Do you find that manually running payroll for your small retail business is time-consuming and stressful? If you’re thinking yes, you’re in the same boat as 70% of small business owners who feel payroll and tax calculations add a significant burden to their workload. It might be time to turn to retail payroll software to eliminate some of that stress.

Because as your business grows, payroll’s poised to become a bigger burden. And without a human resources department to help you, sticking to your manual system may be a recipe for disgruntled employees, late paydays, time tracking errors, and wage miscalculations — not to mention tax mistakes that can come with heavy IRS penalties as high as 15% on top of what you owe that month.

A user-friendly retail payroll software that can run payroll instantly and provide you with automatic, error-free calculations is the best way to avoid these risks, and that’s why we’re going to talk about what the most important features of retail software are and what they can do for your business. We’ll also include a side-by-side comparison of some of the top-rated retail payroll software solutions available.

What is retail payroll software?

Retail payroll software is a tech-based payroll solution that helps automate your payroll process so you can pay your employees more efficiently and with fewer errors. Without requiring manual calculations, a retail payroll software helps you figure out your employees’ gross pay — which includes any sales commissions they earn — and automatically deducts any withholding to determine their net pay.

Why is payroll software important for retail businesses?

Retail payroll software is important for retail businesses because it helps owners and managers save the hefty time, effort, and errors associated with processing payroll manually, especially when they already have an ever-expanding to-do list. And if your employees work on commission, an effective payroll software can reduce the hassle that comes along with figuring commission into each employee’s gross pay on payday.

How is payroll different in the retail industry?

Similar to the restaurant industry, labor shortages and high turnover are common issues in the retail world, making it challenging to account for constantly changing employee hours and wages in the payroll management process. And because retail business owners often pay customer-facing retail workers in hourly wages and sales commission, the risk of making mistakes during payroll increases because of variable week-to-week and month-to-month earnings.

What to look for in retail payroll software

An effective retail payroll software should be an all-in-one solution that takes care of everything you need in your payroll process from beginning to end. It should:

- Instantly sync with your time tracking tool. When employees clock in, your retail payroll software should instantly calculate pay rates, hours, breaks, overtime, and PTO, and then update your timesheets to prepare for payroll.

- Allow employees to fill out and e-sign tax documents during onboarding and sync them with payroll, so you don’t have to chase people down to find out their tax status or get their signatures.

- Automatically convert hours into wages and withhold federal and state taxes, so you don’t have to do the math yourself.

- Pay employees via direct deposit and file your taxes for you so you’ll never pay employees late or incur tax penalties.

- Include mobile team communication features to send notes and important information about payroll. Homebase’s app even confirms when employees have seen the most recent updates.

The top 5 retail payroll software services

If you’re the owner or manager of a small retail business running payroll on your own and aren’t sure where to start researching your software options, this short list of top-rated solutions is for you.

1. Homebase

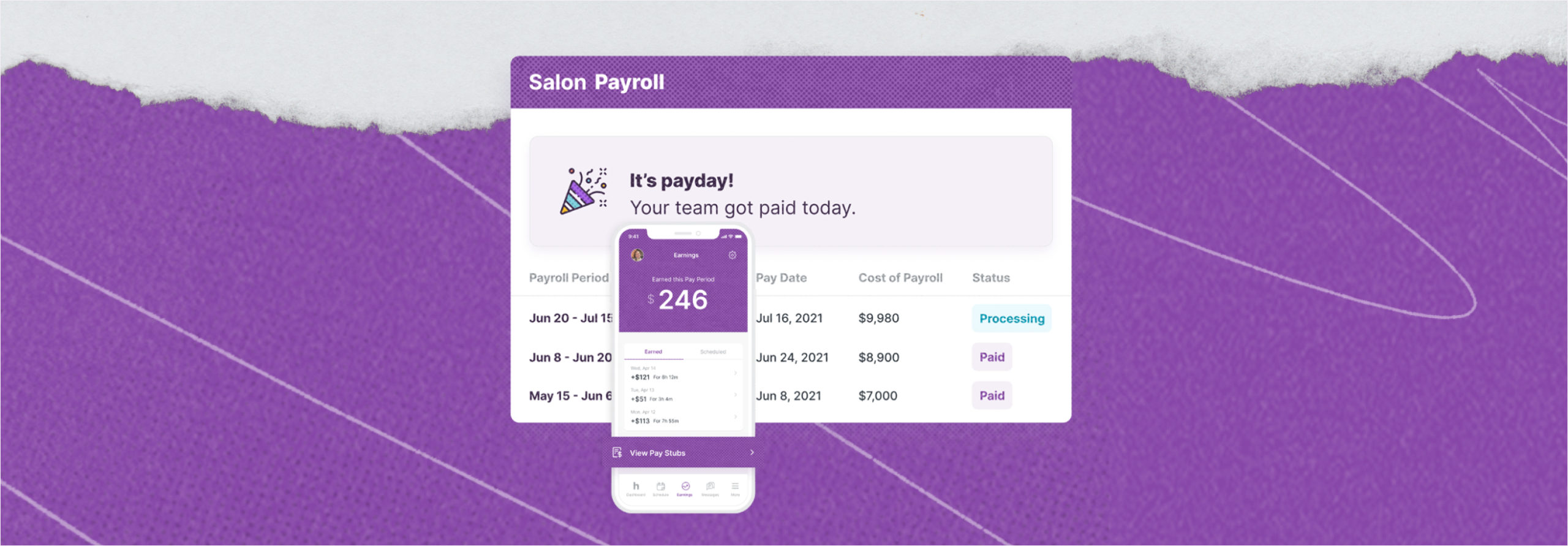

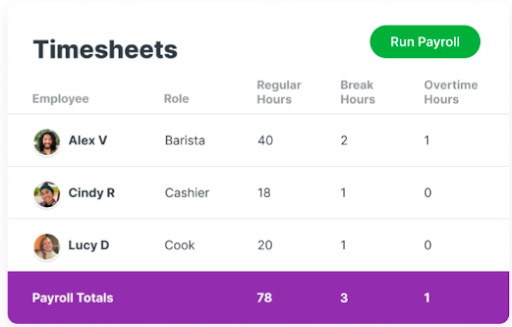

Source: https://joinhomebase.com/

Caption: Homebase timesheets automatically calculate hours into wages for payroll

Homebase is an all-in-one people management software for small business owners who work in an array of industries, and we have tools for scheduling, hiring and onboarding, time tracking, payroll, team communication, and HR and compliance. Best of all, you can manage everything from our mobile app.

- Best for retail owners looking for an all-in-one solution for their growing retail business. Homebase doesn’t just offer solutions for scheduling, hiring, onboarding, and small business payroll — our suite of tools sync together to streamline the entire process — from onboarding a new hire to sending them their first direct deposit.

- Helps you stay compliant. We know retail owners aren’t HR or compliance experts, which is why our payroll features can calculate, pay, and file your taxes for you.

Source: https://joinhomebase.com/

Caption: Employees can access their pay stubs on Homebase’s mobile app

2. Remote

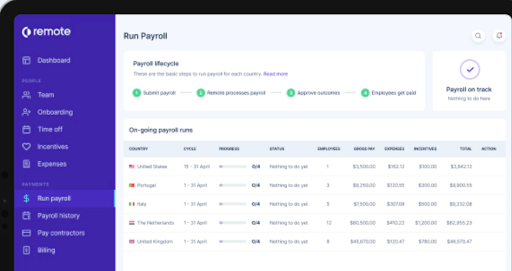

Source: https://remote.com/platform/run-payroll

Caption: Remote’s HR software lets you run payroll for an international team and keeps you compliant with international payroll laws

Remote is an HR management software with features for international payroll, benefits, taxes, and compliance, and they offer solutions for both small and large businesses.

- Best for anyone dealing with international contractors or remote workers. Hiring a remote team is a great option for retail owners who have to outsource or work with international teams or remote suppliers outside their local area.

- Has dedicated features for administering employee benefits, bonuses, and other incentives. If you want to provide your new retail employees with a competitive hiring package, Remote can help you make that a part of your offering at the onboarding stage.

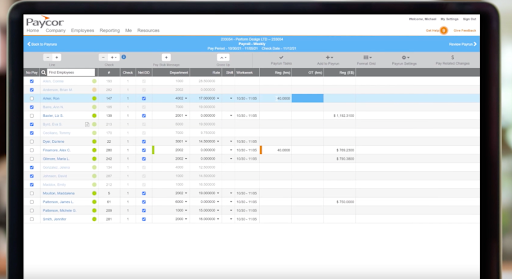

3. Paycor

Source: https://www.paycor.com/hcm-software/payroll-software/

Caption: Paycor gives you detailed insights into your payroll data and analytics

Paycor is a human capital management (HCM) solution that offers dedicated tools for HR and payroll, talent management, workforce management, employee experience, and benefits administration.

- Best for retail owners who want to dig into business analytics. Paycor lets you create custom dashboards so you can make more effective, data-informed decisions.

- Emphasizes a seamless transition to their product. Paycor cares about making their customer onboarding experience smooth and enjoyable, and they’ve even created their own implementation method: GUIDE (Gather, Understand, Import, Deliver, and Evaluate) to facilitate that process.

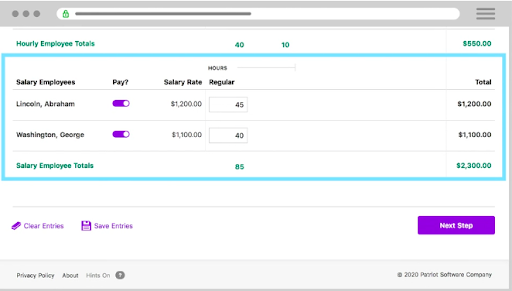

4. Patriot Payroll

Source: https://www.patriotsoftware.com/payroll/

Caption: Patriot lets you run payroll in under three minutes and in three easy steps

Patriot Payroll offers features for payroll, time and attendance tracking, and HR, and Patriot also offers accounting software as a separate solution for businesses of all sizes.

- Best for retail owners with a small budget who only need tools for payroll and tax solutions. With their affordable, full-service payroll plan, you can file your federal, state, local, and end-of-year payroll taxes in addition to their basic payroll tools.

- You can run payroll in under three minutes. Patriot has distilled its payroll process into three simple steps to save you as much time as possible, which could be especially useful as you take on more employees and scale your business.

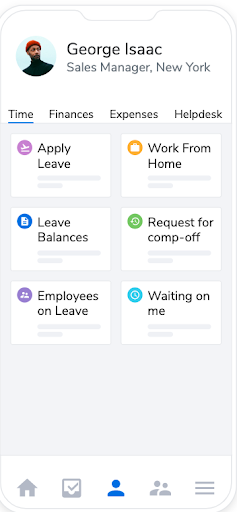

5. Keka

Source: https://www.keka.com/payroll-software

Caption: Keka lets you track employee time and payroll information from their mobile app

Keka is a people enablement software with tools for payroll and expenses, HR, performance and culture, hiring and onboarding, project timesheets, and time and attendance.

- Best for retail owners who want to hire salaried employees like managers or supervisors. Keka’s software can guide you through the compensation planning process so even professionals without a finance background can make sure they’re staying competitive and paying employees according to industry standards.

- Preview your payroll reports before paying employees. Keka lets you double-check your reports before you pay employees so you can make sure your calculations are accurate.

A side-by-side look at the top 5 retail payroll software*

*As of July 2022

| Mobile app? | Mobile team communication? | Mobile time tracking? | Scheduling tools? | Hiring and onboarding tools? | Automatic tax withholding and filing? | |

| Homebase | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Remote | ✔ | ✔ | ||||

| Paycor | ✔ | ✔ | ✔ | ✔ | ✔ | |

| Patriot Payroll | ✔ | |||||

| Keka | ✔ | ✔ | ✔ |

Let Homebase simplify your retail payroll

There are payroll solutions out there for every type of industry and every size of business, but not all of them have all your small retail business needs in mind.

Or they may have the features you need but come at a high monthly cost, which can be tough for a growing business to manage.

Homebase strikes the perfect balance for our small business customers by being affordable — far below the $150 – $300 a month range you’ll see for most payroll software — and by offering everything you need all in one place. Best of all, everything’s manageable from your computer and mobile phone.

Retail payroll software FAQs

What is the cheapest payroll software to use?

The cheapest payroll software in our comparison list is Patriot Payroll, which is priced at $17/month and $4/employee/month. But if you’re looking for payroll software that also lets new employees self-onboard and e-sign forms, syncs with time clocks and timesheets, and includes tools for mobile scheduling, you might consider that Homebase payroll is only $39/month plus $6/employee/month. Many other payroll software can cost you upwards of $150/month.

What are the benefits of using payroll software?

The benefits of using a retail payroll software include:

- Saving time by automatically turning timesheets into wages for payroll.

- Producing error-free calculations, including sales commissions and tax withholdings.

- Making payroll headache-free by syncing hours, breaks, overtime, and PTO with your payroll timesheets when your employees clock in or out.

How do you automate retail payroll?

There are many different software you can use to automate retail payroll — for instance, a system like Homebase payroll. It starts when you use Homebase onboarding to have your employees self-onboard and submit and sign all their tax information directly through the app. Then, our platform syncs that data with your timesheets so you’ll always withhold the right amount of taxes on payday.

After that, our payroll tool automatically updates your timesheets with relevant payroll information when employees clock in and out with our free time clock app — including sales commissions, overtime hours, and PTO. Once you’ve run payroll and are ready to pay your employees, advanced tools like Homebase can even take care of your direct deposits and tax filings for you.