Recent weeks have seen the Federal Reserve monitoring the impacts of its rate hikes closely, with chatter around likelihood of an ever-impending recession.

Homebase data from the US and Canada shows that, despite regulators’ best efforts, wages have continued to rise at SMBs.

In economic conditions where forecasts and expectations can change seemingly daily, real-time data on activity across North American businesses shows that warmer weather is bringing shoppers and diners out and about. Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees during the beginning of Q2 by analyzing behavioral data from more than two million employees working at more than one hundred thousand SMBs.

Summary of findings: From wages to economic activity, things have heated up a bit at small businesses – but not necessarily across the board.

- Employment growth is behind historical seasonal trends; SMBs have shown a modest growth in employment metrics; driven by service-sector businesses, monthly trends aren’t quite as rosy as we’ve seen in previous years.

- Service sectors saw a return to employment growth. Employees working increased in the entertainment industry (+3.0%), but trended down for caregiving and hospitality (-1.4% and -1.1%, respectively), reversing recent trends.

- Regionally, the Northeast has seen the highest growth. This follows an unseasonably warm winter and spring.

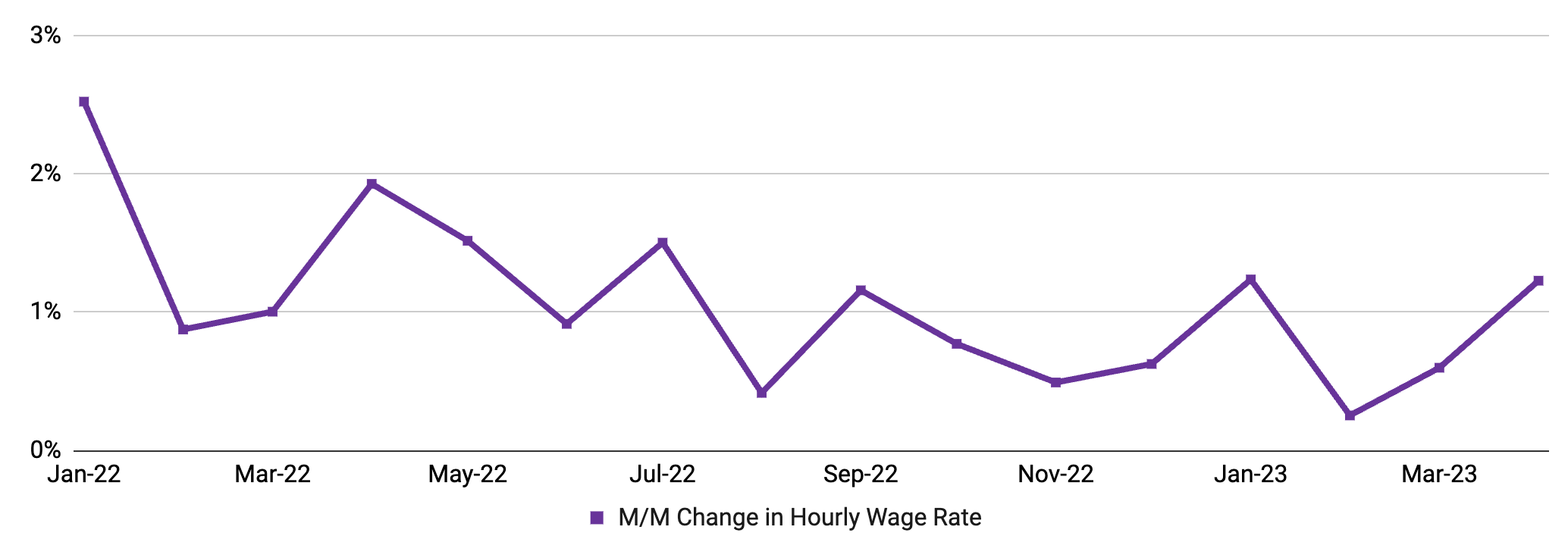

- Wage inflation increased from March, jumping 1.23% m/m despite efforts from fiscal policymakers to curb its growth.

Employment growth is behind historical seasonal trends

SMBs have shown a modest growth in employment metrics; driven by service-sector businesses, monthly trends aren’t quite as rosy as we’ve seen in previous years.

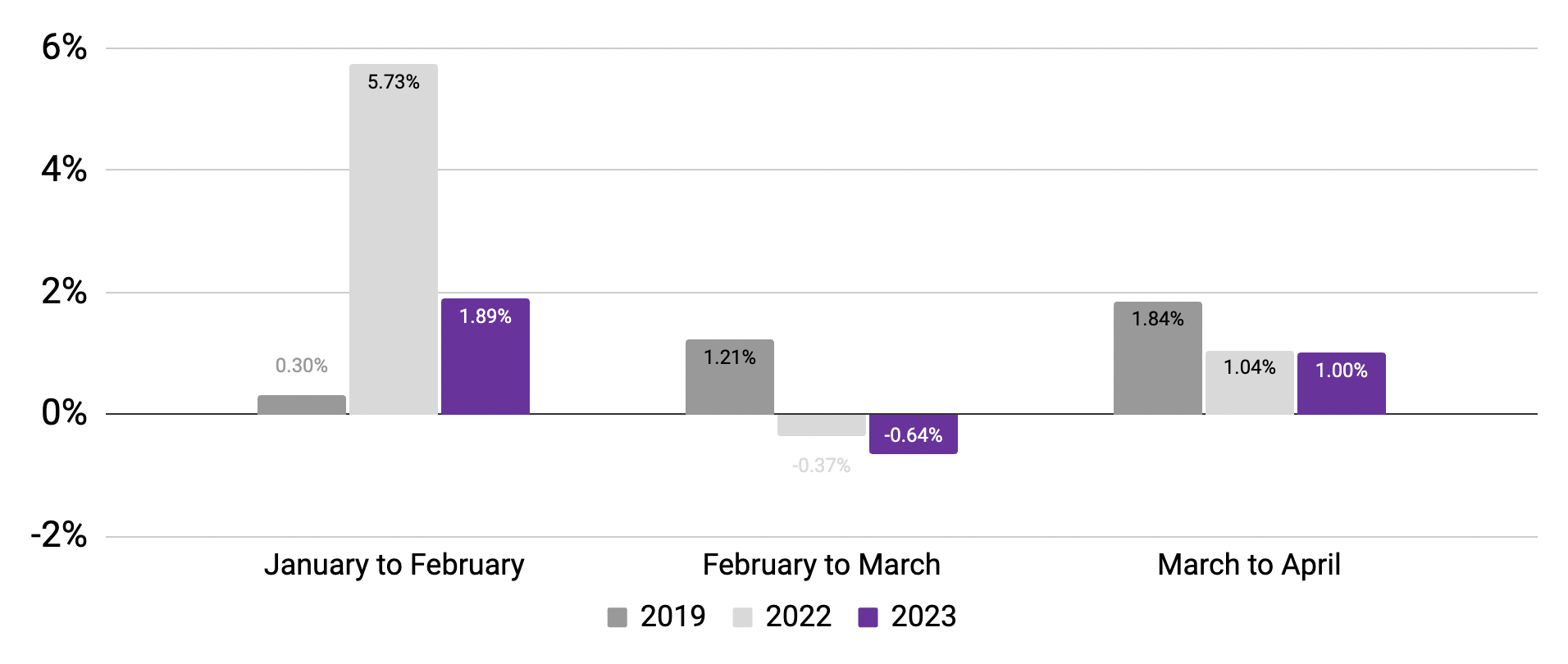

Employees working

(Monthly change in 7-day average, relative to January of reported year)

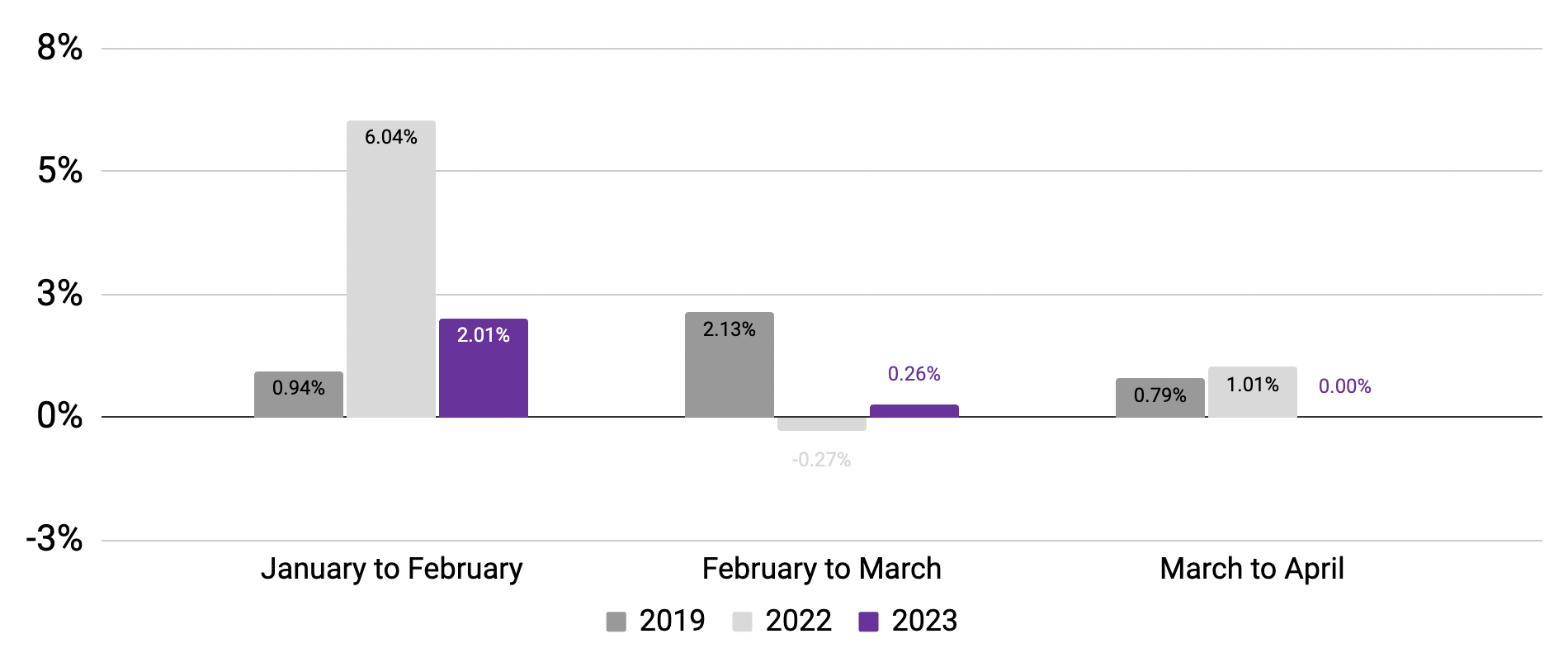

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Data compares rolling 7-day averages for weeks encompassing the 12th of each month; April data encompasses the subsequent week to account for Easter holiday. Source: Homebase data.

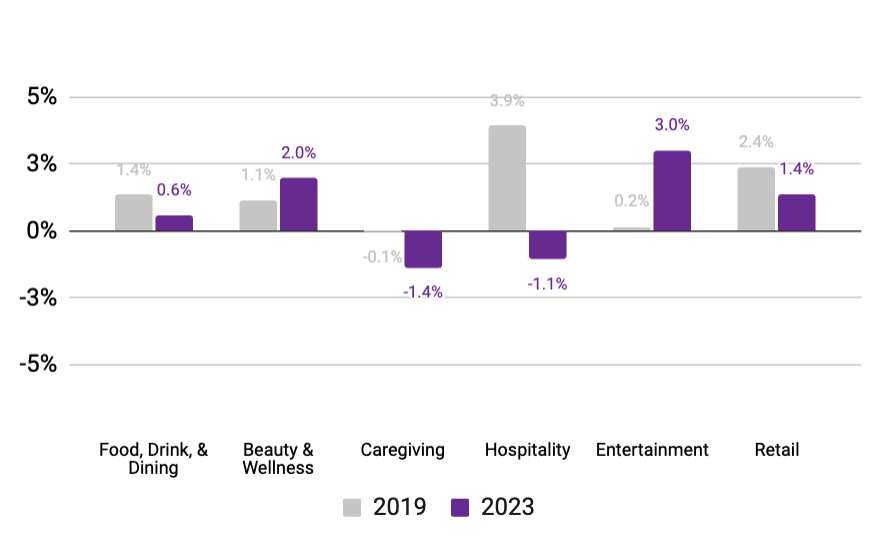

Service sectors saw a return to employment growth

Entertainment¹ saw the largest monthly growth in employees working (3.0%), outperforming other industries relative to pre-COVID levels.

Caregiving and hospitality took a hit (-1.4% and -1.1%, respectively), reversing recent trends and indicating that activity and spending is focused on service sectors.

Percent change in employees working

(Mid-February vs. mid-January, using Jan. ‘19 and Jan. ‘23 baselines)²

1. Entertainment includes events/festivals, sports/recreation, parks, movie theaters, and other categories.

2. April 8-13 vs. March 10-16 (2019) and April 15-22 vs. March 12-18 (2023). Source: Homebase data

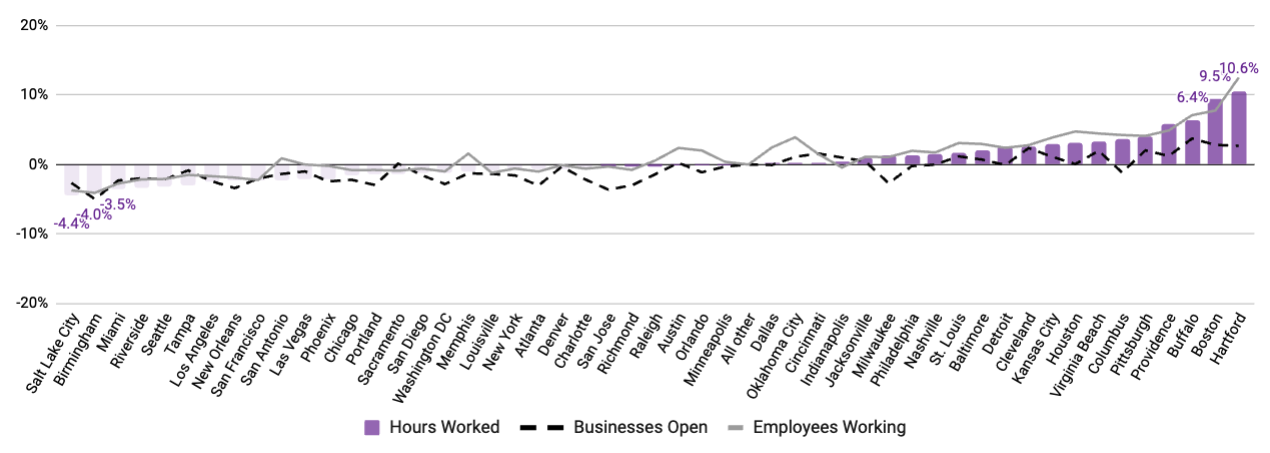

Regionally, the Northeast has seen the highest growth

This follows an unseasonably warm winter and spring.

Note: April 15-22 vs. March 12-18. Source: Homebase data

Wage inflation increased from March, jumping 1.23% m/m despite efforts from fiscal policymakers to curb its growth

Wage inflation

Month-over-month change in average hourly wages

Employee Pulse Check

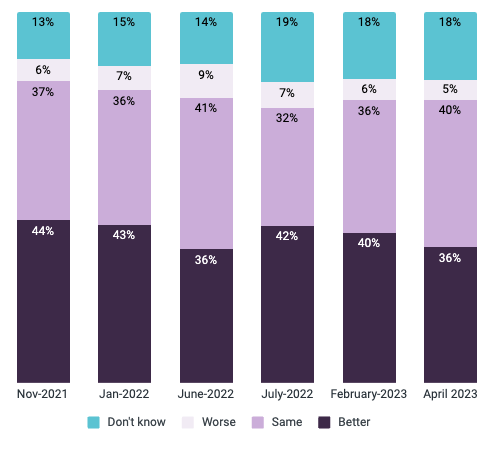

An April pulse survey of nearly seven hundred employees shows a slightly decreasing optimism towards job prospects.

Looking ahead, employees see a plateau in their prospects moving forward

A plurality of employees surveyed see their job prospects remaining the same (40%) in a year, and 36% foresee them improving. While we see similar levels of pessimism (5%) and uncertainty (18%) as in prior months, we’ve seen a decline since mid-2022 in the share of surveyed employees who think that the job market will pick up for them a year out.

The downturn in reported optimism coincides with increased speculation about a market that isn’t as favorable to labor, and shows that small business workers are internalizing that doubt.

Survey question: Do you think your job options will be better, about the same, or worse in 12 months compared to today?

Source: Homebase Employee Pulse Survey. N = 666 (Apr. 2023)

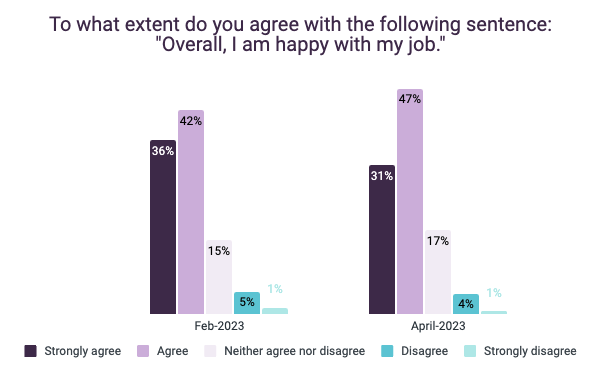

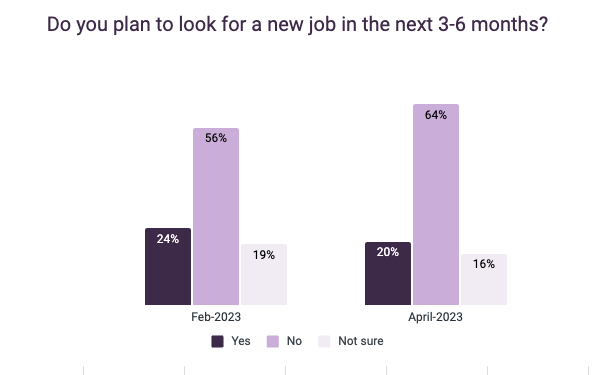

While happiness on the job has remained consistent, SMB employees are less likely to search for a new role in the short-term

As in February, a majority of workers report being happy with their job (78% of those surveyed in both months); however, we saw an 8% increase in reported interest in re-entering the job hunt. 64% of SMB employees report no plans to look for a job in the next 3-6 months, up from 56% in February and a strong indicator that satisfaction is less tied to voluntary separation.

It appears that the macroeconomic fears of an impending recession are working their way to the frontlines, as workers show less appetite for risk and change.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. 2023)

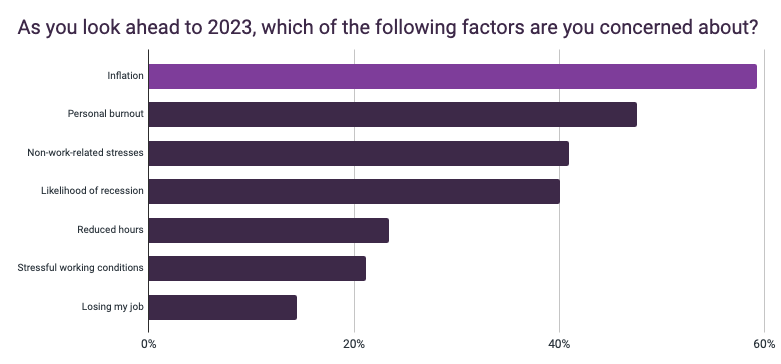

Inflation remains top of mind, as other stress factors increase for workers

As in our February survey, April showed a majority of workers surveyed cited inflation as a top concern through the remainder of 2023 (59%). We’ve also seen an uptick in worry about personal burnout (48%, up 3%) and the likelihood of recession (40%, up 3%) since the last time we asked.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. 2023)

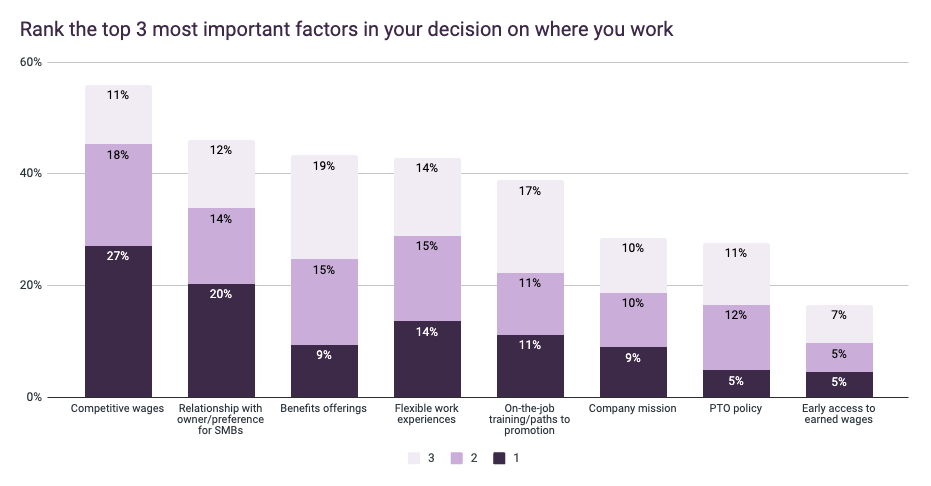

Competitive pay as important as ever for the average employee

Wages remain the most compelling factor in workers’ decision on where they work, with 56% of those surveyed citing it as a top 3 criteria (vs. 53% in February). In uncertain economic conditions, consistent pay is a key tool to attract and retain talent.

Source: Homebase Employee Pulse Survey. N = 666 (Apr. 2023)

For a PDF of our April report, please visit this link; if you choose to use this data for research or reporting purposes, please cite Homebase.