Small businesses have lots of expenses to stay on top of. There are team salaries, rent, utilities, vendors, and everything else in between. Because of this, your own salary might become an afterthought.

But it’s important for owners to pay themselves properly and factor the cost into their budgets. Small businesses often have razor-thin profit margins, so if you don’t keep a close eye on your monthly salary and how it affects your cash flow, you risk causing problems for yourself down the road.

To help you avoid any issues, we’ve created this guide on how to pay yourself as a business owner. We’ll show you all the steps you need to take and explain how Homebase can help you along the way, so let’s begin.

When can you start paying yourself?

You can start paying yourself when your business starts making enough money to cover its expenses and generate a profit. It’s important to make sure that your business is financially stable before you start paying yourself.

This means that you should have enough money to cover your business costs like rent, utilities, and labor costs, as well as any outstanding debts or loans.

Paying yourself by business type: key considerations

Paying yourself as a sole proprietor

As a sole proprietor, you can pay yourself by taking money out of your business earnings. Since you and your business are considered the same, you can simply withdraw money from your business account for personal use.

However, it’s important to keep track of your business finances and separate personal and business expenses.

This can be done by maintaining a separate bank account for your business. By doing this, you’ll have a clear record of your business income and expenses, making it easier to determine how much you can pay yourself while still ensuring that your business has enough funds to cover its costs and grow.

Paying yourself as a partnership

In a partnership, the partners can pay themselves by sharing the profits generated by the business. The partners can agree on a specific distribution method, such as dividing the profits equally or based on each partner’s contribution to the business.

After calculating the profits, the partners can take their share and pay themselves accordingly. It is important to have a clear partnership agreement that outlines how the profits will be divided among the partners.

This ensures transparency and fairness in the payment process. Additionally, like sole proprietors, partnerships should also maintain separate business accounts to track income and expenses accurately.

Paying yourself as a corporation

In a corporation, the process of paying yourself as a business owner is a bit different. As the owner of a corporation, you can pay yourself a salary or receive dividends. To pay yourself a salary, you need to set up an employment agreement with the corporation and become an employee.

You’ll receive regular paychecks like any other employee, and taxes will be withheld from your salary. Alternatively, you can receive dividends if the corporation generates profits.

Dividends are payments made to shareholders based on their ownership percentage. However, it’s important to consult with an accountant or tax professional to ensure you’re staying compliant and fulfilling your tax obligations.

Income tax considerations by business type

Sole Proprietorship:

- Simplified Tax Filing: As a sole proprietor, you report your business income and expenses on your personal tax return (Form 1040). There is no separate tax return for your business.

- Self-Employment Tax: You are responsible for paying self-employment taxes, which cover Social Security and Medicare contributions. These taxes are based on your net business income.

Partnership:

- Partnership Tax Return: Partnerships file an informational tax return (Form 1065) to report their income, deductions, and distributions. However, the partnership itself does not pay income tax.

- Pass-Through Taxation: Each partner reports their share of the partnership’s income on their individual tax return. The partnership income “passes through” to the partners, who pay taxes on it at their individual tax rates.

Corporation:

- Corporate Tax Return: Corporations file a separate tax return (Form 1120) to report their income, deductions, and expenses.

- Corporate Tax Rates: Corporations are subject to corporate tax rates, which are different from individual tax rates. The tax rate may vary based on the corporation’s taxable income.

- Double Taxation: If a corporation distributes dividends to its shareholders, those dividends are taxed again on the shareholders’ individual tax returns.

It’s important to remember that tax laws can be complex and subject to change and your business can be chosen to be audited. Consult with a tax professional or accountant who can provide personalized advice based on your specific business circumstances.

Step-by-step guide to paying yourself as a business owner

Paying yourself as a business owner is an crucial aspect of managing your finances.

We’ll walk you through the process of determining a fair salary or distribution for yourself and handling the necessary tax considerations to ensure a smooth and legal payment process.

Step #1: Look into your business’s financials

Your main concern is probably striking a balance between earning a liveable wage and not cutting into your business profits too deeply. So, before you make any deposits, it’s important to review your finances and see how much you can afford to pay yourself.

Statements will give you the best picture of your business’s overall financial health. Look at your income statement and find your gross profit to see how much extra cash you generated in the last year.

Then, calculate how much you need to leave for potential expenses, emergencies, and growing your business. You never know when you may need funds to repair a leaking roof or replace a faulty coffee machine.

You can pay yourself from the remaining profits. The exact amount will depend on the specifics of your business, but to give you a ballpark figure, this can range from $30,000 to $130,000 annually, with an average of $69,000.

Step #2: Decide between paying yourself a salary or a draw

Business owners also have to decide how to pay themselves — either with a salary or a draw. There’s no right answer here — the best way to pay yourself as a business owner depends on your needs and preferences.

An owner’s draw lets you transfer funds from your business account whenever you choose. If you like, this can be as regular as a standard paycheck. Here are the main pros and cons:

- Pro: You can easily change the amount depending on how well your business is doing financially.

- Pro: You can pay yourself instantly.

- Con: You’re responsible for arranging your own withholdings, social security, and medicare expenses, which means extra paperwork and stress.

Paying yourself a salary means adding yourself to your payroll and receiving a paycheck every month like the rest of your staff. For example, Homebase’s payroll tool lets owners set themselves up as W-2 employees and pay themselves that way. Although this is a less flexible method than a draw, you can still take pay raises and cuts if your financial situation changes. The advantages and disadvantages are:

- Pro: Salaries give you a better indication of your business’s overall health — if your payroll system considers you (the owner) one of your business’s regular employees and flags it can’t afford to pay you, you’ve got a cash flow problem.

- Pro: You can treat your salary as a business expense and save on taxes.

- Con: If you’re not certain of your cash flow, you’re more likely to end up under or overpaying yourself.

Step #3: Set a payroll schedule

Deciding when to pay yourself as an owner is almost as important as how much. If you choose the wrong payroll schedule, you could cause cash flow problems like not leaving yourself enough money to pay a utility bill.

When it comes to draws, you can take them whenever it’s convenient and there are funds available in your business account. You just have to check you don’t have any upcoming expenses or quiet periods with lower revenue.

With salaries, deciding when to pay yourself is more complicated. As you’re adding yourself to your business’s payroll, you’ll get a check at the same time as your staff. That means you need to consider their needs and ensure you stay compliant with any relevant payroll laws.

Start by verifying your state and industry payday requirements on the Department of Labor (DOL) website. For instance, Maine requires employers to pay employees no less frequently than every 16 days. If you need help navigating your state’s laws, Homebase’s human resources feature provides access to experienced professionals who can guide you through the process. Plus, you’ll receive alerts when local payday laws change.

Then, consider which payroll schedule suits your employees and business best. Here are the usual options:

- Weekly

- Biweekly

- Semimonthly

- Monthly

Once you’ve eliminated any options local regulations prohibit, choose a schedule based on your cash flow cycle and the type of employees you employ. For instance, a weekly payroll cadence may suit hourly workers with irregular hours because their paychecks will reflect the shifts they’ve just worked. That way, they won’t have to wait weeks to receive their extra cash after doing overtime. If in doubt, ask your team for their preferences and base your decision on their feedback.

Step #4: Understand the tax implications of paying yourself

You may be apprehensive about the paperwork that comes with paying yourself — if there are lots of forms to remember for employees, surely it’s worse for owners? But the good news is, you don’t have to learn a challenging new method of filing and reporting your taxes.

If you’re paying yourself a draw, you don’t withhold from your earnings. Instead, you file your estimated taxes four times a year. Experts recommend saving 30-40% of your pay to ensure you’ve got enough to cover the bills.

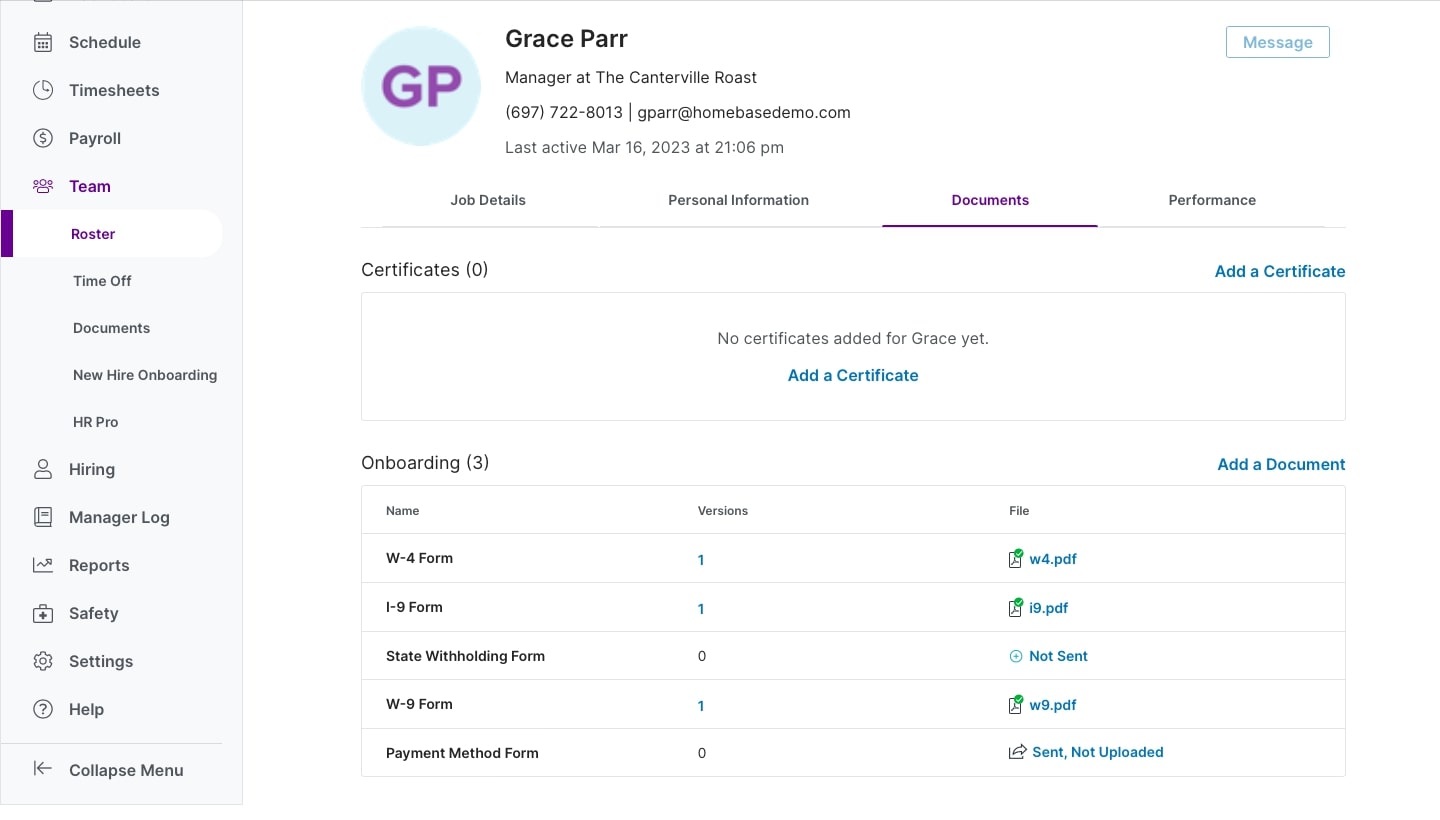

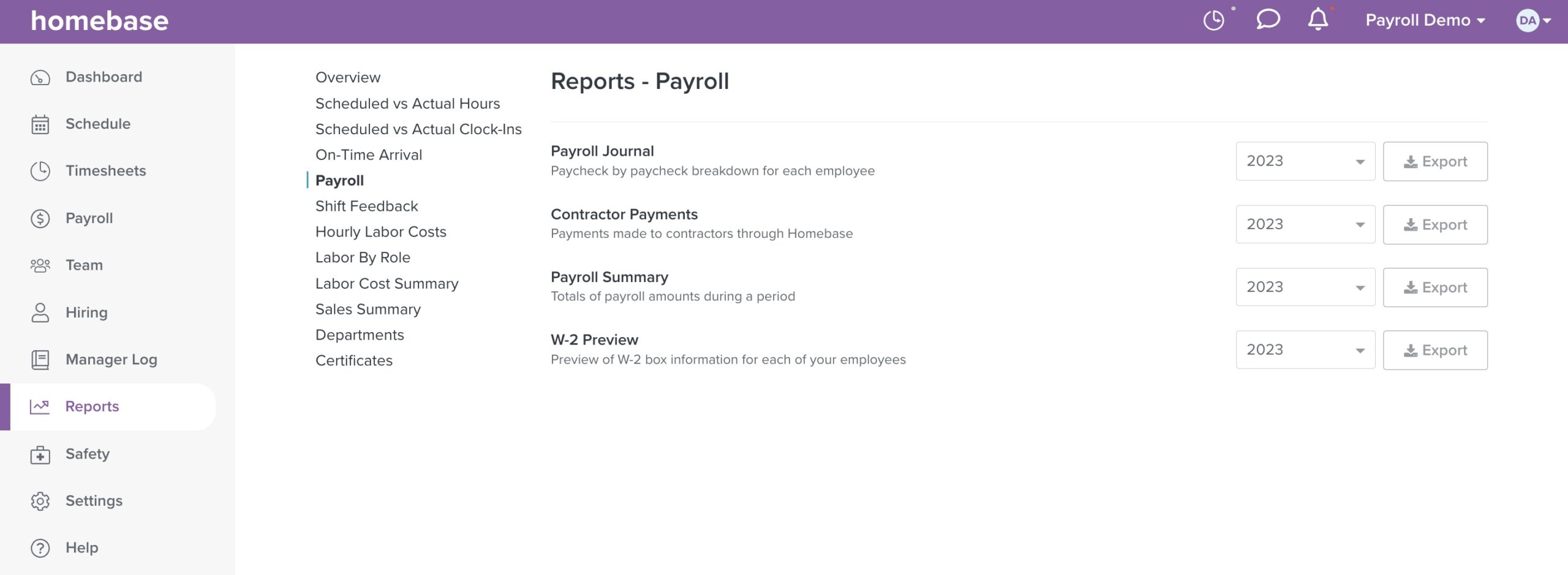

But with a salary, you report your earnings along with the rest of your team’s. You also need to complete the same annual forms as your employees, like the W-2 and the Tax Statement. Download your tax forms from the Internal Revenue Service (IRS) like you would your employees’ and upload them to the social security (SSA) website.

If you don’t have time for all this paperwork or the budget to hire an accountant, consider payroll software like Homebase. Our platform can run payroll for you and automatically report everyone’s taxes — including yours.

Step #5: Pay yourself and maintain a healthy cash flow

Once you’ve paid yourself for the first time and filed all your paperwork, it’s easy to forget about how your salary contributes to business expenses. But you need to follow some further steps to protect your budget and keep yourself profitable.

- Avoid underpaying yourself or working for free: While you’re the business owner, you’re also another member of the team. If you can’t pay every employee — including yourself — you have a cash flow problem you need to solve. Working unpaid is just a temporary fix.

- Make sure you can invest back into your business: Your company needs to adapt and grow to stay competitive, so prioritize funding expansion over giving yourself a pay raise as your investment will likely pay off in the long run.

- Don’t put pressure on your finances: Small business revenue can fluctuate wildly. Be careful not to give yourself a pay bump after a recent surge in profits if you may need that money for a future downturn.

- Review your salary regularly: As your business changes, you may find the way you’re paying yourself doesn’t work anymore. That’s why it’s a good idea to keep monitoring the percentage of the profits you’re taking and considering whether your payment method still works.

- Compare your pay to your team’s wages: Your pay can be a handy barometer for your staff’s wages. Basically, if you notice you can pay yourself a lot extra as a result of your profits, consider whether you should be giving team members a raise, too. Paying a competitive rate is important for retention because staff may look elsewhere if other businesses offer higher wages than you.

Pay yourself effortlessly with Homebase

Learning how to pay yourself as a small business owner might not be at the top of your priority list, but it can save you from stress later down the road. You can give yourself a fair salary, get a good picture of your finances, and avoid cash flow issues.

Homebase can help you overcome roadblocks and spot pitfalls when adding yourself to your payroll. Our HR and Compliance tools ensure you’re not breaking any state or federal laws when you set up your payments. Then, you can use payroll to pay yourself and file your taxes. You can also store all these documents using our cloud system so they’ll be safe and easily accessible online. That way, you’ll be able to pay yourself a reasonable salary while keeping a healthy cash flow into your business.

How to pay yourself as a business owner FAQ

What is an owners’s draw?

An owner’s draw refers to the money that a business owner takes out of their company for personal use. It is a withdrawal of funds from the business’s accounts to the owner’s personal account or as cash. The owner’s draw is typically used by sole proprietors or partners in a partnership to access their share of the business’s profits or to cover personal expenses.

What is an owner’s salary?

An owner’s salary is the regular payment made to a business owner for their work in the company. It is similar to a salary earned by an employee, but in this case, the owner is paying themselves for their role in the business. The owner’s salary is often determined based on factors like the owner’s responsibilities, industry standards, and the financial health of the business.

What is owner’s equity?

Owner’s equity refers to the portion of a business’s value that belongs to the owner or owners. It represents the owner’s investment in the business and the accumulated profits or losses over time. Owner’s equity is calculated by subtracting the total liabilities (debts) of the business from its total assets (property, cash, equipment, etc.). It represents the net worth of the owner in the business and reflects their ownership stake and financial interest in the company.