If you run a business that employs workers in a tipped occupation, you’ve probably heard some rumblings about Fair Labor Standards Act (FLSA) tip credit. But you might be wondering what it’s all about, whether it’s legal in your state, and how it might alter your payroll process.

It might surprise you that FLSA tip credit can help with payroll as it helps you keep on top of your labor costs. Because running payroll isn’t always the most fun part of operating a business. Between collecting timesheets and calculating benefits, taxes, and time off, the process can be overwhelming.

That’s why in this article, we’ll explore:

- What FLSA tip credit is

- Who qualifies for FLSA tip credit

- Tip credit rules broken down by state

- How to calculate tip credit, step-by-step

What is FLSA tip credit?

Fair Labor Standards Act (FLSA) tip credit is a system that allows businesses that employ tipped workers to use tips to satisfy their minimum wage obligation. That means — if the specific state allows it — employers can pay employees less than the full minimum wage, provided they earn enough in tips to make up the difference. It’s worth noting that the minimum wage at the federal level in the United States is $7.25 per hour.

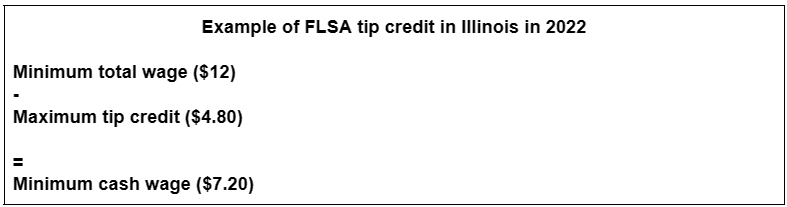

For example, in 2022, Illinois set its total minimum wage at $12 per hour. The state’s maximum tip credit is $4.80. That means employers only have to pay their staff $7.20 per hour, provided they claim tip credit and their staff members make more than $4.80 per hour in tips.

Many states — and even some cities — have their own total minimum wage rate. In cases where the state minimum wage is higher than the federal minimum wage, employers are required to use the higher amount. For example, the minimum wage in Colorado is $12.56 per hour, while that number is $14.25 in the state of Massachusetts and $7.25 in North Dakota.

And if a staff member’s average gratuities per hour are less than their state’s maximum tip credit, meaning they don’t make enough in tips, the employer is required to compensate them for the difference and ensure they get paid the full total minimum wage amount.

Tip credit rules by state

Both states and some cities are allowed to set their own tip credit laws and minimum wage rules. So, while federal law dictates a maximum tip credit of $5.12 per hour, many areas have different rates.

Some states don’t even recognize tip credit at all, requiring business owners to pay tipped staff the same minimum wage as non-tipped employees, like dishwashers and bussers. These states and territories are:

- Alaska

- American Samoa

- California

- Commonwealth of Northern Mariana Islands

- Guam

- Minnesota

- Montana

- Nevada

- Oregon

- Washington

In several states, employers are required to pay their tipped workers a minimum cash wage that’s above the federal FLSA rate, which is $2.13 an hour. That means the maximum tip credit can also vary.

For example, in Delaware, the maximum tip credit is $8.27 per hour and the minimum cash wage is $2.23. This comes to a total of $10.50. In Oklahoma on the other hand, the state minimum wage is $7.25 and the maximum tip credit is $5.12, which makes the minimum cash wage $2.13.

Check out this table of minimum hourly wages for tipped employees to find out more about your specific state laws.

Once you’re sure your business is eligible for tip credit, you have to notify your employees verbally or via written notice and keep track of cash wages and tips to ensure you meet the recordkeeping requirements.

Who qualifies for tip credit?

Employers can claim tip credit for any employee who has a job where they regularly get tips, like:

- Bartenders

- Servers

- Hair stylists

- Nail technicians

- Baristas

- Delivery drivers

According to the US Department of Labor (DOL), a tipped worker is anyone who regularly and customarily receives at least $30 per month in tips. However, this number can vary between states.

For example, employees in Vermont need to earn more than $120 per month in tips in a position that requires direct and personal customer service to be considered a tipped employee. In North Carolina, that number is $20 per month. So make sure to always check the requirements in your state to stay compliant.

Additionally, tip credits can only be applied to tip-producing work or tasks that support it as long as the supporting work doesn’t take up a “substantial amount of time.” The DOL’s Dual Jobs final rule, with an effective date of December 28th, 2021, defines that amount of time as either:

- Exceeding 20% of an employee’s workweek

- A continuous period of 30 minutes

For a server, refilling salt and pepper shakers, setting and bussing tables, rolling out silverware, and folding napkins is considered directly supporting work. However, you can’t claim tip credit for non-tipped duties like preparing food or cleaning the bathrooms and need to compensate employees with the total minimum wage amount.

Want to learn more about FLSA tip credit? Check out the DOL’s Tip Regulations under the Fair Labor Standards Act (FLSA).

How to calculate tip credit step-by-step

Calculating tip credit for each of your employees and taking overtime and various taxes into account can be complicated. That’s where your payroll software can help automate the process and reduce errors, but you can follow the steps below if you prefer to do the calculations manually.

1. Collect records for your specific pay period

When gathering your timesheets and tip records for a certain pay period, remember you’re looking for total hours worked and total tips earned.

Let’s imagine your employee, Hannah, worked 40 hours in the past pay period and made a total of $600 in tips. Let’s also assume your state’s maximum tip credit is $5.12, the minimum wage rate is $2.13, and the total minimum wage rate is $7.25.

2. Calculate your employee’s average tips per hour

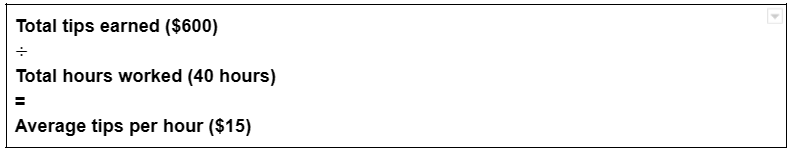

Next, you need to calculate how much Hannah earns in tips on average to find out if the amount exceeds $5.12. Because if you come up with a lower number, she didn’t make enough in tips throughout the past pay period and you’ll need to compensate her for the difference.

Follow the formula below:

That makes Hannah’s average tips $15 per hour within this pay period.

3. Compare your employee’s average tips per hour to your state’s maximum tip credit

Since Hannah’s $15 is higher than $5.12, you wouldn’t be under any further obligation to pay her additional wages and could claim the full tip credit in this example. That means Hannah’s tip credit would be the full $5.12 and you’d only have to compensate her $2.13 per hour plus tips.

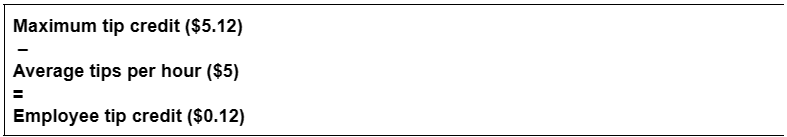

But let’s say another employee, Samantha, only made $200 in tips working the same 40 hours. Her average tips per hour would be $5 ($200 40 hours = $5). In this case, since $5 is lower than $5.12, you’d need to pay Samantha additional wages and wouldn’t be able to claim the full $5.12 in tip credit.

4. Calculate your tip credit

Hannah made enough in tips, which means you can claim the full $5.12 in tip credit. However, you still need to calculate Samantha’s tip credit to understand how much you need to pay her for additional wages. To do that, all you need to do is subtract her average tips per hour by the state’s maximum tip credit.

That makes Samantha’s tip credit $0.12 per hour.

One last tip (credit) from Homebase

FLSA tip credit allows employers to count their employees’ tips towards their minimum wage obligations. And by using this practice, business owners can pay their team members less than the federal or state minimum wage as long as they can make enough in tips to meet — or exceed — the difference.

However, calculating tip credit manually is tricky. Especially when you have to consider multiple employees and locations, overtime rates, withholding taxes, and tip pooling arrangements.

That’s where having a dynamic payroll system can help. Homebase payroll instantly converts your timesheets into hours and wages and sends the correct payments to employees, the state, and the Internal Revenue Service (IRS). That way, you can automate the process and minimize human error so you stay compliant, keep accurate records, and make your employees happy.

FAQs about FLSA tip credit

What is the difference between tip credit and tip pooling?

Tip credit is a practice that allows employers to pay employees less in direct wages than the state or federal minimum wage if they make enough in tips to equal or surpass the appropriate minimum wage rate per hour.

Tip pooling, on the other hand, is when businesses gather a portion or all of the employees’ tips and redistribute them among tipped, and sometimes non-tipped, team members. In many states, mandatory tip pools are legal, which means employers can require their people to participate in tip pooling.

What are the disadvantages of tip credit?

Claiming tip credit can be beneficial for businesses that need to stay on top of their labor costs. However, this practice can make running payroll more difficult since it introduces more calculations and taxes into the equation.

Additionally, since the amount of tips an employee makes depends on the busyness of each shift, tip credit can make fair, equitable employee scheduling more difficult.

How is tip credit calculated?

To calculate tip credit:

- Collect the total hours an employee worked and the total tips they earned

- Calculate the average amount of tips the employee earned per hour

- Compare the employee’s average tip earnings to the state’s maximum tip credit

- If the employee’s average is lower than the maximum tip credit, subtract them from the state’s maximum tip credit to calculate their specific tip credit. That number tells you how much you have to compensate them in additional wages.