Cash Out: Access Your Pay

Clock out and cash out

We know that sometimes waiting for your next paycheck is hard, especially when there are a bunch of bills and expenses to cover. We’re here to help. Enroll and advance up to $400 of your earned income from the Homebase app, anytime you want.

Bridge the pay gap

Get early access to your wages

Handle unexpected expenses

Use it for emergency expenses, rent, utility, and other bills to avoid overdraft fees and payday loans.

No hassle

We’ll take care of scheduling the payback for you so you don’t have to think or worry about it.

Set up in minutes

Use your current debit card and bank account and get connected quickly.

Watch how it works

Why Cash Out?

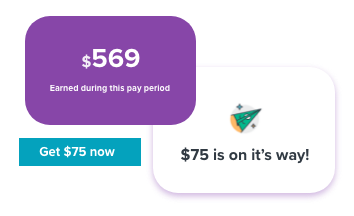

Access a portion of your wages before your next payday

Cash Out is friendly

- No hidden fees

- No credit check

- No late fees

- No interest

- Not a payday loan

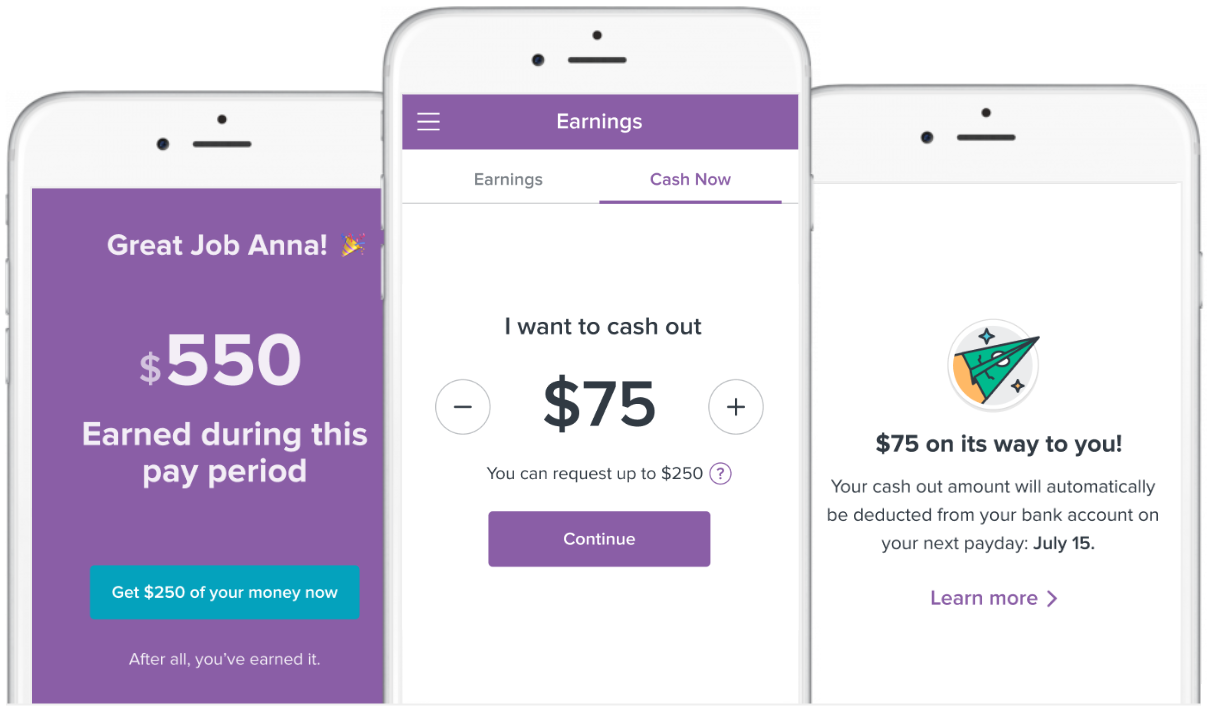

Cash out in minutes

- Finish your shift Once you have worked enough hours each pay period, you’ll be eligible to Cash Out.

- Connect your bank In the Homebase app, securely connect the bank account where you get direct deposit paychecks. (Make sure you’re on the latest version of the app.)

- Cash Out Cash Out up to twice per week. Select how much to cash out and how quickly to receive it. Fees apply for instant Cash Outs.

- Get your cash! The Cash Out is sent directly to your bank account. On your next payday, Homebase collects the cash back from your account.