Giving employees bonus pay can bring massive benefits to your business. You can thank people for doing great work and incentivize them to hit targets, which boosts engagement and productivity.

But it can be challenging to decide what type of bonus pay will work best for your team, as well as figure out which bonuses are mandatory and which are optional. It’s also crucial to know your tax obligations if you pay bonuses, which can feel intimidatingly complex to figure out alone.

Once you know the key facts about bonus payroll and get the right tools in place to help you run it, you’ll be able to manage it quickly and easily. Then, you can get right back to rewarding your incredible employees in a meaningful way.

What is Bonus Pay ?

Bonus pay is extra money you pay your employees on top of their regular earnings. For example, you can use them to:

- Thank team members for their contributions to your business

- Motivate people to consistently perform at their best

- Reward staff for exceptional work

When people talk about bonuses, their minds typically jump to those that come at the end of the year. But bonus pay is a flexible term that can refer to any extra amount of money that’s paid out at any time of the year.

Bonus pay can also be a recurring or one-off payment, and Homebase payroll lets you calculate both kinds.

It’s also important to recognize that, depending on the business and industry, bonuses can make up a substantial portion of your employees’ income. For example, in the US, the average bonus pay for hourly workers is around 5.6% of their salaries, which equates to over a month’s wages.

Why Should You Award Work Bonuses?

Bonus pay isn’t required by the Fair Labor Standards Act (FLSA). But many businesses pay it out because of the advantages it offers, including:

- Incentivizing employees to work efficiently and meet targets.

- Encouraging great customer service, which boosts five-star Google reviews and positive word-of-mouth recommendations.

- Helping staff become more emotionally invested in their work and enjoy it more. In fact, workers who get bonuses are 8x more engaged than those who don’t.

Well-managed bonuses show staff you appreciate and value them and their work. And happier employees are also more likely to show up on time, stick to their allotted breaks, and follow internal policies. They’ll probably want to stay at your business for longer, too, which reduces recruitment and training costs.

Bonus Pay Tax Rates 2024

Alabama

Alabama’s state tax imposes a 5% rate on bonuses. These specified rates are applicable when bonuses are disbursed separately from regular salary. Conversely, combining a bonus with a regular salary alters the tax treatment, potentially changing the applicable tax rates since the aggregate is considered a single payment for taxation.

Alaska

Alaska imposes no state income tax, hence, no state taxes are deducted from bonuses. This means an employer in Alaska will only withhold federal taxes at the specified rates for bonuses, with no state tax considerations.

Arizona

Arizona imposes a flat state income tax rate of 2.5% on all earnings, including bonuses. These taxation rates are calculated on the bonus’s total amount before any deductions are made. Employers have the option to use either the percentage method, which taxes the bonus at a specific rate, or the aggregate method, which combines the bonus with regular wages to calculate the total tax withholding.

Arkansas

Starting from January 1, 2024, Arkansas will implement a new withholding rate of 4.4% for supplemental income like bonuses, down from the prior 4.7%. This adjustment pertains only to state taxes on such income, excluding federal taxes which remain at 22% for bonuses up to $1 million and 37% for those exceeding this amount.

California

For 2024 in California, bonuses and stock options fall under supplemental income and face a 10.23% tax rate. Other forms of supplemental pay are subject to a 6.60% tax rate.

Colorado

Colorado maintains a universal income tax rate of 4.4%, applicable to all earnings, including bonuses. Bonuses, categorized as supplemental income, also incur federal taxes—22% for amounts up to $1 million and 37% for amounts above. When bonuses are issued separately from regular wages, they are taxed at these federal rates alongside the state’s 4.4% rate. For instance, a $1,000 bonus in Colorado would attract $220 in federal tax and $44 in state tax, totaling $264 in taxes, leaving the recipient with $736.

Connecticut

Connecticut does not set a distinct supplemental withholding rate for bonuses. Employers must apply the aggregate method, incorporating the bonus into the employee’s gross wages from the most recent pay period to calculate state income tax. The 2024 adjustments in Connecticut’s income tax rates include a decrease to 2% for the first $10,000 of income for single filers ($20,000 for married filing jointly) from the previous 3%. Income beyond this up to $40,000 for singles ($80,000 for married couples) is taxed at 4.5%, reduced from 5%. Tax relief is limited for those earning above $150,000 (single) or higher for married couples, with the top tax rate at 6.99%. Thus, a bonus’s tax rate in Connecticut for 2024 relies on the individual’s total income within these brackets, contrasting with federal bonus taxation at flat rates of 22% for up to $1 million and 37% for higher amounts.

Delaware

No state supplemental rate; withhold state income tax as if the total of the supplemental and regular wages were a single wage payment for the regular payroll period

Florida

No state income tax or supplemental rate.

Georgia

In Georgia, bonus pay tax rates are determined by the employee’s annual salary. The tax rates on supplemental wages, like bonuses, are set as follows: 2.0% for earnings under $8,000; 3.0% for $8,000 to $10,000; 4.0% for $10,000.01 to $12,000; 5.0% for $12,000.01 to $15,000; and 5.49% for amounts over $15,000. These rates, applicable to bonuses paid separately from regular wages, come in addition to federal and other payroll taxes.

Hawaii

In Hawaii, bonuses do not have a distinct tax rate at the state level but are taxed according to the same rates as other forms of income. The state’s income tax structure is progressive, with rates from 1.4% to 11% over 12 brackets, based on income levels.

Idaho

The state imposes a sales tax of 6.00%, with local jurisdictions able to add up to a 3.00% additional sales tax. This results in an average combined state and local sales tax rate of approximately 6.02%.

Illinois

Bonuses in Illinois fall under the category of supplemental income and incur federal as well as state taxes. The state imposes a uniform tax rate of 4.95% on all forms of income, bonuses included, meaning your bonus will attract this state tax rate alongside federal taxation.

Indiana

Indiana applies a 3.23% tax rate on supplemental wages, including bonuses. The Indiana Department of Revenue mandates that withholding for these one-time or irregular payments be calculated without exemptions.

Iowa

In 2024, Iowa imposes a 6.0% tax rate on supplemental income, encompassing bonuses, commissions, and overtime. This distinct taxation, separate from that of standard salary, is managed in two ways: the percentage method, which deducts a set rate directly from supplemental earnings, and the aggregate method, which merges these earnings with regular pay within a pay period, applying tax rates in accordance with the employee’s W-4 form.

Kansas

For 2024, bonuses in Kansas are subject to a supplemental state tax rate of 5%, which is levied on top of any federal taxes that may apply. This particular rate deals exclusively with the taxation of bonuses within the state.

Kentucky

In 2024, Kentucky has set its individual income tax at a rate of 4.0%, showing a decrease from the rate in the previous year. The state applies this rate uniformly under its flat tax system, which means the same rate is used for all income brackets, including bonuses. Unlike federal returns, Kentucky permits itemized deductions on state returns but does not provide for standard or personal exemptions.

Louisiana

Louisiana does not apply a specific supplemental tax rate for supplemental wages such as bonuses. Instead, it taxes these earnings at the same standard income tax rates applicable within the state. This policy places Louisiana among those states that, while imposing an income tax, do not differentiate tax rates for supplemental earnings

Maine

For 2024, bonuses paid in addition to usual salaries in Maine will incur a 5% supplemental tax. This specific rate is relevant when bonuses are distributed independently of regular pay. Income earned beyond bonuses falls into various tax brackets, with the highest bracket taxed at 7.15% for incomes exceeding $54,450 for individual taxpayers and $108,900 for joint filers.

Maryland

For bonuses, Maryland integrates a 5.75% state bonus tax rate with local tax rates to determine the total tax liability.

Massachusetts

This state does not assign a unique supplemental tax rate for bonuses, adhering instead to its regular income tax framework.

Michigan

Michigan treats bonuses the same as regular income, without a separate supplemental tax rate.

Minnesota

A 6.25% supplemental tax rate is applied to bonuses in Minnesota, reflecting a distinct policy towards supplemental wages.

Mississippi

Mississippi follows the same protocol as Massachusetts and Michigan, applying its standard income tax rules to bonuses without a separate rate.

Missouri

Missouri designates a 4.8% tax rate for bonuses, aligning with states that implement specific rates for supplemental income.

Montana

Bonuses in Montana are subject to a 5.0% supplemental tax rate, illustrating a deliberate strategy for taxing such income.

Nebraska

Nebraska also enforces a 5.0% tax on bonuses, showing a consistent method in handling supplemental earnings.

Nevada

With no state income tax, Nevada does not impose any tax on bonuses or other income at the state level.

New Hampshire

Similar to Nevada, New Hampshire’s lack of state income tax means bonuses are not taxed at the state level.

New Jersey

New Jersey treats all wages the same for tax purposes, not setting apart bonuses with a unique tax rate. It adheres to its overall income tax rules that apply universally to wages.

New Mexico

In New Mexico, a specific 5.9% rate is applied to bonus payments, showcasing a deliberate policy to manage supplemental wages distinctively.

New York

New York taxes bonus payments at a significant rate of 11.7%, highlighting its policy to levy a higher tax on supplemental wages.

North Carolina

A 4.6% tax rate on bonuses is enforced in North Carolina, demonstrating its policy to treat supplemental wages differently from regular income for tax purposes.

North Dakota

With a 1.5% tax rate on bonuses, North Dakota adopts a gentler approach to the taxation of supplemental earnings compared to other states.

Ohio

Ohio mandates a 3.5% withholding rate on supplemental wages such as bonuses and commissions, following specific state regulations.

Oklahoma

In Oklahoma, a 4.75% rate is applied to supplemental wages, demonstrating the state’s targeted approach to these earnings.

Oregon

Oregon’s supplemental wages, including bonuses, are taxed at an 8% rate, showcasing a heavier taxation strategy on such income.

Pennsylvania

Pennsylvania treats bonus payments like regular income, adhering to its overall income tax rules without a separate rate for supplemental pay.

Rhode Island

Rhode Island imposes a 5.99% tax rate on bonus payments, illustrating its specific taxation policy for supplemental earnings.

South Carolina

For bonus or supplemental wages, South Carolina adheres to the regular income tax protocols, eschewing a separate supplemental tax rate.

South Dakota

Given the absence of state income tax, South Dakota does not levy taxes on supplemental or bonus wages at the state level.

Tennessee

Tennessee, lacking a state income tax, does not tax supplemental or bonus wages at the state level.

Texas

Texas, aligning with South Dakota and Tennessee, does not impose state income tax, thus exempting supplemental or bonus wages from state-level taxation.

Utah

Utah applies its regular income tax procedures to bonus or supplemental wages, without a separate tax rate for these earnings.

Vermont

For bonuses or similar payments, the supplemental tax is calculated as 30% of the federal withholding amount for general supplemental wages. If it falls under a nonqualified deferred compensation plan, the rate is 6%.

Virginia

A supplemental tax rate of 5.75% is applied to bonuses and other supplemental wages.

Washington

The state does not impose a personal income tax, so bonuses and similar payments are not subject to a supplemental tax rate.

West Virginia

Supplemental tax rates are adjusted according to annual gross salary, with rates varying within specific salary brackets.

Wisconsin

The state sets its supplemental tax rates based on the annual gross income, applying different rates across various salary bands.

Wyoming

As there is no personal income tax in Wyoming, there is no supplemental tax rate for bonuses or similar payments.

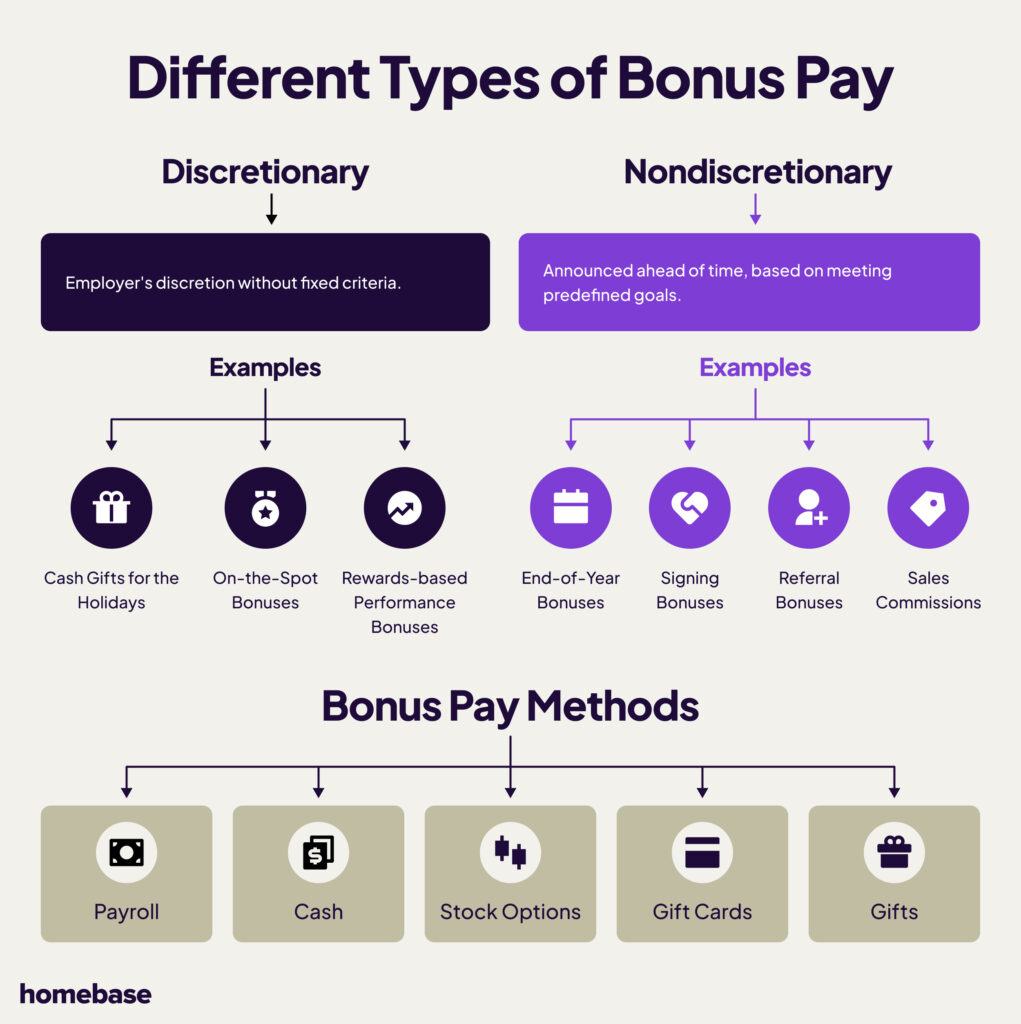

What are Different Types of Bonus Pay?

There are several different types of bonus pay, but here are some of the most popular ones:

Discretionary Bonuses

A discretionary bonus is a special type of bonus pay given by an employer to an employee as a reward for their exceptional performance or contributions. Unlike regular bonuses, it’s not guaranteed or based on specific criteria, but rather at the employer’s discretion.

Some examples include:

- Cash gifts for the holidays

- On-the-spot, one-off bonuses for exceptional work

- Rewards-based performance bonuses

Nondiscretionary Bonuses

A nondiscretionary bonus is a type of bonus pay that an employer is obligated to give to an employee based on specific criteria or conditions. Unlike discretionary bonuses, which are given at the employer’s choice, nondiscretionary bonuses are typically outlined in a contract or company policy.

These bonuses are given when certain goals, like reaching sales targets or completing a project on time, are met.

They may include:

- End-of-year bonuses

- Signing bonuses

- Referral bonuses

- Sales commissions

- Goal-based performance bonuses

How to Pay a Bonus

When it comes to payout methods for bonuses, there are various avenues that companies can use.

Payroll

Using payroll to distribute bonuses means that the bonus amount is added to an employee’s regular paycheck. It’s a simple and convenient method because the bonus is treated as part of their usual salary and follows the same deductions and taxes. This ensures employees receive the bonus along with their regular pay, making it easier to manage their finances and taxes.

Cash

Another way to pay bonuses is to give them in cash. This is a more immediate way of literally handing money to your staff and showing them your appreciation. It may also feel more tangible because employees can actually see and feel the money.

However, when you pay bonuses this way, they’ll still be subject to the same tax rules as when you do it with an electronic payroll process. So, cash bonuses can end up being a hassle for both employees and employers.

Stock Options as a Bonus

Offering employee stock options (ESOs) means giving team members shares in your business. Staff are able to buy shares at a set price rather than the (usually higher) market rate. That means if they sell their shares later, they’ll very likely make money.

If your company is doing well, offering ESOs is a good form of compensation. It can also incentivize staff to stay longer as they may want to wait until their ESOs mature or the share price rises before selling.

Giving more shares the longer an employee stays with the company can also boost retention.

Gift Cards

Gift cards reward employees with a voucher for a specific brand or product type. They may be more personal and can even send a powerful message.

For example, if you give employees a gift card for a wellness day or a massage at a local spa, you’re encouraging them to take a break, which could be a very welcome surprise.

However, this option may be risky because:

- It may be difficult to know what to get an employee, especially if you don’t know them well.

- Some staff, especially if they’re struggling financially, may prefer money to a gift card so they have more choice of what to spend it on.

- It may increase employee frustration if the gift card is for a brand or item they don’t like or won’t use.

- Bonuses are typically worth more than gift cards (for example, $1000 vs. $100). As a result, gift cards might seem tokenistic to some employees.

However, gift cards may be a great option for your business if you can’t afford to give sizable bonuses but still want to show your appreciation. They may also work well for smaller businesses where managers know their employees better.

Gifts

Offering team members gifts is another option. However, they carry a lot of the same risks as gift cards.

Giving gifts in a business setting may also blur boundaries between personal and professional relationships and create a sense of indebtedness. In extreme cases, it may also put you on the wrong side of bribery laws, especially if the gift is of high value.

Gifts also shouldn’t be confused with regular supplies that employees need and should be given anyway. That might include a computer, technical support, safety equipment, or a car fuel allowance.

However, when chosen carefully, gifts can be a nice touch. Some ideas are:

- A bottle of wine during the holiday season (or a non-alcoholic option)

- Pizzas for the whole team on Friday lunchtimes (including options for special dietary needs)

- A group meal paid for by management to celebrate a productive quarter

- A high-value watch to thank an employee for their many years of service

How to Calculate Bonus Pay

Different companies use different methods to calculate bonus pay based on their industry and specific business. Here are some common ones:

Bonus Pay as a Sales Commission

Companies use this method to reward salespeople. The bonus amount is calculated by multiplying the total sales made by a predetermined bonus percentage.

For example, if you made $10,000 in sales and the commission rate is 5%, the calculation would be: $10,000 x 0.05 = $500.

Bonus Pay as a Percent of Salary

This method is used for managers or department heads who determine bonuses based on a percentage of each employee’s salary. The calculation involves multiplying the employee’s salary by the bonus percentage.

For instance, if an employee earns $50,000 per year and the bonus percentage is 3%, the calculation would be: $50,000 x 0.03 = $1,500.

Sign-on Bonus Pay

Sign-on bonuses are typically flat rates given to new hires. If the bonus is paid in increments over a contract period, you divide the bonus amount by the contract length.

For example, if the sign-on bonus is $1,000 and the contract length is five months, the calculation would be: $1,000 / 5 = $200.

Discretionary Bonus Pay Calculation

As a bonus pay example, let’s say you have a small cafe.

You have three full-time employees and two part-time employees, so five in total. Your full-time staff each work 35 hours a week. Your part-time staff each work ten hours a week.

Your bonus budget is $5000 in total.

So to keep your bonus payments fair, you’d calculate:

- Everyone’s total hours: 35 + 35 + 35 + 10 + 10 = 125

- The bonus amount divided by that number: 5000 ÷ 125 = 40. (Each hour worked = $40)

- The full-time workers’ hours multiplied by this rate: 40 x 35 = 1400

- The part-time workers’ hours multiplied by this rate: 40 x 10 = 400

So, you’d give your full-time workers $1400 each and your part-time workers $400 each.

This is a more accurate reflection of each employee’s contribution to your business and is much less likely to cause resentment than if you simply divided $5000 by five.

Nondiscretionary Bonus Pay Calculation

Calculating nondiscretionary bonuses isn’t the same as calculating discretionary bonuses. You need to use other formulas.

For one-off nondiscretionary bonuses, you might decide on a suitable amount for the situation, your business size, and your industry. For example, salons might pay $1000 for each employee referral that stays around for at least six months.

For recurring nondiscretionary bonuses based on employee tenure, role, and performance, you have to get each individual’s data for every criterion and multiply their average monthly salary by those numbers.

Nondiscretionary Bonus Pay Calculation Example

Let’s see how this calculation works in action.

For example, you have a supervisor who has worked at your cafe for four years.

They made $25 000 in sales over the past year and earn $2500 per month.

So, with the formula above, you’d use:

- Their percentages: Tenure = 110%, role = 110%, and sales = 120%

- Their monthly salary multiplied by those percentages: 2500 x 1.10 x 1.10 x 1.20 = 3630

So, the supervisor’s bonus would come to $3630.

What is the Tax on Bonus Pay?

When it comes to taxes on bonuses, things can differ based on where you live. Generally, both the employer and the employee have tax responsibilities. For employees, bonuses are considered income and need to be taxed, similar to their regular salary.

The employer usually takes care of deducting the taxes from the bonus amount and sending them to the government on behalf of the employee. Different places may have specific tax laws on bonus pay, like higher tax rates or special rules.

It’s a good idea to check with a tax professional or look up the tax laws in your area to understand how bonuses are taxed and any important rules you should know.

Bonus Pay Tax Rates 2024

3 Ways to Handle Bonus Payroll Taxes

There’s no legal way to pay employees bonuses without taxes. And you have three options for taxing and processing bonus payments:

- Run separate bonus payroll (“the percentage method”)

- Include the bonus in your regular payroll run and denote it (“the aggregate method”)

- Include the bonus in your regular payroll but don’t denote it (not recommended)

1. Run Separate Bonus Payroll (“The Percentage Method”)

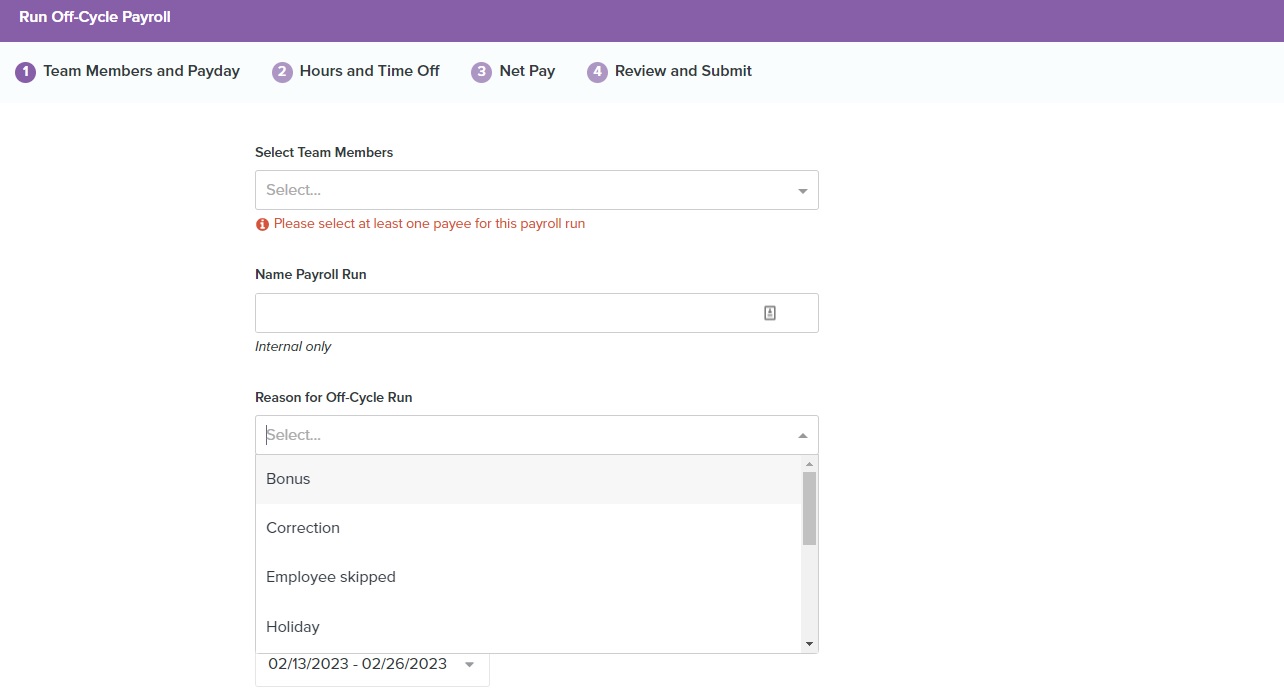

Caption: Homebase payroll makes it easy to run separate payroll. Just select the team members you want to include and select the reason for the off-cycle payroll (for example, a bonus).

If you run separate bonus payroll (as opposed to your regular payroll), employees will get their bonuses on a separate check.

You’ll have to withhold income tax at a rate of 22% — the flat withholding rate for all supplemental pay under $1 million in the United States. The bonus will also be subject to other regular payroll taxes.

Advantages

- Easy to calculate as a flat percentage, so less error-prone. And if you’re using Homebase payroll to calculate and send tax payments, you’ll spend very little time on the process.

- Employees may prefer it. If they’re in a tax bracket equal to or higher than 22%, they’ll pay less tax.

Disadvantages

- Some employees may not like it. If a worker is in a lower tax bracket, this method could result in over-withholding.

In the above situation, the team member can claim the money back, but they’d probably prefer to avoid the paperwork. Also, getting a bonus now rather than later could make a big difference to their finances.

That’s one of the reasons why the best way to pay employee bonuses is through the aggregate method.

Homebase lets you run separate payroll easily:

- In your Payroll dashboard, click Payroll Runs on the left dashboard.

- Under Payroll Actions to the right of the screen, click Run off-cycle payroll.

- This screen (pictured above) is where you choose which team members to include and the reason for the payroll (like bonuses).

- You can then select the pay period and payday and choose whether you want to enter hours manually or import time cards.

- You can then add time off, other earnings, and tips.

- Hit Next to review and submit the run. Homebase will make sure that everything adds up correctly for you.

2. Include a Bonus in Your Regular Payroll Run (“The Aggregate Method”)

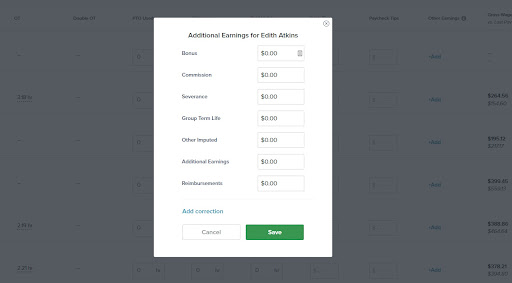

Caption: Homebase payroll lets you add additional earnings when you run payroll by clicking on each team member.

When using the aggregate method of withholding, bonuses should be paid through payroll. That means including them alongside your employees’ regular wages but indicating them clearly.

This method is more complicated but still manageable, especially if you have support from your payroll provider or use Homebase payroll.

To calculate your taxes with the aggregate method, take the following steps:

- Calculate the income tax you need to withhold on the regular pay and bonus combined.

- Calculate the amount you need to withhold on your employee’s regular wages.

- Subtract (2) from (1) to get the total tax you must withhold from the bonus.

|

Imagine you have an employee whose annual salary is $12 500, so around $1400 per month. That puts them in the 12% tax band. One month, you give them a bonus of $500. You’d have to calculate:

So, you’d withhold $60 from that employee’s bonus pay. |

Homebase lets you run this kind of payroll easily:

- In your Payroll dashboard, click Payroll Runs on the left dashboard.

- Click the green button near the top of the screen that reads Run Payroll or Resume Payroll.

- On the page that appears, you’ll see a list of your team members.

- For each team member, you have the option to click +Add under the Other Earnings column.

- For each team member you want to add a bonus for, hit +Add and enter the dollar amount in the Bonus box.

- Hit Save or the Enter key.

- The bonus amount will show up in the Other Earnings column for each team member.

- Hit Next and Homebase will take care of and check all the calculations.

Caption: Homebase will automatically check that your payroll adds up and makes sense.

3. Lump the Bonus in with Regular Wages (Not Recommended)

Technically, there’s a third option. You could increase your employees’ regular wages and not indicate their bonus. That means you’d withhold taxes on their combined wages and bonus pay as though it was all regular pay.

This might seem like an easier option, but it could cause problems for your business and staff, and we don’t recommend it.

The Internal Revenue Service (IRS) usually treats bonuses as “supplemental wages,” which is why they’re subject to a supplemental withholding rate. So if you fail to report your employees’ supplementary pay, it leads to incorrect tax withholding.

That means extra paperwork and stress for you and your employee when you have to fix the mistake later. Even worse, it may damage your team’s trust in you.

Bonus Pay Best Practices

When giving bonuses, it’s important to bear the following in mind.

Ensure Fairness and Transparency

Bonuses should be a source of happiness for employees, but they can easily turn into a contentious issue if they’re not handled carefully.

Above all, prioritize fairness and transparency. That means:

- Offering bonuses that are clearly linked to measurable factors like performance, sales targets, or hours worked.

- Calculating bonuses the same way for all employees.

- Being transparent about how you calculate and pay your bonuses.

- Keeping accurate records for tax purposes.

Understand How to Handle Disputes

Whenever you pay out money, it’s important to be prepared for disputes or issues. For example, if you discover an employee didn’t actually qualify for what they received. Or, maybe someone felt short-changed and wants to challenge you on it.

Ways to avoid and handle issues include:

- Stating your policy for resolving future possible bonus pay issues in your contracts

- Checking the legal rules or requirements that apply to your business

- Always explaining your thought process and actions clearly and fairly

For example, you may not be able to request that an employee pay back their bonus (or deduct it from their future paychecks) unless that possibility is stated upfront in their contract.

You may also not be able to avoid paying nondiscretionary bonuses if they’re stated in an employee contract. Nor can you dismiss someone to avoid paying bonuses. Doing so may give the staff member cause to sue you for wrongful termination.

You should also state very clearly which bonuses are discretionary and which are not, as well as the exact requirements needed for a pay out, as this can avoid ambiguities in the future.

Know the Legal and Tax Implications

However you choose to pay bonuses, it’s important to be aware of the tax implications. As we mentioned above, the IRS typically sees bonuses as “supplemental” to ordinary wages or pay.

That means they get taxed at a flat rate of 22% (no matter the tax rate of the employee). Most types of bonuses are subject to this rate. That includes gifts, tips, cash payouts, overtime, and some commissions.

As an employer, it’s your responsibility to calculate taxes accurately and send the correct portion to the IRS, also known as tax withholding. We covered the two main ways of calculating how much you need to withhold in the section above: the percentage method and the aggregate method.

But using a platform like Homebase makes calculating accurate taxes much easier and reduces both stress levels and the time you have to spend on manual math too:

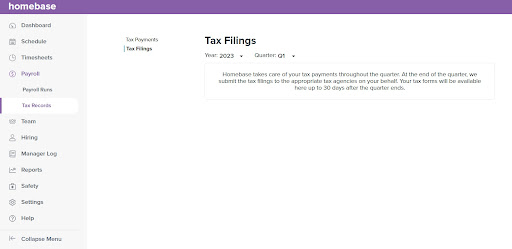

- To access the tax section, click Payroll on the left dashboard.

- Hit Tax Records.

Select either Tax Payments or Tax Filings to see your most recent activity.

Caption: Homebase has a dedicated section within its dashboard designed to help you manage tax payments and tax filings.

Make Bonus Pay a Celebration, not a Stressful Disaster

Who doesn’t want to reward their employees for their hard work? It leads to improved productivity and increased staff loyalty and longevity, after all.

But you want to make sure you pay bonuses without punishing yourself with hours of manual calculations, stressful tax paperwork, or unhappy employees.

If you’re looking to take the hassle out of your payroll process, Homebase payroll can help.

Our platform can handle all your payments, calculations, paperwork, and bonus tax rates for you. And when you sign up, you can onboard employees, track their time, and run payroll all in one place.

Bonus payroll FAQs

How does bonus pay work?

Bonus pay is a special type of additional payment that some employers give to their employees. It’s a way to reward exceptional performance, meet specific goals, or show appreciation. Bonus pay can come in different forms, such as cash, gift cards, or even stock options. The amount of the bonus can vary depending on factors like individual achievements, company profits, or sales targets.

Some bonuses are discretionary, meaning the employer decides who gets them, while others may be based on specific criteria. Bonus pay is typically given on top of an employee’s regular salary and is subject to taxation according to the applicable laws.

Do employers pay taxes on bonuses?

Yes, employers may pay taxes on bonuses. When employers give bonuses to employees, they’re responsible for withholding the necessary taxes from the bonus amount. This means that employers need to deduct a portion of the bonus as taxes and send it to the government on behalf of the employee.

The specific tax withholding rate is determined by the tax laws and regulations of the jurisdiction. By fulfilling their tax obligations, employers make sure that the required taxes are paid, helping to fund government services and programs.

Are holiday bonuses taxed?

Yes, holiday bonuses are taxed as they’re considered a kind of compensation. However, they’re taxed at a different rate than regular pay, so you need to process them differently.

How are year-end bonuses taxed?

If you include a year-end bonus as part of a standard payroll check, you should treat it the same as regular taxable income. If you choose to include year-end bonuses on separate checks, they’ll be taxed at a flat rate of 22%.

What is the difference between overtime pay and a bonus?

Overtime pay is a nondiscretionary bonus. It’s mandatory to pay, and employees are entitled to it based on the number of overtime hours they clocked in during a workweek. On the other hand, many bonuses are discretionary, meaning they’re optional. They’re offered as an incentive for exceptional employee performance.

Is a bonus better than a pay raise?

From a business perspective, yes, bonuses may be more beneficial than pay raises in some cases. Bonuses are variable as they’re often based on employee performance or specific results. That means, unlike pay raises, you can reduce them if your budget decreases.

Are there disadvantages to handing out bonus payments?

Yes, there are some disadvantages to handing out bonus payments. Once you’ve introduced bonuses, employees may expect them even if you don’t have the budget for them. This may lead to lower morale and staff feeling disappointed if you can’t deliver.