Homebase Cash Out

A free benefit for your team

Your employees can access a portion of their earned wages before their next payday, to help them:

- Cover unexpected expenses

- Prevent overdraft fees

- Avoid payday loans

No Hassle

Easy for you and your employees

No cost to you

Cash Out is available to all employees with a bank account or debit card and won't cost you an extra fee or require you to be on a paid plan.

No changes in payroll

The money is sent from Homebase to the employee. When the employee gets their paycheck, they pay back Homebase directly. You don’t have to change anything or do anything.

Nothing to set up

The employee handles setting up Cash Out for themselves directly on their mobile phone, no work or action is required on your end.

Why offer it?

Provide help to your employees between paychecks at no cost.

There is a lot to love

- Attract employees with this new perk.

- Avoid cash advance requests.

- Stay competitive with how employees are now getting paid with gig work.

- Reduce turnover by keeping employees happier.

- Improve employee financial wellness: help them avoid costly payday loans or overdraft fees.

Watch how it works

Cash Out User

Why Cash Out?

Cash Out is here to help your team

A benefit with no hassle!

- No cost to you

- No employer liability

- No change to your payroll

- No process changes

- No accounting shenanigans

- Not a payday loan

How it works

- Finish shifts Once your employee has worked enough hours during the pay period, they can access Cash Out.

- Connect bank Your employee securely connects the bank account where they get direct deposit paychecks.

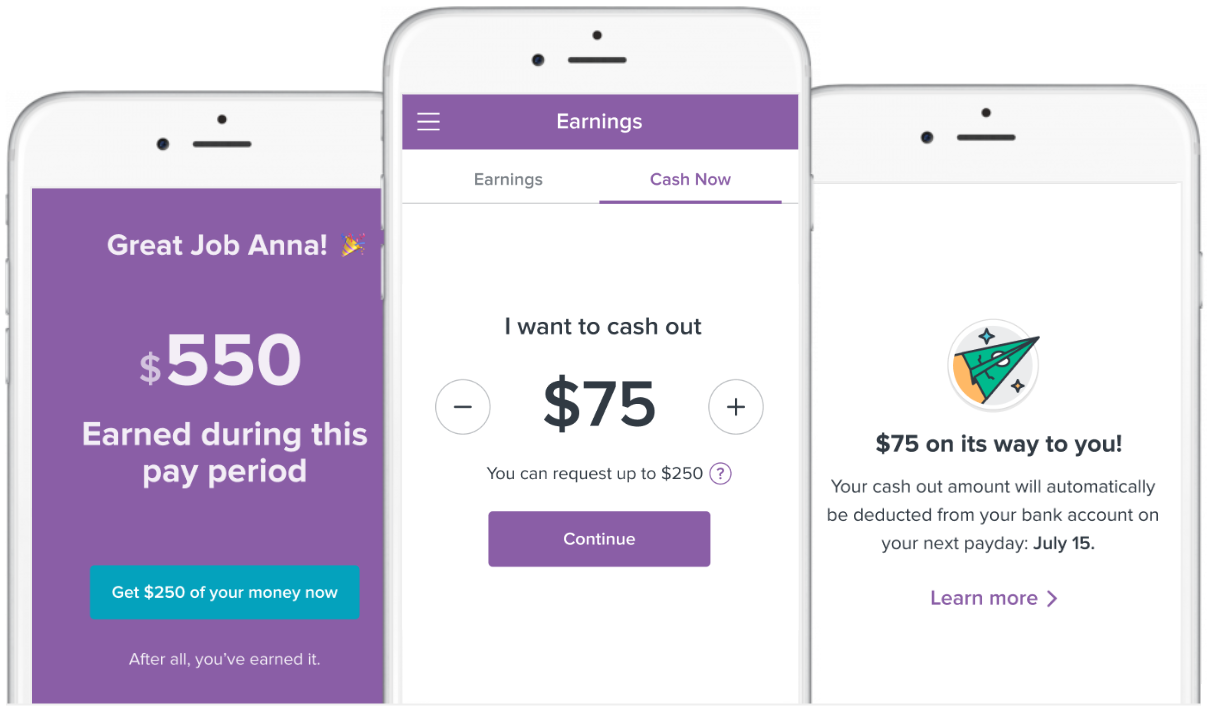

- Select Cash Out Employees can select how much to cash out and how quickly to receive it. Fees apply for instant Cash Outs.

- Receive Cash The Cash Out is sent directly to their bank account. On their next payday, Homebase collects the cash out back from their account.