Are you more interested in perfecting your pie than memorizing pi? If so, we’re betting you got into the restaurant business because you love food — not math and accounting.

It can feel daunting and time-consuming for small business owners to figure out their finances. But without a budget, your restaurant costs can quickly spiral out of control.

An effective budget will help you keep track of your spending, plan for the future, gather insights from your sales trends, and build a clear picture of your business’s health and future needs. You gain more control over revenue while also reducing uncertainty (and the stress that comes with it).

Whether this is your first time setting up a proper restaurant budget or you’ve tried and struggled before, we’re here to help you create one that’s effective, saves you money, and keeps your income on track.

In this article, we’ll discuss

- How to create a restaurant budget in seven steps

- Six tips to control and stay on top of your restaurant costs

We’ll also show you how small business management software like Homebase can make sticking to budgets easier and assist with financial tasks like accounting, sales forecasting, and running payroll.

How to create a restaurant budget in 7 steps

Cut through the budget overwhelm with the following step-by-step plan.

1. Choose your accounting tool

We don’t recommend keeping track of your restaurant budget manually. Even if you skip over pen-and-paper solutions and go straight for a spreadsheet, it’ll take you much longer and have more potential for error than a dedicated tool.

Plus, a standalone spreadsheet doesn’t connect with any other programs, so you won’t be able to easily export your data to run payroll, keep track of staff hours, or calculate taxes.

Instead, research and choose an accounting tool that’ll make it simple to set up and implement your budget.

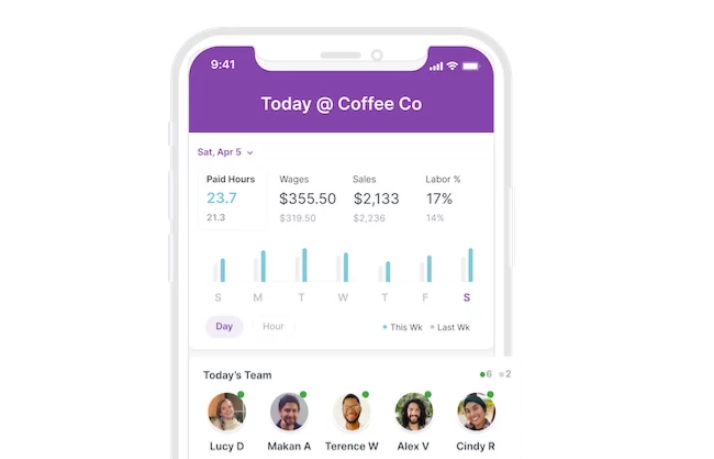

Some all-in-one small business accounting tools like Homebase also come with extra features that make it even easier to manage a restaurant budget and beyond. For example, we have tools to track employee hours, set schedules, enable team communication, and run payroll. Our scheduling tool helps managers understand labor costs vs sales so they can build smarter timetables and avoid costly overtime.

With Homebase, business owners can even give employees early access to up to $400 of their wages if needed. That’s at no extra cost to you, and since it’s not a loan (employees can only access wages they’ve already earned) — there are no interest or late fees for them either. So, you can lend a helping hand to staff for unexpected expenses while keeping your books balanced.

Some other popular accounting tools in the restaurant industry include QuickBooks, Restaurant365, and TouchBistro.

2. Establish your accounting process and periods

Deciding on your accounting process simply means establishing the way you’ll keep a solid record of your budget, expenses, and income. Every single thing you want to include in your budget needs to be tracked, including your labor costs, fixed and variable supplier payments, and other overhead expenses like rent and utilities.

Your accounting period refers to the time when you’ll keep track of your budget. Generally, restaurants choose from one of two options:

- 12 months: Best for businesses with consistent months and days, so similar numbers of customers every day or every evening service.

- 13 periods of four weeks: Best for restaurants with some days that are much busier than others (for example, Friday night vs. Tuesday lunchtime). Each of the 13 periods has four weeks exactly, i.e. four Mondays and four Sundays.

3. Research and set budget targets

These may be set by looking at your expected costs and/or by considering your expenses from previous years.

You can investigate your business’s previous costs by looking at your point of sale (POS) records, like those that are available through a platform like Homebase that integrates with leading POS tools.

You may also wish to consider future projects and expense needs and research how much they’ll cost. Your targets can be adjusted if needed, but it’s helpful to have some goals or limits to keep in mind upfront.

4. Define your fixed and variable costs

Closely related to your budget targets are your fixed expenses. These can act as the “building blocks” of your budget as they don’t change and are therefore easier to predict. That’s in contrast to variable costs, which vary every month.

Consider:

- Fixed expenses: Costs that stay the same, like rent, insurance, salaries, and credit repayments.

- Variable expenses: Costs that you must pay every month but are likely to fluctuate, like hourly staff wages or food expenses.

Some costs may be somewhat within your control, like food. Others aren’t, like rent. Platforms like Homebase can help you predict certain expenses, like restaurant labor costs, for more accurate and useful projections.

5. Forecast your restaurant’s sales

Just like we talked about above, you might be able to forecast sales based on previous years’ records from your POS system. These predictions may give you insights into probable future sales or trends.

Be sure to think about events or changes that could affect sales — negatively or positively! — including:

- Regular or one-off events in your local area

- Increased competition from other new local restaurants

- Changing costs of food, interest rates, rent, or minimum wage

- Menu adjustments

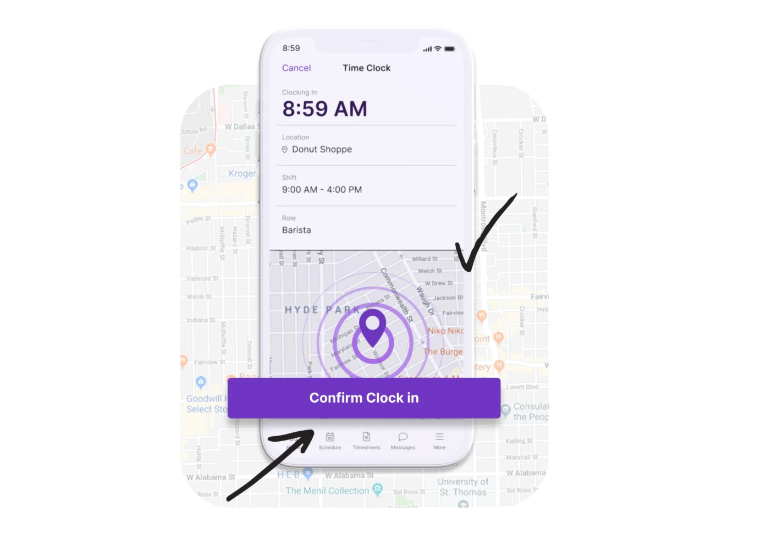

Forecasting sales can also help you project your employee scheduling needs more accurately. A platform like Homebase lets you import your sales data from external systems like your POS device so you can control and forecast labor costs with ease.

Then, you’ll be able to match predicted extra sales with more staff members. For example, if there’s a festival taking place nearby the following weekend that typically brings in a spike in business, you can schedule more employees automatically — and vice versa for slower periods.

6. Build your projected budget

Once you’ve figured out your estimated future expenses and sales, you have everything you need to create your budget plan.

You may want to lay all your business’s data out monthly and annually so you can see it at a glance. We also recommend breaking down each line item into categories, like:

- Food sales

- Food costs

- Payroll costs

- Other controllable costs

- Possible variable costs

This will ultimately produce figures for your estimated total expenses and sales.

7. Monitor and adjust your budget as necessary

Using the figures above, you can then calculate how much your restaurant needs to make to break even. This will enable you to predict whether your budget is balanced and understand if your business is profitable or not.

You can then monitor and tweak your budget as needed, depending on your business needs and revenue goals. Afterwards, work to stick to your budget as much as possible and use it as a clear roadmap for your future objectives, like setting your menu, hiring staff, understanding when to prepare for busier times, or considering when to plan promos and deals.

You can also continue to re-evaluate your budget as the year goes on. It’s not a fixed document set in stone. Use it to guide your operations, but also be flexible as and when necessary. If you find your predictions or targets aren’t working for you, you can always revisit your budget.

6 tips to control and stay on top of your restaurant costs

Now you’ve created an effective budget, you want to abide by it as much as possible. Here are some tips to keep your restaurant costs under control.

1. Be aware of the biggest restaurant expenses

Your most significant expenses are likely to be food, labor, and rent. These may change, however, and any large fluctuations will have a knock-on effect on your costs. Be mindful of this when establishing your budget, and be prepared to reevaluate and take action if necessary.

If you’re looking for concrete ways to reduce some of your biggest restaurant expenses, scroll down to point three.

2. Use specially designed software

It’s exponentially easier — and more accurate — to keep track of business figures and trends if you’re using a platform that was intentionally crafted for that purpose. Don’t waste time trying to make tricky calculations with a pen and paper or reinventing the wheel with your own spreadsheet system.

Software solutions like Homebase are designed to help small businesses manage their finances and empower them in the process, especially when it comes to labor costs, wages, and time tracking practices like split shifts. Homebase also lets users build intelligent schedules based on sales and labor data.

In addition, our platform integrates with other accounting and labor forecasting tools like Toast, PayAnywhere, and Square, so you can stick with the external solutions you like and might already be using if that’s what you prefer.

3. Take immediate action if costs surpass sales

Creating a budget and using software to monitor it is crucial to ensure your finances always stay on track.

If you’re diligent about keeping on top of your restaurant’s operational costs, you’ll notice as soon as you move in the wrong direction. This will set you apart from many business owners who don’t have solid budgets and may not realize they’re in trouble until it’s too late.

And if you see that your costs are surpassing your sales, act right away to avoid your business becoming unprofitable and running into tricky financial issues you might struggle to get out of.

This could include:

- Finding cheaper suppliers or changing ingredients

- Raising your prices

- Renegotiating deals or agreements

- Reducing labor costs by cutting staff or changing their schedules (for example, using split shifts)

- Taking steps to reduce time clock fraud practices like buddy punching

- Focusing on staff retention to reduce hiring costs

Other more drastic ways to cut costs include reducing opening hours or service times, closing on less-busy days, or even changing locations to a place with cheaper rent.

4. Talk to other similar businesses in your community

They say too many cooks may spoil the broth, but when it comes to operating with good business sense, asking around for advice is a great idea.

Reach out to other local businesses in similar industries and see if they’re willing to share any insights into how they manage their budgets and costs.

They may also explain their approach to pivoting during different times of the year and how they maximize the opportunities that come from popular holidays or local events (or, conversely, how they manage downturns during less busy times).

If you worry about asking a direct competitor such detailed questions about their business practices, you could try talking to a business in a similar field but with a markedly different offering to you. This makes them complementary with related experience, but neither you nor they will feel like you’re trying to poach ideas or secrets. That’s a great way to build your network and gain tips from more experienced entrepreneurs.

5. Don’t forget ‘non-restaurant’ costs like hiring

These expenses may not come to mind as quickly as those related to food and beverage, but it’s essential to factor them into your budget. Otherwise, they may unexpectedly make a more-than-planned dent in your balance sheet.

Be sure to bake in a regular budget for hiring, particularly if you know you may need to expand your workforce. This also means you’ll have funds available in case someone on the team leaves or needs to adjust their hours.

The recommended amount to put aside for hiring is significant — recent research by the Society of Human Resource Management (SHRM) found the average cost per hire across all businesses in the US is $4,683.

Homebase offers hiring and onboarding tools to cut down the cost and time needed for hiring, onboarding, and training, including job description templates, job board posting, applicant tracking, e-signing capabilities, document storage, and employee handbooks.

Homebase hiring comes as part of the Plus and All-In-One plans, and onboarding is included within the All-in-One plan, which — for $59.95 and $99.95 per location per month, respectively (for unlimited employees). That’s fantastic value compared to the numerous competitors that charge per employee.

Depending on your small business’s circumstances and location, you may also want to allow for marketing costs, even if you’re just running paid Facebook ads or allocating a small sum of money to hiring a part-time social media marketing or promotions manager.

6. Be aware and flexible about external factors

You know what they say about the best-laid plans. That’s why it’s so important to maintain an open mind, keep your eye on trends and costs, and be open to pivoting and re-evaluating if necessary.

Factors beyond your control are almost bound to come up — in fact, that may be the only thing you can predict for sure. After all, how many business owners included COVID-19 in their budgeting plans in January 2020 or the effect of the war in Ukraine on food and fuel costs in January 2022?

You may be prepared for predictable annual festivals and holidays, but also consider the effect of unexpected weather, minimum wage law changes, food costs, street closures, or any number of variables. A realistic budget plus a flexible mindset will keep you on track but let you stay agile and pivot if needed.

How to create a restaurant budget that works for your small business

Developing a restaurant budget isn’t just helpful when it comes to predicting and calculating costs — it can also be a deeply insightful process to help you understand trends and ensure your business can respond to shifting economic changes or unexpected events easily.

Restaurant budgets mean you can manage staffing, ensure efficiency when it comes to suppliers and hiring, and maximize revenue throughout the year.

Using a dedicated software tool like Homebase to manage yours means deep insights and forecasting, so you can create an accurate budget that really works for you and your small business.

As well as labor forecasting and time tracking, it also has scheduling and payroll features, plus team communication, HR and compliance, hiring and onboarding, and employee happiness tools, so you can manage costs, budget, and staffing under the same digital umbrella.

All that so you can set an effective budget and run a successful, profitable restaurant — and spend less time mired in math and more time mastering that marinara.