Employee payroll can feel like a bit of a beast. Between keeping up with the latest labor laws, tracking employee hours, and dealing with taxes, figuring out how to pay your employees can be a real juggling act.

And as a small business owner, you likely don’t have the luxury of punting the task to a payroll specialist

Fortunately, paying your hourly shift workers doesn’t have to be a major headache. We’ve put together this step-by-step guide for how to pay your employees, so you can finally stop feeling like you want to break the bank every pay period.

What is employee payroll?

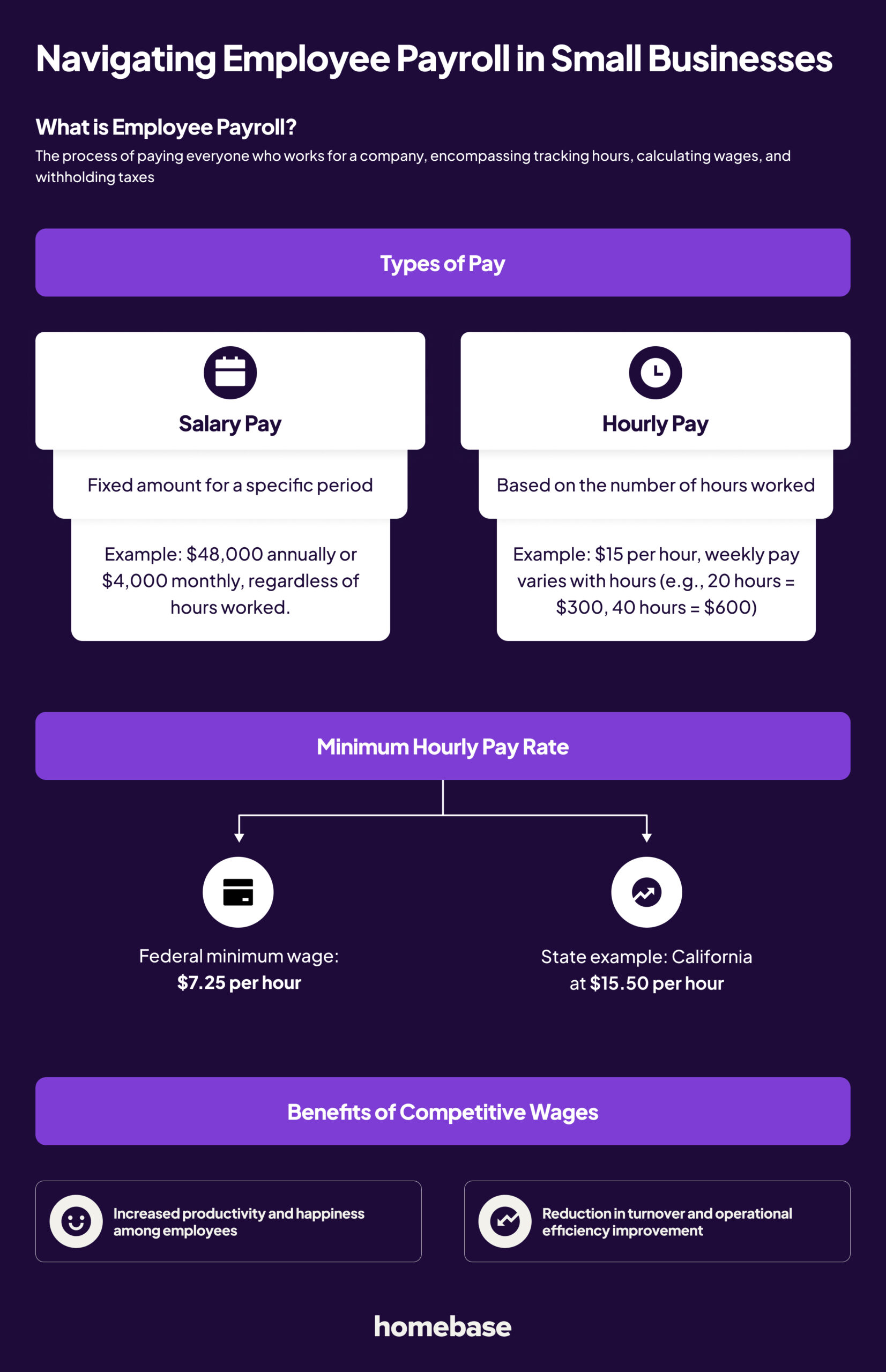

Employee payroll is the process of paying everyone who works for your company.

But payroll isn’t just handing a check to your employees. From tracking employee hours and calculating wages to withholding taxes, there’s a lot that happens behind the scenes before your team can get paid.

Taking care of payroll accurately and on time is a key part of running a successful business. Otherwise, you might find yourself saddled with some unhappy employees and some pretty hefty payroll tax fines.

What’s the difference between salary pay vs hourly pay?

When it comes to paying your employees, there are usually two options: salary pay or hourly pay.

How to pay employees: salaried

When an employee is paid a salary, you pay them a fixed amount for a specific period of time. Typically a salary is expressed in an annual amount, but you may also see monthly salaries from time to time.

Salaried employees are paid their full salary regardless of how many hours they work. This means that they typically receive the same amount every pay period. This can make managing payroll a bit simpler since every paycheck should look very similar.

Here’s an example of a salary pay:

Consider an employee who earns a $48,000 salary per year and is paid monthly—or 12x a year. Before taxes and deductions, this employee will be paid $4,000 every month, regardless of how many hours they work.

Because salary pay is fixed, you’ll find it’s more common in roles that work a 9-5. Think corporate or office jobs where weekly hours are relatively steady. However, some roles in non 9-5 businesses can see salaried employees as well, like with assistant managers, franchise owners, or roles that have specific specialties, like a window dresser or chef.

How to pay employees: hourly

On the other hand, hourly pay compensates an employee based on the total number of hours worked. The hourly pay rate is agreed upon when they join your team. But, the total compensation can vary each pay period depending on how many hours they actually worked—sometimes by a lot.

Managing payroll for hourly employees can be a bit trickier since there are so multiple factors at play.

Here’s an example of hourly pay:

Consider an employee who earns $15 an hour and is paid weekly.

- In week 1, they work 20 hours. They’ll get paid $300 before taxes and deductions.

- In week 2, they work 40 hours. They’ll get paid $600 before taxes and deductions.

Since hourly employees are paid for their time on the clock, getting an accurate timesheet of hours worked is critical.

Another thing to keep in mind with hourly employees is that they’re typically eligible for overtime pay. Overtime pay is applied anytime an employee works over a set number of hours a week.

The U.S. Fair Labor Standards Act considers any working hours over 40 hours a week to be overtime. As an employer, you’re required to pay at least 1.5x an employee’s standard hourly rate for any hours worked overtime.

Hourly pay is common for shift workers where the weekly hours and schedule can fluctuate based on business needs. You’ll often see hourly pay in restaurants, retail, and other service businesses. In 2020, 55.5% of all workers in the US were paid at hourly rates.

What is the minimum hourly pay rate?

In the United States the federal minimum wage is $7.25 per hour.

Each state also has its own minimum wage requirements. There are 29 states with minimum wages that are higher than the federal rate, with California being the highest at $15.50 per hour.

If your company operates in a state with minimum wage requirements that are higher than the federal minimum, you must follow the minimum wage in your state.

This easy-to-use map from the U.S. Department of Labor breaks down all the minimum wage requirements for each state.

| A tip for tips: It’s worth noting that if your employee receives tips, like restaurant workers, the federal minimum wage drops to $2.13 an hour in the U.S. However, if an employee’s tips aren’t enough to cover the $7.25 per hour minimum, you’re required to pay them the difference.

Many states have minimum wages for tipped employees above the federal minimum. For example, California’s minimum wage for tipped employees is $15.50, the same as other hourly employees. |

Minimum wage is the lowest amount you can legally compensate your team for their work. But when it comes to paying your team, less isn’t always more.

There are lots of benefits to offering more competitive wages and benefits. In fact, it can even save you money in the long run. Employees who feel they’re compensated for their time tend to be more productive and happier. And happier, more productive employees stick around longer, reducing turnover and improving your operational efficiency.

Of course, money isn’t the only motivating factor for employees. There are many other benefits you can offer to help retain your employees and keep them happy at work. Even offering perks like early access to wages can make a huge difference in attracting top talent to your team.

A step-by-step guide to paying your employees

If the thought of running payroll feels daunting to you, you’re not alone.

And we won’t sugarcoat it, there’s a lot to consider when it comes to paying your team.

But with a little practice and patience, you’ll be running payroll like a pro in no time. To help you on your way, let’s take a look at a step-by-step guide for how to pay your employees.

1. Collect payroll forms during employee onboarding

Paying your employees isn’t something you can leave to the last minute. Payroll prep starts long before payday.

One of the first steps is to get the right payroll forms and tax documents from your employee from the day they join your team.

Some common forms that you’ll want to collect during employee onboarding include:

- Form W-4 so you can withhold the right amount of federal income tax. Depending on your state, you may also require a state-specific Form W-4.

- Form I-9 to check for employment eligibility.

- Direct deposit form or banking information if you intend to pay your employees via direct deposit.

If you happen to be missing any of these documents from your existing team, don’t fret. Just make sure you collect them as soon as you can, so you don’t miss anything going forward.

| Make payday paperless: With Homebase’s automated onboarding process, you can send a welcome packet to new employees in just a few clicks. We’ll help your employees enter their information and e-sign direct deposit, W-4, W-9, and I-9 forms. Plus, we’ll keep everything carefully organized and securely stored right within Homebase for easy access at any time. |

2. Calculate hours worked through time tracking

Next, you’ll want to get an accurate pre-tax pay amount—commonly known as gross pay. This is typically calculated by multiplying your employee’s hourly rate by the number of hours worked.

In order to pay your team for the hours they’ve worked, you need proper time tracking in place. You should be tracking everything from start time, end time, and any breaks in between. You’ll also want to account for any additional hours, including vacation time, overtime, sick days, or any shifts they may have picked up along the way.

| Time tracking tip: Homebase’s free online time clock app empowers employees to clock in right from their phones, so you don’t have to hear, “I forgot to clock out” ever again. We’ll turn those hours into accurate timesheets that automatically calculate everything including hours, breaks, overtime, and wages—everything you need to make payroll prep a breeze. |

3. Calculate employee taxes and deductions

Remember the documents and paperwork you collected from your team in the first step? It’s time to pull those out because they hold the answer to how much you need to deduct from your employees’ paychecks for taxes.

In general, you should expect to withhold the following amounts:

- Income taxes, including federal, state, and local taxes.

- Payroll taxes, including Social Security and Medicare taxes.

- Benefit deductions, including health insurance and retirement benefits.

Once you’ve subtracted taxes and other deductions out of your employees’ pre-tax pay, you’re left with their net pay. This is the amount that they’ll take home at the end of the day.

Let’s look at an example.

An employee who works 40 hours at $15 an hour receives $600 in gross pay.

Let’s say you need to withhold $100 for taxes. This means the employee’s net pay is $500.

Your employee will receive $500 on their paycheck on payday.

4. Pay your employees on payday

It’s officially payday! Time for the fun part—you get to pay and reward your team for their hard work.

How you distribute paychecks will depend on your payroll process. Some businesses opt to pay their employees with physical checks. However, direct deposit is quickly becoming the norm, even among small businesses.

Everything up until this step needs to happen before payday. Otherwise, you run the risk of paying your employees late. Paying your employees late is illegal and it can cost you. For example, in California, you can be fined $100 for every employee that is paid late.

5. File payroll taxes

When you deduct taxes from your employees’ paychecks, you’re simply withholding them on behalf of the local, state, or federal tax agencies. We hate to be the bearer of bad news, but you don’t get to keep it.

You’re simply responsible for distributing them to the right agencies. Any federal tax you’ve withheld will go to the IRS, state taxes will go to your state’s tax agency, and so forth.

There are also some payroll taxes like FUTA and SUI that are paid exclusively by you, the employer. So you’ll need to make sure that these are paid out appropriately as well.

| Take the headache out of tax time: By using payroll software like Homebase, you can easily calculate payroll taxes, and send correct payments to your employees, the state, and the IRS in just a few clicks. You can also automatically process your tax filings and issue 1099s and W-2s. |

6. Maintain employee payroll documents and records

Once you’ve closed out a payroll period, you need to keep all your payroll records and documents organized and easily accessible. This way, if an employee ever has questions about their paycheck or you need to look back on your records, you’ll have everything you need.

But holding on to payroll records isn’t a nice-to-have, it’s the law. The FLSA requires that you keep records on hand for at least three years, including time cards, schedules, as well as any pay additions or deductions. You’ll need everything on hand if you’re ever audited.

What are some struggles businesses face with hourly payroll?

Hourly payroll is extremely common among small businesses. But it’s not without challenges. In fact, pesky payroll errors can sneak up on even the most diligent business owners. According to the IRS, 33% of employers make payroll errors that can cost a pretty penny.

Here are some common challenges that businesses face when it comes to hourly payroll.

Time constraints

As a small business owner, you likely wear a lot of hats. Payroll is just one of many to-do’s on your list, so it can be hard to carve out a dedicated amount of time for running payroll.

There’s a lot of prep work that goes into ensuring payroll is completed accurately, including calculating hourly pay rates and working hours. Skipping the prep work can create tax discrepancies and in the worst-case scenario, you might find yourself in legal hot water.

Homebase Payroll was recognized as the best payroll for small businesses with hourly workers in 2022. By using Homebase you can save up to 30 minutes every time you pay your team—and trust us, that adds up.

Inaccurate employee pay time sheets

Unlike salaried employees, hourly employees are paid based on the number of hours they’ve worked. If your timesheets aren’t accurate, your team isn’t going to be paid properly. Employee hours can be incorrect for several reasons including:

- Employees forget to clock in and out

- Time theft

- Shift swaps

- Sick days and vacation days

You can minimize timesheet errors by using a free time clock app, as well as creating policies around clocking in and out.

Missing overtime

Hourly pay nonexempt employees are entitled to overtime—it’s the law. This means that you need to be in the know anytime an employee goes into overtime, so they can be paid accordingly.

With manual tracking, it’s easy to miss when an employee slips into overtime. So it’s important to pay extra attention to your team’s working hours, so nothing is missed.

Fortunately, Homebase makes overtime and labor law compliance easier than ever. From setting up breaks and overtime for your state, we’ll make sure your team is paid every penny that they deserve.

Incorrect tax deductions and withholdings

Hourly employee payroll is complicated enough. Throw in all the tax deductions and compliance requirements, and it’s enough to make anyone feel a little dizzy.

Save yourself the headache with Homebase. We’ll do the heavy lifting and help you calculate, pay, and file your payroll taxes. You’ll save time and feel confident that all your money is going to the right place.

Struggling to master payroll?

Get Homebase for the ultimate payroll solution. With time clocks, automated payroll, and compliance guidance, you can pay your employees in just a few clicks. Get started for free with a better payroll system on how to pay your employees.

How to pay employees FAQS

How do I pay my employees?

Paying your hourly employees is simple. Follow these basic steps when it comes to running payroll for your team:

- Collect employee information and payroll forms

- Calculate gross pay based on their hourly rate and hours worked

- Determine employee net pay by deducting the required taxes

- Pay your employees by check or direct deposit

- File payroll taxes

- Document and maintain your payroll records

What’s the difference between salary pay vs hourly pay?

Salary pay is a fixed amount that an employee is paid over a period of time—typically monthly or annually. The amount a salaried employee is paid doesn’t change based on their working hours. Hourly pay is the amount an employee is paid per hour. Their total pay for each pay period can vary depending on the number of hours worked.

What’s the biggest struggle small businesses face with paying their employees?

The biggest challenges small businesses face around paying their employees include errors and the time commitment it takes to make sure everyone is paid properly. Businesses can avoid common errors and reduce the amount of time it takes to prep for payroll by taking advantage of a full-service payroll software like Homebase.