Many small retail businesses learn to do payroll by themselves. The problem is that it’s easy to get overwhelmed by ever-increasing piles of paperwork and lose sight of the bigger picture — revenue. Before you know it, profits have dipped and you’re left feeling frustrated.

Payroll-to-sales ratio is a crucial part of keeping your business running smoothly, and understanding what it means and how to keep it low will solve many problems along the way.

Here’s our handy run-through of everything you need to know about payroll-to-sales ratios, how to optimize your ratio, and the top ten payroll software for making that happen.

What is payroll-to-sales ratio?

Your payroll-to-sales ratio is the percentage of your revenue that goes to payroll costs. Here, a low percentage is good because it means your business is more profitable. The higher your sales and the lower your labor costs, the smaller your percentage will be.

What’s the optimal payroll-to-sales ratio and how do you get there?

Optimal payroll-to-sales ratios vary between industries. According to a breakdown by Netsuite, the average payroll-to-sales ratio for retail is between 10% and 20%. So, it’s a good idea to make that your benchmark and avoid exceeding 20%.

To get an optimal percentage, you can either increase sales, decrease payroll expenses, or both. But this isn’t easy to put into practice. More on that later.

How to calculate payroll-to-sales ratio

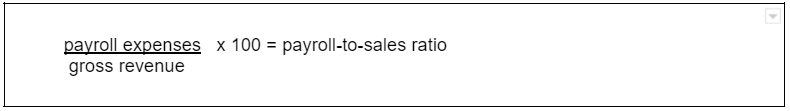

You can use a simple math equation to calculate your store’s payroll-to-sales ratio:

Say your monthly revenue is $25,000 and your payroll expenses are $2750. 25,000 divided by 2750 is 0.11. Then multiply 0.11 by 100, which gets you 11%. That would be your payroll-to-sales ratio.

If the average retail payroll-to-sales ratio is 10-20%, then the retail store in our example is doing very well.

How to keep your payroll-to-sales ratio low

The fastest solution to keeping payroll-to-sales ratio low is simply cutting employee hours. But that’s not a great course of action if you need the employees you’ve got and want to keep them happy. What you do with your employee hours is more important than cutting them down. For example, reducing your percentage to 10% won’t benefit your business if it leaves you understaffed.

Here are some other ways to keep your payroll-to-sales ratio low:

Hire only necessary personnel

Reducing payroll expenses starts with hiring. Or rather, not hiring. Look at everything from your number of shifts to your busiest hours to get an accurate idea of how much support you really need. This will help minimize any money on overstaffing.

Carefully plan employee shifts

Careful scheduling can pay dividends. Get into the habit of assigning shifts in this order:

- Management

- Full-time senior employees

- Newer full-time staff

- Part-timers

By the time you get to scheduling your part-time employees, you’ll just be plugging the gaps in your schedule. You won’t have to squeeze as many of your full-time employees’ shifts into days that are already adequately covered.

Also, share your schedule with your team in advance. If something’s not working, you’ll have plenty of time to address issues earlier. That means there’s less risk of the only available person being on the verge of overtime.

Using employee scheduling tools can help you do both of these things. Simply fill in your budget and employee availability, then watch as the software automatically creates your schedule. Then, you can use an app like Homebase to publish the schedule and make any updates. That way employees always know when they’re supposed to be on shift.

Avoid overtime work

While some overtime may be unavoidable, it’s best to reduce it as much as possible. You have to pay employees time and a half when they work more than 40 hours. This extra cost can add up in time and may lead to burnt out staff if they’re consistently working long shifts.

If you’re wondering why overtime happens, some of the common culprits are poor time management and lack of communication.

To reduce overtime, set alerts when an employee’s overtime is about to kick in. That way, you can make sure they leave their shift before you have to pay them time and a half. If you don’t have any team members available to take over their work, it might be a signal that you have an understaffing issue.

Strategize to increase sales

A low payroll-to-sales ratio could also mean you need to boost your sales. For instance, there might be an issue with bringing in foot traffic or figuring out your best-selling products.

If you’re hitting your quarterly targets but are still struggling, research possible streams of new revenue you can tap into. You could try:

- Getting customer insights on what they like about your store

- Researching new, in-demand products you could bring into your shop

- Revamping your online store or website

- Increasing your social media presence

Have a contingency plan for the slower months

Figure out what to do during the off-season, whenever that might be for you. For instance, shops in beach towns are quiet in winter, but the reverse is true for shops near ski resorts. You could find additional sales elsewhere or make use of your extra time to take care of non-urgent tasks like staff training or reassessing your inventory.

Depending on the kind of business you run, you could also consider hiring seasonal workers and students. If you live near a college campus and have lots of young customers, this is ideal. Your student workers will go back to school as your sales drop, so your ratio will stay the same.

Revise your budget plan weekly

Things change quickly in the retail world, which means store owners and managers often struggle with sticking to a strict budget. Razor-thin profit margins often mean small businesses can’t afford to lose money by overspending on payroll.

A good best practice is to do a weekly budget review. If you check your costs against your budget regularly, you’ll catch errors and overspending sooner and prevent too much damage to your bottom line. Homebase has a nifty labor forecasting tool that gives you an overview of past, present, and future costs.

Develop employee skill sets

Finally, invest in staff training. If you have multi-skilled employees, they can easily hop from one role to another when you need them. That saves you the hassle of finding available staff members when unexpected rushes or tasks come up.

Bonus: Employees will be happier when you invest in their professional development!

Best practices for managing payroll for retail

So far, we’ve covered tips on keeping your payroll-to-sales ratio low, but what about payroll processing itself? Here’s what you need to know about managing your payroll system to bring your payroll-to-sales ratio down and your profits up.

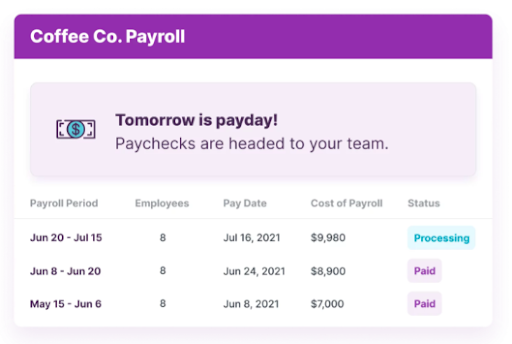

Establish an optimal pay period

Decide how often your employees will get their paychecks. The choice is between paydays:

- Once a month

- Twice a month (e.g., semi-monthly)

- Every week

To decide, weigh your business and employee needs. You might think that going with monthly paychecks is the best option because you’ll have lower payroll processing costs. But don’t forget that employees often find it more convenient and comfortable to have bimonthly or even weekly paydays.

Account for employee work hours accurately

Employees may arrive to shifts late, leave early, and take extended breaks. And all those pesky minutes can eat into your payroll budget and increase the risk of overtime. So, make sure you record the time actually worked, not the time scheduled.

Ask employees to use time cards when they arrive at work and leave at the end of the day to record shifts in real-time. Software like Homebase have a time clock feature that lets employees clock in and out via an app and automatically syncs with payroll. It even has a geofencing feature, so you know everyone’s only clocking in while actually at your premises.

Document everything

Federal law says that you must keep documents for four years after filing your quarterly taxes. This also happens to be a good best practice to follow. Record everything from withholding forms to pre-hiring records.

To ensure you do everything correctly without dedicating every waking second to paperwork, use an HR software compliance feature. Platforms like Homebase take care of compliance work for you, so you can rest easy knowing that you’re doing everything above board and focus on more high-value work like boosting sales.

Keep yourself up to date on payroll tax laws

Small things can trigger a significant change in employee tax status. It could even be something easy to miss, like an employee moving address or turning 50. Learn everything you can about tax laws to avoid doing your payroll incorrectly and consider using compliance tools to aid you.

Vicki Lambert, the Payroll Advisor, tells us that it can cost $300 for every tax error and a whopping $2000 for breaking wage and hour federal law.

Explain your payroll system to employees

Mistakes happen when employees don’t understand your payroll system. But it’s still your responsibility to get everything right. So be explicit about:

- The process you use

- All the codes on their paychecks

- The tax classification system

- How salary is decided

- Procedures for handling mistakes

Use retail payroll software

Luckily, you can outsource your payroll services to a retail payroll solution like Homebase. That way, you’ll be able to streamline your process by automating payroll, tax payments, and filings, and even doing direct deposits. Best of all, you save time but can rest easy knowing that your payroll will be error-free.

10 best retail payroll software tools

Now, let’s look at some of the top payroll software on the market today and their features. It’s worth noting that you can buy some separately, whereas others are part of a human resources software suite.

| Software platform | Main features | Base price (per month) |

| Homebase | Integrated timesheets, unlimited pay runs, auto tax payments and filings, direct deposits, new employee onboarding | $39 +$6 per employee |

| Zenefits | Unlimited pay runs, auto tax payments and filings, direct deposits, garnishment support | Add Payroll to the HR suite for $6 per employee |

| Justworks | Auto tax payments and filing, automated deposits, notifications | $59 per month per employee |

| Gusto | Auto tax payments and filing, unlimited pay runs, garnishment support, new hire reporting | $40 + $6 per employee |

| BambooHR | Auto tax payments and filing, automatic reminders | Contact for an estimate |

| OnPay | Auto tax payments and filing, employee self-service, direct deposits, garnishment support | $40 + $6 per employee |

| ADP | Auto tax payments and filing, direct deposits, new hire reporting | $8 |

| PayChex | Auto tax and filing, direct deposits, garnishment support, employee self-service | $39 + $5 per employee |

| Quickbooks | Auto tax and filing, same-day direct deposits, new hire reporting | Add to the HR suite for $22.50 + $5 per employee |

| Patriot | Auto tax and filing, unlimited pay runs, free expert support | $17 per month + $4 per employee |

1. Homebase

Source: https://joinhomebase.com/payroll/

Caption: Get a complete overview of all your payment processing with Homebase.

Perfect for small businesses with hourly workers, Homebase’s payroll software boasts a wide range of features.

Homebase’s practical automations spare you from data entry by automatically calculating hours, breaks, time off, and PTO out of time clock data. They also pay and file taxes on your behalf and store all the relevant information you’ll need to refer back to. Self-service features also allow employees to e-sign their own payroll forms, so you don’t have to worry about entering their tax details.

With Homebase, store owners can stop thinking about payroll and switch their attention to more pressing issues like sales strategies and employee satisfaction. We’ve also got a handy free plan you can get started with.

2. Zenefits

With Zenefits’ user-friendly platform, it’s easy to make payroll submissions. That means employees get to grips with it in no time, and clocking in and out is also very convenient with the slick functionality of their mobile app.

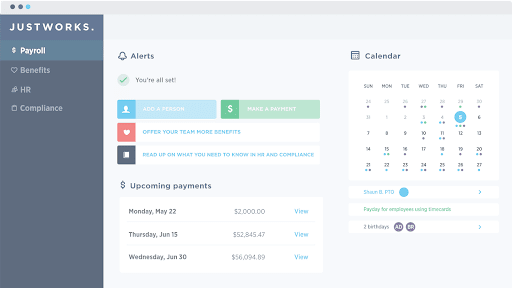

3. Justworks

Source: https://www.justworks.com/

Caption: Justworks keeps payroll management simple and accessible.

Justworks is an all-in-one human resources platform. They offer a simple, hiccup-free payroll solution that can help solve lots of common administrative problems. Their simple interface means you can access everything you need easily and conveniently, so you won’t get bogged down in details.

4. Gusto

Gusto’s platform has it all, including features for payroll, employee benefits, time & attendance, hiring & onboarding, and talent management. There’s truly something for every use case. Their software will also charm employees with its easy-to-use dashboard and pay advance feature.

Most importantly, Gusto’s payroll tool is super user-friendly and intuitive, so you can process yours in just a few clicks.

5. BambooHR

BambooHR simplifies payroll by making every part of the payroll process crystal clear. It lets you keep track of all your staff data and even reminds you when employees have upcoming birthdays. And if you need help with anything, their enthusiastic support team will be happy to walk you through it.

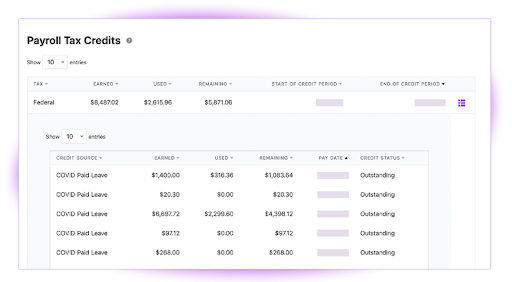

6. OnPay

With OnPay, you get a range of HR and payroll services that are simple yet effective. Many users compliment the platform’s flexibility and speed in handling day-to-day payroll processes. They’ve also got specialized payroll services for businesses and organizations like restaurants, farms & agriculture, nonprofits, and churches.

Source: https://onpay.com/payroll/software

Caption: OnPay has a simple, easy-to-use dashboard.

7. ADP

ADP is an HR and payroll system that’s perfect for businesses of all sizes, whether you’ve got 1 or 1000 employees. They have a wide range of features beyond just payroll, including benefits and insurance, HR outsourcing, and compliance services and are passionate about providing a seamless user experience and excellent customer service.

8. PayChex

PayChex was built specifically for payroll processing. It makes business owners’ lives easy with its highly accessible platform and customer support features. Employees can also take advantage of PayChex’s useful self-service tools, and you can run analytics on what they most often use the app for.

9. QuickBooks

Quickbooks is a robust payroll platform that helps thousands of small businesses stay compliant with ease. In fact, if a customer makes an error while using their system, they take responsibility by helping you to resolve it and reimbursing you up to $25000.

Quickbooks also offers same day deposits for paydays, so your employees won’t have to wait.

10. Patriot

Source: https://www.patriotsoftware.com/payroll/

Caption: Use Patriot to start up your small business.

Made for anyone from small businesses to accountants, Patriot has a simple three-step payroll process. It’s a great option for retail businesses starting out as it’s simple and affordable but has all the payroll features you need. Onboarding is especially easy with their Setup Wizard feature.

How managing your payroll-to-sales ratio can benefit your retail store

When we’re talking about payroll, the stakes are high for businesses of all sizes — and especially for small retail businesses. One bad move, and you lose revenue. Or worse, incur a hefty tax fine.

But, not to fear. If you understand your payroll-to-sales ratio, you can see whether you’re in the optimal range and strategize accordingly. It’s just a matter of pushing your percentage down by increasing sales and cutting unnecessary payroll costs.

All-in-one HR software like Homebase can provide you with an actionable payroll solution. Our platform can save you time, spare you unnecessary costs, and put an end to sleepless nights come tax season. Best of all, it’ll help you lower your sales to payroll ratio and prevent wages from eating up your profits.

Retail payroll FAQs

What is the average payroll percentage for retail?

The average payroll-to-sales percentage for retail is between 10%-20%. It’s lower than in most other industries because retail has fewer non-sales-based employees.

How do you manage a payroll budget for a retail store?

Retail stores can manage their payroll budgets by creating a list of all their payroll expenses and including everything from bonuses to projected overtime. Then, it’s time to determine where costs can be reduced.

How can I save money on payroll?

You can save money on payroll by focusing on staffing, sales strategy, and training. Aim to reduce overtime and staff turnover as much as possible. But remember that you should only try to reduce unnecessary hours and not understaff your business.