Having a paid time off (PTO) policy in your small business lets employees choose how they use their days off at their own discretion. But you might be worried that the obligation to pay out PTO comes at an extra expense to your budget, employee schedule, and your business’s limited HR resources. So do companies have to pay out PTO?

In this article, we explore circumstances when small businesses are required to pay out PTO, the types of PTO compensation, and how PTO payout laws vary from state to state to help you stay compliant with local laws.

When do small businesses have to pay out PTO?

Does a company have to pay out PTO? Business owners and workers everywhere ask this, and no wonder, because there’s no simple answer.

Whether your company has to pay out PTO depends on state and local laws, your company policies, the type of termination or separation, and whether your business uses accrued or granted PTO.

For example, depending on your state or your small business’s policies, you may have to pay out PTO when an employee leaves your business. So does PTO get paid out even if your employee quits? Depending on the situation, yes.

So, how are companies required to pay out PTO? You might be on the hook for paying out any PTO employees accrued as wages, though whether you pay out sick time, vacation time, or both can depend on the state.

You could also face serious fines or legal penalties if you withhold PTO compensation from an employee when they resign from their position. Which states require vacation payout upon termination can depend on state laws, so make sure to do your research.

What are the benefits of a PTO policy?

It’s beneficial for business owners to create PTO policies because of the advantages they can offer both management and employees. Here are a few examples:

-

- Greater flexibility for employees: Instead of creating individual time off policies for sick leave, vacation, and personal days, a PTO policy lets employees choose how they use their days off.

- Improve work-life balance: A PTO policy helps employees maintain a healthy work-life balance by allowing them to take time off from work to rest, recharge, and attend to personal matters.

- More control over employee absences: Unless an employee taking PTO is sick, most PTO policies require employees to give at least a few days’ notice before they take days off to protect the company from too many unscheduled absences.

- Establish trust between employees and employers: When employees can take PTO for any reason, they don’t feel they have to be untruthful about the reasons for their time off.

- Better for retention and recruitment: A comprehensive PTO policy is an attractive employee benefit that can help recruit and retain talent while also reducing the costs associated with employee turnover.

- Simplify HR and administrative tasks: Consolidating time off (e.g., vacation days, sick leave, and personal days) into one PTO policy helps streamline admin.

9 types of PTO for a small business.

Workers used to specify whether they were taking time off for vacation days, sick days, or personal reasons. But now, many businesses are establishing a general paid time off policy that gives people the freedom to choose how they use their paid days off.

Still, some businesses want more control over how their employees use PTO. For example, how much notice for PTO an employee is required to provide may depend on the type of time off.

Let’s look at the different types of PTO policies you could offer your small business employees.

1. Vacation days.

One of the first questions a potential employee may ask is, “do you get paid for vacation days?” Your answer could make the difference between whether they join your team.

Offering vacation pay in a small business gives employees an opportunity to take time off for leisure, travel, relaxation, or doing whatever they please. This means they come back to work feeling energized, refreshed, and motivated. A team with high morale is a superpowered team.

Depending on how you set up your small business’s vacation time policies, you may choose to:

- Let employees accrue their paid time off by adding a certain number of days off for every pay period

- Offer a certain amount of vacation days upfront every year as part of a “bank” of paid time off

- Separate vacation days from sick days

- Combine vacation days with sick days into one PTO plan

Even if an employer offers a certain number of vacation days, it can use policies to dictate whether vacation days are approved. For example, a business could require an employee to submit a formal request a month in advance to request specific days off.

2. Sick leave.

A sick leave policy gives employees time off for illness, medical appointments, or caring for a family member.

While vacation time off policies usually require them to be pre-planned, employees can take sick leave when they need to and with little to no notice. Some businesses, however, may require a doctor’s note to approve a sick leave absence.

Sometimes, employees may need longer periods of time off to tend to more serious medical emergencies or support a family member experiencing illness. This would fall under the Family and Medical Leave Act (FMLA), which states:

“Employees may use employer-provided paid leave at the same time that they take FMLA leave if the reason they are using FMLA leave is covered by the employer’s paid leave policy. An employer may also require an employee to use their paid leave during FMLA leave.”

If you find your small business in this type of paid leave situation, contact FMLA for more information.

3. Personal days.

Life happens, which is why personal days are an important consideration for PTO policies because they give employees time to deal with personal matters, family obligations, appointments, observe a religious holiday, or take a mental health day.

Personal days can accrue over time or be granted in a lump sum at the beginning of the year or employment period. Some small businesses provide a set number of personal days annually, which can range from a few days to a week or more, depending on the company’s policy.

4. Public holidays.

Providing PTO for federal public holidays (e.g., Memorial Day, Labor Day, or Independence Day) gives employees a chance to rest and connect with friends or family, which is essential for well-being.

Some small businesses might include additional public holidays, such as Martin Luther King Jr. Day or Veterans Day, or religious holidays, for example, Good Friday or Boxing Day.

5. Bereavement leave.

Sometimes known as compassionate leave, bereavement leave gives employees paid time off to attend to the death of a family member or loved one. For example, attending a funeral service or managing arrangements.

Time away from work can help an employee deal with the emotions associated with the loss and allow them time to grieve, heal, and support their families.

An employer can choose to offer bereavement leave as an upfront benefit of a PTO plan alongside sick leave and vacation days. Some employers may not offer it as an upfront benefit but choose to offer it in the unfortunate event that an employee loses a loved one.

6. Jury duty.

Sometimes, an employee is called for jury duty, which is an obligation that’s incredibly challenging to get out of attending. To help with this, small businesses can offer PTO to attend jury duty.

Most states don’t allow an employer to punish or fire an employee for taking time off for jury duty, but not all states require employers to offer compensation during jury service.

For example, state laws only entitle Colorado employees to a regular wage of up to $50 a day for the first three days of jury service, while Californian employers don’t have to provide any compensation during jury service.

7. Parental leave.

Parental leave provides employees with time away from work for childbirth, adoption, or foster care placement. The PTO policy allows new parents to spend time with and care for their child without having to worry about reducing their income.

Parental leave duration can vary widely, ranging from a few days to several months, depending on your small business policy, state laws, and individual circumstances.

8. Sabbatical.

Who wouldn’t appreciate an extended leave from work?

Paid sabbatical leave does just that—it provides an extended period of time away from work to give employees an opportunity to pursue travel, leisure time, studying, or development to help support personal or professional growth.

Compensation during sabbatical leave varies depending on your employee policies. For example, some small businesses offer full or partial pay, while others provide unpaid leave.

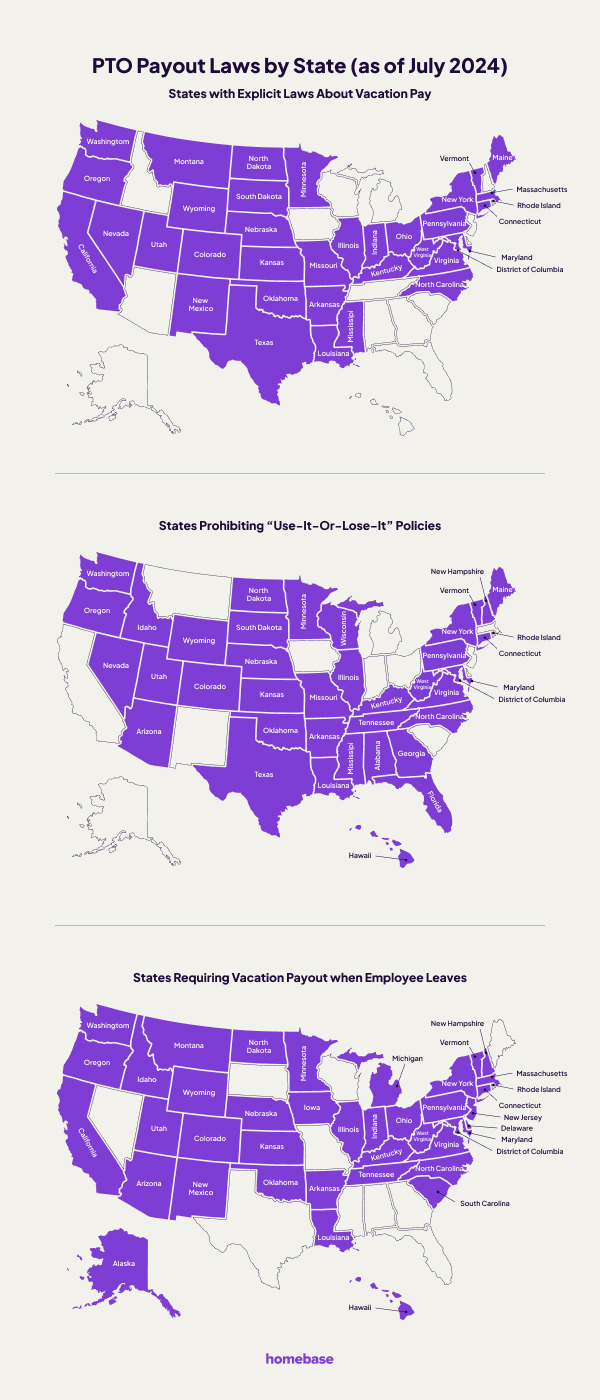

PTO payout laws by state.

Similar to wage and hour laws, PTO payout laws vary from state to state and across different jurisdictions. They’re also impacted by specific company policy, so it’s not a simple yes or no to answer the question “do employers have to pay out pto?”

That’s why we’ve compiled a state-by-state guide of PTO payout laws for you to use as a quick reference. Here are a couple of things to consider before you find your state information in the table below:

- Earned vacation time is the compensation in wages an employee is entitled to for unused vacation time.

- A “use-it-or-lose-it” policy means employees lose any unused vacation or PTO days they’ve accrued at the end of a year, and they can’t ask for it to be paid out or rolled over to the following year.

Now, are employers required to pay out PTO in your state? And is PTO considered wages if so? Take a look at our PTO chart below to find out which states require vacation payout upon termination, including info on when does PTO get paid out by law.

| State | Does the state have explicit laws about vacation pay? | Does state law explicitly prohibit a Use-It-Or-Lose-It Policy? | Does the state require vacation payout when an employee leaves? | Is there a penalty to employer for failure to pay? |

| Alabama | * | * | Not stated specifically, though employer must give notice if they discontinue upon separation. | No |

| Alaska | * | No, but vacation pay is a vested, or earned, right for employees. | Not stated specifically in state law. The employer’s agreement or policy determines this protocol. | Employers who do not pay can be held liable for wages, from the time that employee requested to time of actual payment. |

| Arizona | No | * | Does not explicitly say this is PTO, but it is required to pay “all wages due” by time of separation. PTO payments are outlined in each agreement or policy. | Employers that do not pay can be sued by employee (either for triple damages or file a wage claim for no more than $5000 from the Industrial Commission). |

| Arkansas | Yes, though only for state employees. | * | Policy dictates what will happen. For state employees, all wages (including unused holiday and accrued vacation) will be included on final pay. | Employer must pay within 7 days of final payment, or be held liable for double the amount. |

| California | * | Prohibited by state law, however employers may implement a accrual cap on vacation time. | * | Employer who does not pay final wages (including vacation time) can be held liable for the amount as well as 30 days of wages payable at employee’s standard rate. Further restitution may also be required by employer. |

| Colorado | * | * | * | Upon receiving written demand of employee, the employer must pay in 14 days or be held liable for double the amount, or up to 10 days worth of employee’s regular wage (whichever is higher). |

| Connecticut | * | * | Employer’s policy or agreement governs actions upon separation. | If the employer has a policy that they do not follow, the employee can claim twice the amount owed. |

| Delaware | * | * | * | If the employer has a PTO policy, they must make any payouts within 30 days or be liable to unpaid wages and/or damages. |

| District of Columbia | Yes | * | Employer’s policy or agreement governs actions upon separation. | Employer can be held liable for damages equal to 10% of the employee’s unpaid wages per day until paid. |

| Florida | * | * | * | n/a |

| Georgia | * | * | * | n/a |

| Hawaii | * | * | If the employer has policy or agreement, it must be paid upon the employee’s last day. If there is no policy or agreement, employer is not required to make any payments. | If policy is present, employer must pay on final day, by end of day. If they do not do so they may be liable for amount, additional fines, and/or jail time. |

| Idaho | No | * | Employer’s policy or agreement governs actions upon separation. | Employer held liable for up to 15 days’ unpaid wages (up to $750), if a policy is present and has been violated. |

| Illinois | * | * | * | Employer may be held liable for unpaid wages and damages up to 2% of unpaid amount. |

| Indiana | * | Not specifically stated in state law. Indiana courts have suggested a policy is permitted. | Employer’s policy or agreement governs actions upon separation. | Employer can be held liable for 10% of unpaid wages, per day (up to 2x of the amount of unpaid wages). |

| Iowa | No | No | Employer’s policy or agreement governs actions upon separation. | Employer can be held liable for a fine of $500 per failure, plus damages of 5% per day (after 7 days of due date of unpaid wages). |

| Kansas | * | * | * | Employer can be liable, beginning on 8th day, for unpaid wages or amount unpaid plus %1 of wages per day, whichever is less. |

| Kentucky | * | * | Employer’s policy or agreement governs actions upon separation. | Employer can be liable, given civil penalty of $100-1000 per offense. |

| Louisiana | Yes | * | * | In a dispute over amount, employer must pay undisputed amount. Employee may sue for balance claimed. Employee may be entitled to reasonable attorney fees. |

| Maine | * | * | Employer’s policy or agreement governs actions upon separation unless employers has more than 11 employees. Private employers with 11 or more employees must pay those employees for any unused PTO. This overrides any individual policies in this case. | n/a |

| Maryland | * | * | If employer does not have a policy outlining forfeiture of pay, then they must pay cash to employee for any earned unused vacation. | Employer may be liable for fines ranging $100-500. Employer may also be sued for unpaid wages. |

| Massachusetts | * | No. Permitted by state law, but employers have to give employees fair notice of policy when implementing an accrual cap of vacation time. | * | Employer may be guilty of a misdemeanour and liable for fines of up to $1000. Court may also award triple damages if employer has willfully withheld back wages. |

| Michigan | No | No | Employer may pay for ‘fringe benefits’ if outlined in their policy or agreement. Willfully contracted vacation pay is considered a fringe benefit. Employer cannot revoke or withhold any earned wages at time of separation. | If an employer fails to pay earned wages they must pay restitution to the employee or a civil penalty of $25,000/per violation (reduced to $7000 for an employer who has no other violations). Further offenses can include jail time and further compensation). |

| Minnesota | * | * | * | Employer may be liable for 10% of unpaid wages, per year as well as damages up to 2x the amount of unpaid wages. For flagrant offenders, further penalties can apply. |

| Mississippi | * | * | Employer’s policy or agreement governs actions upon separation. | n/a |

| Missouri | * | * | Final wages do not include vacation pay. | n/a |

| Montana | * | * | If a vacation has been agreed to, both in writing or verbally, it must be paid out on separation. | Employer may be found guilty of a misdemeanour and penalty to 110% of unpaid wages. |

| Nebraska | Yes | Yes | Employers must pay any earned unused vacation time at time of separation. | Employee may sue for any unpaid wages, in addition to attorney fees of up to 25% of unpaid wages. If employer found to be willfully withholding, employee may recover 2x unpaid wages. |

| Nevada | * | * | Employers may restrict payment of unused vacation pay, however they must maintain a consistent policy. | n/a |

| New Hampshire | No | * | Employer’s policy or agreement governs actions upon separation. | Employer may be held liable for damages equal to 10% of the employee’s unpaid wages per day until paid. |

| New Jersey | No | No | Earned unused vacation time will not be considered as wages, unless an employer’s policy or agreement states otherwise. | Employer may be liable for administrative fees (10% or 25% depending on the number of offences) on the amount of unpaid wages. |

| New Mexico | Yes | No | Accrued vacation compensation is considered the same as wages. | Employer may be liable for up to 60 days of unpaid wages, guilty of a misdemeanour (as well as additional fines and possible jail time for multiple offences). |

| New York | * | * | Employer’s policy or agreement governs actions upon separation. | Employer may be liable for a $500 civil fine, per violation, as well as criminal penalties (including additional fines and jail time for multiple offences). |

| North Carolina | * | * | * | Employer may be liable for unpaid wages, interest, and court costs. |

| North Dakota | * | * | * | Employer may be liable for unpaid wages, plus up to 30 days at employee’s regular rate, plus interest. Additional amount may be awarded dependent on multiple offences by employer. |

| Ohio | Yes | Not specifically addressed by state law, however, Ohio courts have suggested these policies are permitted. | Ohio courts have interpreted that vacation pay is a deferred payment of earned benefits. Unless an employer’s policy states otherwise, employer must pay at time of separation. | Employer may be liable for unpaid wages, in addition to 6% of amount due or $200, if they have not paid final wages within 30 days (60 days of an uncontested court filing). |

| Oklahoma | * | * | Employer’s policy or agreement governs actions upon separation. | Employer may be held liable for unpaid wages and damages up to 2% of unpaid amount, whichever is less. |

| Oregon | * | * | Employer’s policy or agreement governs actions upon separation. | Employer may be liable for unpaid wages, plus up to 30 days at employee’s regular rate, calculated at 8 hours per day. Penalties will not be assessed if employer pays balance within 5 days of receipt of final time stamp. |

| Pennsylvania | * | * | Employer’s policy or agreement governs actions upon separation. | If employer has withheld final wages for more than 30 days they may be liable for damages of up to 25% of unpaid wages, or $500, whichever is greater. An employer that does not pay, or satisfactorily explain why to the Pennsylvania Secretary of Labour, may be liable for an additional penalty of 10% of the amount due. |

| Rhode Island | * | * | * | Employer may be liable for amount of unpaid wages, and damages of 2x that amount. Employers who are not able to pay may be found guilty of a misdemeanour, and subject to additional fines and possible jail time. |

| South Carolina | No | No | Employer’s policy or agreement governs actions upon separation. | Employer who violates policy is subject to a civil penalty of $100 per violation. Employee may sue employer for unpaid wages and possibly receive up to 3x the amount, plus costs and reasonable attorney fees (proceedings must begin within 3 years after wages were due). |

| South Dakota | * | * | * | n/a |

| Tennessee | No | * | Employer’s policy or agreement governs actions upon separation. | Employer may be found guilt of a misdemeanor and subject to fine from $100-500. If an employer has committed 2 or more offences, they may be liable for a civil penalty of $500-1000 per offence. |

| Texas | * | * | Employer’s policy or agreement governs actions upon separation. | n/a |

| Utah | * | * | Employer’s policy or agreement governs actions upon separation. If the employer does not pay for accrued days upon separation, this must be explicitly stated. | Employer must pay final wages within 24 hours of separation or become liable for the unpaid wages, plus up to 60 days at the employee’s regular rate. Employee must sue in order to recover any unpaid amount. |

| Vermont | * | * | Employer’s policy or agreement governs actions upon separation. | Employer may be liable for $5000 fine. Employee may sue for 2x the unpaid amount, plus costs and reasonable attorney fees. |

| Virginia | * | * | Employer’s policy or agreement governs actions upon separation. | Employer may be liable for unpaid wages, 8% interest (calculated from date wages were due). Employer may face additional fines, etc, if found to be withholding willfully with intention to defraud. |

| Washington | * | * | Employer’s policy or agreement governs actions upon separation. | Employer may be found guilty of a misdemeanor. Employer may be ordered to pay unpaid wages, plus 1% interest (per month). Further fines and consequences if the employer willfully withholds the amount. |

| West Virginia | * | * | If an employer has a written policy that states accrued vacation time will not be paid at separation, they will not be held liable to pay employee for this time. | Employer may be liable for 2x the unpaid wages as damages, in addition to the amount of the unpaid wages. |

| Wisconsin | No | * | Employer is not required to pay employees upon separation. | n/a |

| Wyoming | * | * | Employer’s policy or agreement governs actions upon separation. | Employer may be found guilty of a misdemeanour and liable to a fine for $500-750 per offence. Employee is entitled to 18% interest accrued from separation date on unpaid wages. |

How Homebase helps you manage PTO.

When you’re a small business owner navigating employee schedules and compensation on your own, it might seem hard to manage PTO. You don’t want to impact employee morale and engagement, and of course, you need to comply with state and local labor laws.

So what’s the fix? Some business owners use time-tracking software to help streamline managing paid time off for employees. Homebase even has a time clock app that tracks hours, overtime, and PTO digitally, consequently saving you time, headacies, messy spreadsheets, and time-consuming math.

The platform also lets you manage payroll, which makes it easy to keep important information in one place. And with Homebase HR Pro, you can even consult with a live HR expert. In particular, they can guide you through the process of specifically creating your own PTO policy so you stay fair and compliant.

Do companies have to pay out PTO? FAQs

Can a company refuse to pay out PTO?

Whether a company has to pay out paid time off will depend on the state and specific company policies. For example, in California, employers pay out all accrued and unused PTO at the time of termination. Whereas Texas doesn’t require PTO payout unless the company’s policy or a contract says so.

What happens to PTO when you quit?

What happens to PTO when you quit your job depends on your state and company policy. Many states require employers to pay their employees in wages for the PTO they accrued while working for their business, but others don’t entitle employees to time accrued if they leave the business voluntarily.

Can an employer take away earned vacation time?

Generally, employers can’t take away vacation time that has already been accrued according to their company policy and must adhere to state and local laws.

Some businesses will have a “use it or lose it” policy, which means that vacation time must be used in a specific time period. If an employee doesn’t use the vacation time, the employer isn’t obligated to carry it over to the next period. Therefore, the employee will lose their vacation time.

Can a company force you to use PTO?

A business can force you to use PTO in certain circumstances. For example, a business could shut down for a week and require all employees to use their accrued vacation time during that period. However, this will depend on state law, employment contracts, and company policy.

Can a company deny your PTO?

Yes, a company can deny your PTO request for various reasons. For example, it conflicts with the business’s needs, it creates scheduling conflicts, there’s not enough notice, or there are contractual obligations that the employee must fulfill.

There are some exceptions. For example, it is challenging for an employer to legally deny leave covered under the FMLA, such as family or medical leave.

Do you get paid for personal time off?

PTO is time away from work that employees can use for various purposes, including vacation, sick leave, or personal days. Whether you get paid for personal time off will depend on the nature of the time off and on specific company policies, employment contracts, and state laws.

Do you get paid for unused sick days when you quit?

According to the U.S. Department of Labor, if you quit your job before using all of your sick leave, your employer is not obligated to pay you for that time. Some businesses might have a policy where they pay out the full or partial amount of unused sick days, but this will depend on individual company policy.

Can you cash out PTO at any time?

Cashing out PTO varies from employer to employer. Some businesses might allow employees to cash out PTO at any time, while others may limit cash-outs to specific situations, such as during annual open enrollment periods or reaching a certain threshold of accrued PTO.