After a higher-than-expected February jobs report, the Fed has again positioned itself to continue raising rates through 2023 to curb inflation.

Our data from the US and Canada reflects a slight decline in core employment metrics during February – and notably, a stark decline in wage inflation.

Higher non-farm payroll adds than expected in February have renewed interest in the Federal Reserve’s immediate plans to raise rates in an effort to put the brakes on a hot economy. As in prior iterations of this report, Homebase seeks to understand how the broader economic environment is affecting small businesses and their employees during the start of 2023 by analyzing behavioral data from more than two million employees working at more than one hundred thousand SMBs.

Summary of findings: February saw a slowdown in hours worked and employees working, across most industries and major metro areas

- Core indicators have been relatively flat through the first 2 months of 2023; compared to the same time period last year, we do not see the monthly growth that we saw at the same time in 2022.

- Core indicators have been relatively flat through the first 2 months of 2023; compared to the same time period last year, we do not see the monthly growth that we saw at the same time in 2022.

- We see relatively low month-over-month variance in economic performance across metro areas, with the average MSA experiencing declines across core employment metrics.

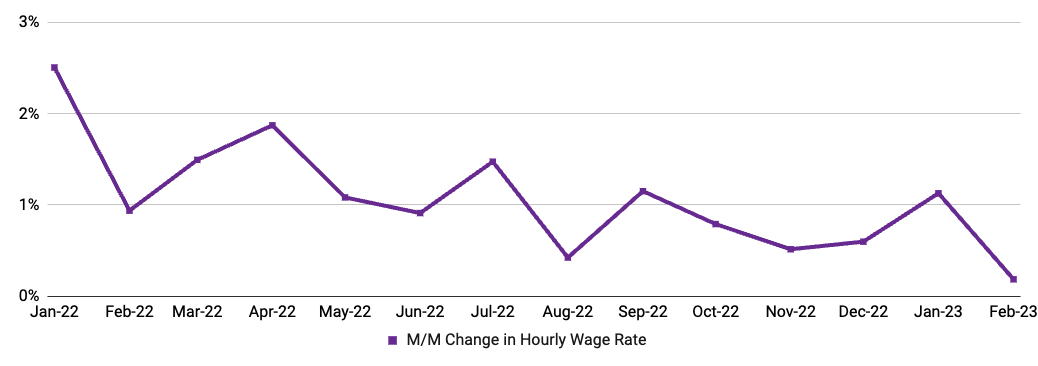

- Wage inflation, while still positive, hit its lowest point since October 2021.

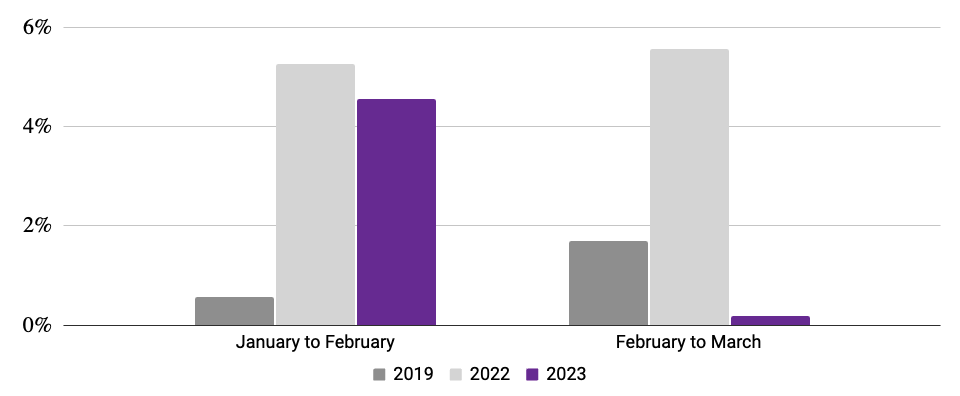

February employment grew slower than in recent years

After a strong January, February saw a large drop in employment growth. Homebase data also showed declines across hours worked for employees

Employees working

(Monthly change in 7-day average, relative to January of reported year)

Businesses open

(Monthly change in 7-day average, relative to January of reported year)

Source: Homebase data.

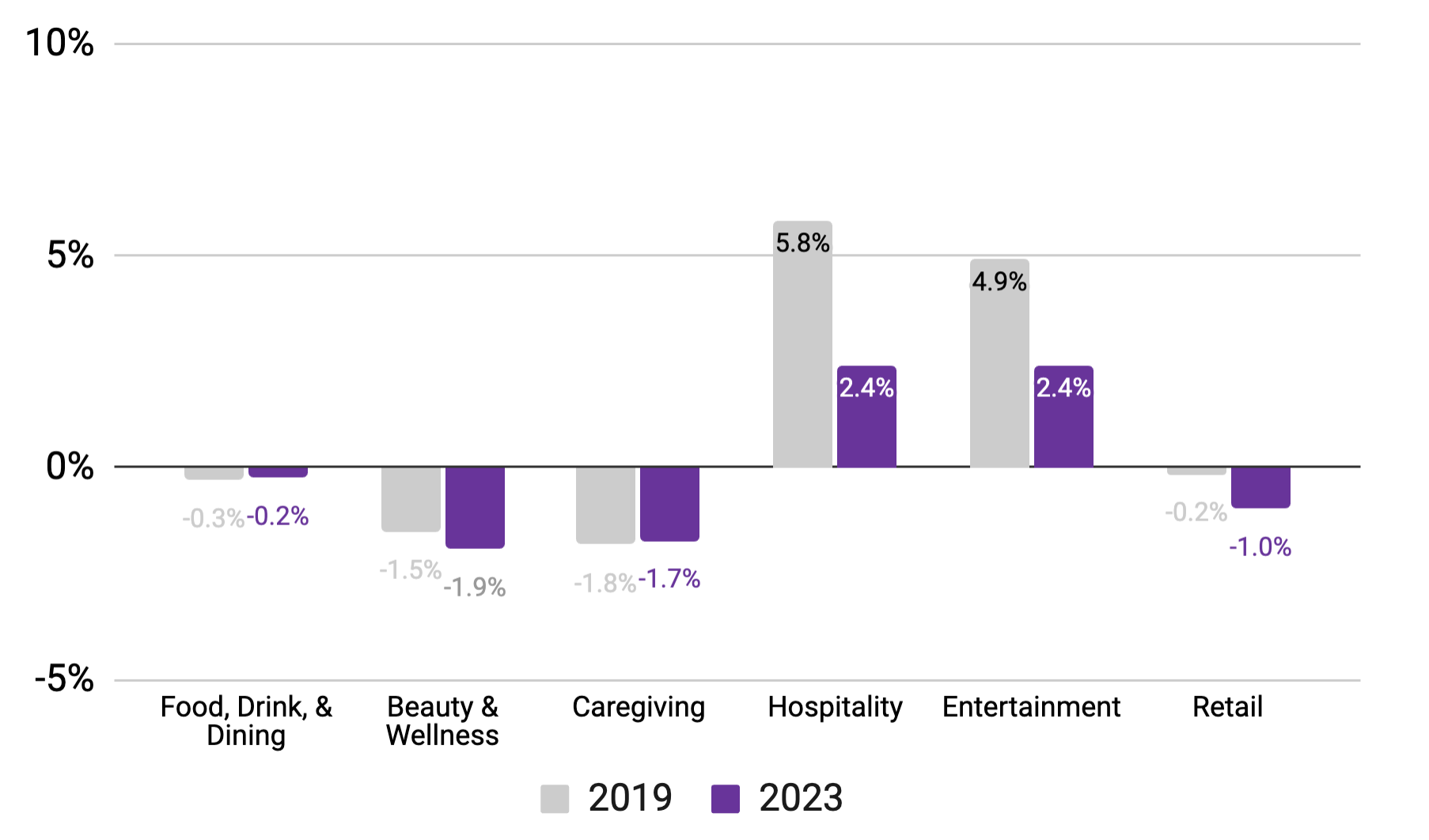

Most industries saw a decline in employment, with Hospitality and Entertainment as the outliers

After a strong start to the year, key industries declined in February. Entertainment, food and drink, and hospitality are still up relative to December employment.

Employment metrics are down about 1% for the retail sector, which has seen a significant downturn in recent weeks

Percent change in employees working

(Mid-February vs. mid-January, using Jan. ‘19 and Jan. ‘23 baselines)1

1. February 17-23 vs. January 13-19 (2019) and February 19-25 vs. January 15-21 (2023). Pronounced dips generally coincide with major US Holidays. Source: Homebase data

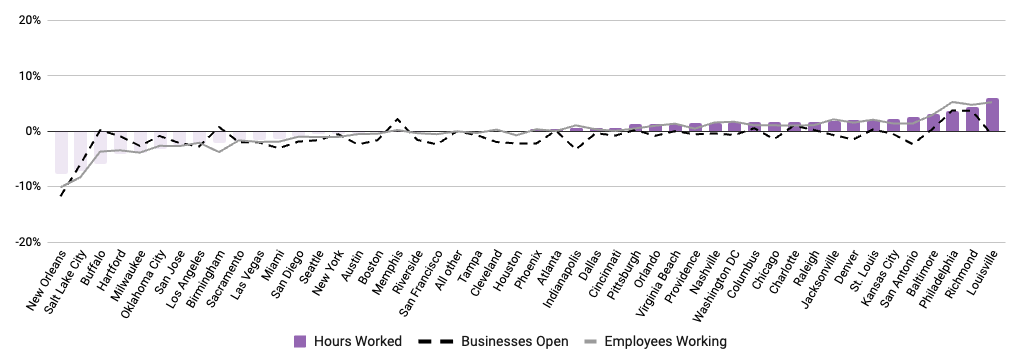

Regions fared differently in February, with weather and seasonality driving some of the differences

Note: February 19-25 vs. January 15-21. Source: Homebase data

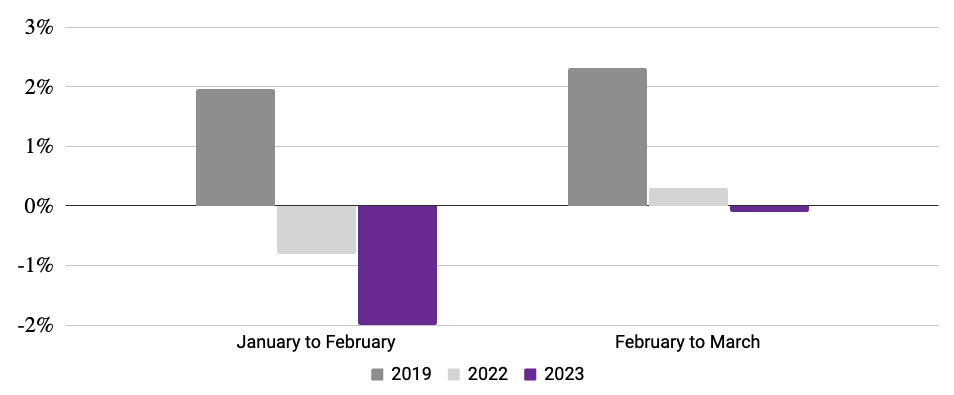

February saw wage inflation hit its lowest level since 2021

Wage inflation

Month-over-month change in average hourly wages

Employee

Pulse Check

A February pulse survey of approximately eight hundred employees shows a consistent, positive outlook towards job prospects.

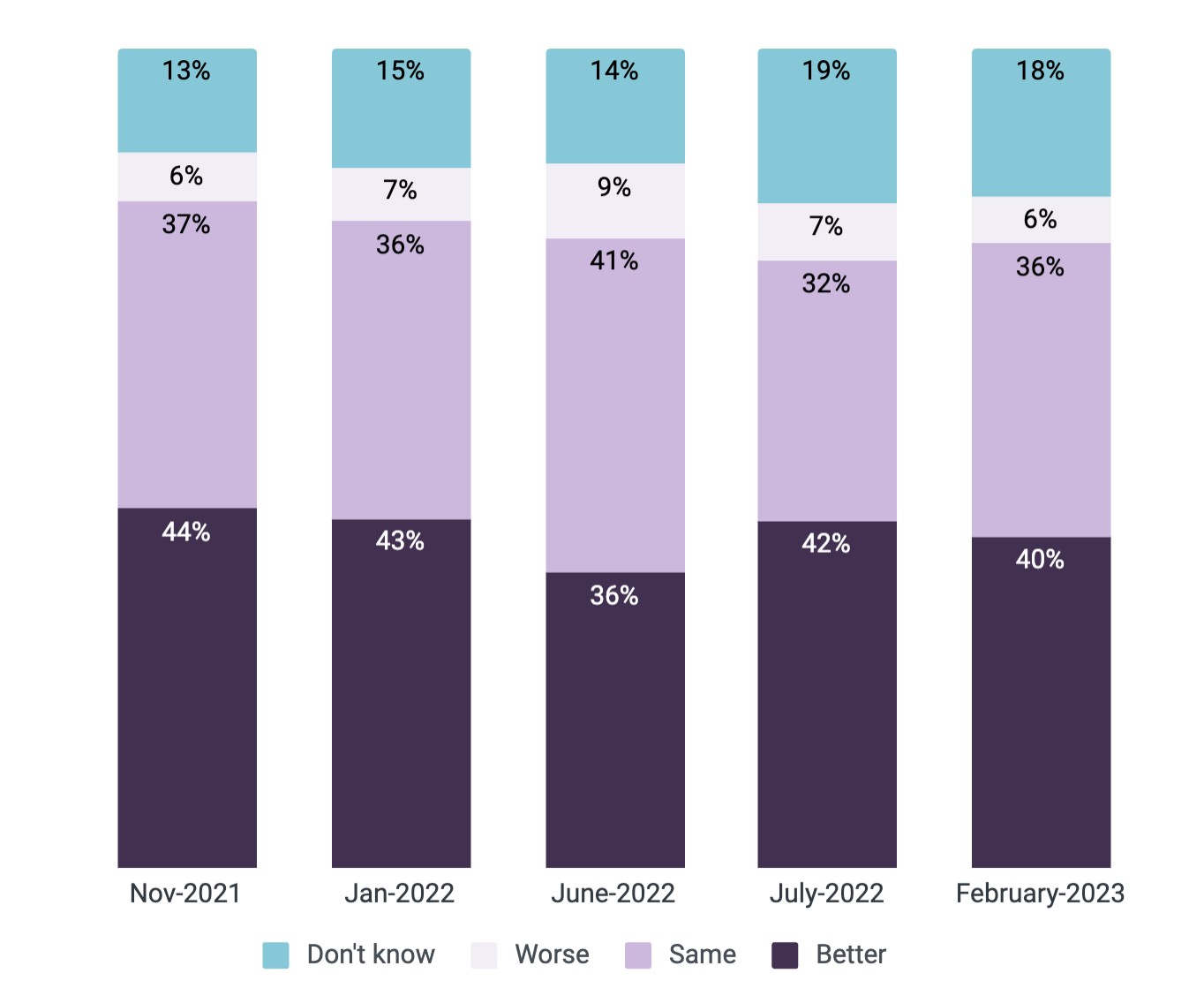

Employees see their job prospects improving in the coming year

Most employees surveyed see their job prospects improving (40%) or staying the same (35%) in a year, while only 6% think they’ll have worse options than they do today. This represents a slightly less negative outlook compared to mid-2022, and increased uncertainty compared to the beginning of last year. With inflation top of mind for many, small business workers have remained confident that they’ll continue to have options on where they work in the future.

Survey question: Do you think your job options will be better, about the same, or worse in 12 months compared to today?

Source: Homebase Employee Pulse Survey. N = 873 (Feb. 2023)

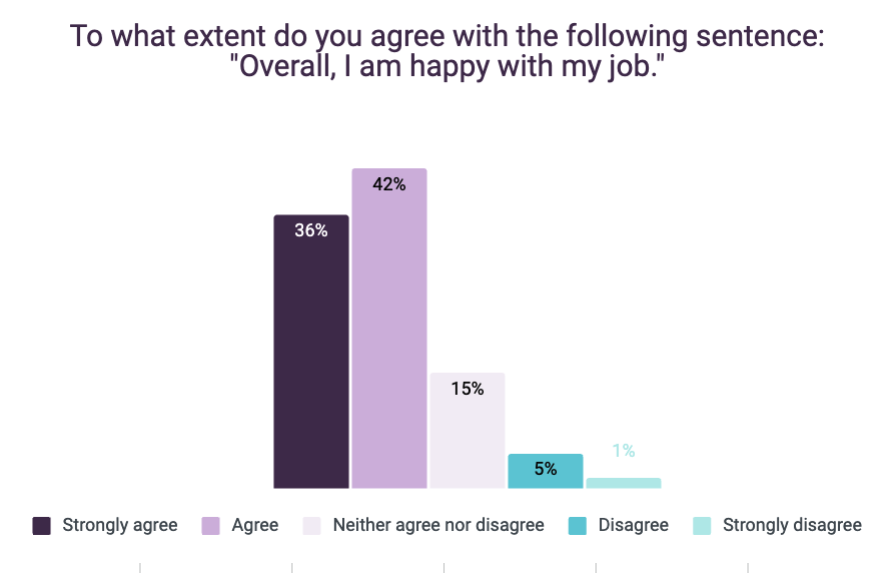

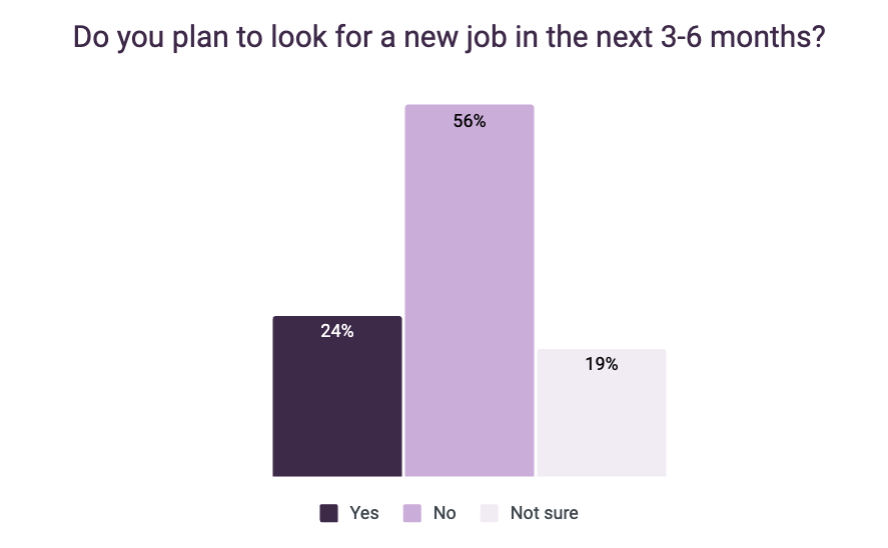

Nearly 25% of employees plan to look for a new job in the coming months

While a majority of workers are generally pleased with their jobs, that doesn’t necessarily mean that they plan to stay with their current employers long-term; just 57% of workers surveyed have no plans to look for a new opportunity in the next 6 months, even though 78% report being happy with their job. As the labor market stays hot, small business employees are aware of the choices that they have in front of them.

That said, our October survey saw 48% of employees say that they weren’t planning to look for a new job in the coming year, indicating that economic fear is boosting retention compared to prior months.

Source: Homebase Employee Pulse Survey. N = 873 (Feb. 2023)

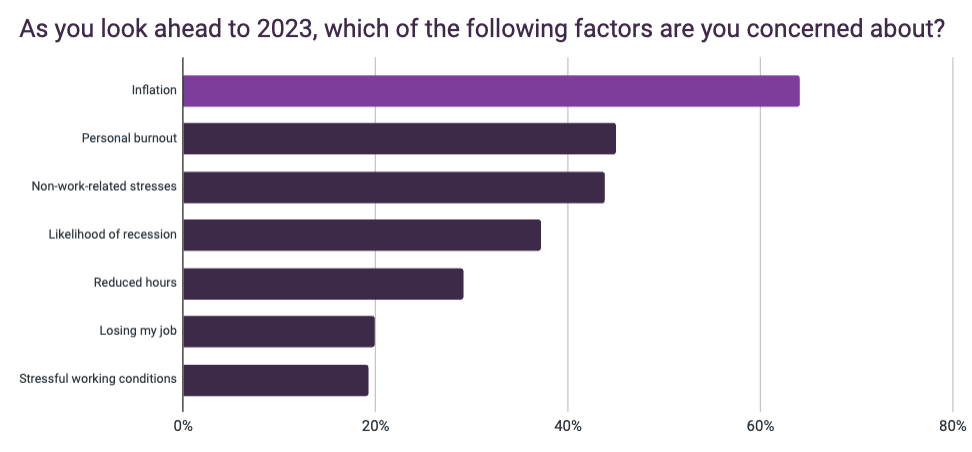

Inflation isn’t just a talking point for economists – it’s the top concern for workers, too

Of all issues that employees are facing – both at and outside of work – only inflation was cited as a concern for a majority (64%) of those surveyed. Workers feel secure about their jobs and the hours available to them, but worry about how far their paychecks will go for them in an inflationary environment.

Source: Homebase Employee Pulse Survey. N = 873 (Feb. 2023)

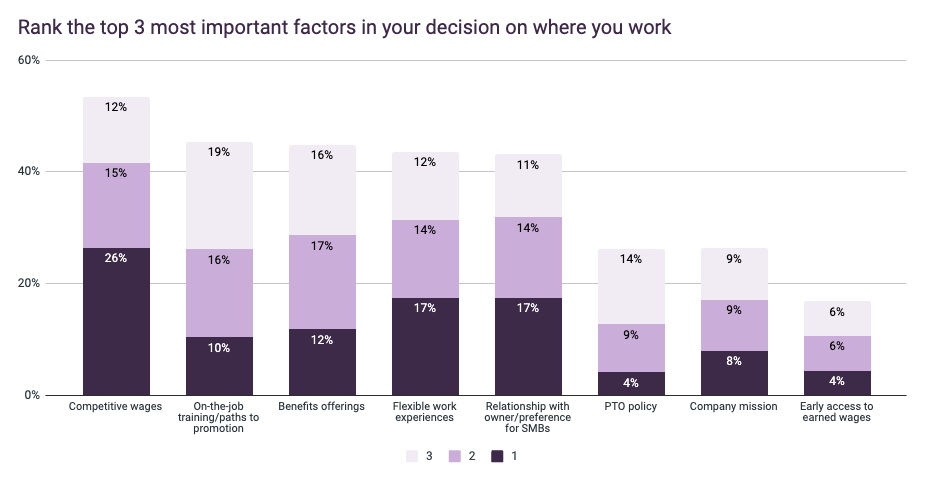

In the face of inflation, wages remain the top priority for worker

It should come as no surprise that the biggest factor in where respondents decide to work is wages, as 54% cited wages as a top 3 factor in their employment decisions. Benefits and employer-sponsored upskilling are close behind, indicating that employers need to be investing in their workforces in order to attract and retain talent.

Source: Homebase Employee Pulse Survey. N = 873 (Feb. 2023)

For a PDF of our February report, please see below; if you choose to use this data for research or reporting purposes, please cite Homebase.