Full-service payroll

- You might not have the time or resources to hire and train an HR employee to do payroll for your business, and doing so on your own takes up a lot of your important time.

- Full-service payroll providers take all the frustrating tasks of payroll, including tax filing and year-end reports, off your hands.

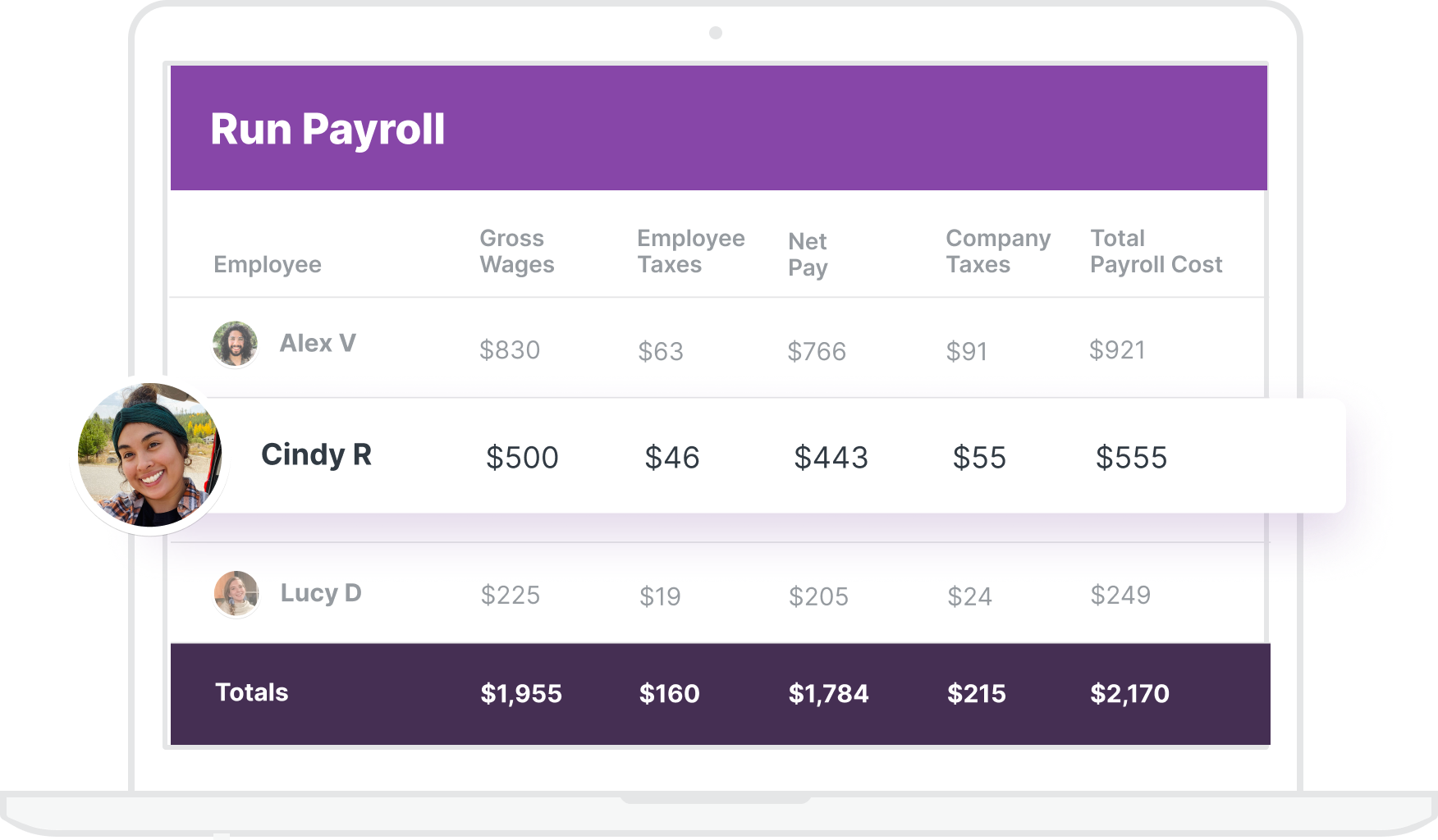

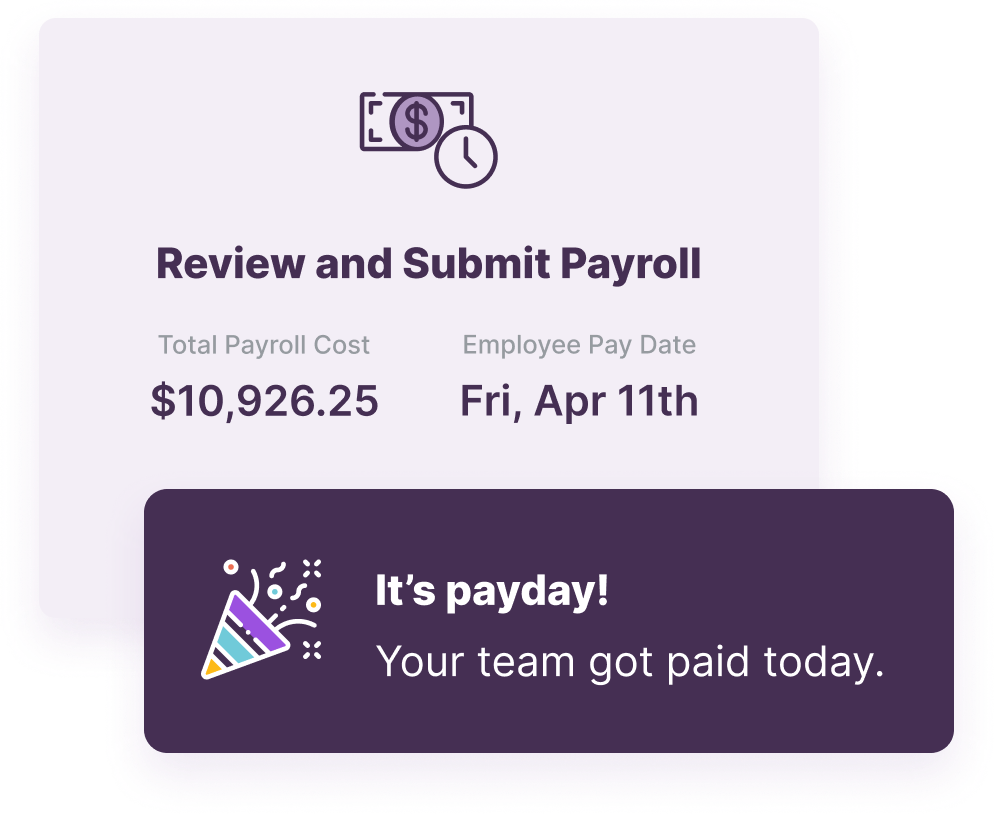

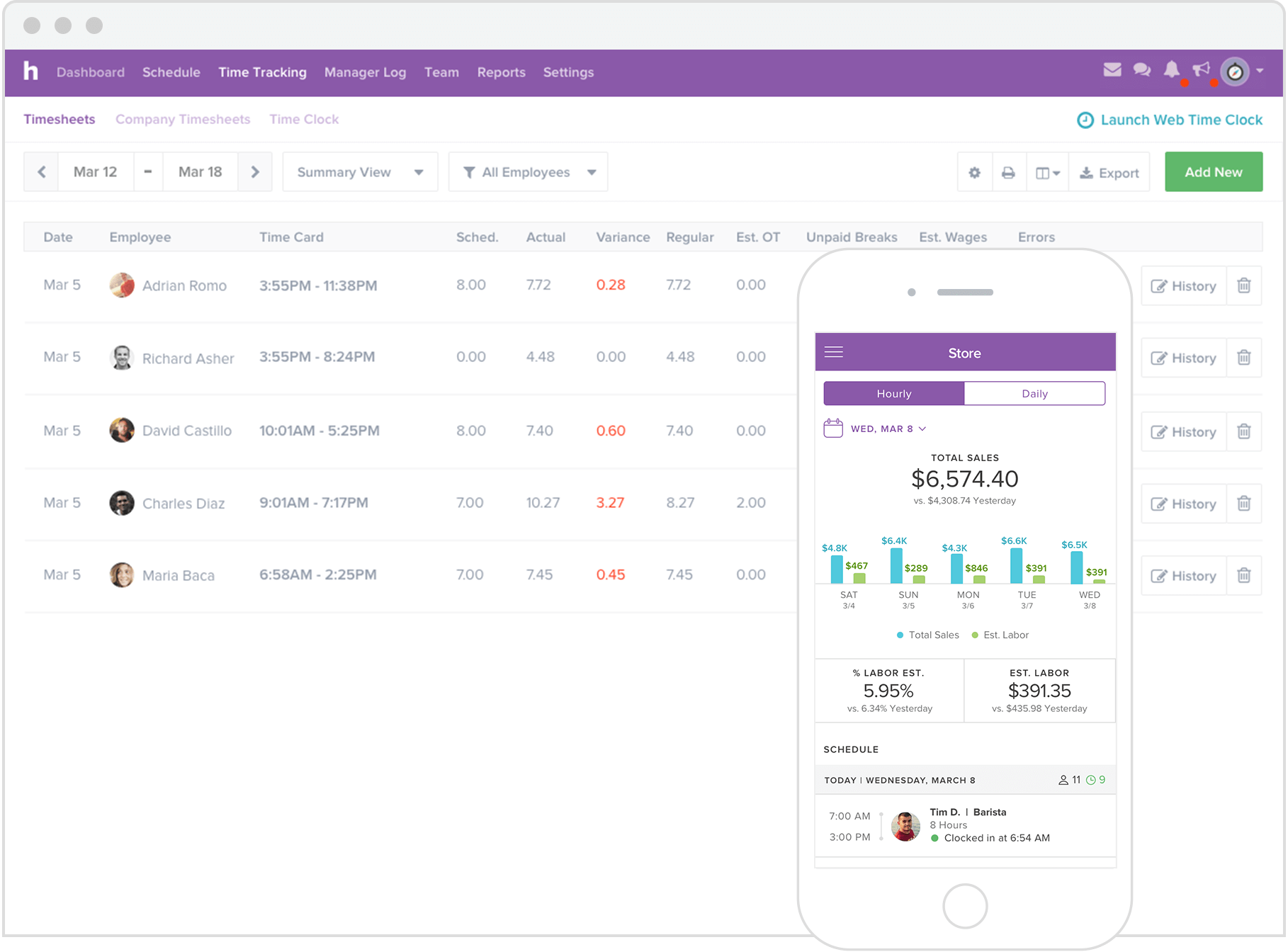

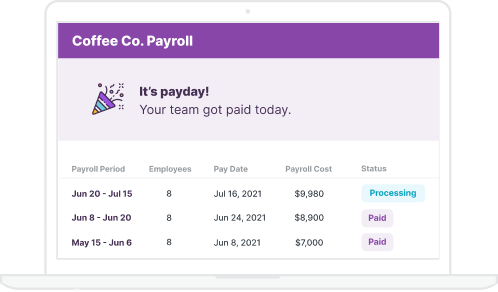

- Homebase automates your payroll process by paying your employees and processing tax filings correctly for you.

What is full-service payroll?

Full-service payroll providers are companies that you use to outsource your small business payroll practices. When you outsource to one of these companies, they take all tasks of payroll off your hands. These include the processing of payroll, printing of checks and direct depositing, tax filing, and tax payments.

Full-service payroll support companies, like Homebase, Quickbooks Payroll, ADP, and more, automatically process all these tasks for small businesses. Other tasks they automate include payroll calculations, year-end tax reports, payroll tax filing, and even more.

When small business owners have a full-service payroll provider like Homebase in their armory of hr tools, running a business is that much easier.

Homebase saves you hours each pay period and reduces errors in your payroll data to ensure an accurate process each time.

Why is payroll so complicated?

Most business owners have experienced the frustration that comes with the complexity of processing payroll. It feels like it’s a neverending effort if you take it on by yourself, when you should be spending that effort on tasks that boost your business and increase your bottom line.

The complexity of payroll stems from the fact that employers are essentially working as tax collectors for local, state, and federal government agencies. The rules in regards of calculation requirements change constantly, which makes it that much more difficult.

It’s required by law that employers collect income tax from each employee. They also have to collect social security taxes, which then need to be matched. On top of that, federal and state unemployment taxes need to be paid, as well as a workers’ comp policy that is required by law.

Payroll doesn’t have to be complicated, especially if you have access to the right software and tools. Homebase will do all of this for you, making it simpler every step of the way.

Barzotto

Marko Sotto

Owner at Barzotto

How much do full-service payroll providers cost?

The cost of your payroll provider depends on which type of pricing model they operate with, but regardless, the affordability of payroll service is surprising to some small business owners. You typically see 3 common pricing models in the payroll provider industry.

The first pricing model is “per frequency,” in which case the company will charge you a base fee for each employee and per payroll process. So if you process weekly, bi-monthly, or monthly, that frequency will be reflected in your bill. If you have 10 employees, you might pay $3 for each team member with a $20-40 base fee per pay period. Your total for the month would be calculated to around $140 if you ran payroll twice a month.

Another pricing model is “per employee, per month.” This model occurs when payroll providers allow you to process payroll an unlimited amount of times a month, but charges you a fixed rate based on how many employees you have at your business. This one would work best for small business owners whose payroll practices are slightly different each month.

“Fixed rate” monthly pricing is another popular pricing model among payroll providers. These companies look at how many employees you have and charge you the same amount each month based on the count. However, some providers cap the amount of employees you can run payroll for each month with this model.

There are also a few providers on the market who offer free payroll services, but beware of these models. You might have to put a little more work into the process, and you also might not get the necessary value of increased security. You don’t want to put your payroll data and sensitive employee information at risk of getting into the wrong hands.

Can I do payroll myself?

As mentioned above, if you have a human resources team to run payroll for you, or if you are willing to take on the difficult responsibility yourself, you don’t need to use a full-service payroll provider and can in fact get the job done on your own. But it will be time consuming and arduous as far as small business tasks go. Do you really want to be burdened with year-end reporting when you should actually be focusing on making the most of your holiday season?

You also run the risk of facing compliance risks and IRS audits, which no small business owner wants to encounter. A full-service payroll company takes on the hard work for you and completes your payroll process efficiently and accurately.

And again, Homebase takes the ease of payroll processing to the next level by doing it all for you. We automate your payroll process, so you can pay your team in a matter of clicks.

Even if you do decide to take the payroll journey on your own, Homebase is here to assist you. When you sign up, you receive full access to human resource experts who offer live advice, training, templates, and policy reviews for any questions you may have surrounding small business HR.

Get started today or start a free trial to learn more about how Homebase can keep your business running smoothly and efficiently. If you have any questions, our customer support team offers top-notch customer service to make sure you’ve got everything you need to make the most out of your account.