While there’s no formal rule that states you have to pay employees for time they don’t work, the reality is a bit more complex. Holiday pay can be seen as a gift to your hardworking team members — a way for them to enjoy some time off without feeling the pinch in their wallets.

But how do you calculate it? And how do you ensure you’re not over or underpaying? In this article, we’ll give you a step-by-step guide to calculating holiday pay so you can focus more on spreading holiday cheer and less on crunching numbers.

What is Holiday Pay?

Holiday pay is the compensation an employee receives for time off during public holidays, like New Year’s Day, Christmas Eve, Labor Day, Thanksgiving Day, and Independence Day in the United States. It’s a benefit that ensures staff members don’t lose wages when they’re not working on designated holidays.

In some cases, if an employee works on a public holiday, they’ll receive additional compensation — often called “time-and-a-half” — meaning they get their standard hourly wage plus an extra 50%. But, the specifics can vary greatly depending on local laws, company policies, and the terms of your employees’ contracts.

Who’s eligible for holiday pay?

According to the Fair Labor Standards Act (FLSA), you don’t have to pay employees for time not worked, including holidays. It’s largely a matter of agreement between you and your workers, often outlined in employment contracts or company policies.

Generally, full-time employees — salaried or hourly — are eligible for holiday pay. Some businesses might require part-time employees to complete a certain service period before they receive it, while others might extend this benefit to all their team members from day one. Offering holiday pay also helps improve retention for hourly employees.

| Note: Independent contractors and freelancers aren’t typically eligible for holiday pay as they aren’t considered employees. |

How do I Set up a Holiday Pay Policy?

Whether you’re managing salaried or hourly employees or a combination of the two, it’s essential to establish a holiday pay policy where you define the guidelines and set expectations for both your business and your staff.

Here are some key points that should make up the basis of your holiday pay policy:

- Eligibility criteria: As discussed above, this typically includes both full-time and part-time employees under certain conditions but probably excludes temporary staff or contractors.

- Process for requesting time off: Specify any deadlines when it comes to asking for days off and define how you’ll handle situations where you get multiple requests for the same day. For example, if you’re using Homebase employee scheduling, mention how team members can use this tool and any circumstances that might lead to a request being denied. This helps maintain fairness and transparency in managing holiday schedules.

- Holiday schedule: List the holidays for which employees will receive holiday pay. This usually includes recognized federal holidays, but you may include additional days based on your local area, business operations, or industry.

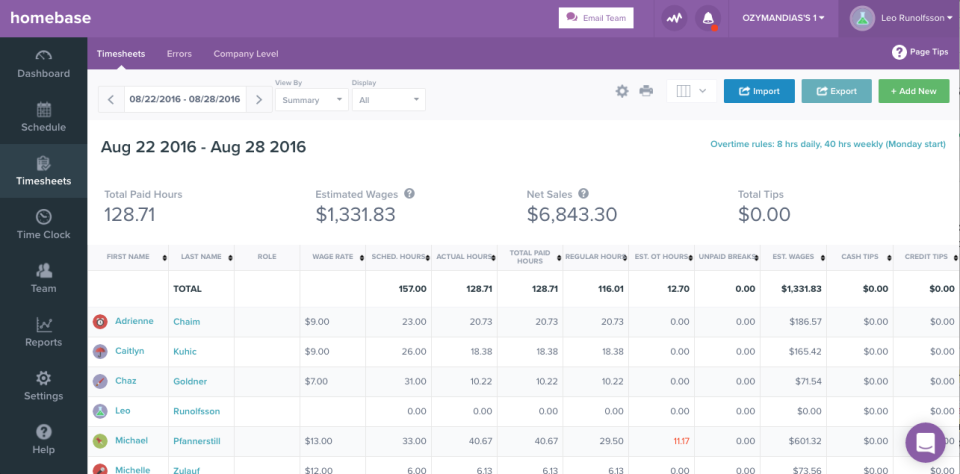

- Payment calculation: Outline how you’ll calculate holiday pay. For example, if you’re using tools like Homebase time tracking and payroll, you can quickly convert your employee timekeeping data into hours and wages that are ready for payroll (more on this in the next section!)

- Working on a holiday: Specify your small business’s policy for working on federal holidays. Does your business close altogether? Will you require some employees to work? How will they be chosen and compensated?

- Unused holiday pay: If your company allows staff to accrue holiday pay, specify what happens if they don’t use it. Can it be carried over to the next year, or will they have to forfeit it?

- Policy exceptions: Detail any exceptions to your holiday pay policy. This may include probationary periods for new employees or specific rules for part-time or shift workers.

| ⚠️ Remember: If an employee logs more than 40 hours in a workweek due to working on a holiday, they’re entitled to overtime pay. |

How do you Calculate Holiday Pay?

Calculating holiday pay depends on your small business policies and can differ between salaried and hourly employees.

How to calculate holiday pay for salaried employees

Salaried employees receive a set amount of pay each year regardless of the number of hours they work. As holiday pay is typically built into their annual salary, they generally receive their usual pay for holiday periods, whether they work or not.

Let’s say a staff member has an annual salary of $52,000. If this is paid bi-weekly, they have 26 pay periods per year. This means their gross pay per pay period is $52,000 divided by 26, which equals $2,000. So, even if one of the pay periods includes a public holiday, the employee would still receive the $2,000.

In some cases, companies might offer additional incentives or bonuses for salaried employees who choose to work on a holiday.

How to calculate holiday pay for hourly employees

Calculating holiday pay for hourly employees can be slightly more complex because it often depends on whether the person worked on the holiday and the specifics of your company’s holiday pay policy.

Here are some situational examples:

1. If an hourly employee doesn’t work on the holiday and your company offers paid holidays

| Formula: Average daily hours x hourly wage = Holiday pay |

Let’s say an employee usually works an 8-hour day and earns $15 per hour. Their holiday pay would be 8 hours (average daily hours) x $15/hour (hourly wage) = $120. So, although they didn’t work on the holiday, they’d still receive $120 as holiday pay.

2. If an hourly employee works on the holiday and your company offers regular pay for working on holidays

| Formula: Hours worked x hourly wage = Holiday pay |

If they logged 6 hours and their hourly wage was $15 per hour, their holiday pay would be 6 hours (hours worked) x $15/hour (hourly wage) = $90. Here, the employee would get paid as normal for working on a holiday. So, for working 6 hours on the holiday, they’d receive $90.

3. If an hourly employee works on the holiday and your company offers premium pay for working on holidays (like “time-and-a-half”)

There are two different but very similar formulas you can use to calculate this.

| Method 1 formula: (Hours worked x hourly wage) + [(hours worked x hourly wage) x 0.5] = Holiday pay |

The first formula assumes the employee worked 6 hours on the holiday, their hourly rate is $15 per hour, and your company pays time-and-a-half for holidays. Then, their holiday pay would be: (6 hours x $15/hour) + [(6 hours x $15/hour) x 0.5] = $135.

| Method 2 formula: (Hours worked x hourly wage x 1.5) = Holiday pay |

Based on the same numbers above, you’d use the second formula to calculate: 6 hours x $15/hour x 1.5 = $135. So, you’d effectively be paying the employee their standard hourly wage plus an additional 50% for every hour worked on the holiday.

| Pro tip: If you want to automate employee holiday pay, Homebase payroll lets you add “holiday season” periods and set rules for them. Our platform then automatically calculates a different wage rate and overtime for employees working during that period. See it in action: |

Benefits of Holiday Pay

Holiday pay is an investment that can have tangible returns for your small business. Here are some of its far-reaching benefits:

1. Increased employee happiness and retention rates

Employees feel valued when their well-being is taken into account. Offering holiday pay allows them to enjoy time off without worrying about unpaid leave. This sense of security and appreciation contributes to a positive work environment, which in turn increases employee loyalty. When team members feel cared for, they’re more likely to stay with your company longer, reducing the cost and disruption of a high turnover rate.

2. Higher productivity and motivation

Compensation (like “time-and-a-half”) for working on holidays can serve as an incentive, motivating employees to contribute willingly during holiday periods. This increased motivation can drive higher levels of efficiency and output. It can also solve some potential scheduling issues by prompting team members to work on less desirable days of the year.

3. Promotes cultural diversity

Promoting diversity, equity, and inclusion (DEI) is a crucial aspect of modern workplace culture and your paid time off (PTO) policy can play a significant role in these efforts. This could mean acknowledging holidays like Diwali, Hanukkah, or Juneteenth, which might not be typically recognized in conventional holiday schedules but hold immense importance for different employee groups.

How Much is Holiday Pay?

Holiday pay rates differ based on company policies, local and state regulations. While federal laws do not require holiday pay, some companies offer extra pay to hourly workers on holidays. This extra pay might be “time-and-a-half” or “double-time,” but this varies by location and employer. To find out about holiday pay rules where you are, checking with local or state government labor offices is advised. The U.S. Department of Labor also lists resources for state and local labor laws.

Revised Calculation Section with Example

For calculating holiday pay, consider whether employees are salaried or hourly and your company’s policies. Here’s a detailed example for hourly employees: If an employee earns $15 per hour for 8-hour shifts, their daily pay is $120. If this employee doesn’t work on a holiday but gets paid holidays, they earn $120 for the day. If they work and receive “time-and-a-half,” the pay is $22.50 per hour, totaling $180 for an 8-hour shift. For “double-time” pay, the rate is $30 per hour, leading to $240 for the day.

Massachusetts and Rhode Island have specific requirements for holiday pay for hourly workers. In Massachusetts, the rules differ for retail and non-retail, but usually, workers get 1.5 times their regular pay on certain holidays. Rhode Island mandates time-and-a-half pay on Sundays and some holidays.

For those updating holiday pay policies, understanding federal and state regulations is necessary. Consulting a labor law specialist or the U.S. Department of Labor’s website might assist in ensuring policies are compliant and fair.

Empower your Team with a Fair Holiday Pay Structure

Implementing a solid holiday pay policy isn’t just a good business practice. It’s an investment in your most valuable asset — your employees.

A holiday pay policy involves tasks like outlining eligibility, defining the request process, detailing payment calculations, and setting holiday schedules. But it’s easy to waste time, lose track of information, and make avoidable mistakes when doing this kind of work manually.

With a platform like Homebase, you can automate these key payroll processes — from converting time tracking data into timesheets complete with hours and wage reports that are ready for payroll. You can also set up communication alerts to make sure staff don’t accidentally run into expensive overtime and send reminders to team members to take their breaks and sign out of work on time to avoid significant rounding errors.

At the same time, our HR and compliance tools help you navigate complex compliance requirements, and our free plan gives you access to basic scheduling, time tracking, and employee management features.

Step into a simpler, faster way of managing holiday pay with Homebase because it’s an investment in the backbone of your business — your employees.