The Fed introduced another rate hike on March 22, while a new set of banking crises dominated headlines.

In the face of these broader economic headwinds, our data from the US and Canada shows a month-over-month decline in employment activity at SMBs.

Another rate hike from the Federal Reserve in March has led many to worry about the persistently hot economy and the efficacy of national leaders’ approach to curbing inflation. As in prior iterations of this report, Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees during the start of 2023 by analyzing behavioral data from more than two million employees working at more than one hundred thousand SMBs.

Summary of findings: Core activity markers are flat to down from mid-February levels, and the downward trend accelerated through the end of March.

- A once-hot economy is showing signs of slowdown; core indicators have shown none of the seasonal growth we’ve seen in prior years.

- Hospitality and entertainment diverged from other industries with increased activity in March – driven by spring break, activity in leisure industries has outpaced a downward trend across the board.

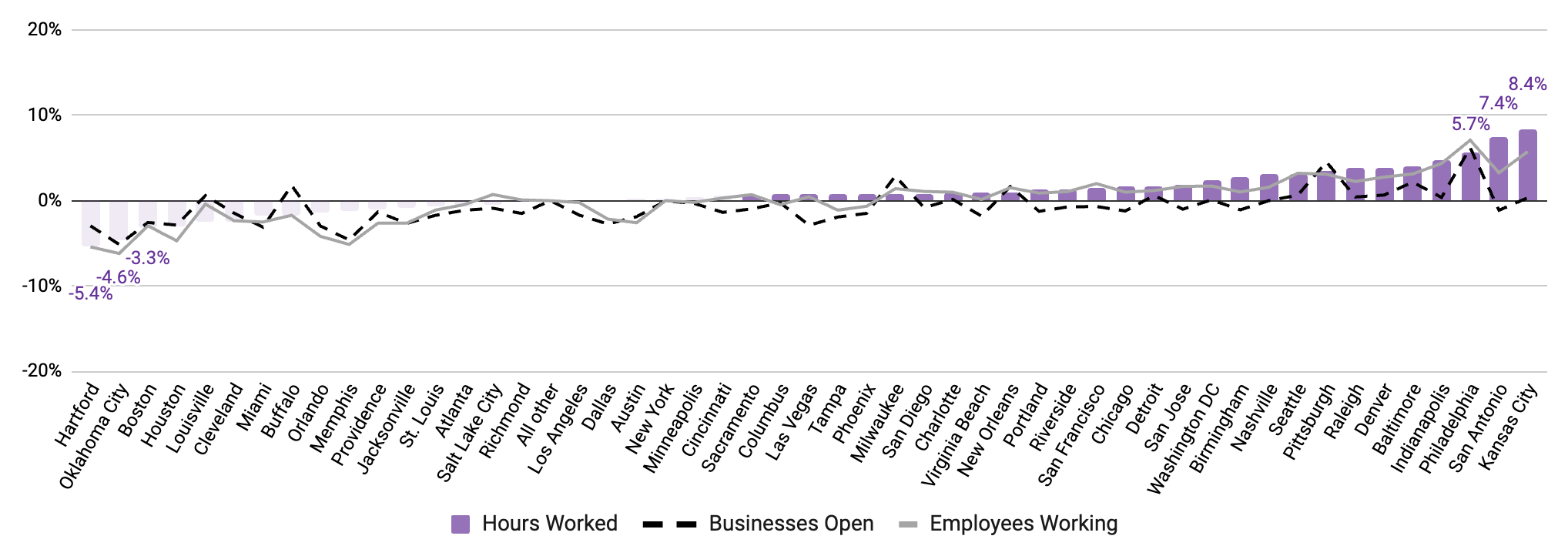

- The average metropolitan area saw little to no economic growth from February to March.

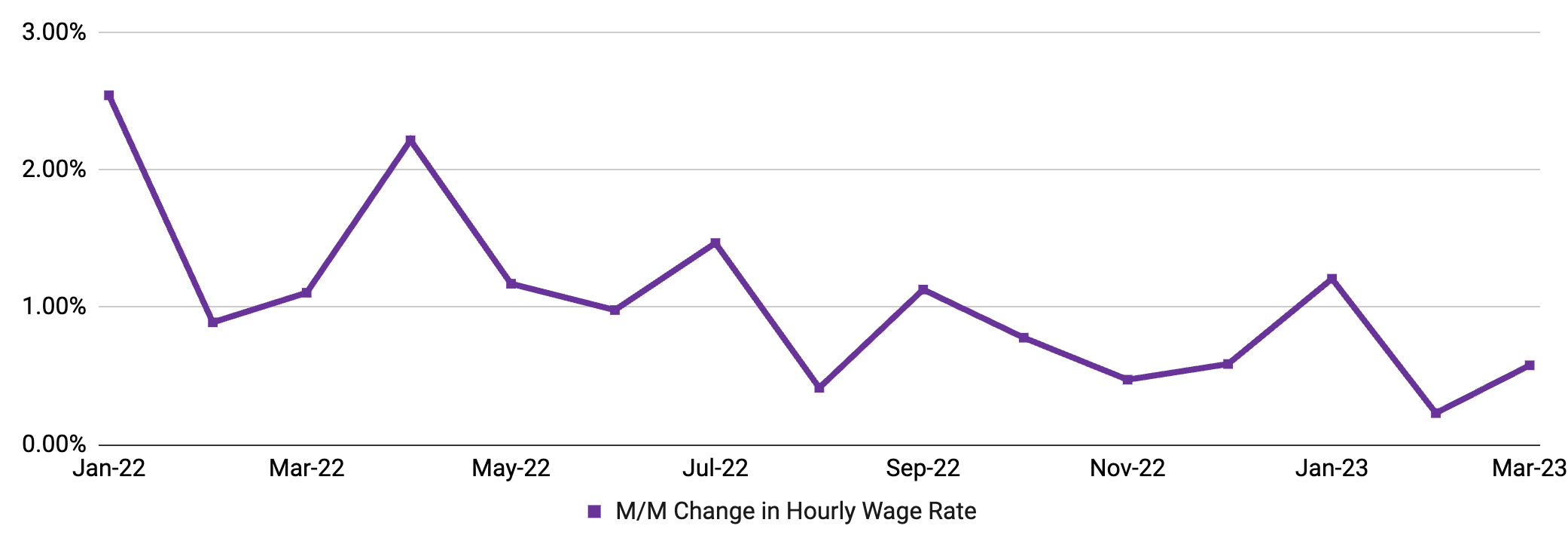

- Wage inflation ticked back up by 0.58% in March, in line with moderate growth seen at the end of 2022.

Main Street economic activity is showing signs of slowdown

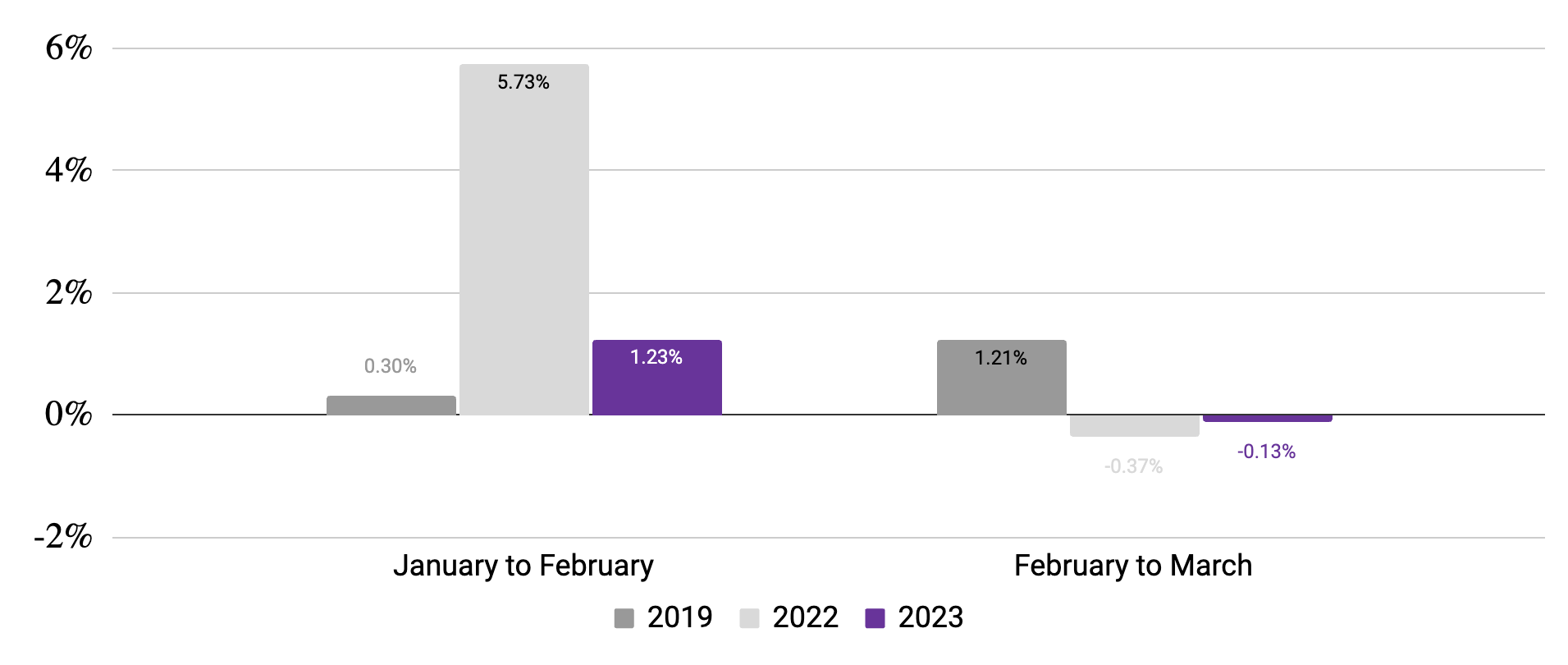

After a strong start to the year, employees working and businesses open have both shown a downward trajectory in the past month. This is against usual seasonal patterns.

Employees working

(Monthly change in 7-day average, relative to January of reported year)

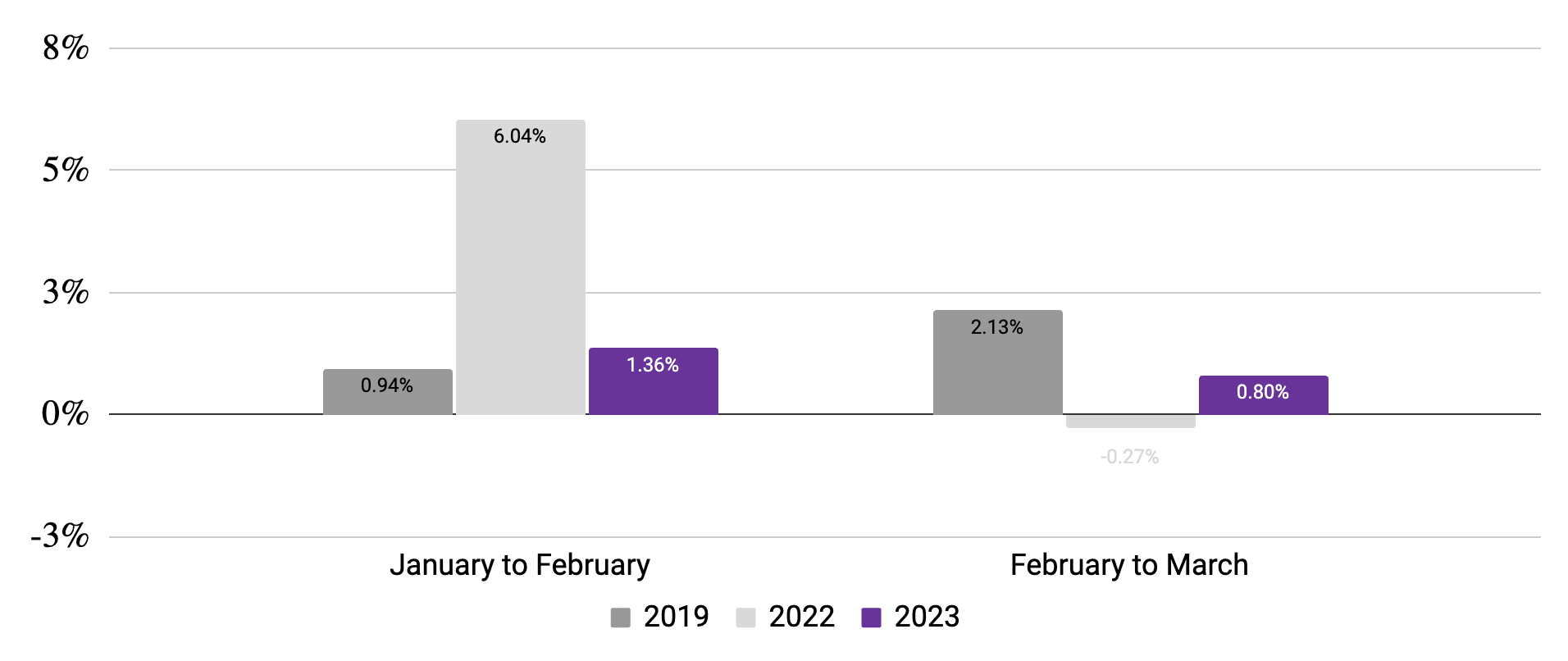

Hours worked

(Monthly change in 7-day average, relative to January of reported year)

Source: Homebase data.

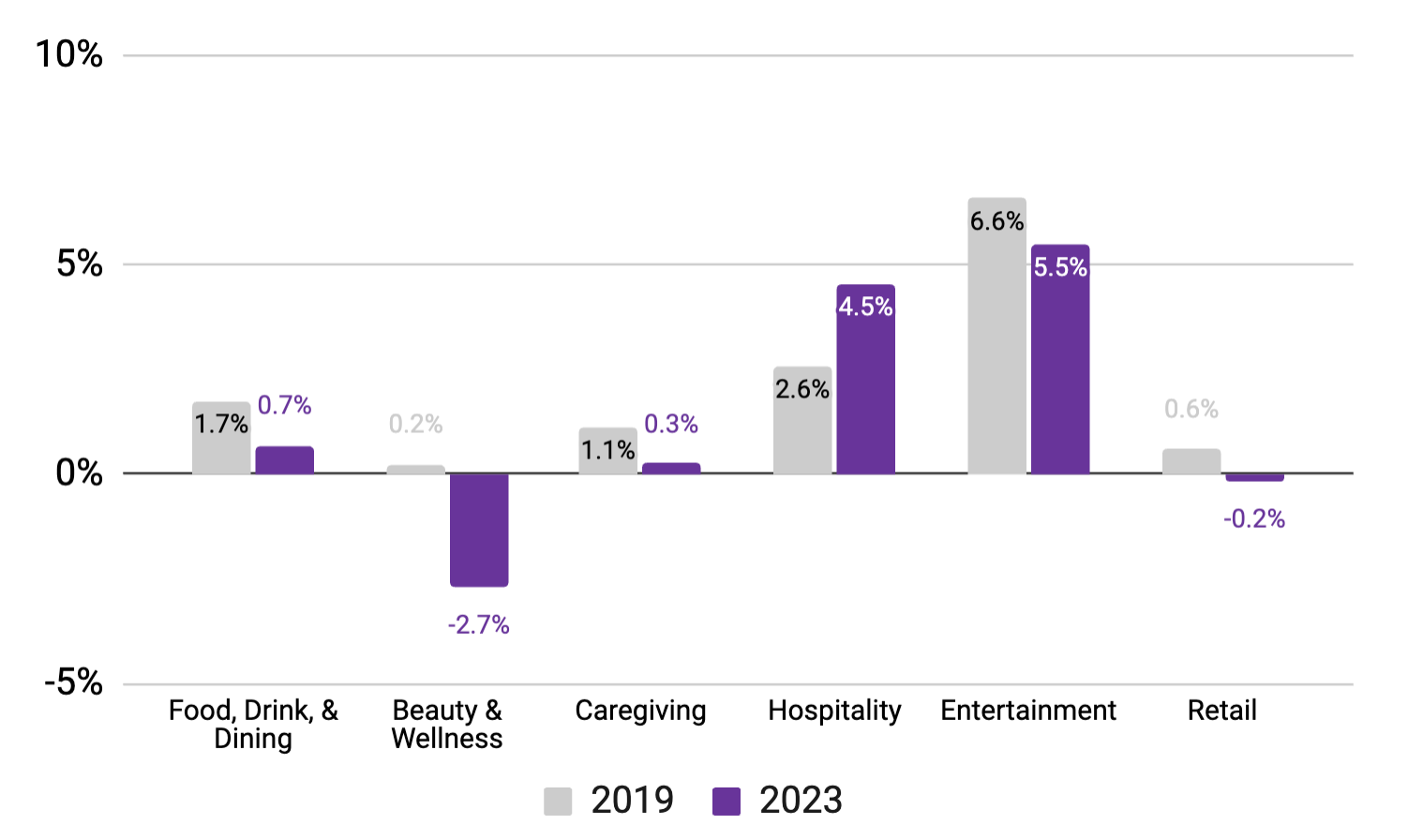

Hospitality and Entertainment continue to be the bright spots of growth as other industries decline in activity

Hospitality and entertainment both saw major upticks in employees working in the past month (4.5% and 5.5%, respectively), though the March spring break lift in entertainment was less significant than we saw pre-COVID.

Beauty & wellness showed the greatest decline from February to March, dropping about 3%, while other industries were relatively flat.

Percent change in employees working

(Mid-February vs. mid-January, using Jan. ‘19 and Jan. ‘23 baselines)1

1. March 10-16 vs. February 10-16 (2019) and March 12-18 vs. February 12-18 (2023). Pronounced dips generally coincide with major US Holidays. Source: Homebase data

The average metro area saw little growth in employment activity

Note: March 12-18 vs. February 12-18. Source: Homebase data

Wage inflation ticked back up in March, in line with modest growth seen at the end of 2022 and below 2022 average

Wage inflation

Month-over-month change in average hourly wages

For a PDF of our March report, please visit this PDF; if you choose to use this data for research or reporting purposes, please cite Homebase.