There’s a reason why small business employers and operators outsource their payroll processes to payroll software.

If you’re the owner of a growing business who feels like payroll takes too much time and energy out of your already busy schedule, you’re not alone. Around 70% of small business owners feel that payroll adds a substantial burden to their workload (1).

It’s not just about tallying up hours and writing paychecks — you have to make sure your payroll is error-free because you could:

- End up losing employees due to a single paycheck error

- Incur steep fines from the Internal Revenue Service (IRS) for late or insufficient tax payments (2)

- Face lawsuits or fines for misclassifying employees as independent contractors (3)

But we’re here to help you research — and compare — the top payroll tools for small businesses. We’ve created this guide to break down the variety of functions that payroll software can perform for you and explore some of the unique features that set each of these tools apart. That way, you can start running payroll with peace of mind and without a lump in your stomach.

- National Federation of Independent Business, 2021

- IRS Data Book, 2021

- National Employment Law Project, 2020

What is payroll software?

Payroll software lets you automate and streamline the process of tracking employee pay, deducting the right state and local taxes, and issuing paychecks and direct deposits regularly. Depending on the provider you choose, payroll software can take you from the beginning to the end of the process — from the moment employees fill out and e-sign their tax documents to when you have to file tax payments and reports. Ultimately, effective payroll software will save you time, resources, and room for error.

Top payroll services for small businesses compared

You may be familiar with one or two of the payroll services listed below, but you might not be aware of what makes these services so valuable to small businesses. Scroll down to check out a table that breaks down six of the top payroll services based on their key features.

Note: The acronym PEPM refers to the “per employee, per month” pricing model that many payroll software providers use.

| Company | Price range per month | Integrated timesheets | Unlimited payroll runs | Automated payroll tax payments and filings | Mobile app | Extra features (including HR tools like time tracking, scheduling, etc.) |

| Homebase | $39 + $6 PEPM to $119 + $6 PEPM | X | X | X | X | X |

| QuickBooks | $37.50 + $5 PEPM to $80 + $8 PEPM | X | X | X | X | X |

| Gusto | $40 + $6 PEPM to $80 + $12 PEPM | With integration | X | X | X | |

| Paychex | $39 + $5 PEPM for their Paychex Flex Essentials plan. Sales team will provide you with a custom quote for their Select and Pro plans. | X | X | X | X | |

| OnPay | $40 + $6 PEPM | X | X | X | X | |

| RUN powered by ADP | Sales team will provide you with a custom quote | X | X | X | X | X |

How to choose the best payroll provider for your small business

Online payroll providers give you the freedom to do payroll by yourself and make the process customizable and less daunting. Still, choosing a payroll software solution alone can be overwhelming, so let’s take a look at what elements you should prioritize while deciding.

Payroll pricing

Small business owners need to save their pennies whenever possible. Even so, it can be tempting for those who feel intimidated by payroll to entrust their processes to an external bookkeeper who promises to take everything off their hands. However, that choice could cost anywhere between $500 to $2500 a month, depending on your needs. There’s a wide variety of payroll software options available now — we’re here to tell you that you can handle the process on your own with the help of the right software.

With that said, you need to decide how often you’re going to run payroll and consider the size of your team to figure out pricing. Most payroll software providers charge a flat monthly fee plus a “per employee, per month” fee that can range anywhere from $5 to $12 per team member. However, some providers will charge you every time you run payroll. So, if you plan on doing payroll weekly or bi-monthly, it may be best to choose a provider that only asks for a monthly fee

You’ll also want to select a payroll provider that’s upfront about pricing and features, as you don’t want to get hit with any additional fees or unnecessary tools that’ll force you to spend more than you planned.

Ease of use

While the term “ease of use” is somewhat relative, great payroll software shouldn’t take you a month to set up, learn, and get comfortable with. And yes, every online tool comes with a learning curve. But the right software for you will be intuitive and intentionally designed to predict how you’ll interact with it. If your platform of choice takes more than a day to figure out, or you can’t make sense of it without a customer service expert, you may want to give it a pass.

Still, the software you choose should offer excellent customer service if you need it. When it comes to support, you should look for:

- A dedicated — and certified — customer support manager or team

- Various ways to get in touch, including by text, email, and phone call

- Short response times

- Plenty of availability throughout the day

Scalability

You don’t have to stick with one payroll provider forever, but it’s simpler to use payroll software that’s built to grow with you. That means you can start with a basic plan that offers all the simple, entry-level features you need. Then, as you gain more experience with the tool and expand your business, you can upgrade to plans that offer more features.

So, for example, if you choose Homebase and start by adding the payroll option onto the free plan, you’ll have access to our payroll tools and our free scheduling, time clocks, hiring, and team messaging features. When the time is right, you can upgrade to plans that include features for performance tracking, labor cost controls and budgets, and HR and compliance.

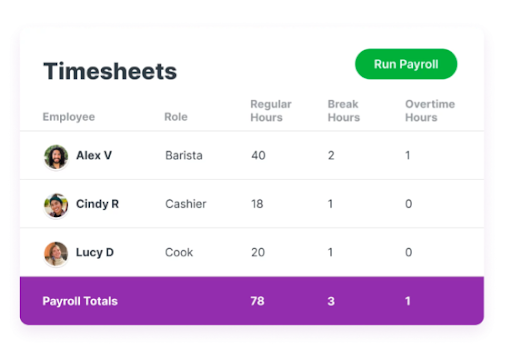

Integrated time clocks and timesheets

If you’ve ever done manual data entry, you know how much concentration it takes to avoid errors. And for small business owners who often employ hourly workers, data entry is extra challenging. You have to transfer employee hours to a timesheet and then convert those hours into wages.

Thankfully, there are payroll providers that include integrated time clocks and timesheets. That means whether employees are clocking out with a mobile app or from your point of sale (POS) system, an effective payroll provider can track their hours and automatically convert them into wages for your timesheets. Some tools even track personal time off (PTO) for you.

Integrations

If you’re the owner of a restaurant or retail store, you may need to use industry-specific platforms like Restaurant365, Bevspot, or Shopventory for inventory and team management. These tools, however, typically don’t have robust payroll features.

Instead of having to transfer that data manually, select a payroll solution that offers dedicated software integrations for the industry tools you need. The small business payroll software you choose should also integrate with your POS so you can track labor and sales costs alongside each other.

Automated tax payments and filings

If your small business tax payments and filings are giving you nightmares, we feel your pain. You don’t want to have to pay tax penalties for underpaying or making late payments, which can add up to 5% to 25% of what you owe.

No need to worry — automated tax payments and filings are some of the major reasons small businesses invest in payroll software, especially if it offers employee self-service.

That means you can ask your employees to self-onboard with a payroll app and fill out their own tax forms when you hire them. And once your payroll platform processes and stores their tax details, it’ll automatically update your timesheets with each employee’s tax information. You won’t have to reference employee W-4s to see how much tax you need to withhold from every paycheck — your payroll software should calculate that for you and even send correct payments to the state and the IRS.

Mobile app

A lot of small business owners try to bootstrap things on their own and are reluctant to rely on administrative and managerial staff. That often translates into wearing a lot of different hats and managing tasks away from their offices and storefronts on their days off. That’s why a payroll provider with a mobile app is a great option for employers who need more flexibility in where they work from day to day.

There are plenty of payroll solutions with mobile apps that’ll let you run payroll from your phone. But some (like Homebase) give employees the option to access their schedules, earnings, pay stubs, and W-2s with the app as well. The Homebase platform will even let employees request early access to their wages and notify them with texts when they get their paycheck.

Taking a closer look at top payroll providers for small businesses

We’ve given you a visual comparison of the top payroll providers side by side, but let’s take an in-depth look at each of them to see what makes them stand out.

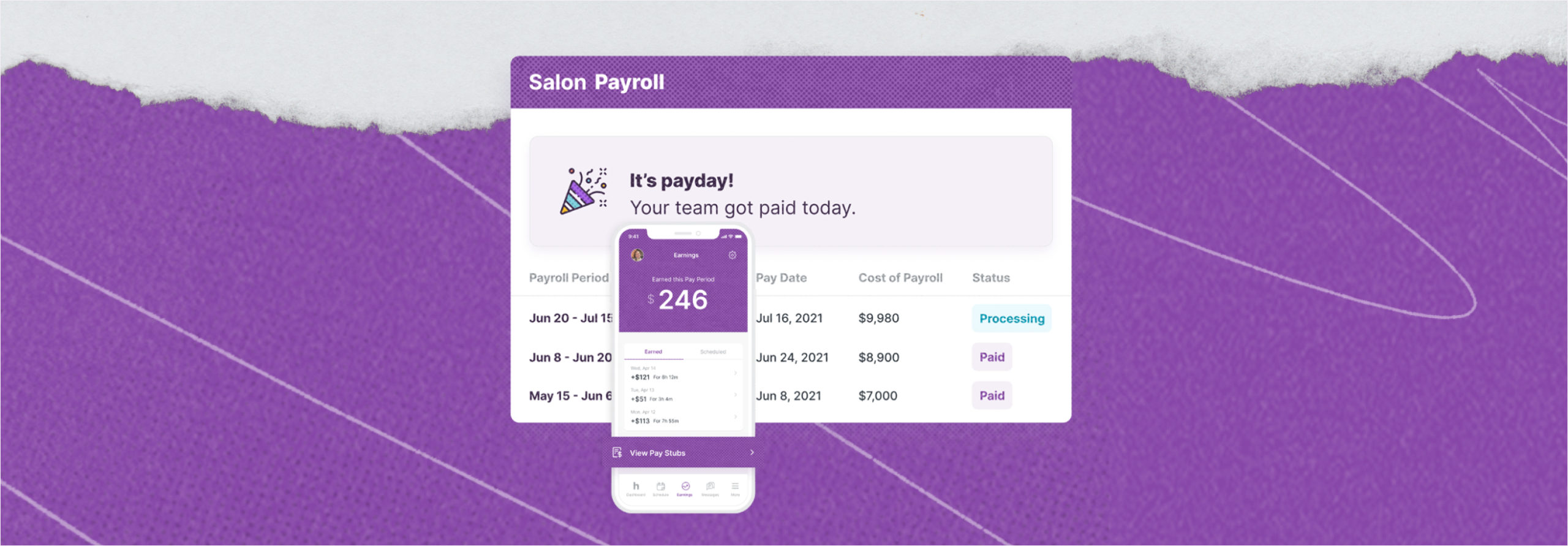

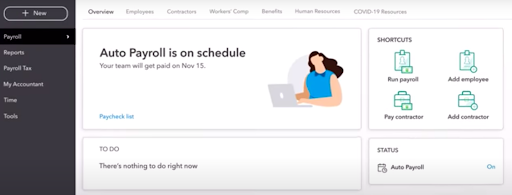

Homebase

Source: https://joinhomebase.com/payroll/

Caption: Homebase automatically converts employee hours into timesheets for payroll.

Homebase is an all-in-one solution that lets small business owners manage scheduling, time tracking, payroll, and HR for their employees. It’s also specifically designed to make managing hourly workers more convenient. We’ve helped small business owners across a range of industries — from food and beverage to retail to beauty and wellness — and we pride ourselves on simplifying processes like payroll, HR, and team management so entrepreneurs can focus on the big-picture tasks that help them grow.

What makes Homebase unique

Homebase users can sign up for the Basic plan for free. They also get access to our easy-to-use tools for scheduling, time clocks and timesheets, messaging, and hiring.

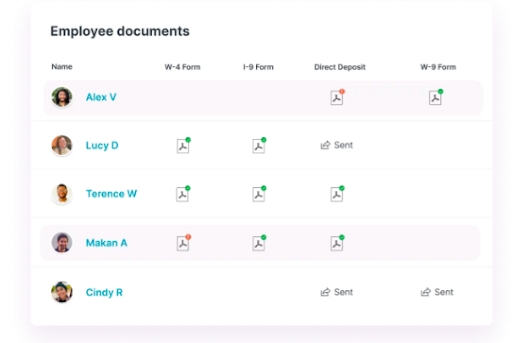

Once you and your employees get comfortable with how our platform works, you can add payroll for $39/month plus $6 per employee per month. Then, you can have your employees self-onboard and e-sign necessary tax documents, like the W-4 and 1099. You’ll also be able to sync your employee time clocks with payroll. That way, when employees clock in and out on the mobile app, our payroll tool will automatically update their timesheets with their wages and tax withholdings.

Source: https://joinhomebase.com/payroll/

Caption: You can store and access employee documents with Homebase’s mobile app.

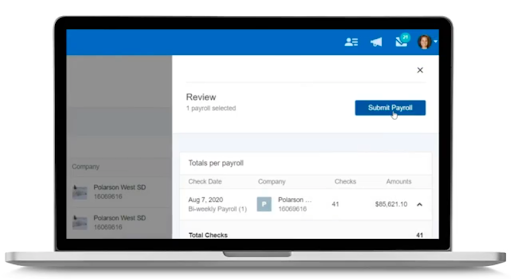

QuickBooks

Source: https://quickbooks.intuit.com/payroll/

Caption: You can bundle QuickBooks Payroll together with your other Intuit products.

You might be familiar with QuickBooks’ accounting software, but did you know they also have a dedicated payroll platform? In fact, QuickBooks lets you bundle its bookkeeping and payroll features together so you can track your business and labor costs side by side.

What makes it unique

QuickBooks payroll is a great solution for people who are looking for a platform that’s compatible and easy to integrate with Intuit’s suite of products.

If you already have a Quickbooks account for bookkeeping, you can activate payroll through QuickBooks Online. And with their Payroll Core plan, you’ll be able to run payroll automatically, but you can also offer your employees next-day direct deposits, 401(k) plans, and health benefits administration and manage it all in one place.

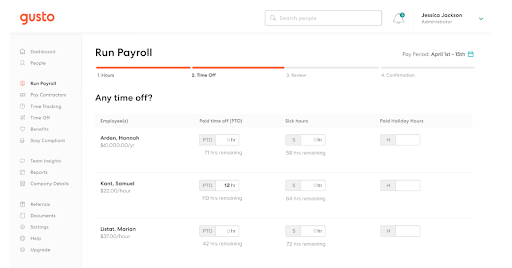

Gusto

Source: https://gusto.com/

Caption: Gusto gives you access to team insights and reports in addition to payroll tools.

Gusto is a widely known small business payroll solution that was initially designed for employees to access and update their payroll information and download their pay stubs. But it has since expanded to include features for tax filing, hiring and onboarding, HR services, insurance, and employee benefits. Gusto also offers integrations for accounting tools like Xero, QuickBooks, and Clover.

What makes it unique

Gusto is great for small business owners in the accounting or personal finance industries. Why? Because with Gusto for Accountants, you can partner with Gusto to access perks like revenue sharing, client discounts, and even earn continuing professional education (CPE) credits.

If you choose Gusto to help you run payroll for your small business, you can also give your employees access to a Gusto Wallet spending account. With that, they can access, track, budget, and spend their paycheck with their Gusto Wallet card.

Paychex

Source: https://www.paychex.com/

Caption: Paychex lets you choose your payroll plan based on your company size.

Paychex offers solutions for payroll, HR, business insurance, employee benefits, and time and attendance tracking. Their Paychex Flex plans, which refer to their payroll bundles, offer three tiers of payroll options for businesses from 1 to 1000 employees. You can also customize each plan to fit your specific needs.

What makes it unique

While it depends on the plan you choose, Paychex Flex is a useful option for new business owners who need some training to get a handle on payroll-related issues outside of their expertise.

With a Paychex Flex Select and Pro Plan, you have access to a dedicated payroll specialist and HR services like training modules that are great for new business owners. And with Paychex’s Flex Pro plan, you can even run background checks.

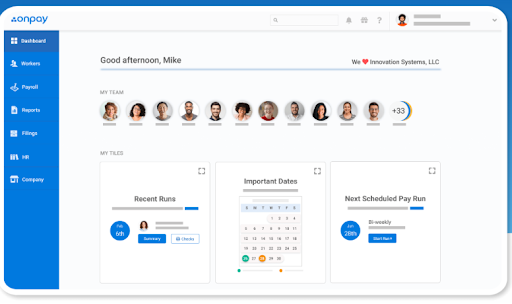

OnPay

Source: https://onpay.com/

Caption: Employees can create personal profiles with OnPay’s platform.

OnPay is a cloud-based business solution that lets you automate your payroll, but it also includes features for HR and benefits. You can integrate OnPay with popular software, including accounting solutions like QuickBooks and Xero, time tracking solutions like When I Work, retirement and 401(k) solutions like Guideline, and HR and compliance solutions like Mineral.

What makes it unique

OnPay lets employees create their own personal profiles within the software, which they can use to access their tax documents and paystubs, which is a helpful HR feature that keeps everyone up to date.

And, if you’re looking for the most affordable insurance plans for your employees, OnPay can serve as your insurance broker and consolidate plans based on your state. They’ll also do the administrative work of updating and managing your health insurance plan once you’ve selected one for your business.

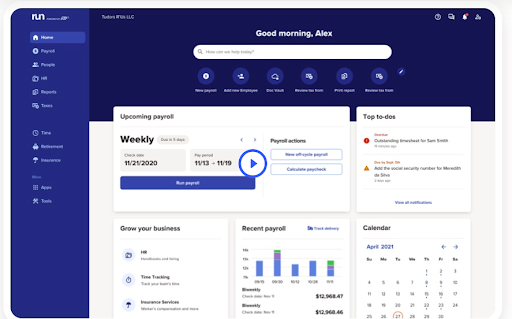

RUN powered by ADP

Source: https://runpayroll.adp.com/

Caption: With a RUN Essentials plan, you can access payroll, taxes, and compliance tools.

ADP has been in the HR and payroll services industry for decades, but the RUN product is specifically designed for small businesses of up to 49 employees. ADP also offers four tiers of plans — Essential, Enhanced, Complete, and HR Pro — that work for businesses at every stage of growth. You can get a custom quote for each plan by contacting the sales team.

What makes it unique

ADP’s most basic plan — the Essentials plan — offers customers assistance with payroll, taxes, and compliance. And with the most popular plan, the Enhanced plan, you’ll get access to features for garnishment payment services, state unemployment insurance (SUI) management, background checks, and job posting with ZipRecruiter.

For businesses with more in-depth HR and legal needs, the HR Pro plan offers access to an HR support team, employer/employee training, business advice, and even legal advice from Upnetic Legal Services.

How Homebase makes small business payroll a breeze

As you research payroll tools for your small business, speak with sales teams, and test out tools for yourself, remember: You can always change your mind in the future.

Because even though there’s a wide variety of payroll tools that claim to be small business solutions, not all of them understand the specific challenges that small business owners — particularly those who employ hourly workers — face.

Homebase understands that retail operators, restaurateurs, and accountants all require different types of solutions. That’s why we’ve made our tools for scheduling, time tracking, team communication, and hiring free, so that you can easily integrate the tools you need with our payroll option. And, with our upfront pricing and intuitive features, we’ve made it super simple and affordable to add payroll tools onto any Homebase plan you choose.

FAQs about payroll software for small businesses

Can I do payroll myself?

You can do payroll by yourself, but without the help of an HR professional who’s knowledgeable about labor law compliance and taxes, it might take you longer than anticipated to run error-free payroll for your employees. However, using full-service payroll software means you can run payroll quickly — and with less risk! — in a few simple steps.

What is a full-service payroll system?

A full-service payroll system is software like Homebase, Quickbooks, or ADP that helps you handle the entire payroll process — from calculating hours to issuing paychecks to filing taxes — without having to outsource to an HR professional. With all of the legal requirements and complexities involved with paying employees, payroll can be an intimidating process for business owners who are new to it. A great payroll provider not only makes the process faster and easier but also acts as a learning tool.

How do I decide on a payroll provider for my small business?

When deciding on a payroll provider for your small business, it’s important to take your specific needs into account and do your research. Even if most business owners you know use a particular payroll provider, that doesn’t mean it’ll work for you. You should also consider whether the platform:

- Offers cost and pricing transparency

- Integrates with the platforms and apps you need

- Provides full-service tax filings

- Can handle different types of pay structures, including hourly pay

- Is scalable, i.e., does it offer features you’ll be able to use as you grow, like onboarding or HR and compliance features?

- Gives employees easy access to their tax and payroll information

- Prioritizes security

- Has a great customer support team

What are the benefits of using payroll software?

There are many benefits to using payroll software. For one, it reduces the time, stress, and cost that’s often associated with the payroll process, but how?

- Fewer payroll errors with automatic tax deductions and filings

- Better compliance with tax regulations

- No need to spend money hiring an HR professional

- Easy integrations with POS and time tracking tools

- Gives employees straightforward access to their payroll information

- Can be used from anywhere with a mobile app

Which payroll software solutions are easy to use?

The easiest payroll software solutions to use are Homebase, Quickbooks, and Gusto, but if you’re a small business owner, you’ll find that Homebase is the simplest for owners and employees alike to set up, learn, use, and scale. And when you sign up for Homebase payroll, you can also get access to the free, integrated tools for scheduling, time tracking, hiring, and team communication that come with our basic plan.

How much should small business payroll software cost?

The cost of your payroll software will depend on the payment model of the payroll provider you choose.

If you choose a provider with a “per frequency” model, you could be paying a base fee for every pay period and every employee. So, for example, if you ran payroll bi-monthly and had five employees, you’d pay $30 for every pay period and $3 for every employee, which would amount to $90 a month to run payroll.

Some payroll providers follow a “per employee, per month” model where they charge you a monthly fixed rate based on how many employees you have. This may work best for you if your payroll schedule changes from month to month.

In a “fixed rate” model, a payroll provider charges based on how many employees you have, usually within a certain range. So, for example, you might pay $150 a month if you have between 10 and 15 employees.

At Homebase, we’ve worked to make our pricing affordable for both small and large teams, so we charge our customers a base fee of $39 a month plus $6 a month per active employee. You also get complete access to all our payroll capabilities, including features for employee self-onboarding and e-signing tax forms.