If you’re running payroll for your small business, there’s a good chance you may also be handling pre-tax health insurance deductions. This can be a tricky topic, especially if it’s your first time dealing with health insurance for your team. But you can set yourself up for success by understanding how health insurance and taxes intersect and how to best support your hourly employees.

Is Employee Health Insurance Pre-Tax?

Most employer-sponsored health insurance premiums are pre-tax for both employees and employers. For example, if you offer a Section 125 qualified plan (like a cafeteria plan), your premiums will be pre-tax. That means neither employer contributions nor employee deductions will be subject to payroll taxes, which can mean big tax savings for both your business and your employees.

However, not all employee health insurance plans are pre-tax, so always be sure to double-check with your provider.

Pre-tax contributions to health insurance

When running payroll, make any necessary benefit contributions and deductions before you calculate and withhold taxes. Then, you can use that money to make premium payments on time for your plans.

It’s also a good idea to check that you’re properly indicating your benefit contributions on pay stubs, so employees have a record of how much money is being put towards their insurance.

What Other Health-Related Benefits are Pre-Tax?

There are other health-related benefits you can offer to your employees that qualify as pre-tax deductibles. Some examples include:

- Health Savings Accounts (HSAs)

- Flexible Spending Accounts (FSAs)

- Supplemental health insurance coverage

If you’re interested in offering any of these plans, talk to your insurance broker.

S-Corp Owners and Post-Tax Health Insurance Contributions

Generally, employer-sponsored health insurance has pre-tax premiums, but there’s a notable exception, which is health insurance for owners of S-Corporations.

If you’re a greater than 2% shareholder of an S-Corp and your company pays for any health and accident insurance premiums, those premiums are subject to taxes like regular wages. So make sure that no pre-tax deductions or contributions are made via payroll, and include the cost of those premiums in your taxable wage base.

8 More Small Business Tax and Healthcare Questions

1. Does my small business have to offer health insurance?

Small businesses with fewer than 50 employees don’t have to offer health insurance under the Affordable Care Act (ACA). But it’s still a good best practice to cover your employees: they’ll benefit from lower taxable income and healthcare costs, and you’ll attract and retain more employees, as well as get tax breaks for yourself.

It’s also noteworthy that you may qualify for group health insurance if your business has between one and 50 employees. You must have at least one employee besides yourself who works full-time and isn’t a family member.

2. What’s the average cost of health insurance for a small business?

According to a report by Kaiser Family Foundation (KFF), the average small business pays the following:

- $7,813 for individual plans ($6,485 by the employer, $1,328 by the employee)

- $21,804 for family plans ($13,737 by the employer, $8,067 by the employee)

The percentage employers pay also depends on what employees want to include in their plan and what kind of coverage they need.

3. How do I get health insurance for my small business?

Starting the process of looking for small business health insurance can be daunting. Here are some steps you can follow if you don’t know where to begin:

- Collect all the information you need, like business and employee details and budget

- Learn about different health insurance types and decide which one best suits your needs

- Find a broker to help you navigate the insurance market

- Consider joining a trade or professional association to share costs

- Compare and evaluate all of the options from your research

- Choose an insurance plan, sign the paperwork, and inform your employees

4. Which type of health insurance plan should I choose?

Just like many other health insurance-related questions, the answer is “it depends.” Luckily, as a small business owner, you have a smaller number of employees to consider. You probably know them well and can tailor your health insurance plan towards their specific needs.

Younger employees with no dependents, good overall health, and lower savings may prefer a plan with smaller premiums. For instance, shops or restaurants that have lots of student workers. The drawbacks to this route are higher pay-as-you-go costs and unpredictability with your employees’ medical expenses for the year.

Then, there’s the reverse situation. Higher premiums mean lower deductibles and more affordable hospital and medical bills. This is a more appealing option for employees with families and those over the age of 55. In these demographics, minor health problems are more likely to occur and medical bills can pile up more quickly.

5. What percentage of health insurance is paid by employers?

The ACA doesn’t require employers to pay a specific percentage of their employees’ premiums. That said, many states require employers to pay at least 50%, so check your state laws to be sure.

But employers tend to pay more than half of health insurance premiums anyway. According to KFF, employers pay around 83% for single coverage on average. Remember, in many cases, you’re competing with other businesses for the same pool of employees. You can keep yourself competitive by offering attractive health insurance coverage.

Plus, small businesses have smaller profit margins and can’t afford to keep hiring underperforming staff. You need top talent so you don’t lose money through low productivity and high turnover.

6. How do I calculate pre-tax health insurance deductions?

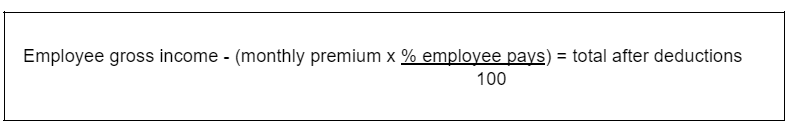

Use a simple formula to calculate what to deduct from your employee earnings for pre-tax health insurance:

Let’s say your employee earns $2,000 a month, their monthly premium is $500, and they pay 25% of the cost:

- 25 divided by 100 is 0.25

- 500 multiplied by 0.25 is 125

- 125 subtracted from $2,000 is $1,875, your total

Don’t forget, you must deduct health insurance before withholdings. And afterwards, you calculate the 7.65 FICA rate based on the adjusted gross income. That’s $1,875 in the example above, not $2,000.

Make sure to explain to employees they can’t claim those premiums back in their tax return because they’ve already received the tax benefit.

7. How do I determine employee eligibility for each health insurance plan?

Generally speaking, employers can offer different health insurance plans to different employees. For example, you can decide to only offer health insurance to full-time employees or more health benefits to more senior staff.

But you must base your decisions on employment-related criteria like working hours, location, and experience. You’ll open yourself up to a discrimination lawsuit if you treat employees differently for any other reason.

Legally, you’re also not allowed to treat people within the same category differently. For example, you can’t single out one full-time worker and give them special treatment.

If you have self-employed people working for you — in a salon or tattoo studio, for example — they’ll be responsible for their own medical insurance.

8. Are dental and vision included in any healthcare plans?

Health insurance plans can include dental and vision, but usually don’t. Employers must add them on separately most of the time. But note that enrollment for this kind of insurance is ongoing, not just at the end of the year.

Consider finding a healthcare plan that includes dental or vision or gives you the option to add them on later. Your employee’s dental and visual health is crucial, especially as most modern businesses involve staring at screens. Routine appointments mean detecting problems early and making sure employees can keep doing their jobs effectively.

Understanding Health Insurance Deductions: Navigating Limits and Regulations

It’s worth mentioning that health insurance deductions do not extend without boundaries.

The IRS establishes yearly caps for contributions to pre-tax plans such as Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs).

Beyond federal oversight, each state may set its own rules concerning pre-tax health advantages.

Ensure you review the latest IRS and state directives to plan your healthcare spending accurately and leverage any available tax advantages.

Get All your SMB Healthcare and Tax Questions Answered with Homebase

Hopefully, you now have a better understanding of pre-tax deductions and health insurance. But maybe you’re still feeling the pressure of choosing the right insurance provider. There’s a lot to get through and even more that could go wrong — like accidentally leaving employees uninsured or getting nasty fines from the IRS.

Take a breath, because we think we’ve got the answer. Homebase’s payroll feature lets small business owners and managers like yourself auto-calculate their payments, including health insurance. Then, you can rest assured that your employees’ healthcare expenses are error-free and taken care of.

With Homebase, you also get total support with all your taxes and healthcare, so you can simply set it up and watch our software work for you. And if you experience any growing pains, our support team will have your back.

FAQs about pre-tax health insurance

Is health insurance a pre-tax payroll deduction?

Most employer-based health insurance is pre-tax and gets deducted from wages before taxes. It’s the employer’s responsibility to calculate the employee’s deductible during the payroll process. Afterward, employers only apply income tax to the leftover pay.

Which is better, pre-tax or post-tax for health insurance?

Pre-tax health insurance is widely seen as better for employers and employees alike. It has tax benefits for both and lets employees enjoy wider and more affordable health coverage.