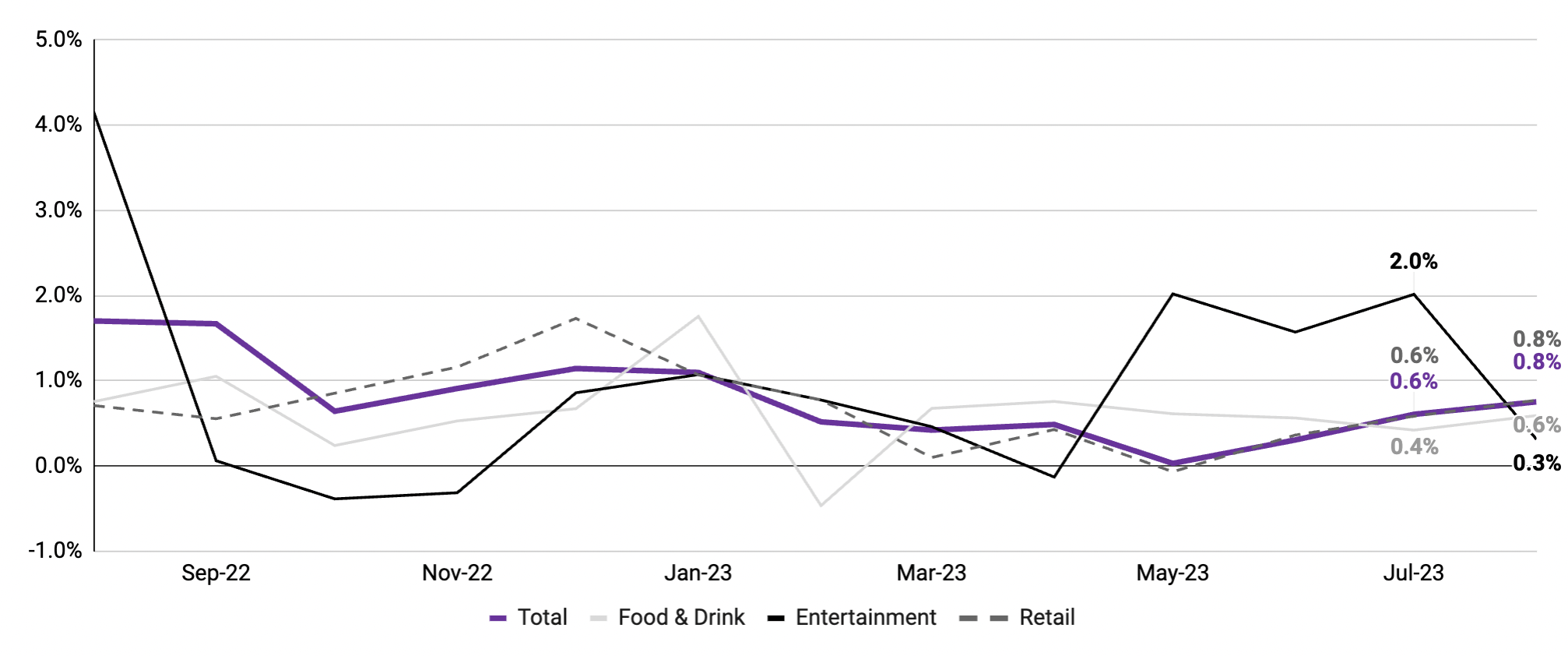

Wages at small businesses grew even more in August than July.

Small businesses continue raise staff wages to retain seasoned teams in the face of labor shortages.

Avg. wage changes, m/m

Monthly change in average hourly wages across all jobs

Hourly Employee Pulse Check

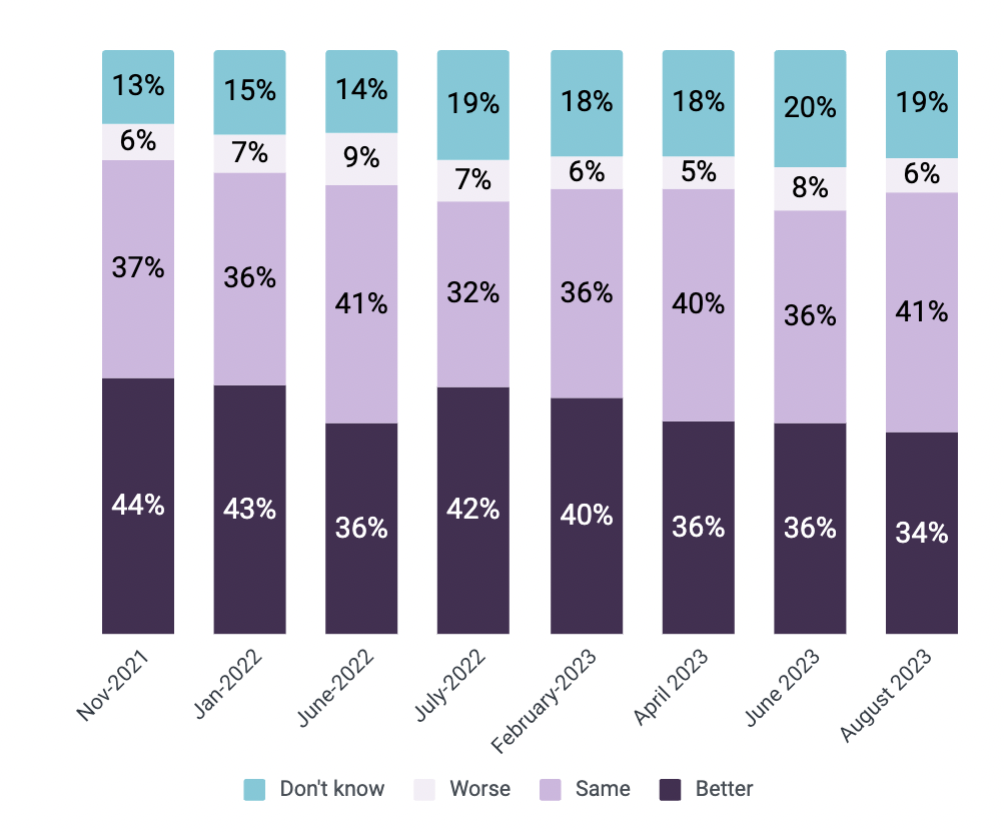

Hourly workers are less optimistic about future job options.

Even as wages continue to grow and labor remains tight on Main Street, worker optimism is decreasing and uncertainty is gradually on the rise. This is likely driven by general economic instability or stories in the media.

34% of hourly workers think their job options will be better in 12 months. This rate has been steadily declining since July 2022 when it was at 42%.

Survey question: Do you think your job options will be better, about the same, or worse in 12 months compared to today?

Source: Homebase Employee Pulse Survey

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

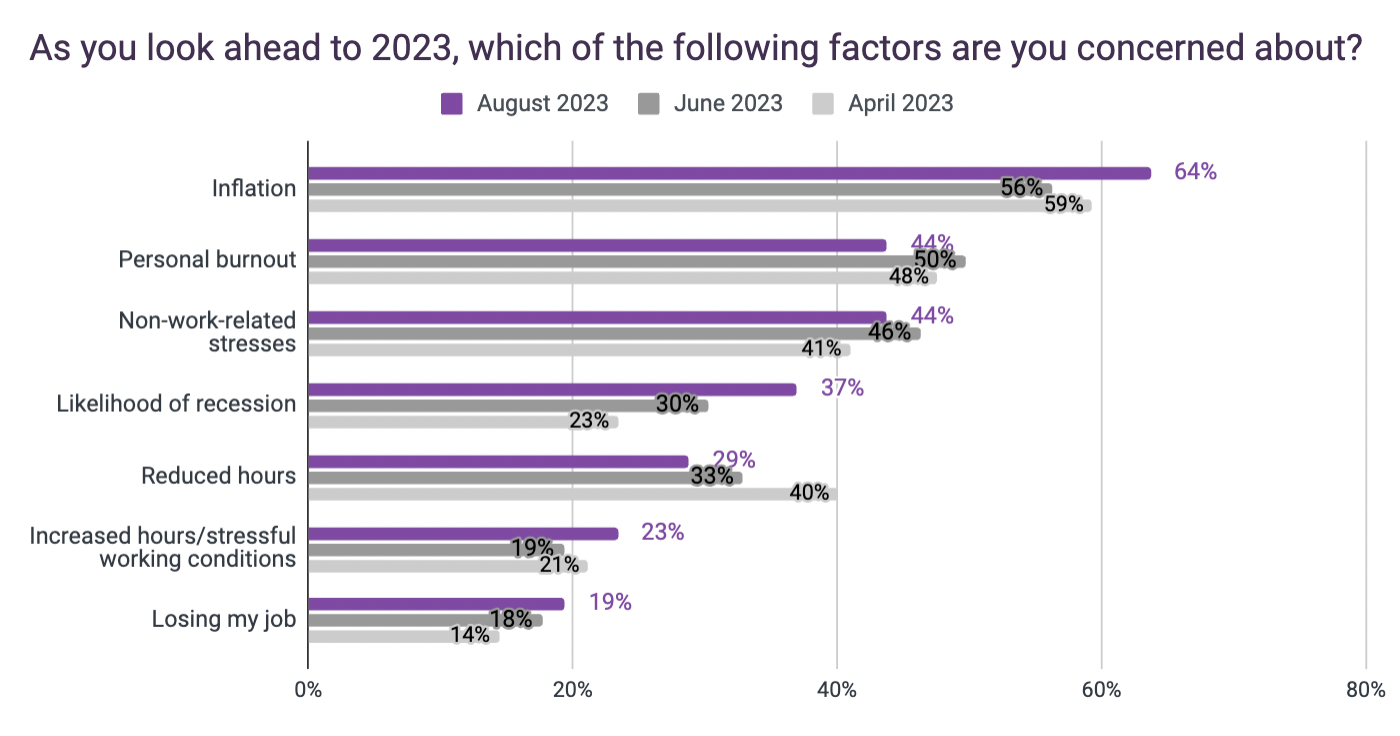

Workers are 3x more concerned about inflation than losing their jobs.

Inflation remains a top concern in 2023, as the cost of living rises. In August, 64% of hourly workers reported being concerned about inflation, an increase of nearly 10% from June.

Longer working hours for employees also appear to be on the rise. Workers are more worried about increased hours (23% in August, up from 19% in June), and are less worried about reduced hours (29% in August, down from 33% in June).

Source: Homebase Employee Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

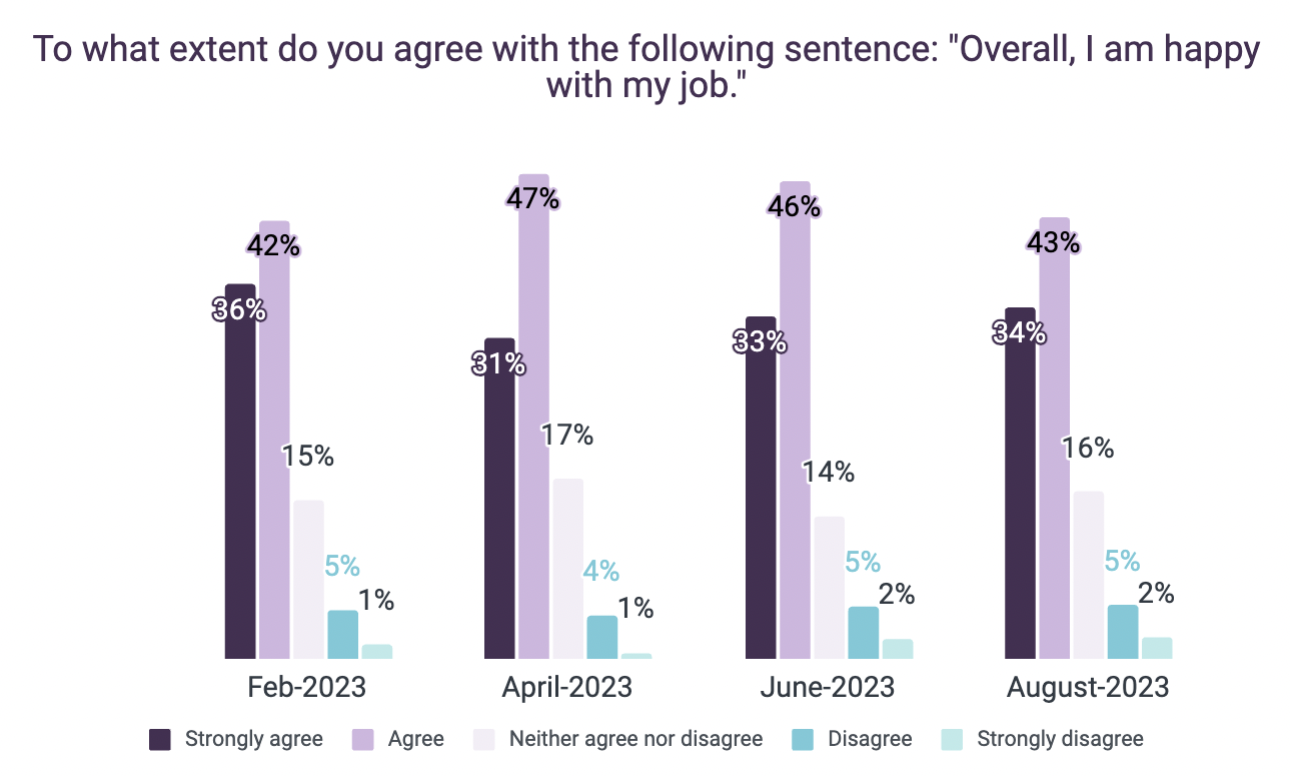

Job satisfaction on Main Street is consistently high.

As many as 4 out of 5 hourly workers agree they’re happy with their jobs overall.

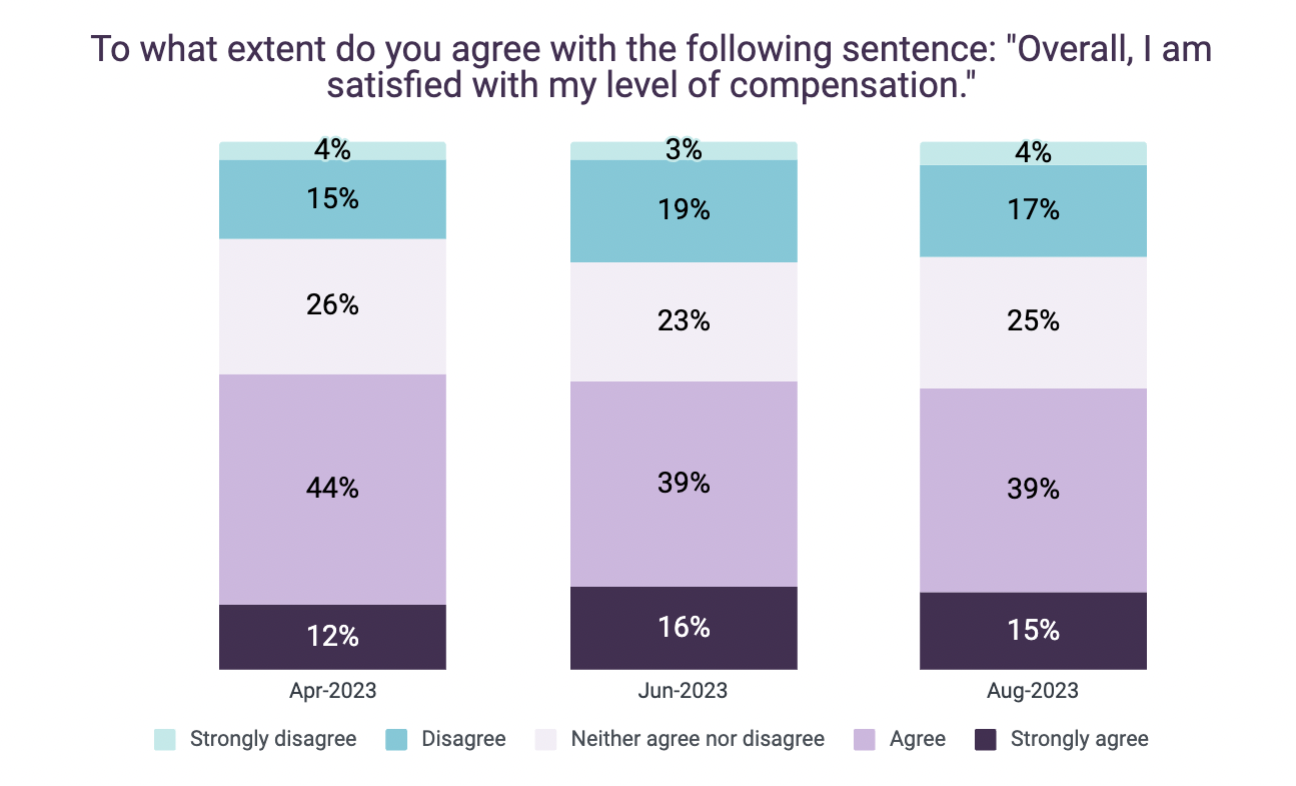

Their outlook on wages has remained generally consistent. In August 2023, 54% of hourly workers at small businesses said they were satisfied with their compensation.

Source: Homebase Employee Pulse Survey

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

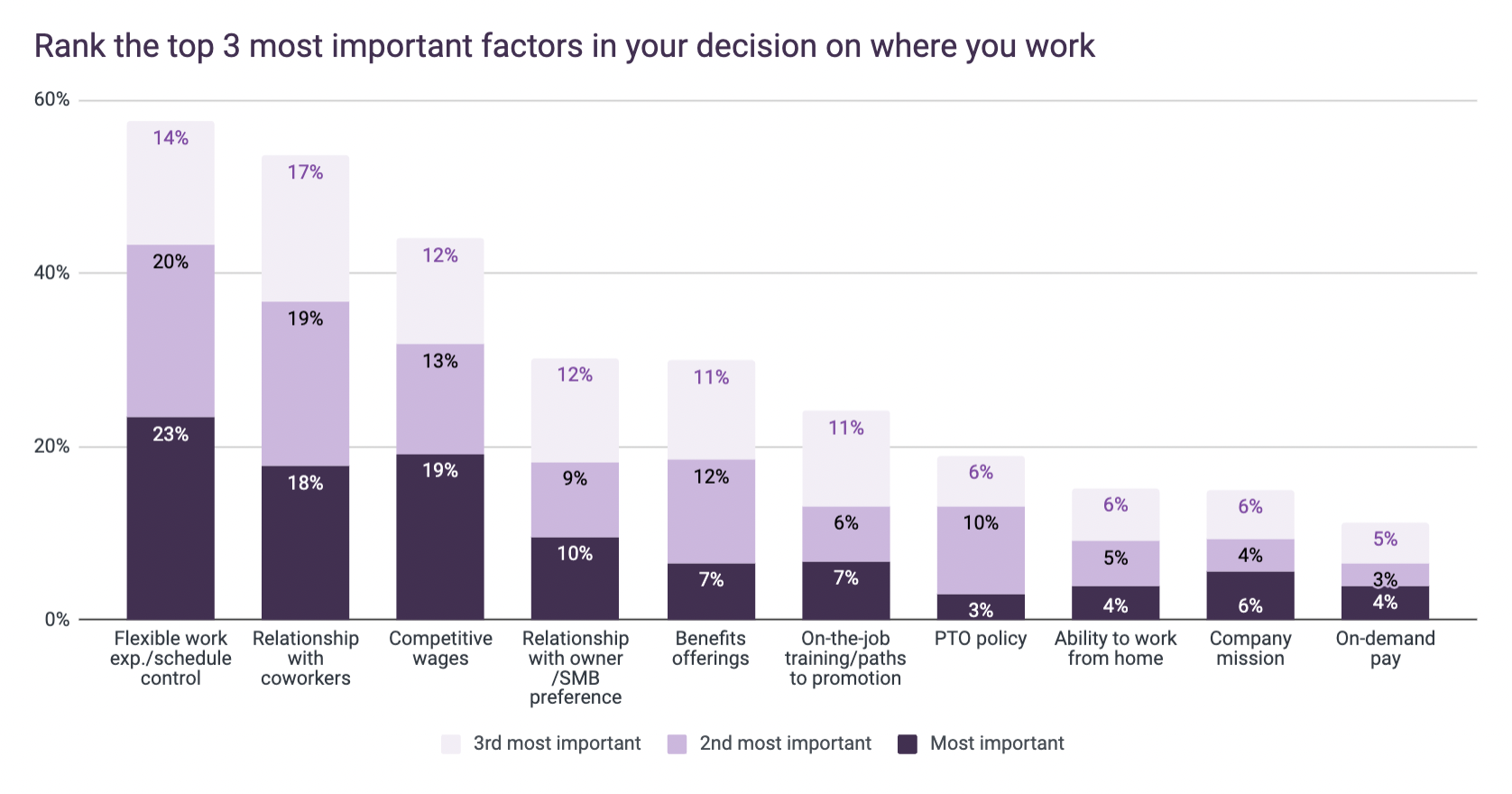

It’s about more than just money, say hourly workers.

Flexibility & schedule control and team relationships are the most important factors for employees.

Since May, wage growth has impacted hourly worker priorities, with schedule flexibility and team relationships consistently ranking above wages.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

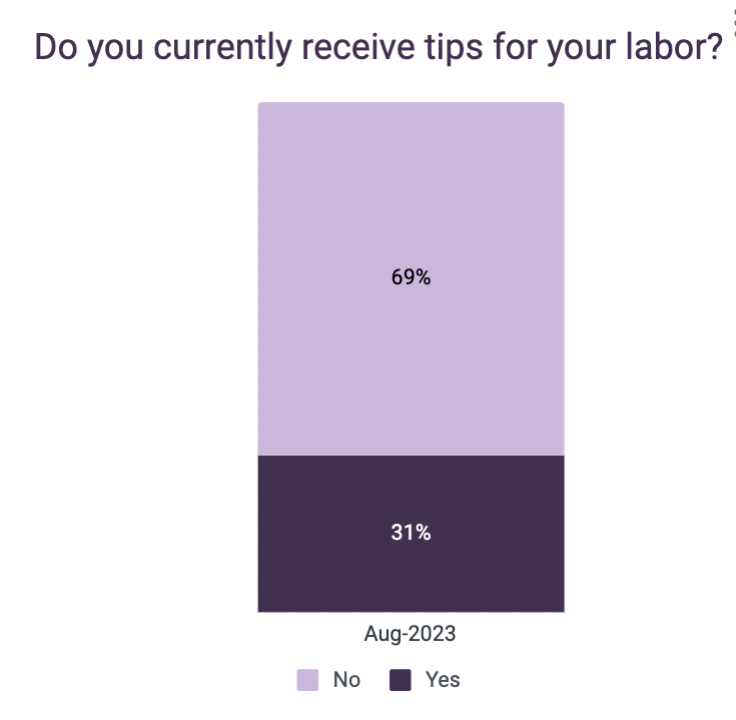

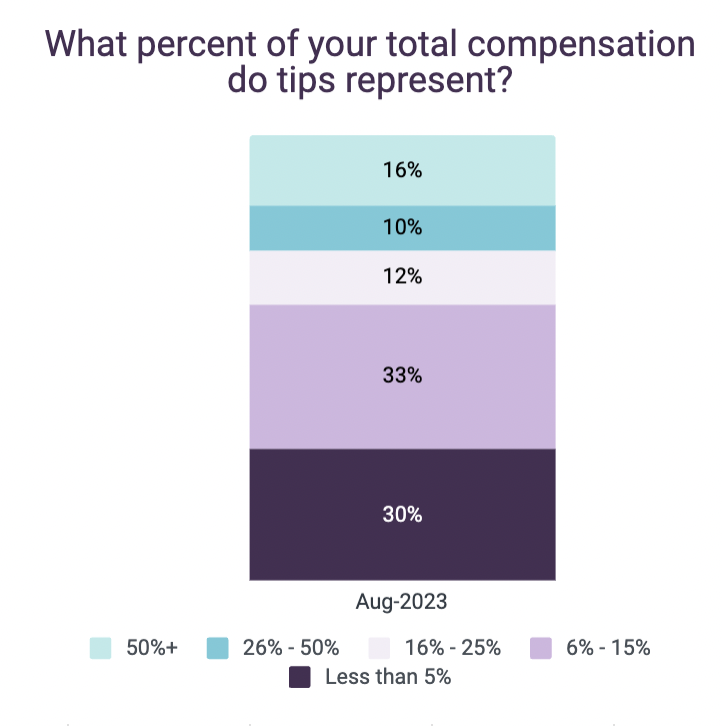

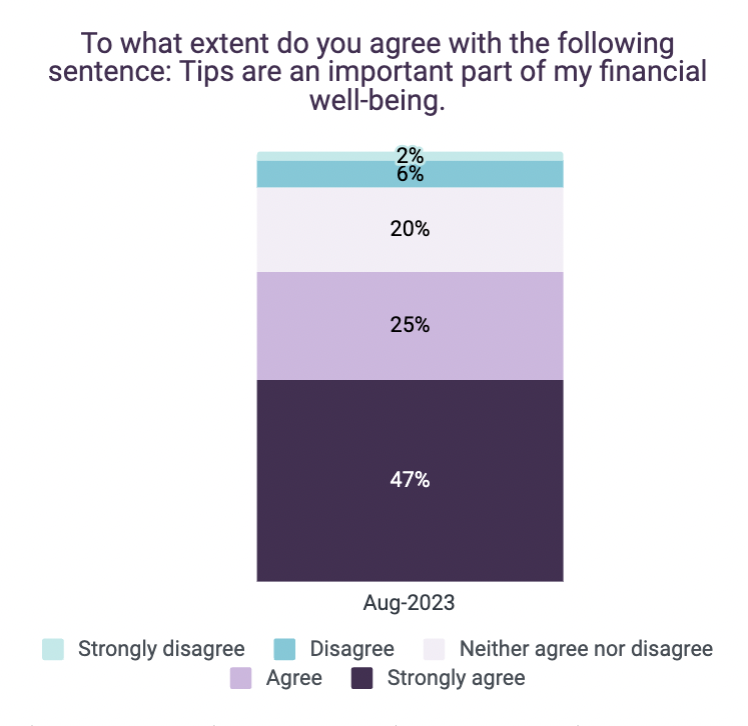

For workers who receive tips, they are a critical component of compensation.

Source: Homebase Employee Pulse Survey. N = 427 (Aug. ‘23)

Link to PDF of: August 2023 Homebase Main Street Health Report. If you choose to use this data for research or reporting purposes, please cite Homebase.