In May, economic uncertainty persisted in the face of debt ceiling debate, and another interest rate hike by the Fed.

Although, this didn’t stop small businesses from their summer hiring ramp up, albeit at lower employee wage rates than seen last year.

Another month, another rate hike from the Federal Reserve – policymakers continued to pump the brakes in May, as they remain split on whether additional intervention might be necessary in coming months. Homebase seeks to help clarify how the broader economic environment is affecting small businesses and their employees as summer approaches by analyzing behavioral data from more than two million employees working at more than one hundred thousand SMBs.

Summary of findings: SMB employment activity increased, but wage rates decreased for the first time since 2021.

- Employment activity at small businesses increased in May; as spring turns to summer, small businesses are experiencing a seasonal boost.

- Retail and Food & Drink are showing strength, continuing to outpace their historical seasonal growth.

- Spring weather variation is likely driving regional differences – warm weather in the Midwest and storms in Texas translated into varied business activity.

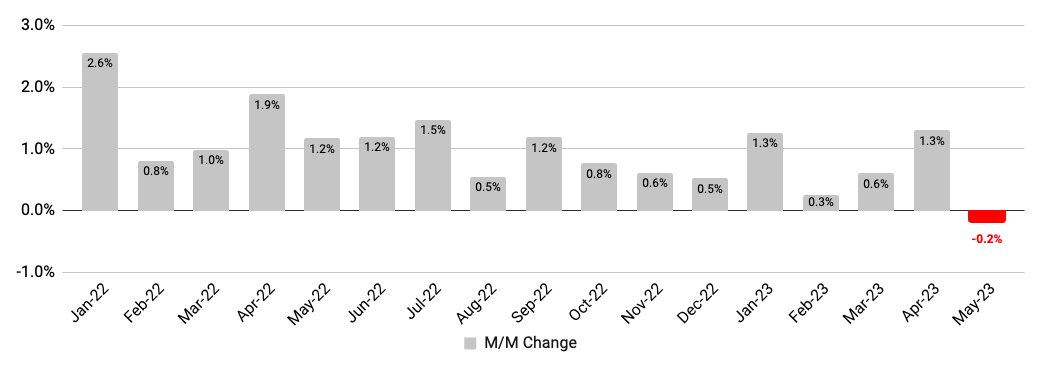

- Wages declined from April to May (-0.2%) for the first time since 2021, as decreases show a cooling labor market.

Employment activity at small businesses increased in May

As spring turns to summer, small businesses experience a seasonal boost

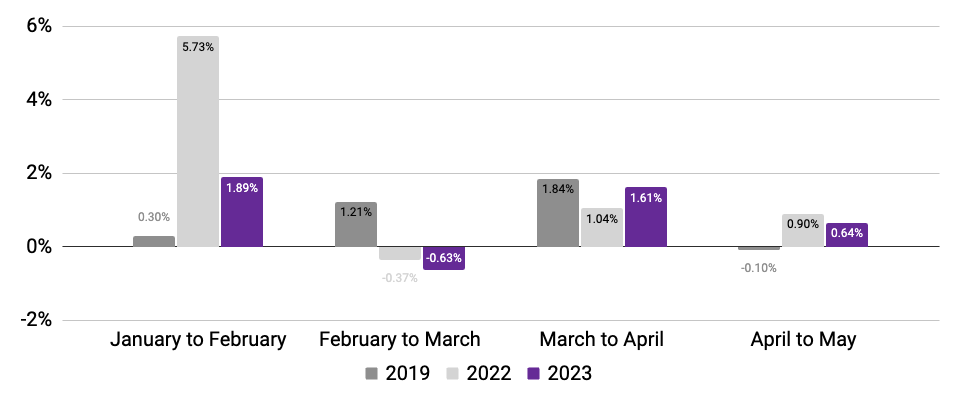

Employees working

(Monthly change in 7-day average, relative to January of reported year)

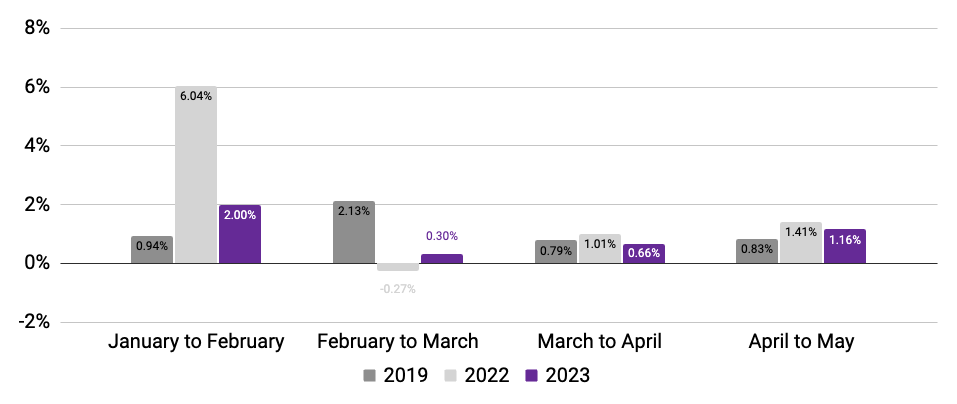

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Data generally compares rolling 7-day averages for weeks encompassing the 12th of each month; April 2023 data encompasses subsequent week to account for Easter holiday. Source: Homebase data.

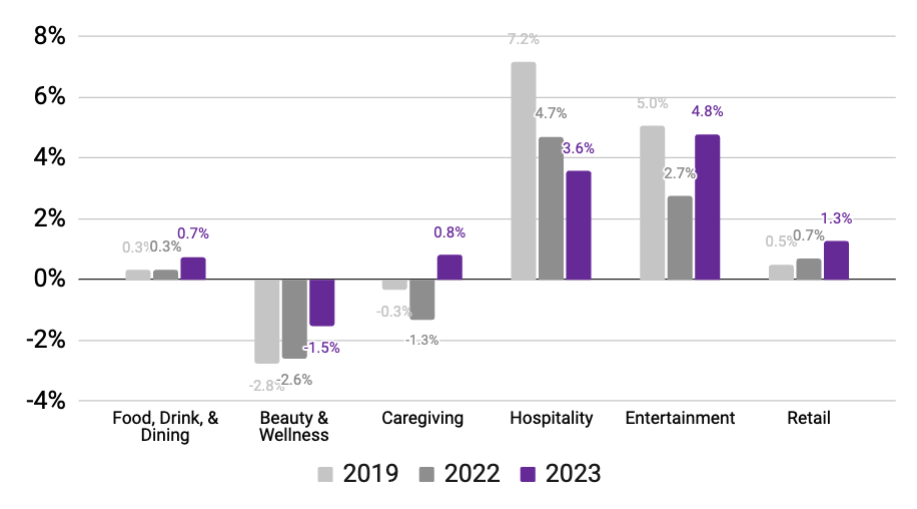

Retail and Food & Drink are showing strength, continuing to outpace historical seasonal growth

While most industries have picked up through May, Retail, Food & Drink, and Caregiving (1.3%, 0.7%, and 0.8%, respectively) have exceeded their seasonal growth benchmarks most significantly.

Hospitality (3.6%) and Entertainment (4.8%) saw the strongest increases from April to May, though their growth fell short of previous years.

Percent change in employees working

(Mid-May vs. mid-April, using Jan. ‘19 and Jan. ‘23 baselines)1

1. May 12-18 vs. April 7-13 (2019) and May 7-13 vs. April 16-22 (2023). Pronounced dips generally coincide with major US Holidays. Source: Homebase data

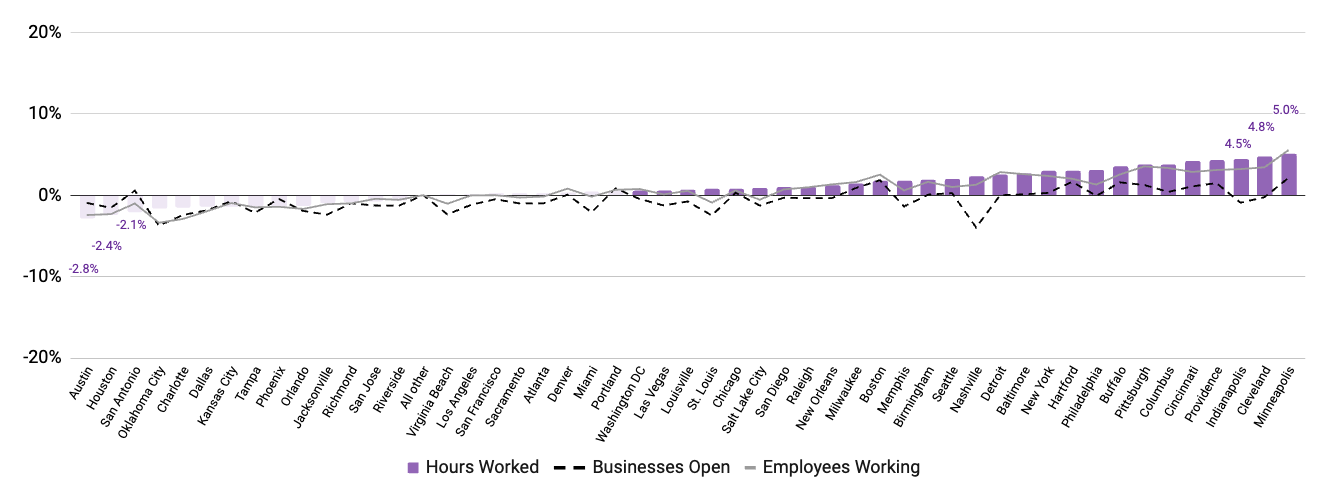

Spring weather likely driving regional differences

Warm weather in the Midwest and storms in Texas translated into varied business activity

Note: May 7-13 vs. April 16-22. Source: Homebase data

After yet another interest rate hike, wage rates declined month over month for the first time since 2021

Wage inflation

Month-over-month change in average hourly wages

Note: Data includes individuals who have been continuously employed and active since January 2022. Source: Homebase data.

Link to PDF of: May 2023 Homebase Main Street Health Report If you choose to use this data for research or reporting purposes, please cite Homebase.